Chainlink (LINK) price has now tumbled 11% from August 10 after the bears broke down the $7 support on Wednesday. However, the buying pressure from the bullish whales looking to scoop the dip could soon trigger a price rally.

Last week, Chainlink announced the integration of its price feeds to Coinbase-led Layer-2 Network, Base. On-chain data now reveals that the integration has attracted the attention of Coinbase institutional investors to LINK.

But will this be sufficient to trigger a sustained LINK price rebound in the coming weeks?

Whale Investors Have Chainlink on Their Radar

Due to its public-listing status, Coinbase is widely regarded as the choice crypto exchange for institutional investors in the US. This factor seems to have positively impacted LINK over the past week.

Amid an industry-wide drop in demand, LINK has witnessed a noticeable surge in whale transactions this week. As shown below, Chainlink whales’ trading activity increased nearly three-fold from 40 to 117 transactions between August 12 and August 16.

Whale Transaction Count tracks changes in whales’ trading activity by summing up the daily number of confirmed transactions exceeding $100,000.

This increase in Whale Transaction count suggests LINK is now back on the radar of institutional investors. Considering the correlation between this uptrend and the recent price feed integration into the Base layer-2 network, Coinbase whales may have played a vital role in this positive development.

Large Transactions provide market liquidity, allowing investors to execute high-volume trades at favorable prices. Hence, this could put LINK in a prime position for a sustained price rebound in the coming weeks.

Empower your investments with LINK price predictions.

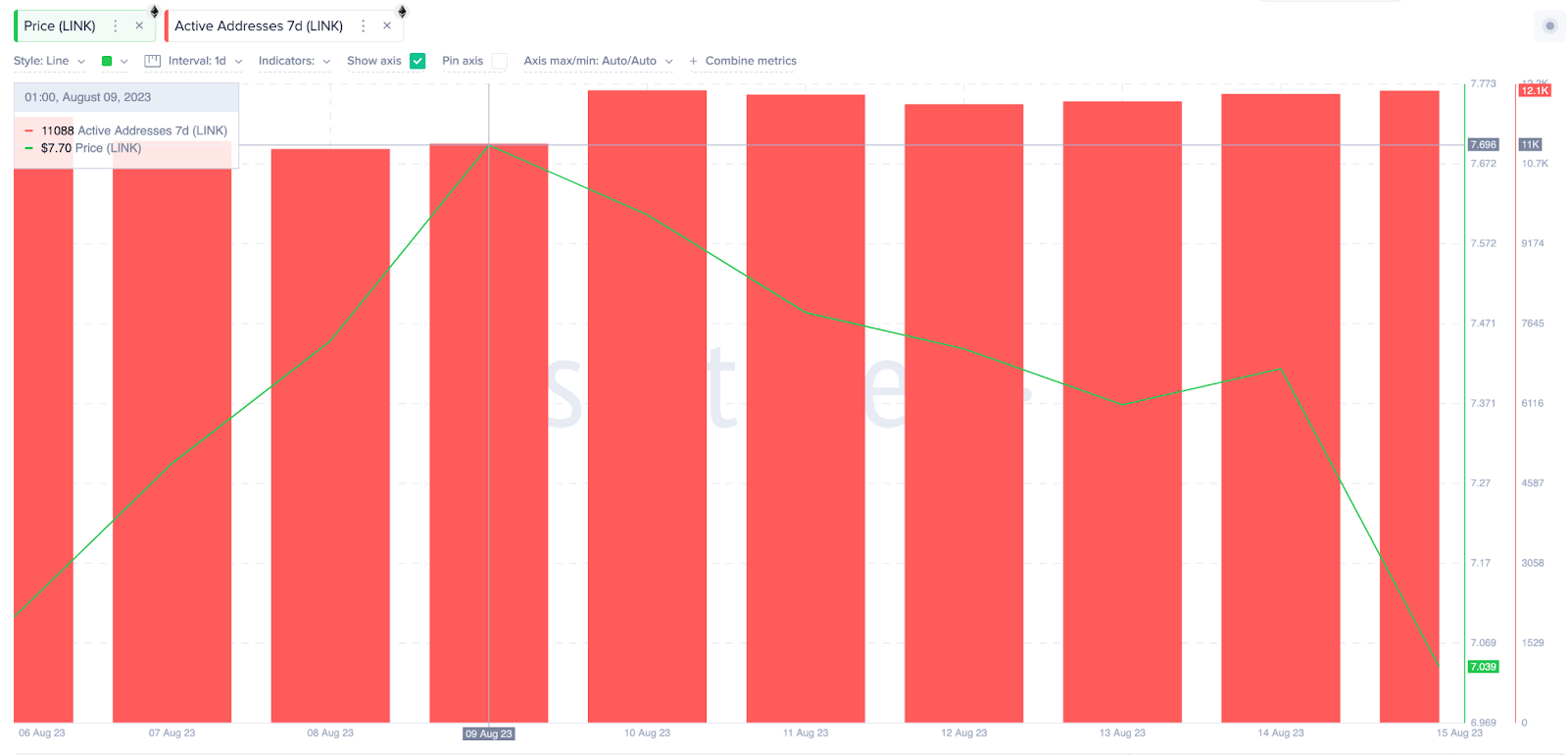

Despite Retracement, Chainlink is Attracting a Healthy Network Activity

Despite the recent double-digit price correction, Chainlink has continued attracting healthy network activity this week. In an indication of this, the Santiment chart below depicts that LINK Active Addresses (7d) have continued to increase since August 9. As of August 16, it has now surged from 11,088 to 12,102, representing a 9% growth in network activity.

The Active Addresses (7d) metric aggregates the number of individual wallet addresses carrying out transactions over seven days. This tracks real-time changes in the portion of users carrying out economic activity on the network.

The chart above shows that despite the 11% price retracement over the past week, Chainlink network activity has increased by 9%. Such a positive divergence between price and network participation indicates an imminent bullish reversal.

In summary, both Chainlink whales and retail investors are showing signs of growing optimism despite the recent downtrend in price. Hence, LINK could make an early recovery once the altcoin market momentum goes green again.

Check Out the Best Upcoming Airdrops in 2023

LINK Price Prediction: The Bulls Could Target $8

The In/Out of Money (IOMAP) data shows the distribution of LINK holders’ purchase prices to establish key support and resistance levels. It shows that the $7.50 territory is the most significant sell-wall that could prevent LINK from hitting the $8 price target.

As depicted below, 18,000 holders had bought 20 million tokens at an average price of $7.51. If they close their positions, they could instantly trigger a pullback.

But if the Coinbase whale investors continue buying, as previously highlighted, LINK could proceed to claim the $8 target.

Still, the bears could invalidate the positive Chainlink price prediction if it falls below vital $6 support. But first, the 22,040 addresses that bought 242 million LINK tokens at the average price of $6.28 could offer considerable support.

Nevertheless, LINK could sink below $6 if that support level cannot hold.

beincrypto.com

beincrypto.com