July presented itself as a potential turning point for the crypto market, with positive news driving price growth and sparking optimism within the community. However, the month ultimately brought more uncertainty and fear about the future of crypto, with high-profile hacks and suspended projects.

Despite ongoing regulatory pressure and macroeconomic uncertainty, the crypto industry continues to evolve and adapt. But it remains difficult to predict when the bull run will begin.

In this report, we will delve deeper into the state of the crypto market in July, examining the most important data, events, and trends that impacted the industry last month.

Summary

- Despite some significant news that could affect the future of the crypto industry, July was a relatively quiet month for BTC price and the total crypto market cap.

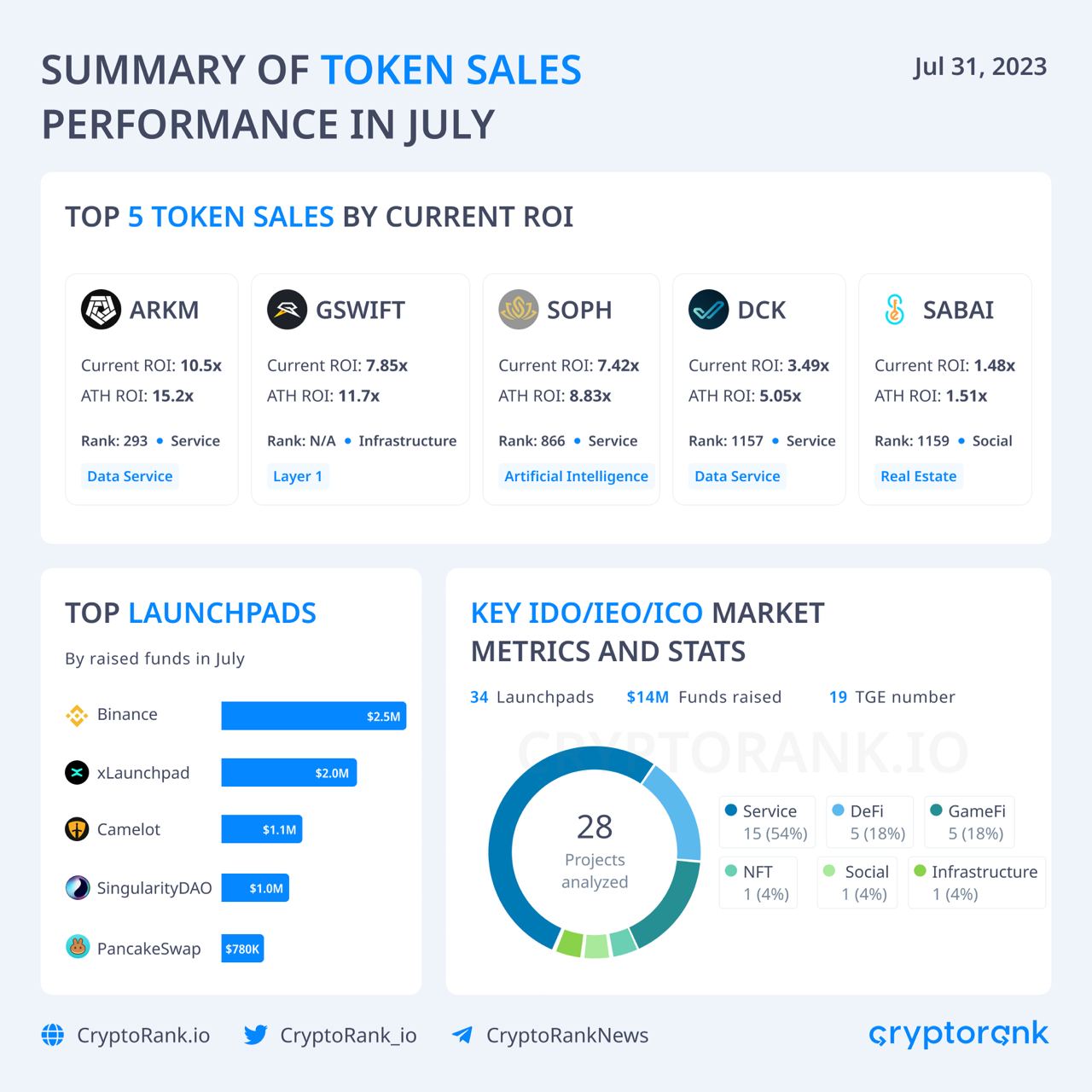

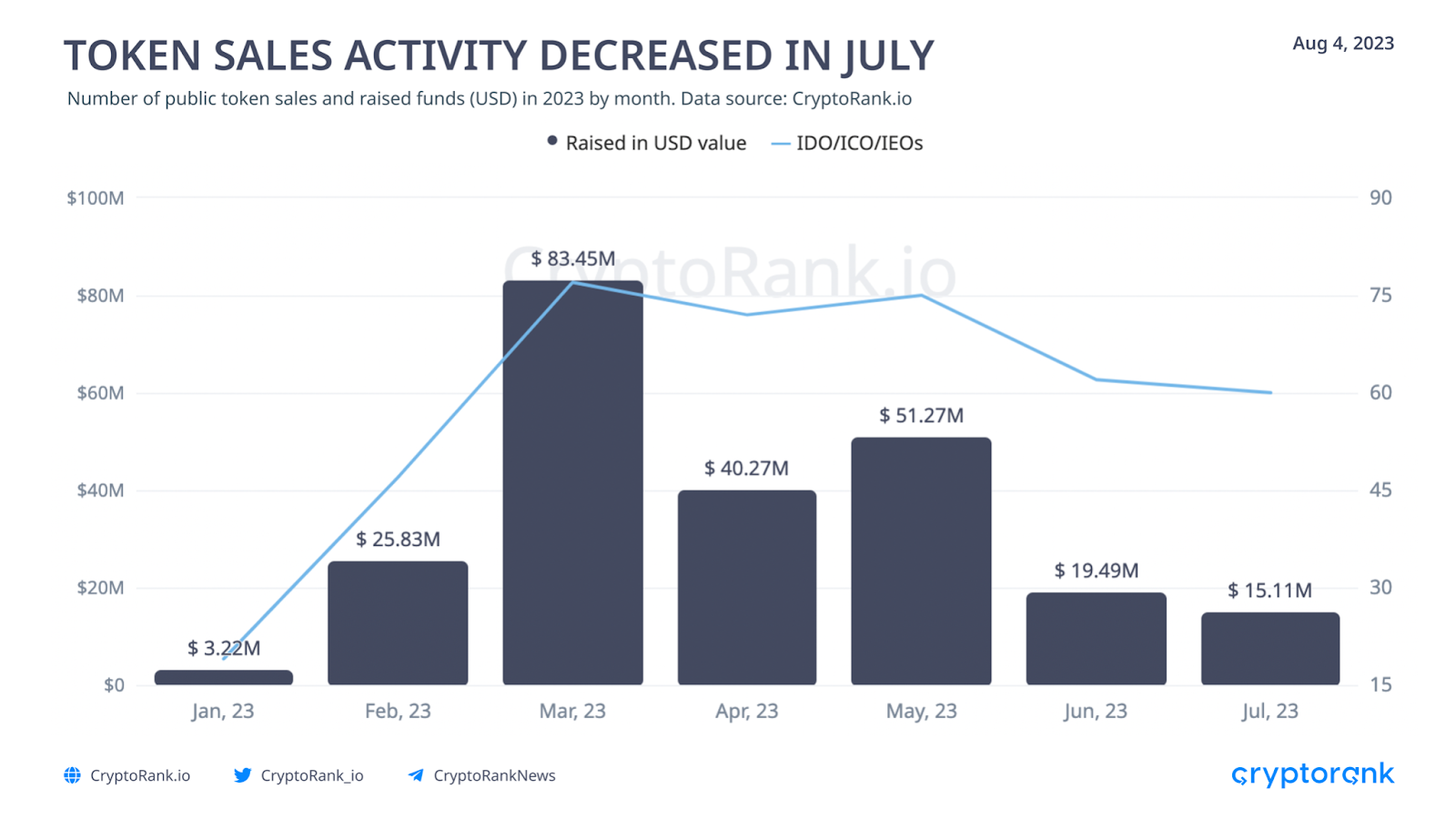

- Token sales activity in July decreased, with only 28 public token sales raising a total of $14M.

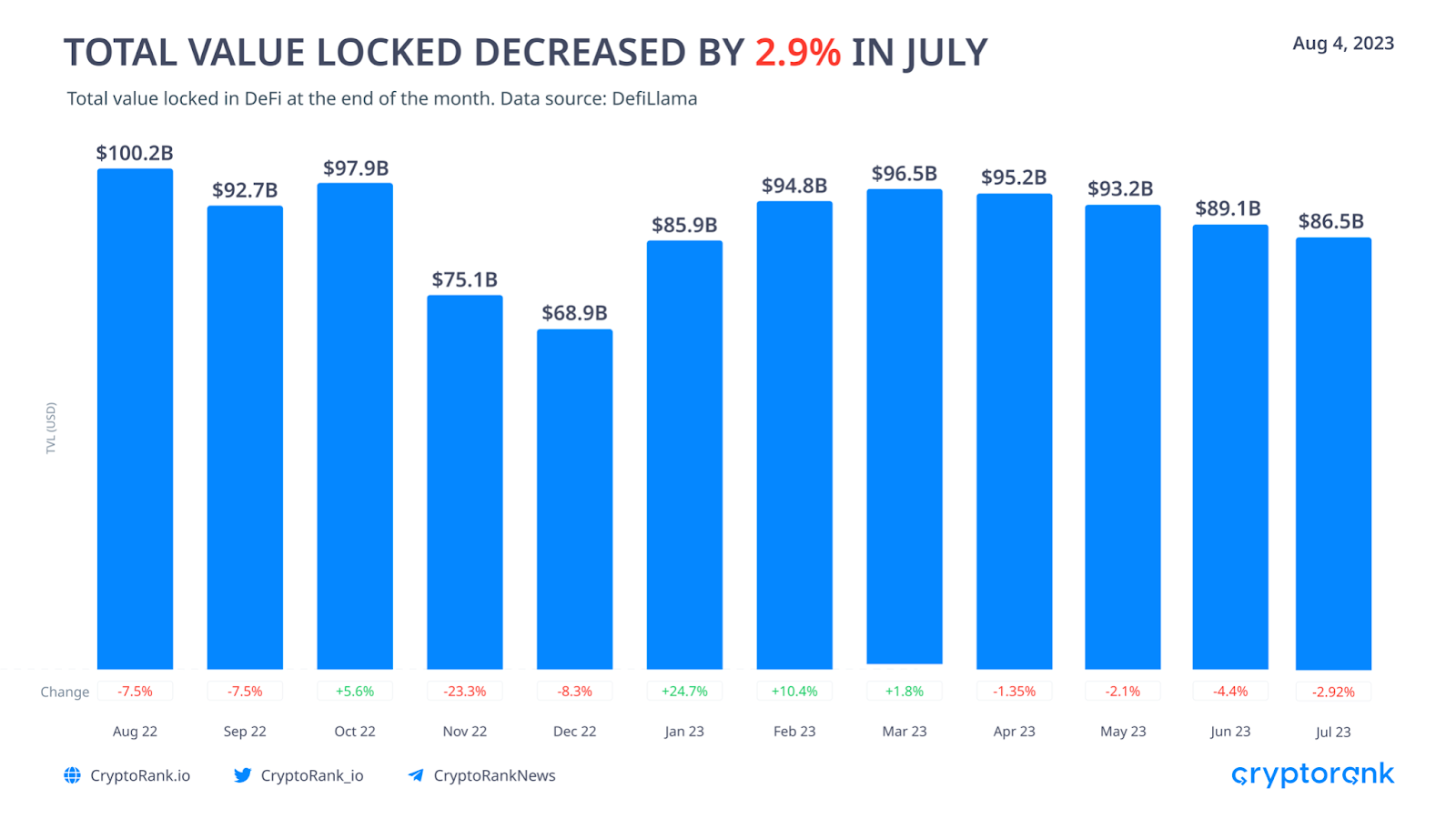

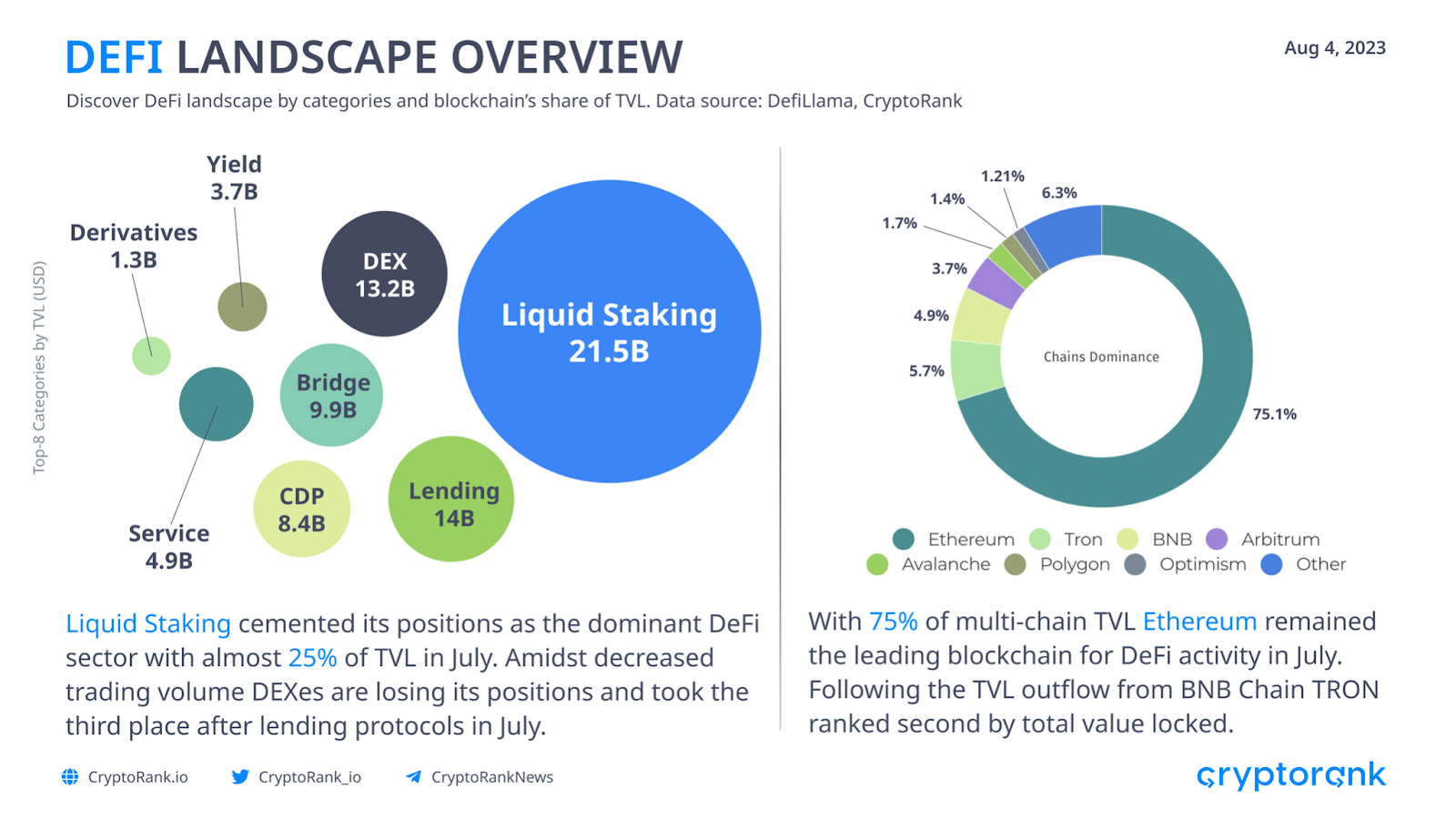

- While the activity of new L2 networks kept growing, most of DeFi saw a decline in total value locked in July. Liquid staking strengthened its position as the largest category by TVL. Ethereum continues to be the flagship of DeFi, with 75% of multi-chain TVL.

Prominent Events

July was a relatively quiet month for the crypto industry in terms of volatility. However, several events that occurred this month provoked some actions in the crypto market and will have long-term consequences for the industry.

XRP is not a security

The most prominent event of July was Ripple’s partial victory in the lawsuit against US SEC. The court ruled that XRP secondary sales are not investment contracts and therefore are not considered securities. This decision is significant given the current regulatory landscape in the crypto industry. In response, XRP’s price increased by almost 100%, and its market capitalization grew by almost 70%, making it the fourth-largest cryptocurrency by market capitalization for a short period of time.

This ruling is a positive sign for the crypto industry and may also impact projects currently considered securities by the SEC. However, XRP’s lawsuit is not yet finalized, so the future remains unclear.

Multichain is ceasing operations after the hack

Multichain, a popular cross-chain router protocol used for transferring assets between blockchains, has recently announced that it will cease operations following a hack and the arrest of its CEO, Zhaojun. The project lacked operational funds and was unable to contact Zhaojun after his arrest by Chinese police. The protocol’s collapse was further fueled by a $130M exploit in July (which could actually be a seizure of funds by the police), highlighting the vulnerability of bridges and cross-chain activities to hacking.

Curve Drama

The end of the month saw another exploit after hackers found a vulnerability in older versions of the Vyper compiler contract programming language. This could well be one of the worst events in crypto since the FTX collapse, putting half of the DeFi sector at risk. While the hack damaged other projects, the CRV token became the risky one, as Curve’s founder had a significant DeFi loan secured by the CRV. If its market price fell below $0.4, it could end up in massive liquidations.

Now it seems that the Curve drama has ended well, but it has taught the DeFi another lesson: risk management is key.

Market Performance

July was a relatively quiet month for the crypto market, with low volatility and decreasing trading volumes. However, some projects from the top 100 ranking significantly outperformed the market.

Bitcoin performance

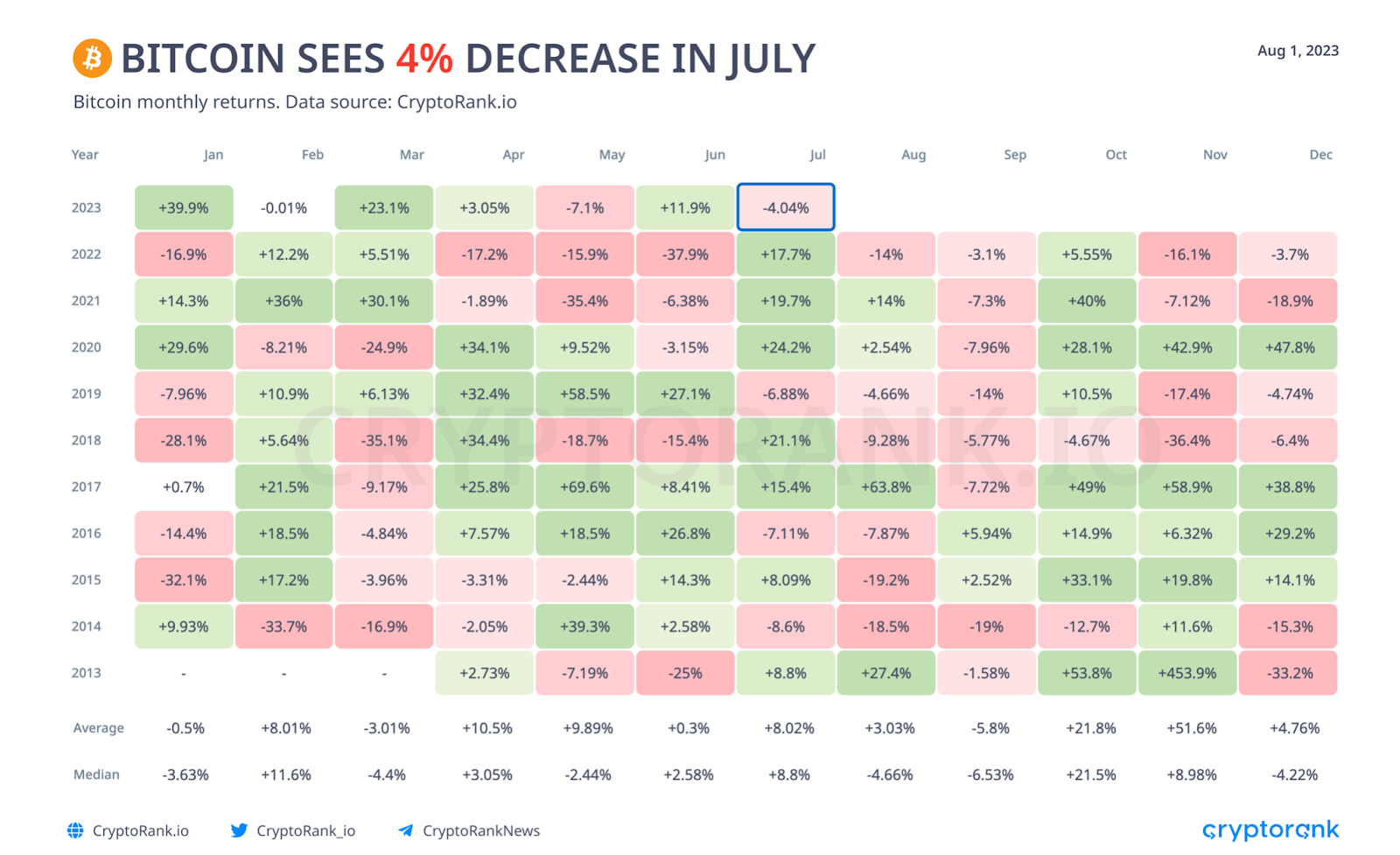

July is traditionally a good month for Bitcoin, with an average price growth of 8%. This year, it seemed like this trend would continue, as Bitcoin reached a year-to-date all-time high this month. However, Bitcoin failed to defend the $30K level and closed the month with a 4.04% price decrease, falling below this important psychological mark.

Some top altcoins outperformed the market

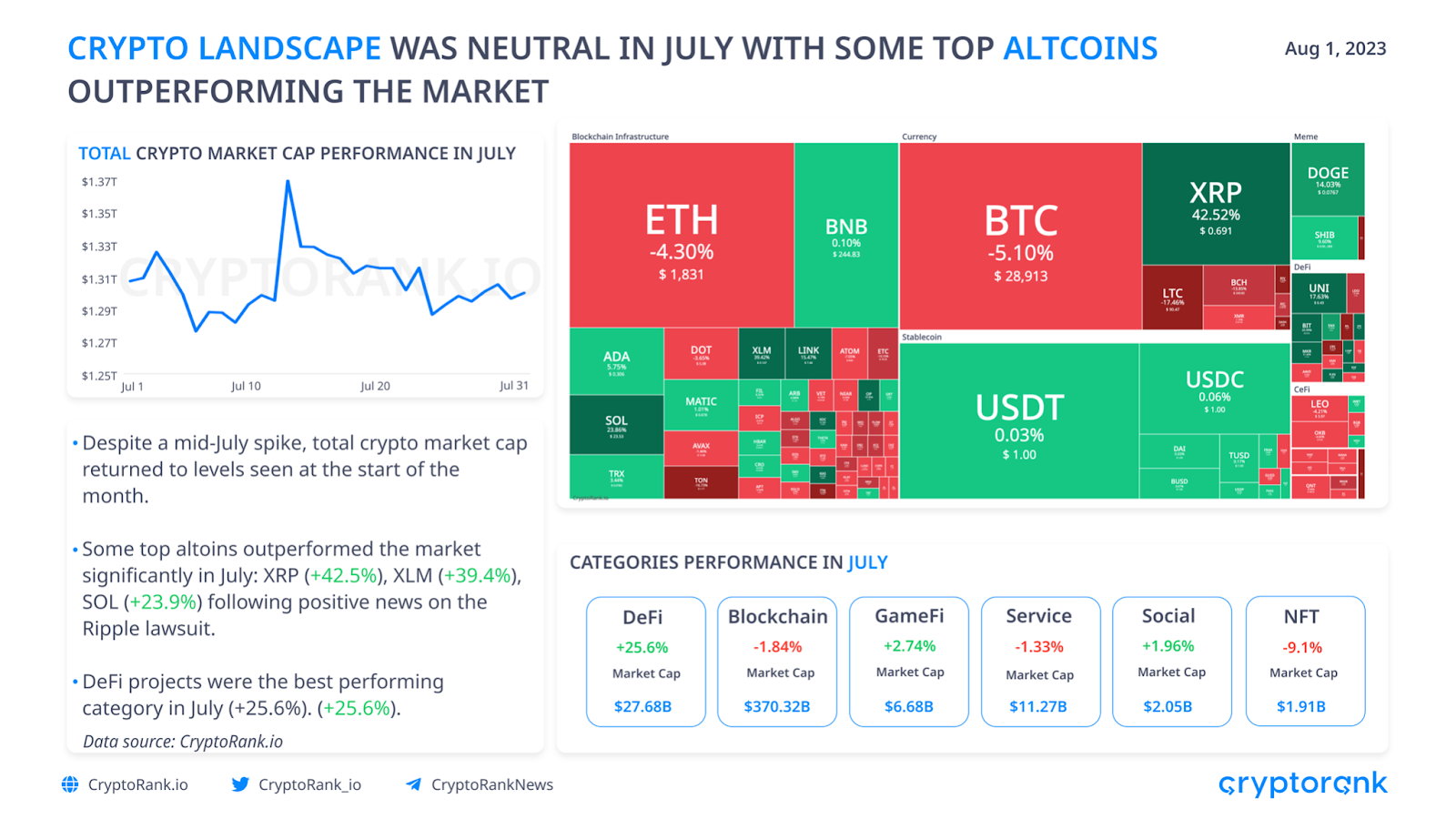

Despite low volatility in July, several top altcoin projects demonstrated significant price growth this month, outperforming the market. Positive news about the XRP lawsuit triggered a price surge for the coin (+42.5%), and some blockchains also reacted positively to the news, such as XDC Network (+80.7%), Stellar (+39.4%), and Solana (+23.9%).

Overall, the crypto landscape has not changed significantly in July, with the total market cap remaining at the same level for almost the entire month, except for a mid-July spike following XRP’s growth. At the end of the month, the total crypto market cap was around $1.3T.

DeFi projects showed the best performance among other categories in July (+25.6%), while NFT-related tokens showed the worst result (-9.1%).

Trading Volumes Are Down in July

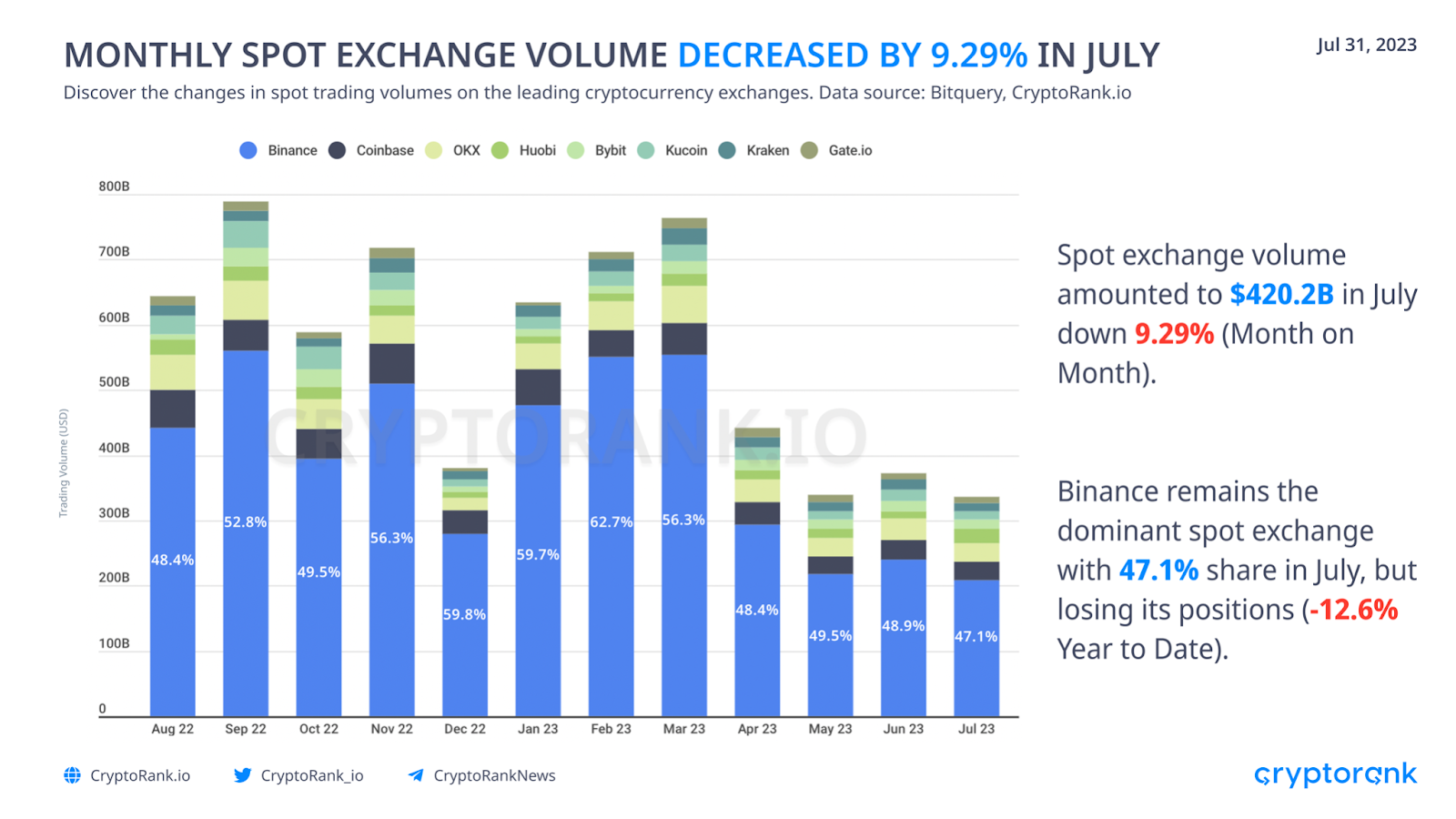

In July, the monthly spot exchange volume decreased by 9.3%, marking the second-worst result of the year at $420.2B. Binance remained the most popular exchange, accounting for 47.1% of trading volumes in July. However, it has been steadily losing market share, with a decrease of -12.6% Year to Date (YtD) and -1.8% Month on Month (MoM).

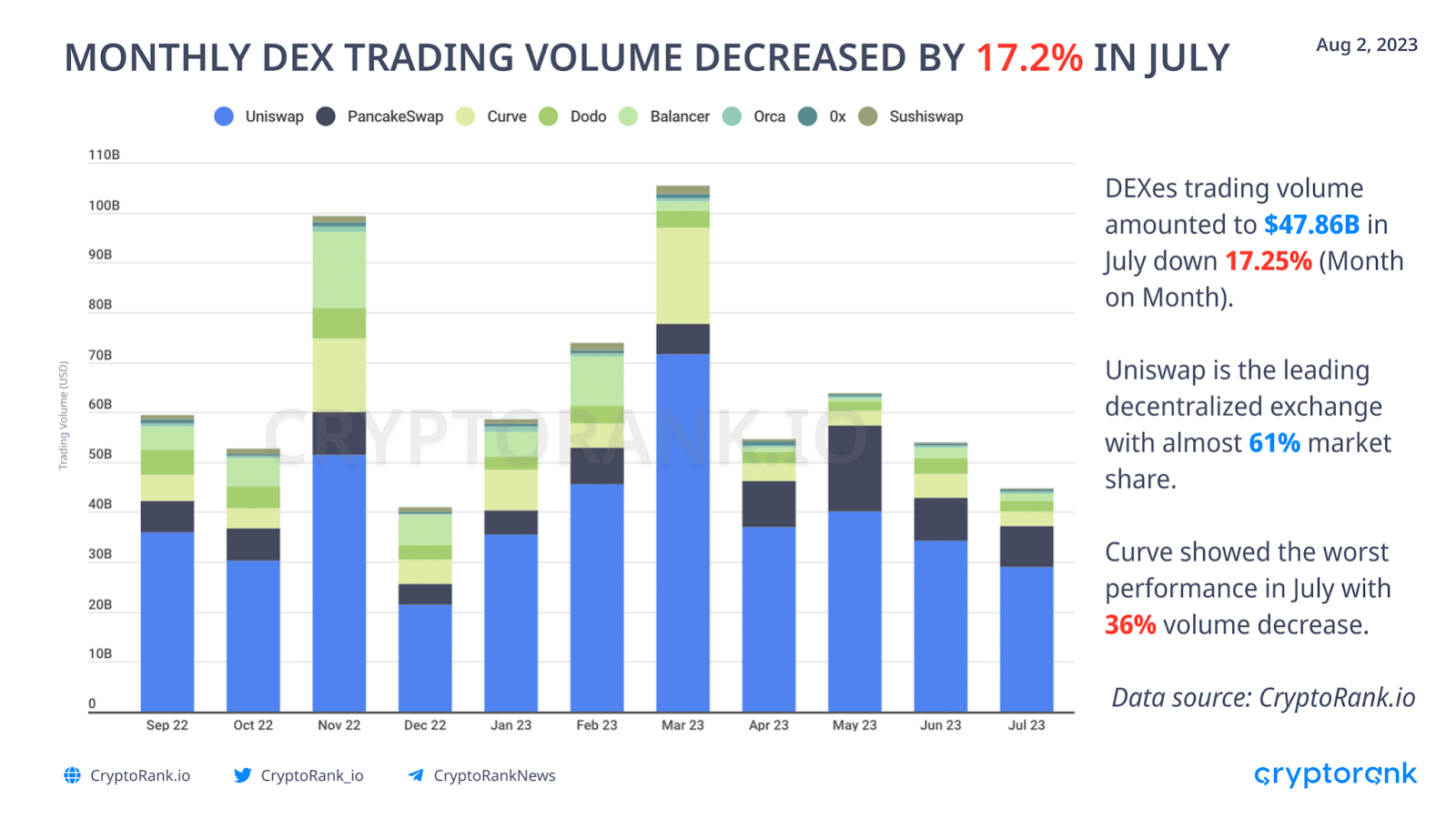

Decentralized exchanges experienced a significant decrease in trading volumes in July, dropping to $47.86B (-17.25%). This represents the worst result since the beginning of the year. The market for decentralized exchanges is highly concentrated, with Uniswap accounting for 61% of trading volumes and the top five decentralized exchange protocols (Uniswap, PancakeSwap, Curve, Dodo, Balancer) generating 91.3% of trading volumes in July.

However, some market leaders are losing their positions. For example, Curve DEX saw a 12.6% drop in trading volumes in July.

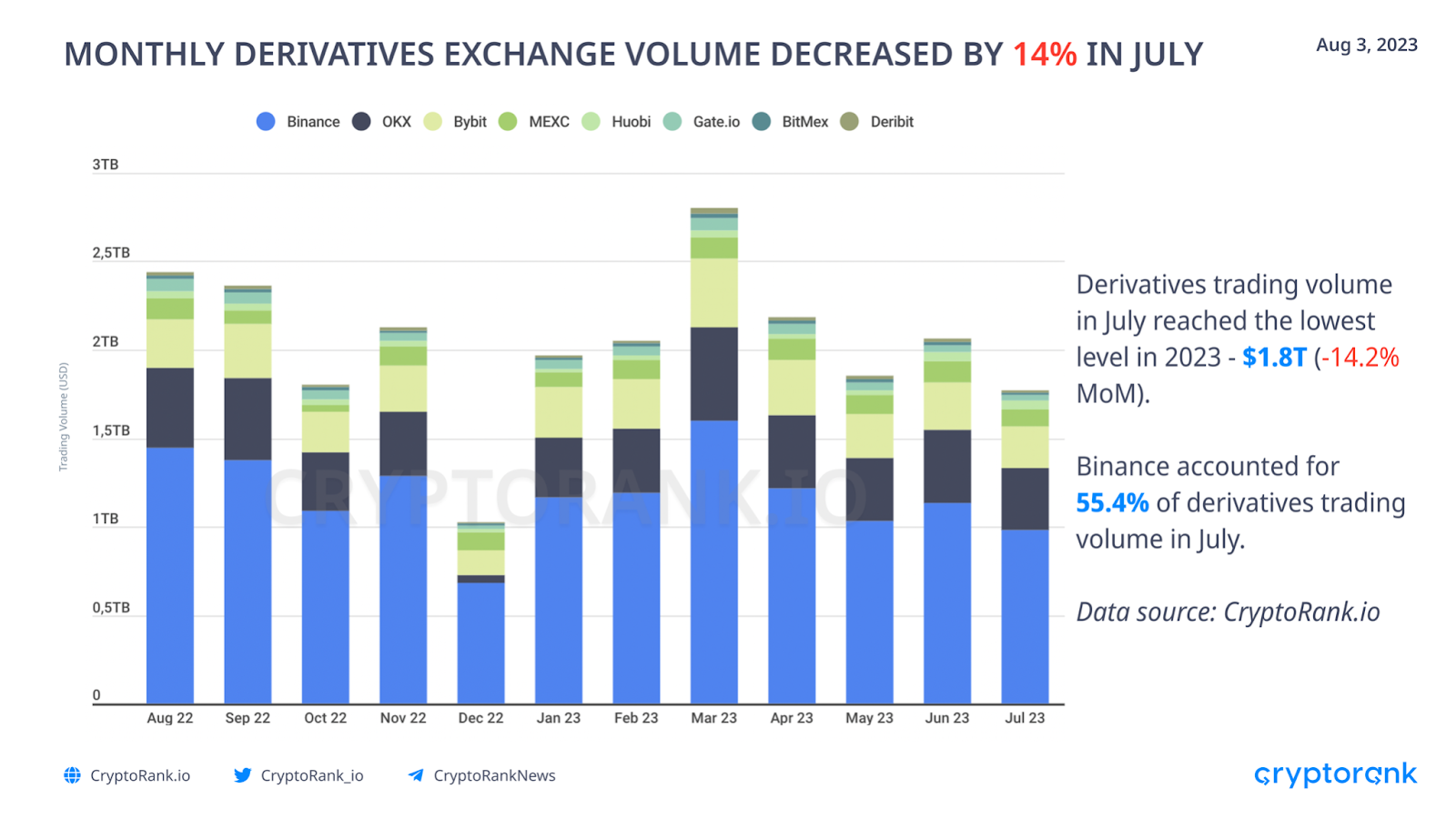

The leading derivatives exchanges showed the same dynamics as the spot market. July 2023 was the worst month for trading volumes of crypto derivatives, with a total of $1.8T (-14.2% MoM). Binance Futures accounted for 55.4% of derivatives trading volume in July, with its market share remaining stable over the last 4 months.

Token Sales Performance in July

Public token sales activity was relatively low in July 2023, with only 28 public token sales completed, raising a total of $14 million. This marks the second-lowest result of the year. Due to decreasing trading volume, many projects are hesitant to conduct public sales and instead prefer to wait for a potential bull run. Additionally, some projects are choosing to distribute tokens through airdrops to avoid regulatory scrutiny.

Blockchain services have become the most popular category for token sales, with 15 projects falling under this category. Among them, the most attractive sale was Arkham IEO on Binance. Arkham is building an intelligence platform that provides information on the real-world entities and individuals behind crypto market activity. The project received $12M in funding from leading investment firms such as Coinbase, Digital Currency Group, and angel investors. Arkham’s ATH ROI was 15.16X (+1,415.8%) with current ROI (at the time of writing) of 10.5x (+824%). Other projects that followed Arkham in terms of current ROI include GameSwift, SophiaVerse, DexCheck, and Sabai Ecoverse.

Binance Launchpad raised the largest amount of funds in July – $2.5M, followed by xLaunchpad ($2M) and Camelot ($1.1M).

However, fundraising activity, including private rounds, increased in July. Projects raised $721.6M in 117 token sales last month. This can be seen as a positive sign for the market as projects continue to attract funds from investors.

DeFi Landscape Overview

The total value locked (TVL) in the DeFi sector decreased by 2.9% MoM in July. This decline was largely due to the Curve hack, which caused TVL to drop by almost $2 billion since July 30. The incident raised concerns about the future of DeFi, as several major protocols faced issues. However, the situation improved when the Curve hacker agreed to return the stolen funds.

Liquid staking has cemented its position as the leading DeFi sector by Total Value Locked (TVL). On the other hand, as trading volumes decrease, Decentralized Exchanges (DEXs) are losing their positions and have been surpassed by Lending Protocols in terms of TVL.

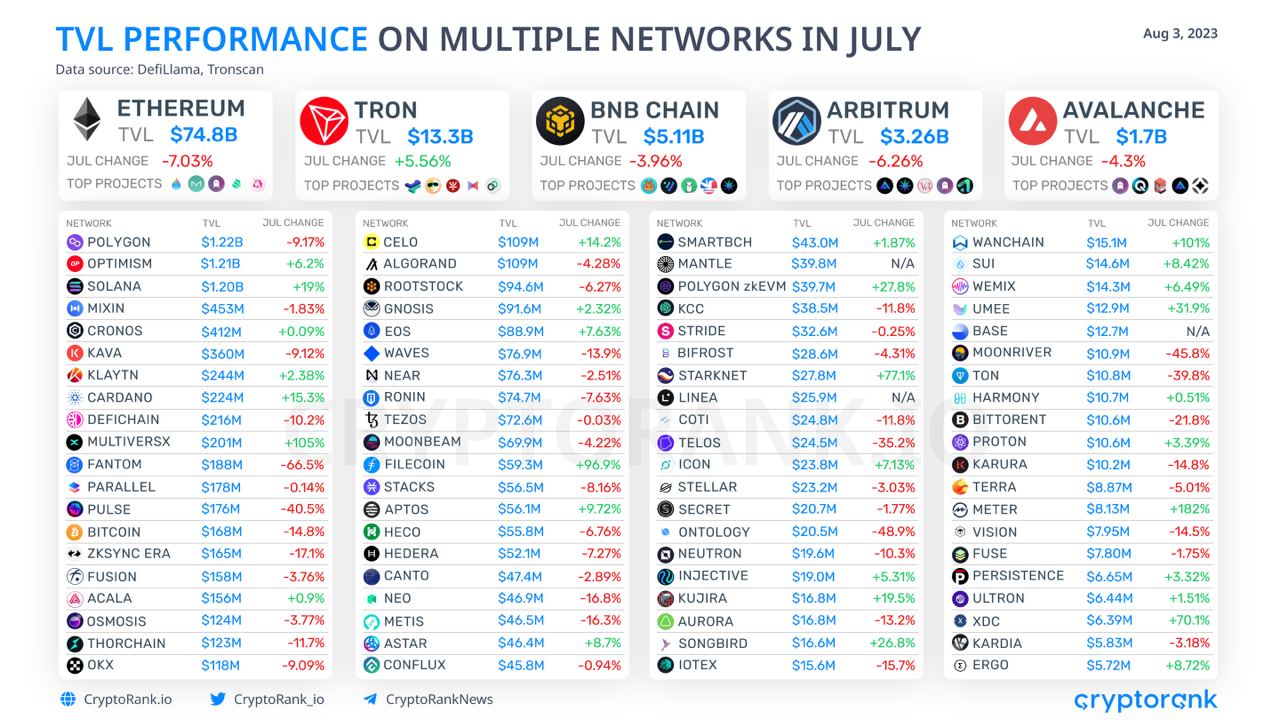

In July, Ethereum accounted for almost 70% of multi-chain total value locked (TVL), maintaining its position as the leading blockchain for DeFi activity. TRON came in second place with a 5.7% share, followed by BNB Chain, which accounted for nearly 5% of TVL.

Meter, MultiversX, and Wanchain showed the highest growth of TVL among the blockchains, while TVL on the leading chains except TRON dropped slightly in July.

July was a relatively quiet month for DeFi, except for the last few days when the Curve hack occurred. Despite this setback, it appears that DeFi can survive, with new chains challenging TVL and projects aimed at solving existing problems within DeFi.

It Is Not That Bad As It May Look

Despite some news that triggered volatility in the crypto market, July brought little change to the state of the industry. With decreasing trading volumes, low token sale activity, and an outflow of value from DeFi protocols, it is hard to predict the next movement in the crypto market.

The news feed has become an important factor that significantly impacts the state of the crypto industry. However, even positive news such as XRP’s partial win in the lawsuit cannot foster growth in the crypto market. In the past, August has been a neutral month for BTC price, with an average growth of 3.1%. We will see how it goes this time.

Everything that is happening in the market right now, including regulatory changes, hacks, and project updates, is making the industry evolve. This is an important step towards the global integration of the blockchain industry into the financial world, especially as it can happen in conjunction with the upcoming bull run.