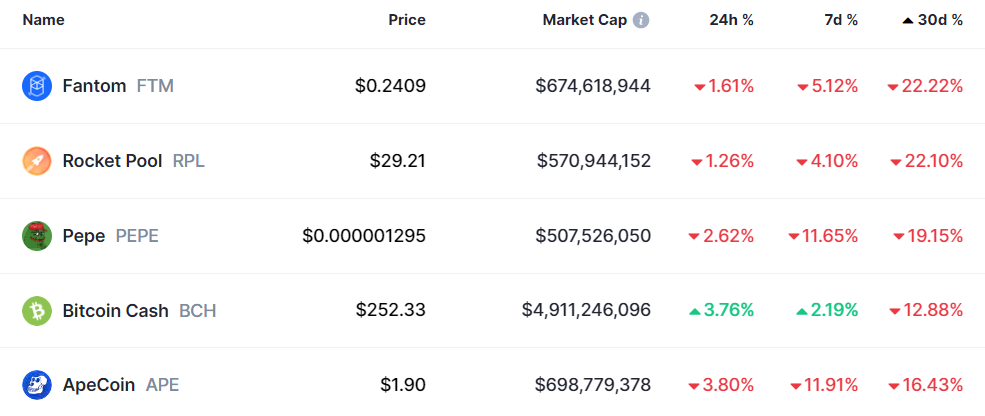

Five tokens stand out as the biggest losers among the top 100 assets, facing significant challenges in recent times.

As July comes to a close, the crypto market has witnessed notable fluctuations, with some assets experiencing a downward spiral in their 30-day performance.

Fantom (FTM)

Fantom (FTM) took a heavy hit. Its price plummeted by a staggering 22.22% in the last 30 days. Fantom’s woes began mid-July when it forfeited the $0.31 price territory to the bears after reclaiming it in an impressive 24-hour rally.

Currently trading at $0.2409, Fantom has struggled to maintain a stable trajectory as its 24-hour and 7-day percentages are also negative. Over the past week, it has experienced a 5.12% decline, recording a 1.61% drop in the last 24 hours.

Rocket Pool ($RPL)

Rocket Pool ($RPL) faced a similar fate, witnessing a 30-day decline of 22.10%. Priced at $29.21, Rocket Pool’s performance suffered across all recorded timeframes.

In the past seven days, it has registered a 4.1% loss, and in the last 24 hours, it faces a decrease of 1.26%.

You might also like: Rocket Pool rallies amid future upgrade for ETH stakers

$PEPE

Pepe ($PEPE) experienced a moderate decline in value, losing 19.15% over the past 30 days. This 30-day drop prevailed despite a whale accumulation pattern observed last week. Notably, an unidentified address procured $6.7 million worth of $PEPE between July 24 and 25.

Moreover, Pepe is currently trading at $0.000001295. The asset has struggled to regain lost ground amid the market-wide turmoil. In the last week, it faced an 11.65% decrease, while its 24-hour performance shows a 2.62% dip.

You might also like: Whale buys $PEPE coins worth $6.7m despite price decline

Apecoin ($APE)

ApeCoin ($APE) faced similar challenges in its 30-day performance, losing 16.43% of its value since the start of July. $APE witnessed a discouraging one-week drop of 28% on July 11 amid mounting controversy surrounding the salary structure of the ApeCoin DAO.

The asset is currently trading for $1.90.

You might also like: ApeCoin loses 28% in a week amid salary controversy

Bitcoin Cash ($BCH)

Bitcoin Cash ($BCH) also made it to the list of losers, despite its massive 166% increase in the two weeks leading to July 4. The asset is experiencing a 30-day decline of 12.88%.

While it achieved a positive 24-hour and seven-day percentage, the overall drop in value from July 14 has led to its inclusion in the top 5 losers of July. In the last seven days, Bitcoin Cash has been up 2.19%, and in the past 24 hours, it has registered a 3.65% surge.

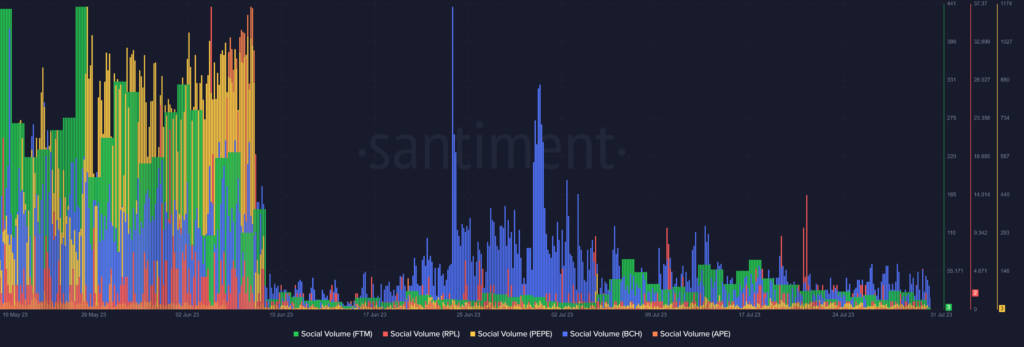

Furthermore, a common thread among these tokens was the significant drop in social volume since June 10. This downward trend was a crucial factor contributing to their abysmal performance, as investors’ interest waned drastically.

Although $BCH saw remarkable spikes in social volume from late June to early July, the asset could not escape the negative market sentiment as it relinquished the $297 monthly high on July 4.

Read more: SEC asked Coinbase to cease all crypto trading except Bitcoin, CEO says