Uniswap ($UNI) price faces bearish headwinds as SEC lawsuit FUD surrounding Binance and Coinbase wanes and South Korean centralized exchanges emerge. The on-chain analysis examines how Uniswap price could react after a cohort of strategic whales were spotted buying the dip.

The SEC’s lawsuit against Binance and Coinbase in June 2023 triggered a ripple effect across the crypto markets. As one of the most prominent DEXs, Uniswap ($UNI) quickly climbed the top gainers’ charts after its daily transaction volumes skyrocketed above $800 million.

Incidentally, a month later, SEC’s lost its long-running case against Ripple (XRP) in mid-July. While an appeal still looms, Investors are confident that Ripple’s victory could provide a foundation for Binance and Coinbase to build a strong defense case.

In effect, on-chain data shows how Uniswap has been losing traction since U.S. District Judge Analisa Torres delivered the verdict on July 13. How will the $UNI price react in the coming weeks?

Uniswap Faces Traction Hurdles as CEXs’ Regain Foothold

While Binance and Coinbase have regained traction recently, Korean exchanges like UpBit have also grabbed media headlines. This has caused crypto investors to switch attention from DEXs, including Uniswap.

According to on-chain data compiled by Santiment, Uniswap’s user-acquisition rate has recently declined to a two-month low. As depicted below, Uniswap recorded only 185 new addresses on August 21.

Notably, the last time Uniswap Network Growth dropped to this level was June 1, just days before the SEC announced its lawsuits against Binance and Coinbase.

By tracking wallet addresses created daily, Network Growth estimates the number of new users joining a blockchain network. As seen above, the decline in user acquisition began around July 21, just a week after Ripple’s victory over the US SEC.

Apparently, $UNI Network Growth sliding to a 2-month low signals that the Uniswap user-acquisition decline could be linked to the CEXs’ resurgence in August. If it persists, the $UNI token could struggle to find sufficient demand to propel it out of its current price downtrend.

Ride the crypto wave with confidence. Predict the $UNI price here.

Strategic Whales Buying the Dip Could Offer a Lifeline

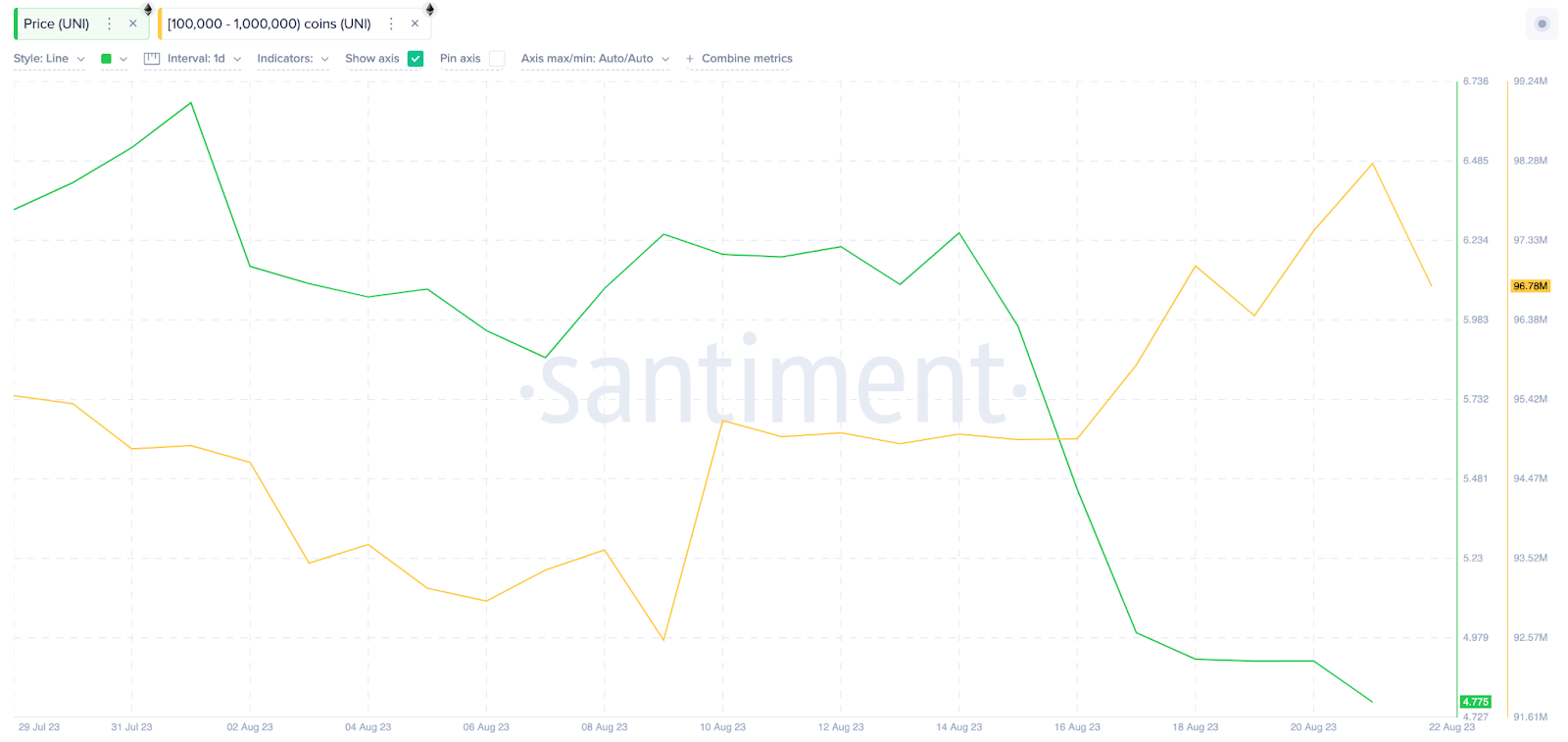

Despite the bearish headwinds facing Uniswap, a strategic whale cluster has shown resilience. According to on-chain data, a cohort of crypto whales holding 100,000 to 1 million $UNI tokens were spotted buying the dip between August 13 and August 21.

While Uniswap’s price declined 25%, they took advantage of the downswing to increase their holdings by 3.25 million $UNI.

At the current price of $4.70, the whales’ cumulative fresh acquisition of 3.25 million $UNI tokens is worth a little over $15.5 million. Whales investing such a large sum during a price dip suggest they remain confident in Uniswap’s medium to long-term prospects.

If the whales keep up the buying pressure, they could absorb the bearish headwinds. Hence, the $UNI price will likely trend neutral in the coming days, consolidating near the $5 territory.

Check Out the Best Upcoming Airdrops in 2023

$UNI Price Prediction: More Consolidation Before Breakout

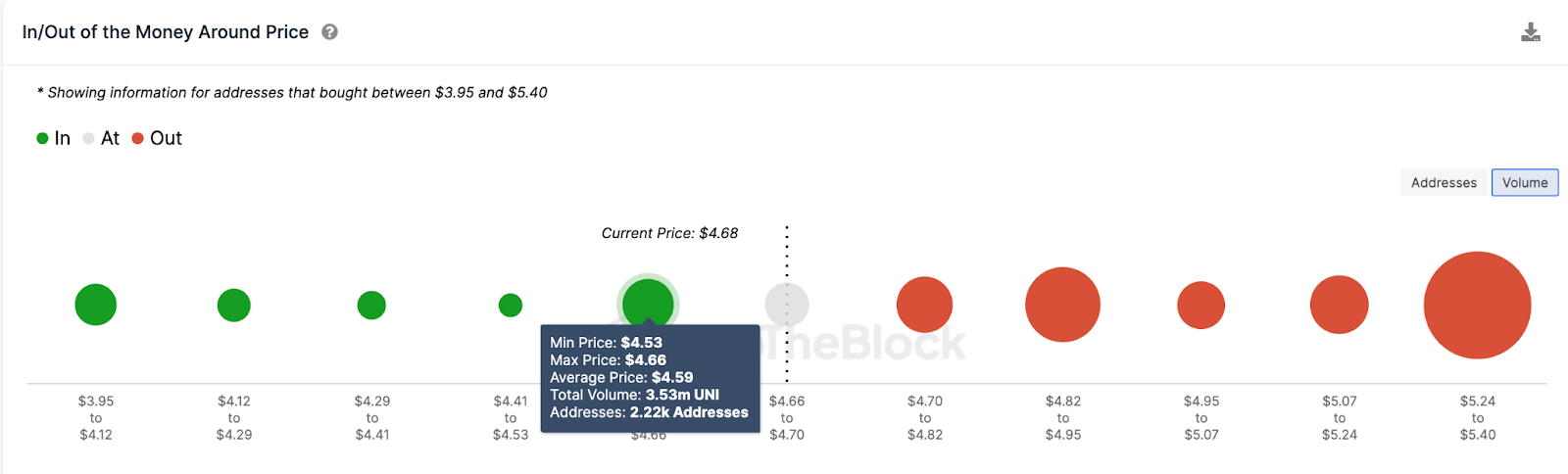

The In/Out of Money Around Price data illustrates the purchase price distribution of current investors on the Uniswap network. It confirms that $UNI price could react to the decline in user acquisition rate by dropping slightly toward $4.

However, as shown below, 2,220 addresses had bought 3.53 million $UNI at the minimum price of $4.53. They could offer considerable support by making desperate attempts to cover their positions.

But, if those efforts fail, $UNI’s price could drop further toward $4.

But, conversely, Uniswap could also react to the whales buying pressure with a rebound above $7. However, the 9,940 addresses that had bought 32 million Uniswap tokens at the maximum price of $5.40 will pose significant resistance.

But if that resistance caves, then $UNI could reclaim $7.

beincrypto.com

beincrypto.com