Top crypto analyst Benjamin Cowen is warning about Litecoin ($LTC) after its halving event while updating his outlook on Bitcoin ($BTC).

Cowen tells his 754,600 Twitter followers that the peer-to-peer payments network will likely decline in price after Wednesday’s halving event when miners’ rewards were cut in half.

“As mentioned a month ago, $LTC tends to peak in June/July of its halving year and then fade into the halving. Following the halving, history shows you should temper your expectations on $LTC until the post-halving year (2025).”

According to his chart, Litecoin historically rallies two months prior to a halving event then goes on about a year-long decline before rallying in the subsequent year.

Litecoin is trading for $87.46 at time of writing, down 6.8% in the last 24 hours.

Looking at Bitcoin, Cowen believes that an outflow of altcoin market liquidity into $BTC is sustaining Bitcoin’s rally as indicated by the declining total market cap of altcoins (TOTAL3).

“$BTC is up while altcoins are down. This goes along with the theory that the $BTC rally is primarily fueled by the conversion of alts to $BTC. Historically, in the pre-halving year, we reach a turning point where alt liquidity is no longer sufficient for $BTC to continue the rally.”

According to Cowen, both the TOTAL3 market cap decline and an increase in Bitcoin’s dominance ($BTC.D) support his thesis.

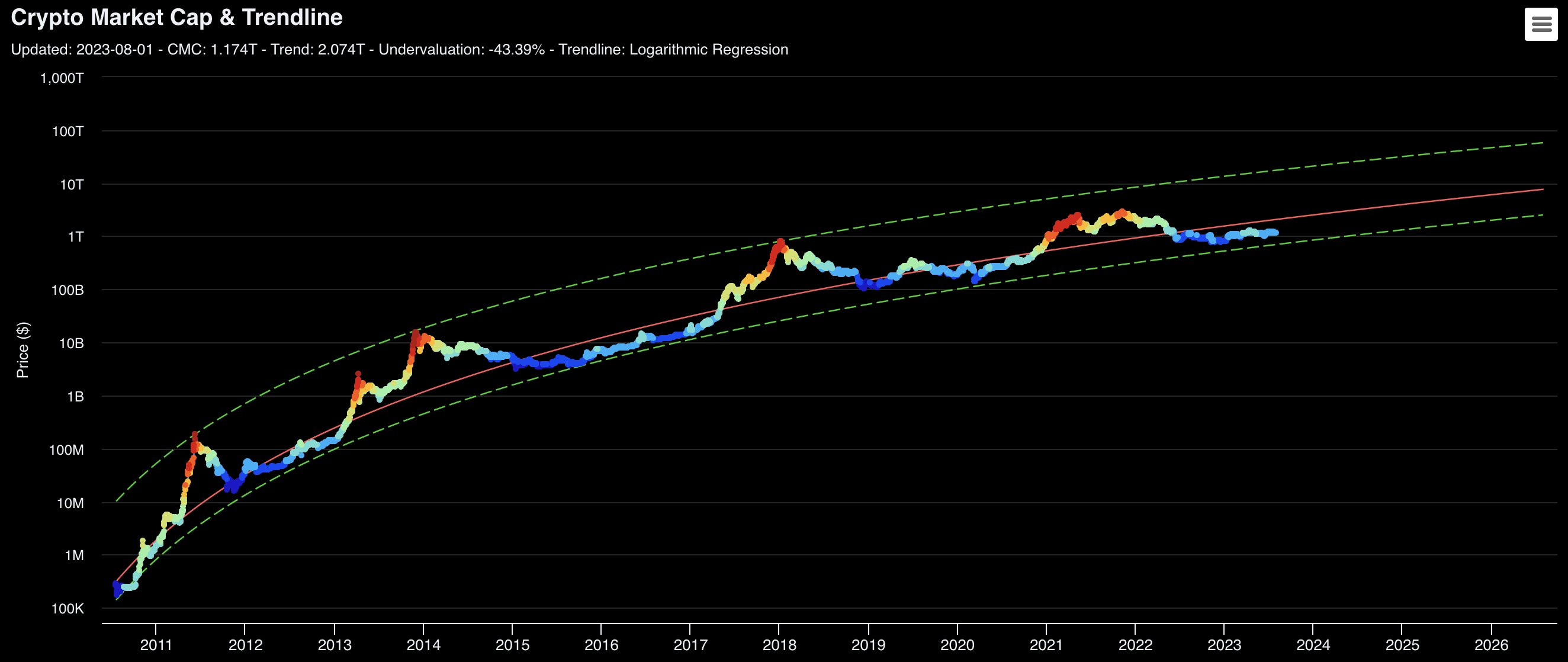

“Total crypto market capitalization color-coded by $BTC risk, which depends on price, on-chain, and social metrics. Total market cap has gone sideways for the last year because while $BTC went up, most altcoins went down. During that period, $BTC dominance went from 39% to 49%.”

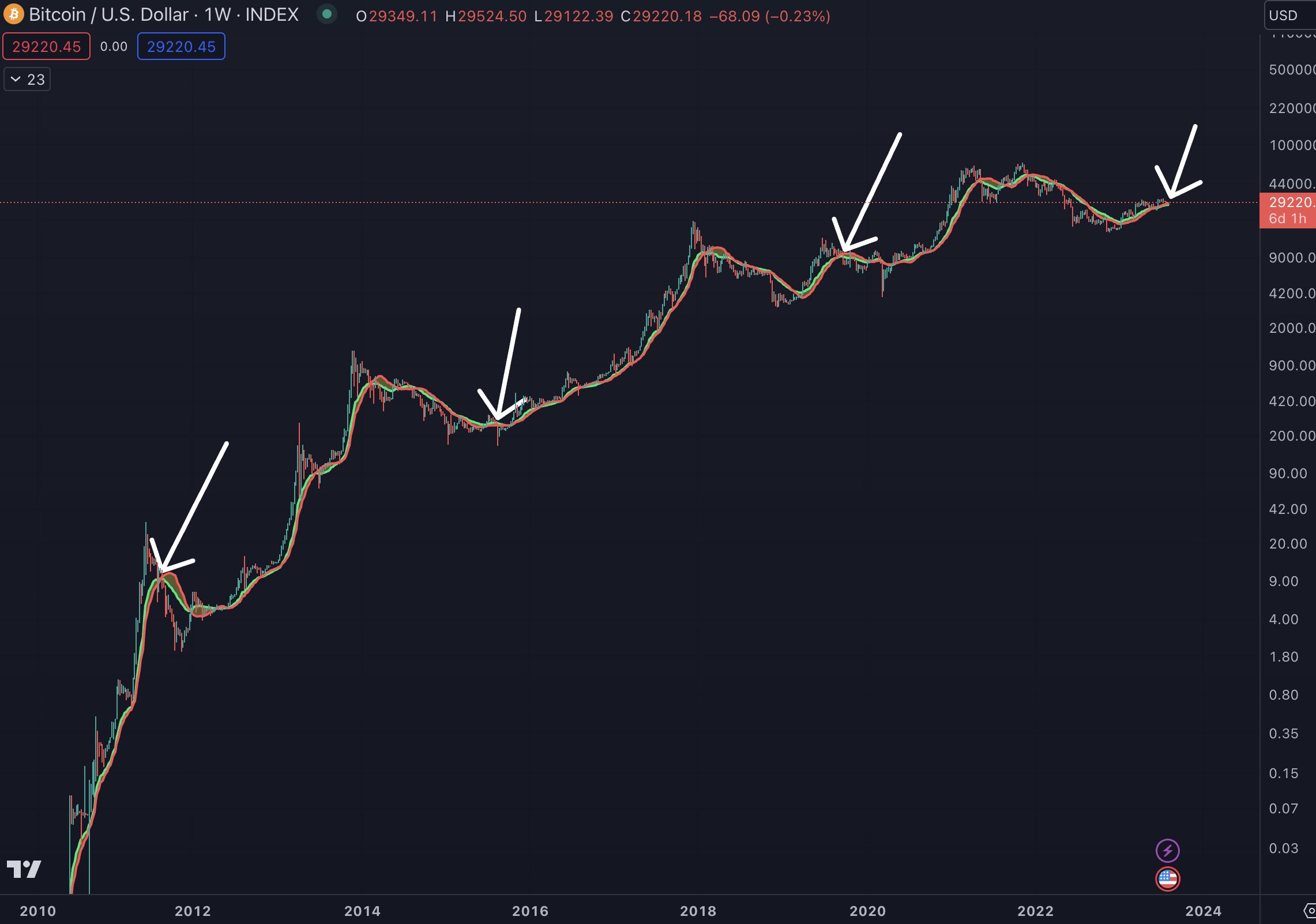

Cowen warns of a Bitcoin market correction based on historical price action during pre-halving years.

“During the last three pre-halving years, Bitcoin fell below its bull market support band in August/September…

No guarantee it happens this time, but certainly a strong possibility.”

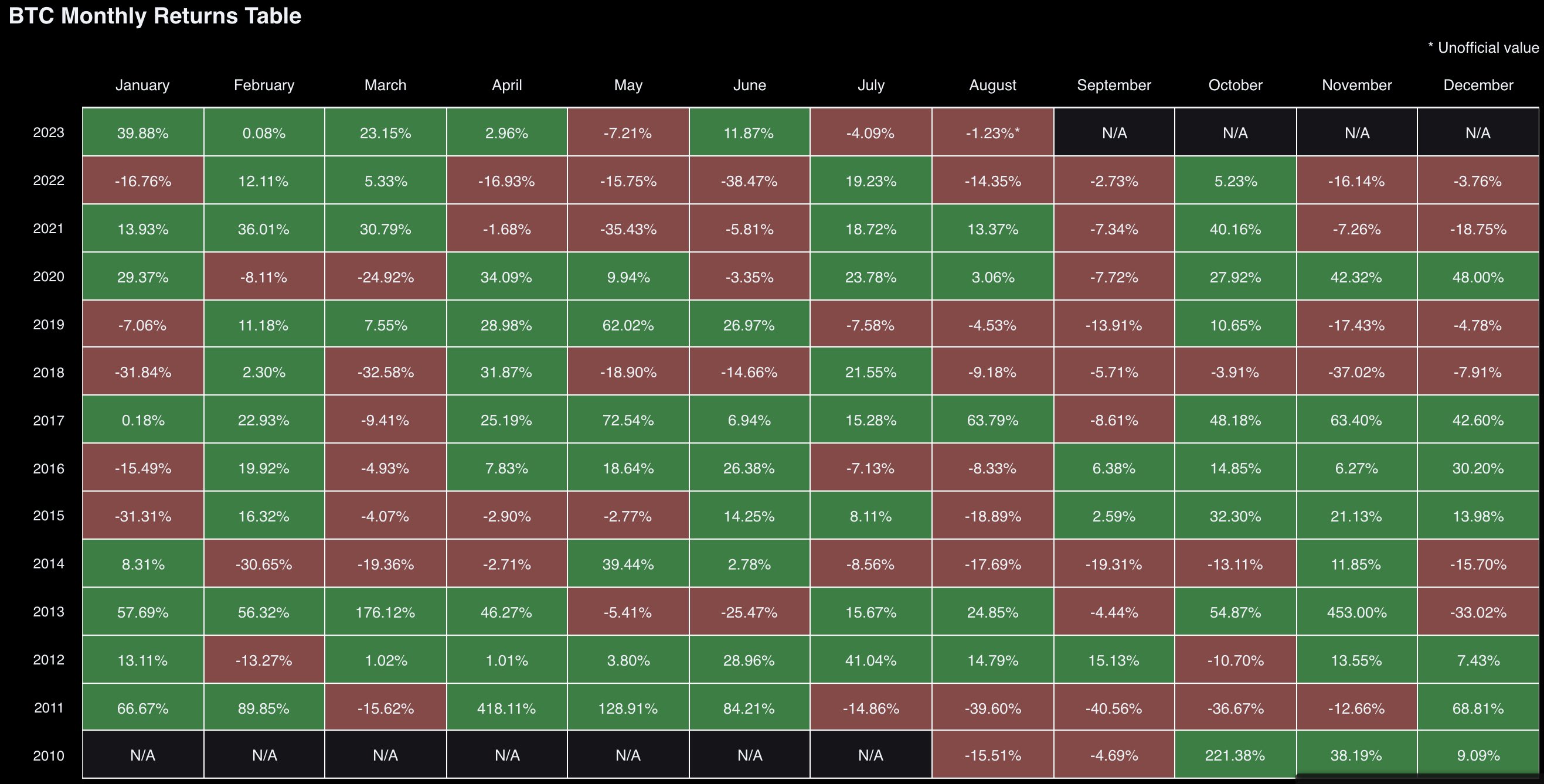

He notes an August Bitcoin dip is also supported by the historical average return on investment (ROI) for pre-halving years, which in July matched pretty closely to other Julys. If August plays out similarly, Bitcoin could be looking at an ROI of more than -20%, according to Cowen.

“As I previously mentioned, the ROI of Bitcoin in July of the pre-halving years was -4.74%. The return of $BTC in July 2023 ended up being -4.09%. FWIW (for what it’s worth), the average return of $BTC in August of its pre-halving years is -21.3%.”

Bitcoin is trading for $29,187 at time of writing, down 1.8% in the last 24 hours.

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com