Yield Guild Games (YGG) has smashed through the top gainers’ charts as it gained over 350% during the last 7 days. On-chain data analysis examines how Binance’s YGG/USDT Perpetual Contract launch and the ongoing “GAP” event drive the YGG price rally.

Yield Guild Games (YGGs) is a decentralized play-to-earn platform that allows gamers to invest in virtual world assets and non-fungible tokens (NFTs). With a 350% price rally over the past week, the native token, YGG, has grabbed investors’ attention.

Why is Yield Guild Games Price Rallying?

On Thursday, Aug 3, the Yield Guild Games announced the Guild Advancement Program (GAP) Season 4. The GAP is a periodic gaming event that distributes tokens and other rewards to community members who complete specified quests in the participating YGG-affiliated games.

The participating games in the ongoing GAP Season 4 include big guns like, Axie Infinity (AXS), Splinterlands, and Skyweaver. Unsurprisingly, YGG network usage instantly spiked to a one-month high of 192 active addresses.

Coincidentally, barely 24 hours later, on Aug 4, Binance announced that it would launch a YGG/USDT trading pair for perpetual contracts on its CEX trading platform, allowing up to 20x leverage. On-chain data shows this also attracted more than $100 million in new capital into the YGG ecosystem.

How did these two factors propel YGG to a 350% price surge, and what is the most likely price movement to expect in the coming days?

YGG Network Activity Hits a One-Month Peak After New Gaming Event Begins

The GAP Season 4 community gaming event commenced on Aug 3. On-chain data suggests that it propelled the Yield Guild Games network activity to a one-month peak.

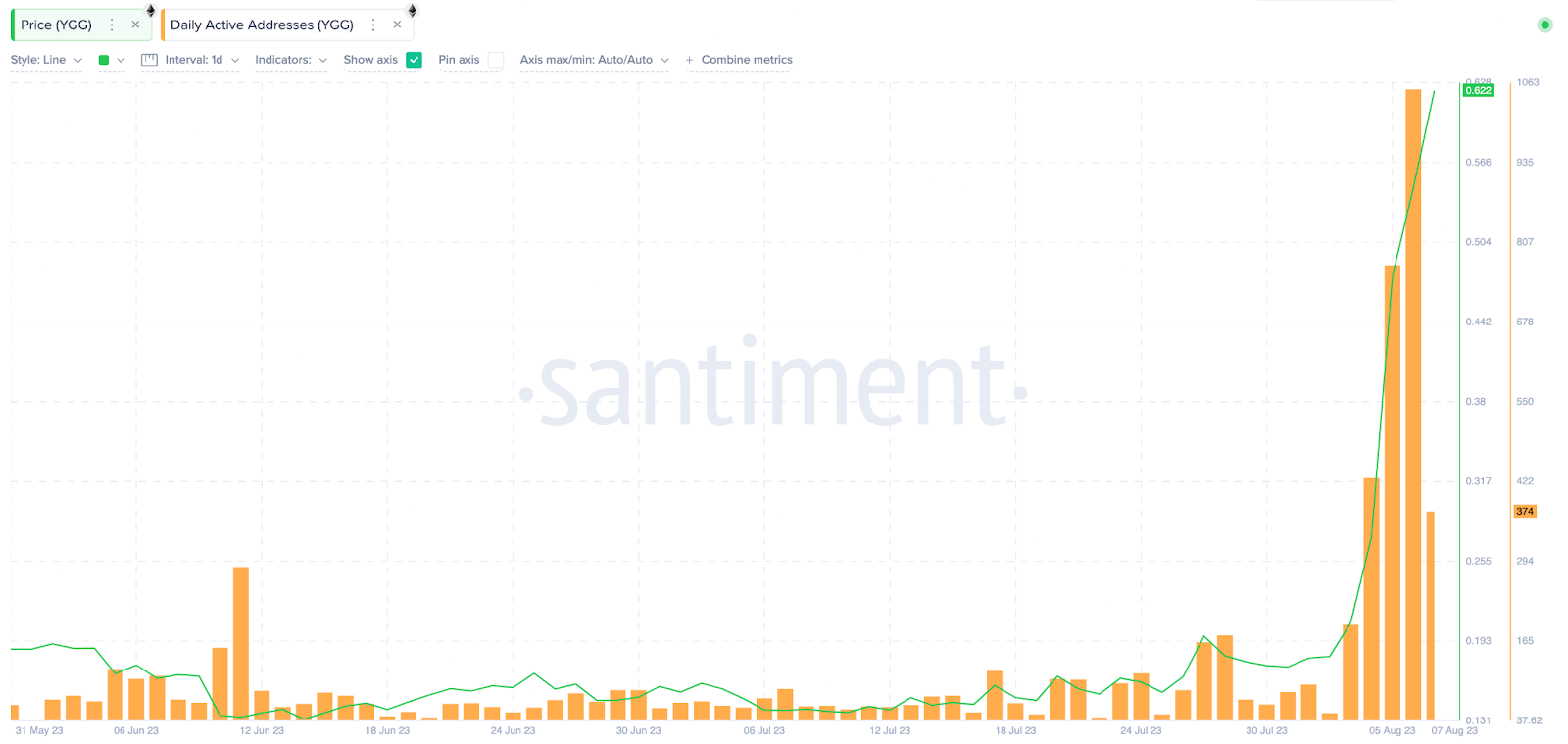

According to Santiment, YGG only attracted 50 Unique Active Addresses on Aug 2. After the gaming event was announced, it instantly climbed to 192 Active Addresses by the close of Aug 3.

As depicted in the chart below, that 284% spike saw YGG attract its highest network activity since June 14.

Daily Active Addresses tracks changes in network activity by summing up the number of unique wallet addresses that carry out transactions on a given day. Multiple spikes in network activity are a bullish signal indicating growing demand for the underlying native token.

As observed above, last week’s 284% spike in network demand had set the pace for the exponential price gains.

Binance Product Offering Launch Attracted New Capital to YGG

On Aug 4, the world’s largest CEX by active user base, Binance, announced that it would launch a YGG/USDT trading pair for perpetual contracts.

Perpetual Contracts are a special trading product offering that allows investors to either speculate on the future price of an asset being lower than the current price (short position) or higher (long position).

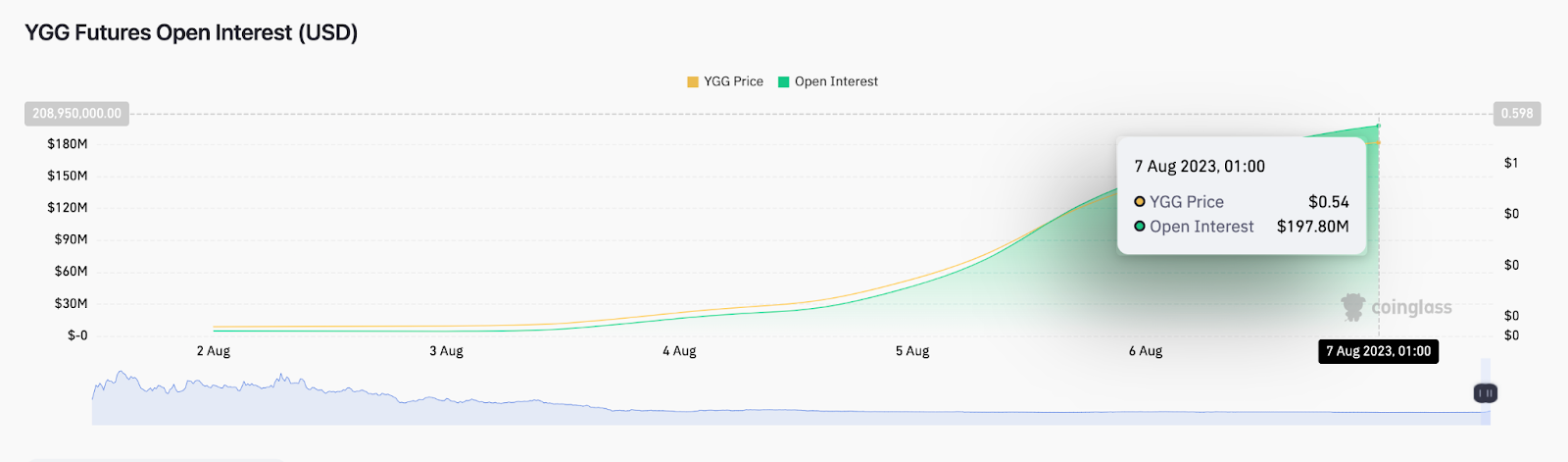

On-chain data shows that it allowed investors to pile more than $100 million in new capital inflows into YGG-denominated markets. According to data from Coinglass, YGG Open Interest began to skyrocket immediately after Binance launched the YGGUSDT perpetual contracts pair on Aug 5.

Initially, YGG Open Interest soared by 900% from $4.39 million to $46.67 million between Aug 3 and Aug 5. But as of Aug 7, it has climbed by another 320% to reach $190.7 million in Open Interest.

Open interest sums up the value of outstanding derivative contracts for an asset, such as options or futures contracts. An increase in open interest suggests that new capital flows into the asset offering. Indicating more traders have opened positions for the day than closed them.

In summary, on-chain data shows that there has been a 284% spike in network activity and 320% growth in open interest. Both factors have combined to propel the ongoing YGG price rally.

Read More: 9 Best Crypto Demo Accounts For Trading

YGG Price Prediction: Short Squeeze Risk Ahead?

Strategic investors will be wary of taking long positions on Yield Guild Games. This is because YGG’s Open Interest now sits at $190.8 million, exceeding the current market capitalization of $144 million.

Whenever Open Interest surpasses the market cap of the underlying asset, it indicates excessive market speculation. This market imbalance means the YGG long position holders now run the risk of a vicious short squeeze.

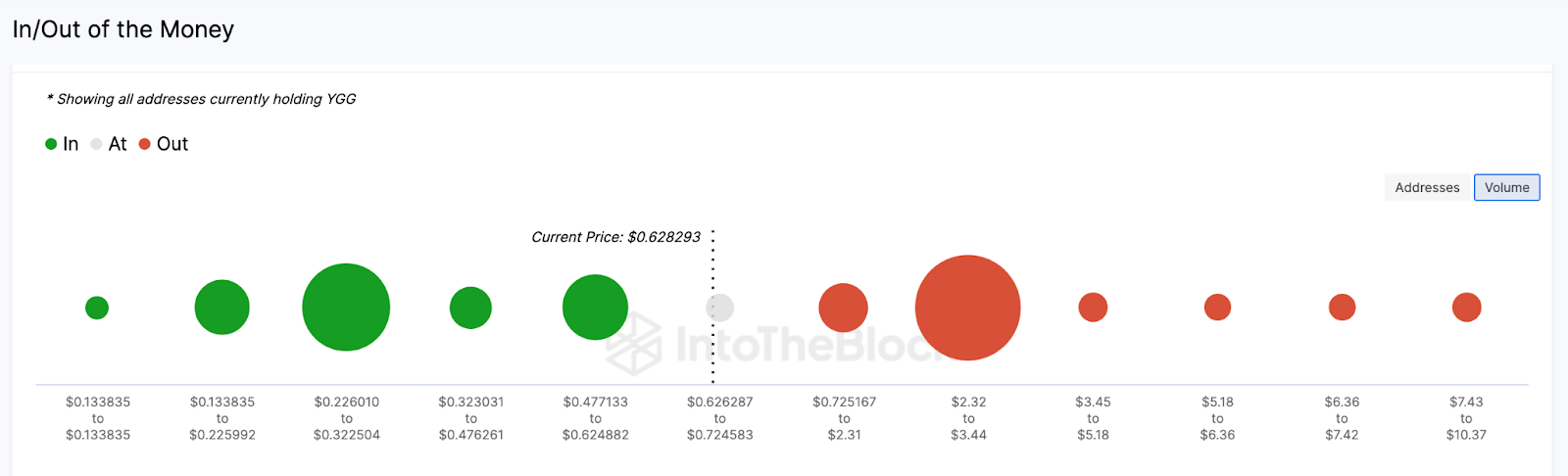

However, IntoTheBlock’s IOMAP data shows that after breaking out of the critical $0.60 resistance, the YGG price rally could continue as high as $1. But as seen below, 1,280 holders had bought 44 million YGG tokens at the minimum price of $0.72.

This cluster of holders has been holding unrealized losses for at least 1-year. Hence, many of them will likely book profits and close their positions once YGG price approaches that territory.

But if Yield Guild Games price speculators keep piling on new capital, YGG price could proceed to hit $1.

But conversely, considering the growing risk of a short squeeze, the bears will have their eyes on the $0.40 target. However, the 572 addresses that bought 121.3 million YGG tokens at the average price of $0.55 will offer initial support.

But if there is a massive liquidation wave, YGG could lose that support and promptly retrace toward $0.40.

Read More: Top 11 Crypto Communities To Join in 2023

beincrypto.com

beincrypto.com