After a bearish start to August 2023, Bitcoin Cash (BCH) price is finally flashing on-chain signals of a potential purple patch. With BCH short sellers suffering their highest liquidations since July 13, a market momentum swing could trigger another Bitcoin Cash price rally.

The Bitcoin Cash (BCH) price has climbed over 8% from Monday’s low of $216 to its current price of $235 on Tuesday morning, allaying initial fears of a potential reversal below $200. On-chain data analysis examines the likelihood of another BCH price rally in August.

BCH Short Sellers Suffer Highest Liquidations Since July

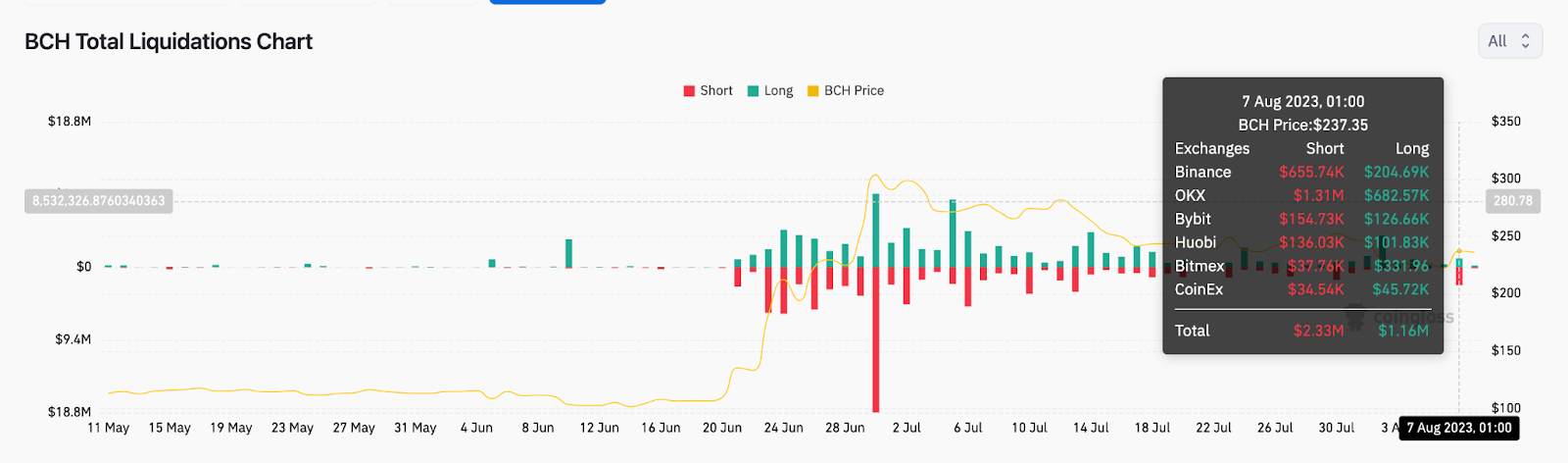

Traders betting against Bitcoin Cash prices racked up big losses on Monday. According to data analytics portal Coinglass, $2.33 million short contracts were liquidated on Aug 7.

Notably, this is the highest liquidation volume the short sellers have suffered since July 13, as depicted in the chart below.

Short Liquidations occur when traders who have taken short positions on an asset are forced to close those positions due to an adverse price upswing.

The significant spikes in short liquidations observed above can be bullish for BCH prices for several reasons, especially when multiple short positions are being liquidated simultaneously.

Be the oracle of your crypto future. Get BCH price predictions here.

The Large Institutional Investors are Back in Action

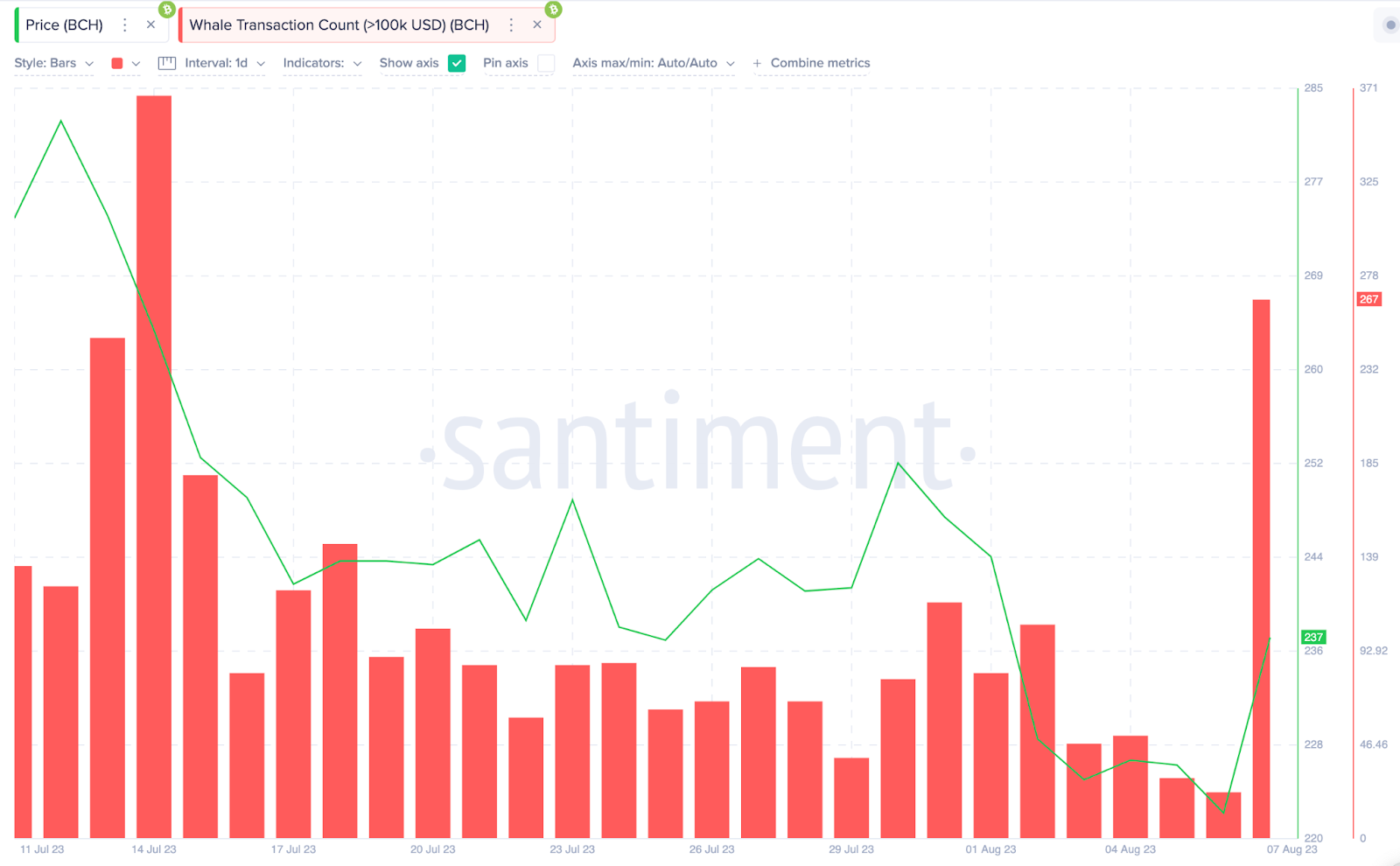

Bitcoin Cash’s listing on the institutional trading platform, EDX markets, had been pivotal to the BCH price rallying to a 2023 peak of $329 in late June. After cooling their trading activity for nearly a month, the whales now appear to be returning to action.

According to data from Santiment, BCH recorded the highest Whale Transaction Count on Monday since mid-July.

The chart below shows BCH hit 267 Whale Transactions on Aug 7. Remarkably, the last time Bitcoin Cash attracted this level of whale trading activity was nearly a month ago, on July 14.

Quite literally, Whale Transaction Count sums up the number of confirmed BCH transactions that exceed $100,000 in value on any given day. This essentially paints a picture of changes in the whales’ trading activity.

A spike in Whale Transaction count is bullish, meaning whale investors are now making big bets on Bitcoin Cash again. Furthermore, large transactions provide much-needed market liquidity and boost the confidence of retail investors.

These factors could facilitate a sustained BCH price rally if the recent short liquidations do not abate.

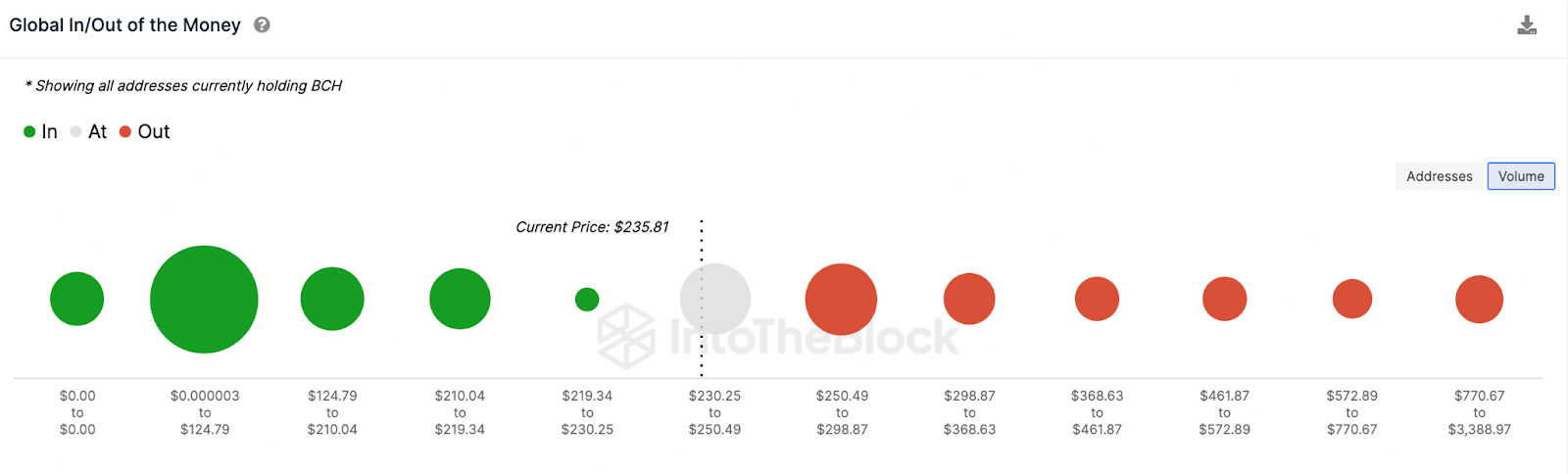

BCH Price Prediction: The $250 Resistance Could Become an Accumulation Zone

With bulls clearly in control now, BCH shorts could suffer more liquidations as buys ramp up. This could trigger a further price rally toward the $280 range in the coming days.

However, BCH could hit a massive sell-wall around the $250 territory. As seen below, 363,000 addresses had bought 2.21 million BCH at a maximum price of $250. If they chose to exit, it could slow down the BCH price rally.

But since the data shows BCH holders’ historical preference to buy around that range, there’s a fair chance the $250 territory could now form a larger accumulation zone.

The BCH price could promptly climb toward $280 if that bullish scenario plays out.

On the contrary, the bears could regain control and potentially push the BCH price toward $220. However, 182,430 holders have bought 450,000 BCH coins at an average price of $225, making this another area of strong support if the price declines. If they can hold firm, they could trigger an early rebound.

But BCH could drop much lower than $220 if that support level caves.

beincrypto.com

beincrypto.com