The Polkadot ($DOT) price has broken down from a short-term horizontal support area and is approaching a long-term one at $4.30.

Whether the price bounces at this level or breaks down will determine the long-term trend.

Polkadot Price Approaches Long-Term Support

The weekly timeframe technical analysis for $DOT shows that the price has bounced twice at the $4.30 horizontal support area (green icons). However, despite increasing development activity, the price has failed to sustain the bounce.

This is a crucial support level since it has been in place for nearly 1,100 days. So, whether the price bounces once it reaches it or breaks down will be essential in determining the future trend.

A breakdown could catalyze a decrease to the all-time low at $2, which would be a drop of 56%, measuring from the current price. On the other hand, a bounce could initiate a 60% upward movement to $7.70.

Crypto investing, simplified. Get $DOT price predictions here.

The weekly RSI provides a bearish reading, suggesting that the price will break down. With the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset. Bulls have an advantage if the RSI reading is above 50 and the trend is upward, but if the reading is below 50, the opposite is true.

The indicator is below 50 and falling, both signs of a bearish trend. Moreover, the RSI was rejected twice by the 50 line (red icons), another sign of waning momentum and a bearish trend.

$DOT Price Prediction: Rejection Leads to Drop

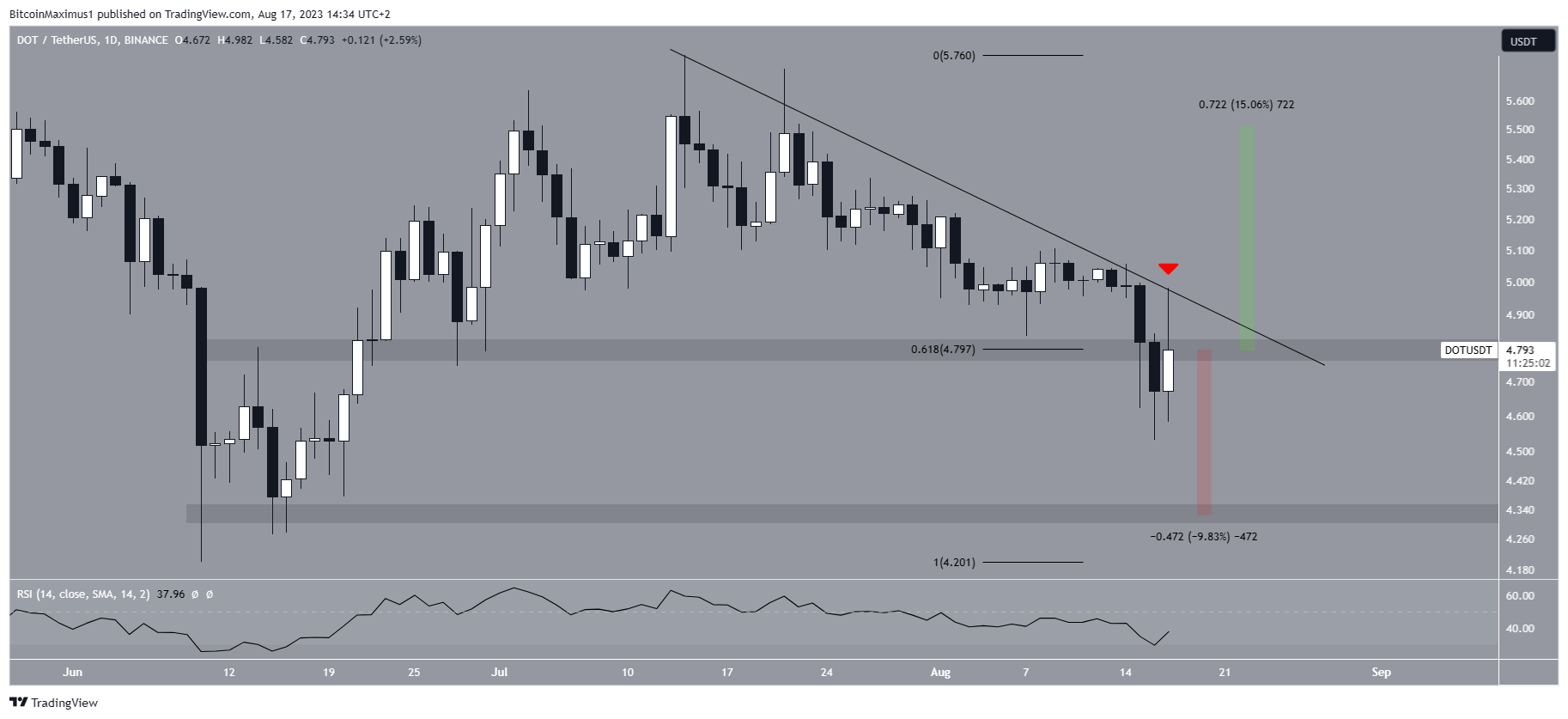

The technical analysis from the daily timeframe provides a decisively bearish outlook. The main reason for this is the breakdown below the $4.80 support area and ensuing rejection.

The $4.80 area is crucial since it is both a horizontal support area and the 0.618 Fib retracement support level. Due to this confluence, it was important that the $DOT price remains above this level for the bullish structure to remain intact.

However, $DOT fell below it and failed to reclaim it the next day, also validating a descending resistance line (red icon) in the process, creating a long upper wick.

The daily RSI is also decreasing and below 50, both signs of a bearish trend.

Check Out the Best Upcoming Airdrops in 2023

Therefore, the most likely future price outlook is a 10% decrease to the long-term $4.30 horizontal support area.

Despite this bearish $DOT price prediction, reclaiming the $4.80 area and breaking out from the descending resistance line will lead to a 15% increase to the next resistance at $5.50.

beincrypto.com

beincrypto.com