Real World Assets, in the context of the blockchain sector, refer to physical assets such as real estate, art, music, and commodities brought to the blockchain through tokenization. Tokenization is the process of creating a digital version of a physical real-world asset through a trustless smart contract. Developers generally create smart contracts which issue a token representing an RWA alongside an off-chain guarantee that the issued token is always redeemable for the underlying asset.

The hype around the RWA space is evidenced by the strong performance of tokens attached to RWA projects so far this year:

YTD RWA token Price Performance

* Maple Finance = +96.0%

* Clearpool = -35.3%

* Goldfinch = -18.8%

* TrueFi = +39.3%

* Centrifuge = +93.3%

* Maker = +143.3%

* Boson Protocol = -38.9%

* Realio= +1350%

**Overall Sector performance =** +203.6%

* Bitcoin (BTC) = +77.3%

* Ethereum (ETH) = +54.1%

Despite some underperforming tokens within the sector, tokens connected to RWA projects have flown this year and the sector has out-performed Bitcoin.

Tokenize All of the Things

RWAs have been considered a holy grail amongst crypto investors and product builders. The size of global real estate, carbon, gold, art, and music markets, to name a few potentially tokenizable RWAs, is enormous, dwarfing the crypto market itself. These physical asset markets are often noted for having high barriers to entry and inefficient trading systems.

Permissionless, decentralized blockchain systems have the clear potential to disrupt and improve those systems. Tokenization has the capability to make these assets more liquid and accessible to participants. Investment Bank Citi says that the Blockchain-based tokenization of real-world assets is the next “killer use case” in crypto. The bank forecasts that the market will reach between $4 trillion to $5 trillion by 2030.

Another layer to this equation is Decentralized Finance (DeFi) which can create new financing potential for physical assets within the RWA sphere. DeFi protocols can offer investment yield for participants willing to finance real physical assets. This type of yield may be very appealing for DeFi participants because it would be free from the volatility of their other crypto asset class holdings.

In December 2022, Ethereum’s founder Vitalik Buterin wrote a blog titled “What in the Ethereum application ecosystem excites me”. He specifically cited stablecoins as an area of interest. One of the stablecoin models he endorsed is DAO-governed RWA-backed stablecoins. This is a model where a Decentralized Autonomous organization manages the operations of a stablecoin. The DAO would manage the real-world assets that would back a stablecoin and determine the respective proportions of each RWA used. Buterin backs the model by saying it “Adds resilience by diversifying issuers and jurisdictions”, and that is “still somewhat capital efficient”. DAI is a current example of a stablecoin protocol where real-world assets underpin a stablecoin and DAO members determine the structure.

Buterin says in the blog — “Such stablecoins could combine enough robustness, censorship resistance, scale, and economic practicality to satisfy the needs of a large number of real-world crypto users.” He continued, “The formula behind stablecoins can in principle be replicated to other real-world assets. Interesting natural candidates include major stock indices and real estate.”

While stablecoins, tokens that represent real-world fiat currencies, are the most popular form of crypto RWAs, a new type of RWA is emerging into a position of relevance. Lending protocols are connecting borrowers with real-world businesses. In exchange for lending, DeFi users are offered a yield. This yield shouldn’t be as volatile as lending pool yields that come from offering liquidity within automated market makers but they do come with their own risks.

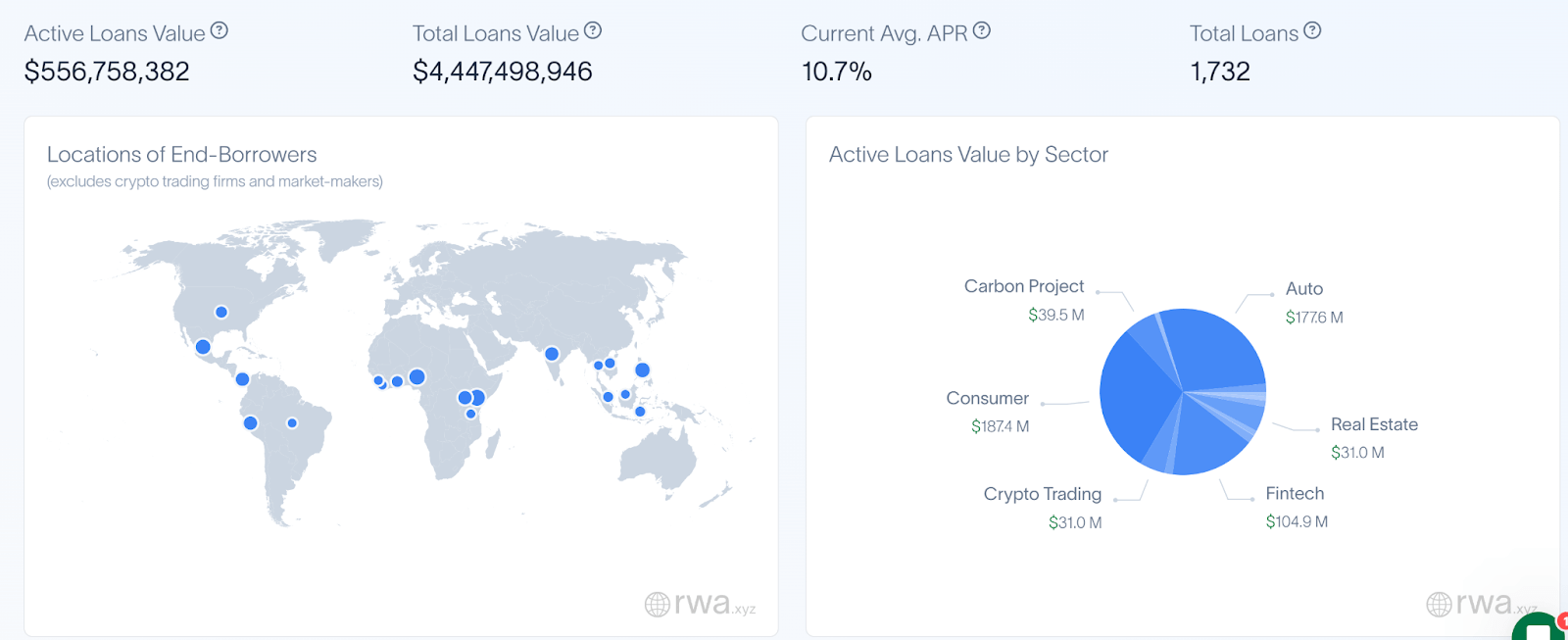

Source: RWA.xyz

Website RWA.xyz has created a dashboard to view Loan-based RWA’s or ‘Private Credit’. There are currently over US$550 million worth of Private Credit RWA value active in crypto. The average return of 10.7% is impressive. The majority of loans listed by RWA.xyz are ventures and startups may have challenges accessing traditional avenues for capital raising.

Active loans are spread evenly across a number of sectors including Energy, Consumer, Auto, and Fintech. Most of these private credit loans originate from areas of the developing world including in continents like Africa, South East Asia, and South America.

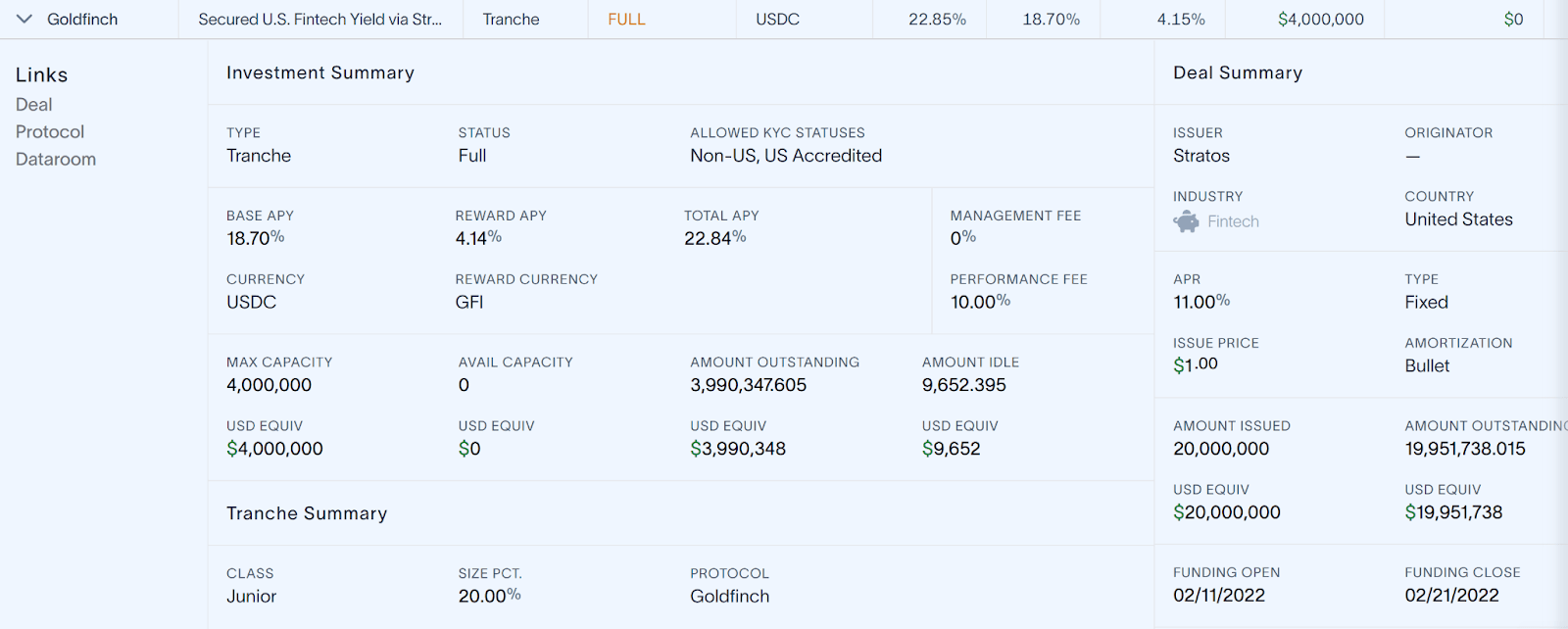

An example of one of these Private Credit options is the Stratos US Fintech yield offered by DeFi protocol Goldfinch.

With this investment, Stratos is the borrower. Stratos is a firm that invests in secure loans to venture-backed companies. The borrower profile for Stratos explains that it “has the expertise and a five year track record of advising and financing technology and technology-enabled businesses.”

At the time that the borrowing pool opened, Stratos had exposure to Rezi — an institutional scale residential lease broker, Braavo — that provides accounts receivable financing for software developers selling software for mobile apps, and Threecolts — An e-commerce and SAAS company focused on capturing value within retail marketplaces like Shopify and Amazon.

Stratos explains that they have an edge in identifying successful start-ups because their “sourcing strategy is primarily driven by introductions from founders that we’ve worked with in prior transactions, as well our strong network of venture capital equity investors who recognize the benefits a Stratos credit facility can provide to their portfolio companies.”

Community Lenders, and DeFi users, are essentially lending to buy into the edge Stratos has, identifying successful startups and capturing the returns they offer. The dealroom for Stratos has a variety of documents evidencing research capabilities including Due Diligence capabilities.

In a summary of Goldfinch’s activity for 2022, it was revealed that Goldfinch grew outstanding loans by 162% year-on-year with no defaults. Goldfinch borrowers originated from 25 different borrowers.

Freight Forwarding

Another example of an RWA private credit option is the Centrifuge Protocol’s ConsoleFreight 4. ConsoleFreight 4 offers investors exposure to cash flows associated with international goods trading as well as Freight forwarding invoices.

Investor funds go towards short-term trade finance which refers to financing solutions that help facilitate international trade transactions, like imports and exports. This type of finance is designed to be short-term and bridges the gap between when a good is shipped and when the payment is received. Freight forwarding is the process of organizing and managing transportation, invoices are the document that lists the goods or services provided and the associated cost. By backing ConsolFreight 4 as a borrower, investors are financing short-term trade and are paid when the gap in logistics is bridged.

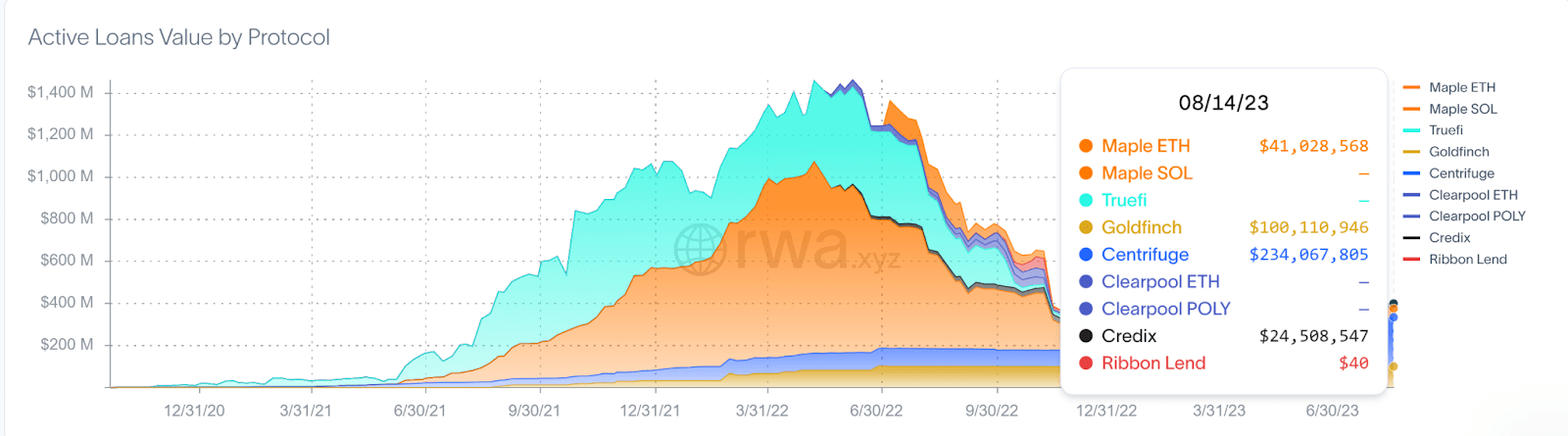

In their end-of-year report for 2022, Centrifuge writes that their TVL has grown and remained steady to reach US$87 million “while most of DeFi has heavily contracted.” This number has risen to US$216.4 million (in both cases this includes assets borrowed).

Centrifuge has a number of unique financing pools. Inventory Technology Provider Databased.Finance uses Centrifuge, as a tool to allow sellers of goods on Amazon to pool their assets together and then use them as collateral for loans and to access a community of decentralized lenders. As is the case for many small businesses, it is challenging for Amazon sellers to find cheap capital to expand their businesses.

Centrifuge is the largest major loan provider in the RWA space according to RWA.xyz.

The largest assets in the Real-World Asset tokenization space. Source, RWA.xyz

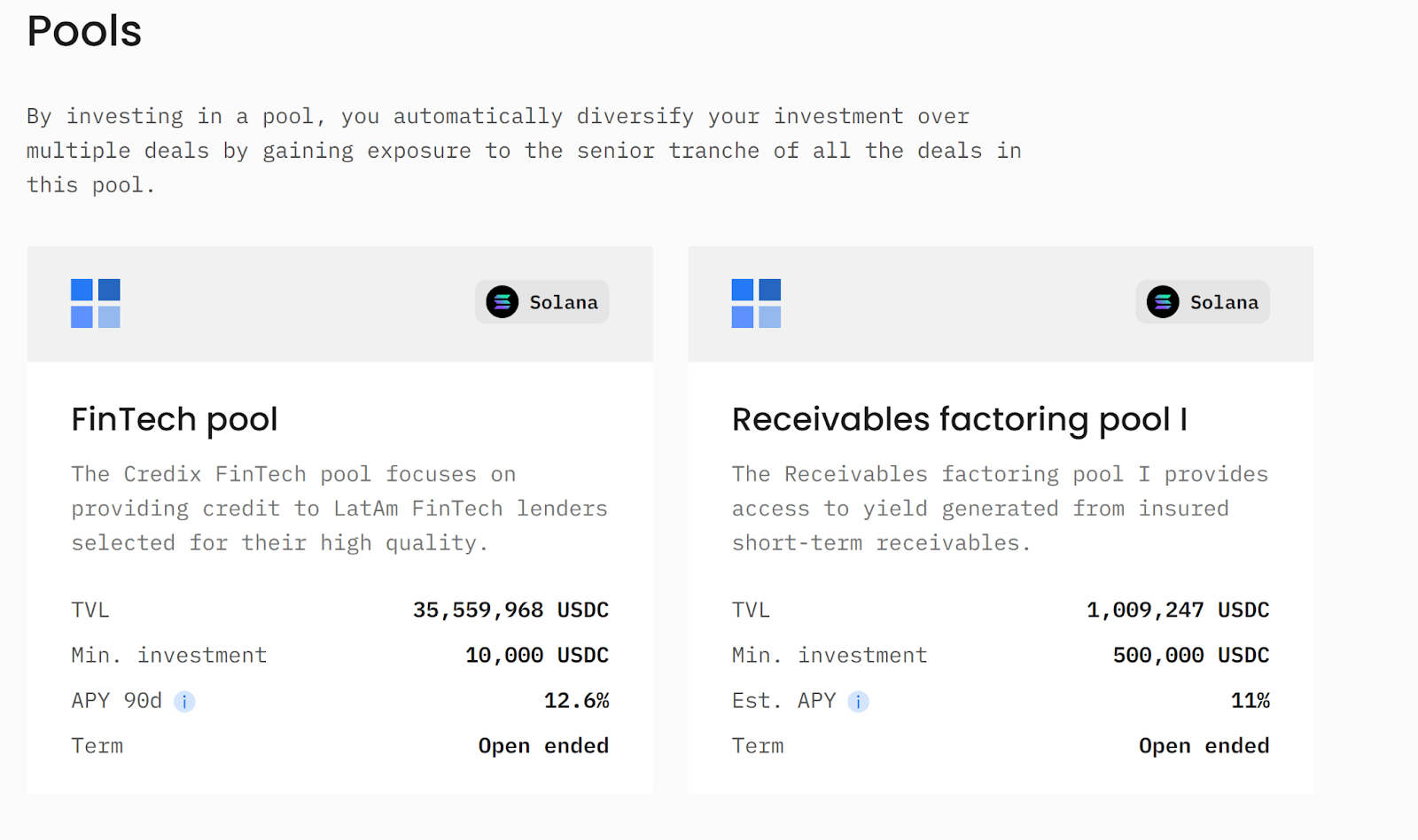

The RWA space is currently dominated by the Credit pool-model popularized by Goldfinch and Centrifuge. Credix operates with a similar model. These projects offer some of the highest USDC yields in the space without relying on an additional token that may or may not fall in value.

Yields offered by Credix’s diversified pools. Source: https://app.credix.finance/

Yields for USD offered by these financing protocols average around 8% but can rise to as much as 15% for some protocols. A weekly report by Brave New Coin covering the best interest rates and yields offered on digital assets regularly finds higher USDC savings rates offered by YouHodler and Nexo, 12% APY, and 14% APY respectively. YouHodler and Nexo are outliers, however, with the interest on USDC from other major borrowing & lending protocols and companies ranging from between 3% and 8%. Additionally, Centrifuge, Goldfinch, and Credix are Web3.0 based, and non-custodial, adding a layer of flexibility & security when compared to protocols like Nexo.

There is an element of risk to the yield offered by the Private Credit pools. The ability to offer yield is based on the ability of the projects supported to deliver outcomes. If, say, Consol Freight is unable to ship goods or the projects Stratos invests in are unsuccessful, the yield will dry up.

This considered, these Private Credit protocols provide significant documentation on projects and initiatives supported by their pools. Investors can conduct due diligence before they deposit into pools and have a more clear picture of where yields come from, compared to many centralized borrowers and lenders where it is often assumed that customer funds are reinvested into high risk, high-return options. The collapse of firms like Celsius and BlockFi means users are now wary of centralized borrowers and lenders like Nexo and Youhodler.

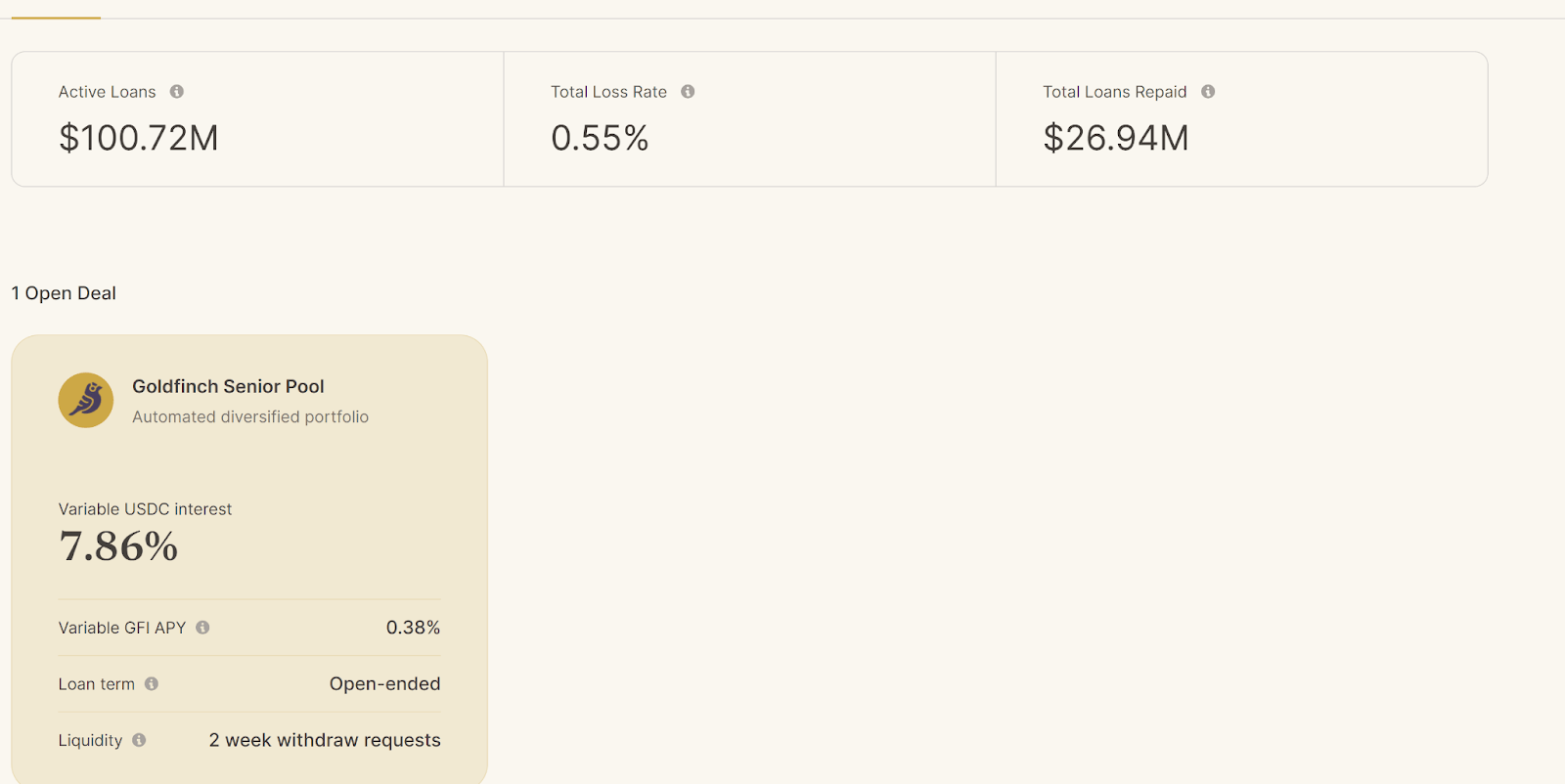

Yield and total loans repaid, Goldfinch. Source: https://app.goldfinch.finance/earn

Goldfinch, likely due to these factors, displays the number of loans repaid by borrowers.

Real Estate Tokenization

Real Estate is also seen as a promising form of RWA. Through tokenizing real estate assets, investors can invest in a fraction of a single piece of real estate, and enter the asset class with a much smaller investment than they normally would. Fractionalizing and democratizing Real Estate is something that has been attempted through models like Timeshares but tokenization offers a potentially sleeker solution than what has been built so far. The RWA model offers a chance to create accessibility and liquidity for the real estate sector.

Brave New Coin spoke to Trevor Bacon, co-founder and CEO of Parcl, A blockchain-based real estate investment platform that allows users to invest in a digital square foot of real estate in the most desirable neighborhoods. Cities covered by Parcl include Miami, Los Angeles, and New York. Bacon says “For younger generations, new challenges have made it harder than ever to invest in real estate. Home ownership rates are at nearly 20-year lows, in part due to the tedious and outdated processes necessitated.”

Parcl uses its own indices that are based on hyperlocal data feeds from Parcl Labs, an internal technology partner. Parcl Labs’ context-driven data updates daily in real-time, tracking the median price per square foot of each given city. Investors can use these insights to invest fluidly in the real estate they believe is right for them. Bacon explained to BNC that as opposed to taking a physical house and putting it on the blockchain, users gain exposure to high-demand cities around the globe. This offers diversification and a more>

Music publishing revenue is on a long term growth trajectory. _Source: Midia Research, Statista_

Nonetheless, several companies such as Royal.io, TunedCoin, and BandRoyalty have all revealed new initiatives in the last year that offer a path to fractional ownership of musical copyrights and create more symbiotic relationships between artists and fans.

Conclusion

RWA models have the potential to revolutionize traditional markets such as real estate, art, music and commodities by leveraging tokenization and decentralized finance. The market for RWAs is expected to grow exponentially in the coming years, and development has been exciting. The types of assets being tokenized are unique and layered. They are offering investors diversification, yield separated from crypto price volatility, and exposure to a variety of global industries.

The strong performance suggests growth. While it also appears that some of the value flowing into the RWA space is speculative, it is undeniable that progress has been made. There are already two clear success stories within the RWA space, stablecoins and private credit. There are also projects related to Real Estate, Music, and other asset tokenization initiatives quietly gaining traction.

DeFi protocols are playing a key role in the development of the RWA space by enabling greater liquidity and accessibility for physical assets, benefiting both investors and asset holders. Examples of emerging RWA-based lending platforms and real estate tokenization projects demonstrate the growing interest in this sector.

bravenewcoin.com

bravenewcoin.com