As the second half of 2023 picks up steam, the crypto market has seemingly followed suit. After a lackluster month of May, which saw very little in terms of noticeable gains, the market has made a sharp turn and posted some impressive gains throughout the month of July.

A bulk of this newfound energy can be attributed to the infamous $XRP lawsuit, which Ripple has partially won.

While not a resounding victory in of itself, the SEC found no incriminating evidence to suggest a violation of federal securities law by Ripple Labs, which skyrocketed the broader crypto market throughout the month - a momentum which is unlikely to stop throughout August.

The Crypto Fear and Greed Index stands at a moderate 53 – showing a point of careful anticipation on the market.

Top 5 Gainers

July has seen a lot of duality on the market - with some cryptocurrencies, such as $XRP and $XLM, bouncing back massively and posting an average 40% gain between them, others were not so lucky.

As already mentioned, the positive outcome of the SEC’s case against Ripple Labs gave the market some much needed energy to reclaim some of their losses in what has been a quite problematic and tumultuous year for global crypto traders and investors.

With improving economic sentiment and institutions pouring more money into crypto, July could be a turning point for major cryptos to regain some lost ground.

$XRP ($XRP) +44.6%

Starting off with Ripple’s $XRP, which was at the forefront of the broader crypto market in July. The infamous SEC investigation and subsequent lawsuit made against Ripple Labs, had been a major thorn in the side for most crypto investors since its initiation by the SEC in late 2020.

The SEC argued that $XRP was not a security and should be regulated as any other cryptocurrency. The lawsuit went on for over two years, with Ripple Labs achieving a landmark victory in July, which sent $XRP price soaring by over 75%.

As expected, many traders chose to keep their money, choosing not to overextend, as the price gradually pulled back again, leading to a monthly gain of 44.6% for July. This makes 2023 an unexpectedly positive year for $XRP investors, with the price of the coin being up 86.6% since the start of the year.

Stellar ($XLM) +38%

Up next is Stellar, which also reacted very positively to the outcome of the Ripple Labs case - gaining over 60% in a matter of minutes after the news had hit the market on July 14. After a small pullback over the next few days, $XLM rose further to the $0.18 mark, before pulling back once again.

Overall, $XLM posted a monthly gain of 38%, which amounts to an annual price increase of 29%. All things considered, $XLM has had a positive year overall and with market sentiment on the rise, the coin could be poised for further growth in the near future.

Solana ($SOL) +22.7%

After what has been a terrible year for Solana investors, the coin benefited hugely from the SEC news in July. As we’ve already covered, the conclusion of the Ripple Labs case reignited the crypto market and Solana was no exception, as the coin gained over 22% over the month.

However, the pullback in Solana’s price after the news was also noticeable, as the price fell from $30 to below $23 – a more than 23% drop from its peak on July 14.

As for future predictions, Solana seems to have reached a support point at $22.7, which could be broken if no major buying takes place. This could see $SOL drop as low as $20 - effectively erasing the gains from July 14. Regardless, 2023 has been a very challenging year for Solana investors, as the coin is down by 42% over the past year of trading.

Chainlink ($LINK) +16%

The improved sentiment on the crypto market was a sign for Chainlink bulls to break over the $8 resistance point that had plagued them for so long. However, after achieving this feat, $LINK retraced back to the $7.5 territory. Chainlink’s trading volume suggests that the bulls are trying to build up their positions to firmly cross over the $8 resistance point and hold their positions for the long term and avoid another retracement below resistance.

Chainlink has gained roughly 16% throughout July and its annual returns sit at a low 7.3%. However, considering the rough market conditions of 2023, $LINK takes a deserved spot on our list of top gainers for July, 2023, with a positive outlook for the near-term future.

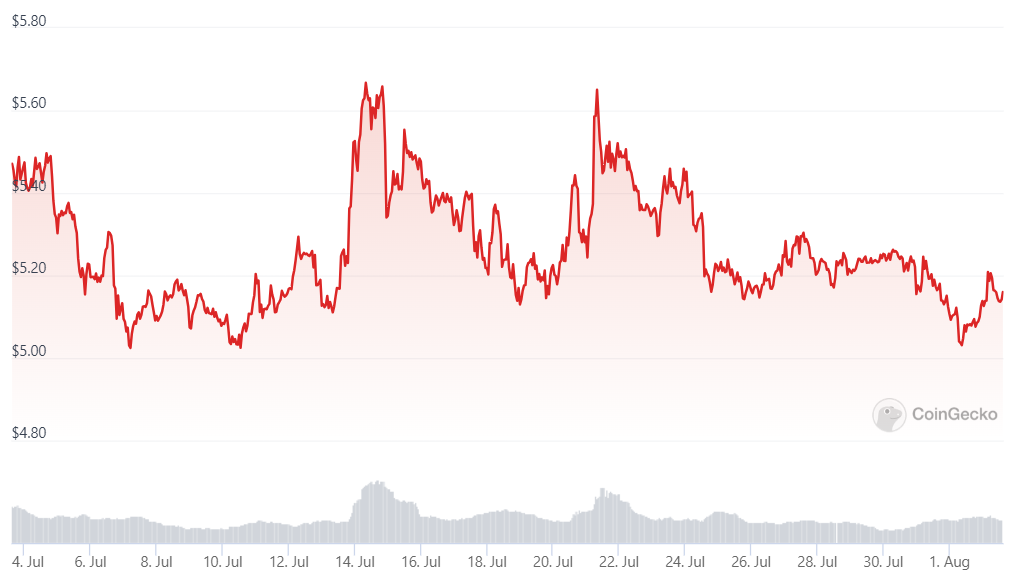

Uniswap (UNI) +16%

Uniswap was another notable gainer during the month of July - growing by 16% over the period.

However, unlike other entries on this list, Uniswap continued to grow after the July 14 news had reached the market.

After a pullback on July 24, the price regained momentum and reached over $6.50, which reduces the annual loss for Uniswap to 19.4%. While the year has been quite difficult for Uniswap investors, a gradual rise could be on the cards for the broader crypto market - helping Uniswap regain some lost ground over the coming months.

Top 5 Losers

On the flip side, July has seen some old favorites, such as Litecoin and Bitcoin Cash, shed over 18% of their respective prices. While the broader market trend for some coins has remained bearish throughout 2023, Litecoin’s price drop was triggered by an anticipated halving event scheduled for 2 August of this year.

While in comparative terms, the market has seen more growth than losses throughout July, some investors have seen their holdings dwindle in market value over the same period.

Litecoin ($LTC) -18.6%

Litecoin leads the downward slide for July – losing roughly 18.6% of its market value throughout the month. While broader bearish trends had been driving the crypto market since the start of the year, Litecoin’s steep drop in price can be attributed to its halving event scheduled for August 2.

But what has happened? Simple. When a halving happens, the amount of a particular coin being mined halves, which increases the incentive to mine more in the period leading up to the laving event, which is exactly what has been happening and the Litecoin whales have been accumulating their holding all throughout the months of May and June. The slowdown of the momentum on the whales’ part has forced the price to drop, as some whales opt to collect their gains before halving. July’s results come as a stark contrast from Litecoin’s annual results, which show a gain of 59% over the past 12 months.

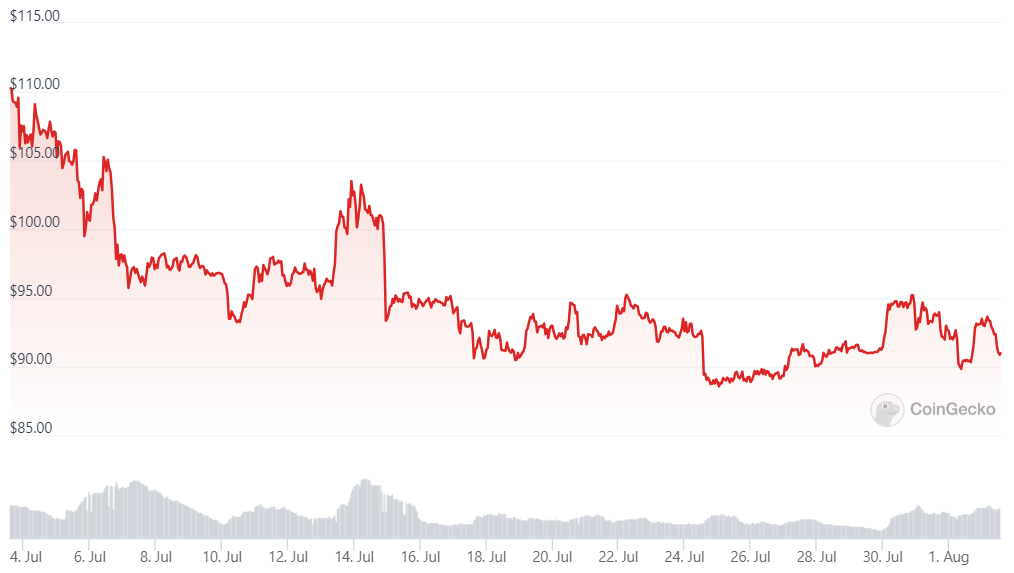

Bitcoin Cash ($BCH) -18%

Another coin with contrasting monthly and annual performance has been Bitcoin Cash. $BCH has lost 18% of its market value after a hard correction starting on July 14. Compared to its annual performance, which has seen the coin gain over 82%, $BCH has come a long way since its 2021 low of $86.

After the correction, $BCH has slowly regained some lost ground and sits at $237.6 as of this writing. Whether this correction is temporary or a sign of a broader bearish run on $BCH remains to be seen. However, analysts consider this to be a temporary and much-needed correction after an otherwise stellar year for the cryptocurrency.

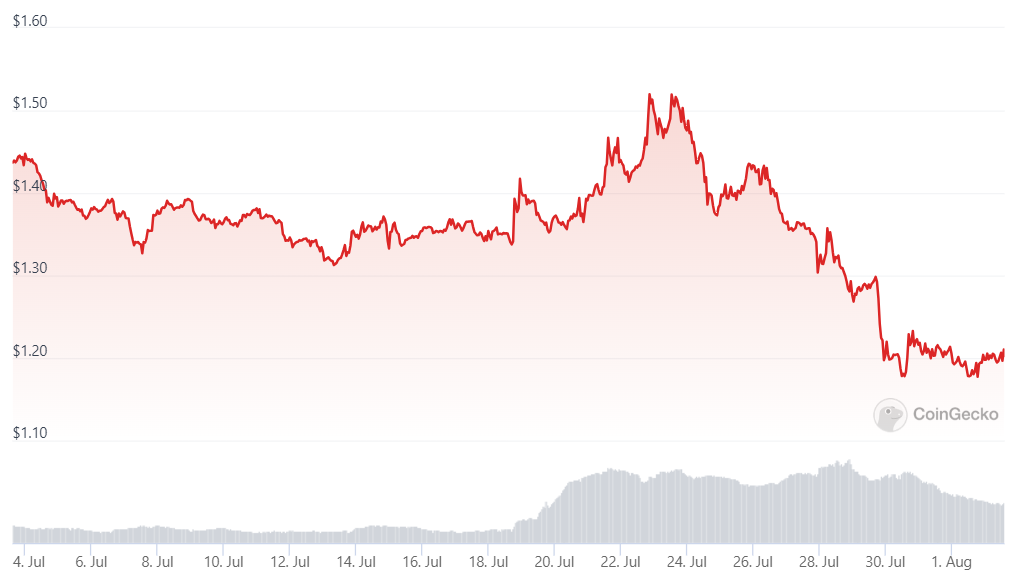

Toncoin ($TON) -15.8%

$TON, short for The Open Network, has seen a steep drop-off starting on 22 July, which resulted in a monthly loss of over 15% for the token. Conversely, $TON’s annual performance has been quite remarkable, as it gained over 31% during the past 12 months.

$TON isn’t known for following the broader crypto market very closely, which could prove a double-edged sword for investors, as the crypto misses out on some major gains posted by other currencies, while growing itself as the rest of the market struggles. However, $TON’s positive 2023 performance could point to a short refractory period, followed by a gradual increase over the coming months.

Cosmos Hub ($ATOM) -10.3%

$ATOM was another crypto that exploded after the July 14 news, but the coin could not manage to hold its positions for long, as investors were quick to sell off their holdings and take profits home. The coin dropped even lower than it had been before the news had reached the markets, which amounts to an over 10% decline over the past month.

$ATOM’s annual performance is almost identical to its monthly returns, having lost around 10% over the past 12 months of trading.

Polkadot ($DOT) - 6%

Things have gone from bad to worse for Polkadot investors, as the crypto fell sharply after the 14 July gains - deepening annual losses to over 33%. It must be noted that Polkadot managed to repeat the July 14 high within a week, which is beneficial for short-term traders, while long-term investors have been left with little optimism in the short tem.

A broad market turnaround could help Polkadot regain some lost ground, but as things stand, $DOT has been one of the worst-performing major cryptos on the market in 2023.

Final Thoughts

The month of July has been significantly better for the broader crypto market than May and June. However, July was also characterized by polarity - with some cryptos, such as $XRP and $XLM, gaining massively, while others like $BCH and $LTC lagged behind.

It must be noted, that July saw the finalization of the SEC case against Ripple Labs (creator of $XRP), which concluded that Ripple Labs had not violated any SEC rules in registering $XRP as a security, rather than a cryptocurrency, as was challenged. This news sparked a lot of hope among the crypto community for a gradual turnaround for the market, which could see gainers increase their annual returns, while losers cover some lost ground over the past 12 months of trading.

cryptonews.net

cryptonews.net