Although the majority of the cryptocurrency market has been flashing red in the past few days, some cryptocurrencies have managed to fight through the prevailing bearish sentiment and stand out with their remarkable performance during this time frame.

Indeed, the industry’s representative decentralized finance (DeFi) asset, Bitcoin (BTC), has declined 2% in the last week, having pulled most of the other market participants into the red zone, but these five digital assets have topped the weekly charts as of July 28.

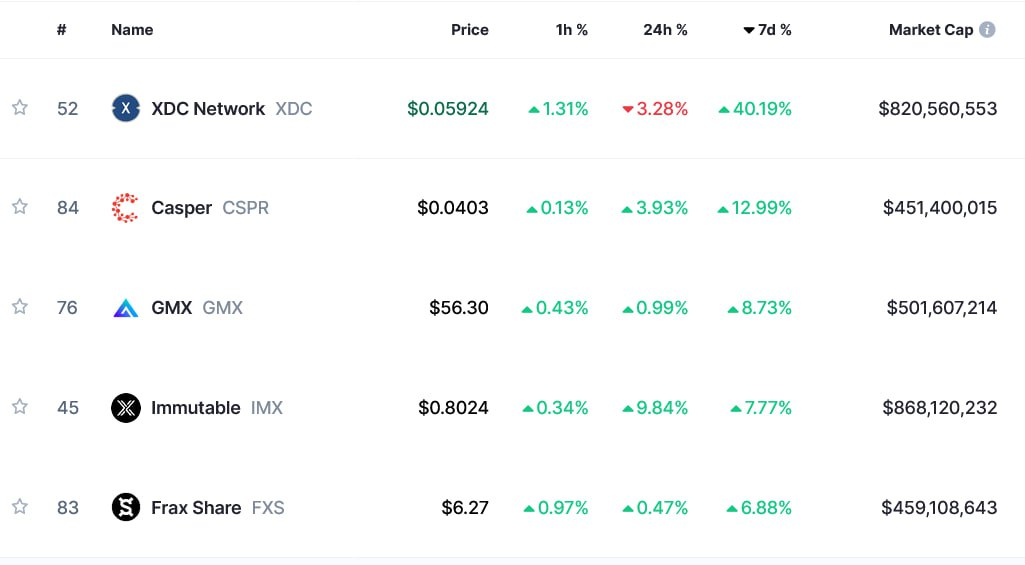

XDC Network (XDC)

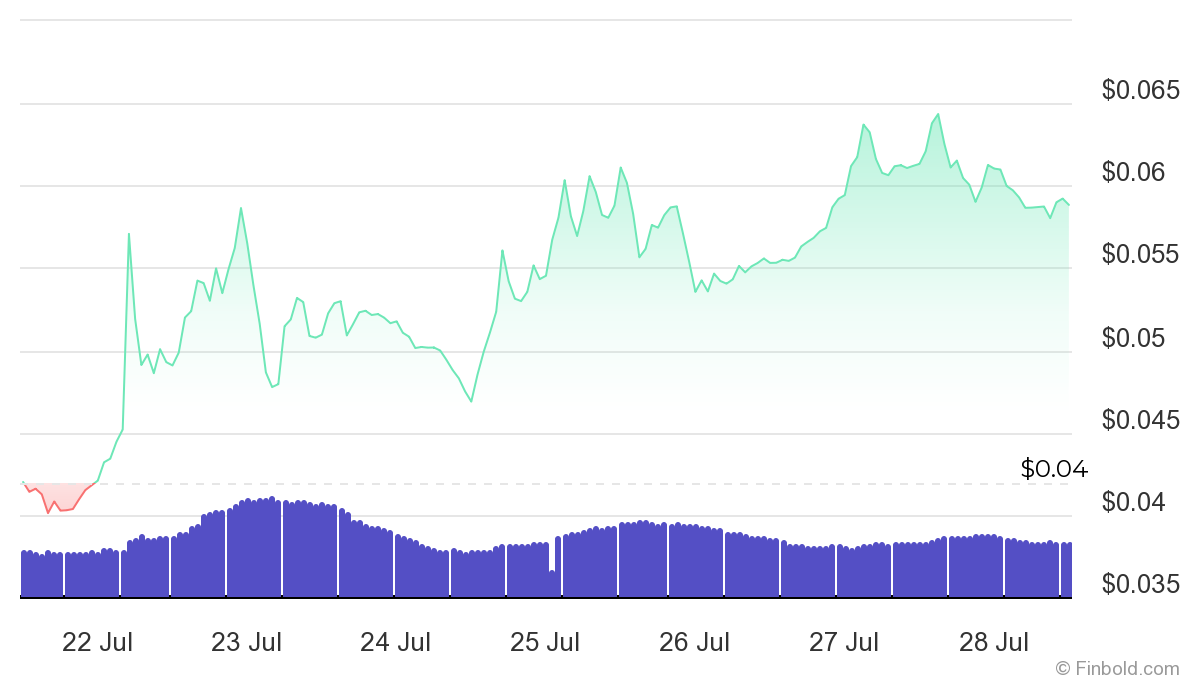

Specifically, the native crypto of the hybrid blockchain technology company optimized for international trade and finance, XDC Network (XDC), has seen significant advances thanks to leading institutions like ICC, WTO, Citi Group, and Trade Finance Global recognizing XDC Network’s potential in trade finance.

Although at press time, XDC Network’s token is trading at $0.059, which is a decline of 3.28% in the last 24 hours, it is nonetheless recording a massive gain of 40.19% across the previous seven days, as well as advancing 102.48% on its monthly chart, according to the most recent information retrieved on July 28.

Casper (CSPR)

Meanwhile, the cryptocurrency of the first live proof-of-stake (PoS) blockchain built off the Casper CBC specification with an aim to accelerate enterprise and developer adoption of blockchain technology, Casper (CSPR) has been recording gains after Casper Labs teamed up with the United States-regulated broker-dealer INX to tokenize and list its equity.

Currently, Casper is changing hands at the price of $0.04, up 3.93% in the last 24 hours, as well as advancing 12.99% across the previous seven days, and gaining 3.46% over the past month, as the most recent charts retrieved by Finbold indicate.

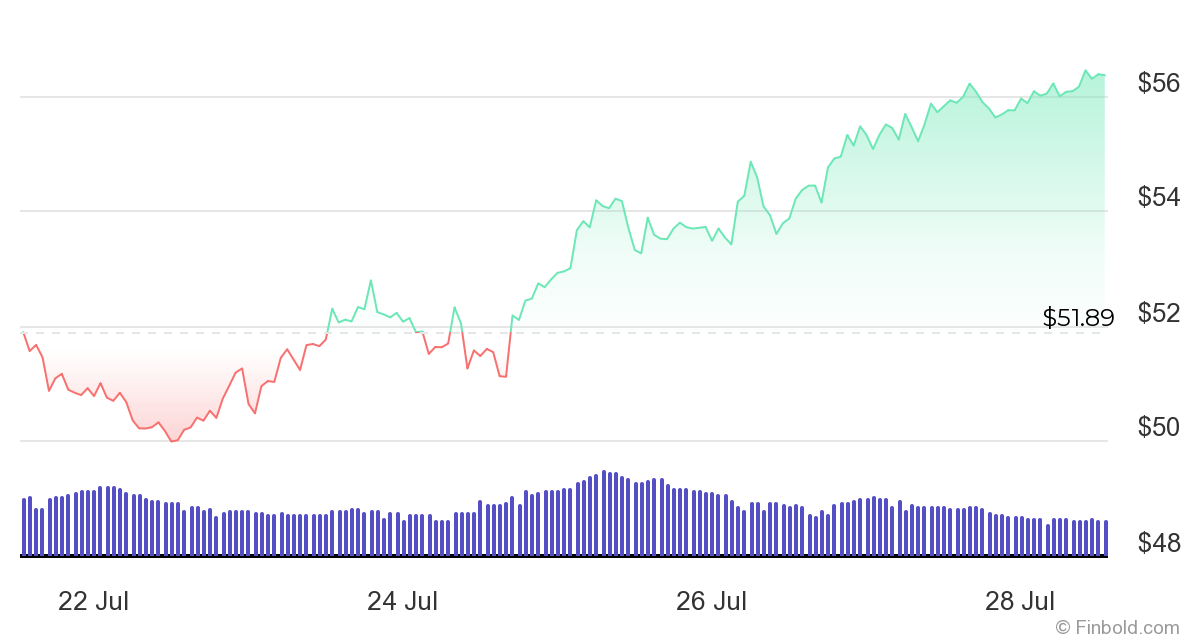

GMX (GMX)

As for decentralized spot and perpetual crypto exchange that supports low swap fees and zero price impact trades, GMX (GMX), its native token has been rising following GMX’s integration with Kunji Finance, a decentralized platform built on Arbitrum that facilitates cryptocurrency hedge fund-like active portfolio management and custody services for retail investors.

As things stand, GMX is presently trading at the price of $56.30, which represents an increase of 0.99% on the day, in addition to being an 8.73% gain across the previous week, as well as advancing 5.69% on its monthly chart, as the most recent information suggests.

ImmutableX (IMX)

In the meantime, the surge of the native token for the ImmutableX (IMX) network, the first zero-knowledge-rollup with game creation tools for non-fungible token (NFT) and Web3 games on Ethereum (ETH), has accelerated after South Korean cryptocurrency exchange Upbit announced it would list it in its Korean Won market.

As for its price, IMX was at the time of publication changing hands at $0.8024, indicating it has increased 9.84% in the last 24 hours, adding up to the 7.77% advance across the previous seven days and the 9.75% gain on its monthly chart.

Frax Share (FXS)

Finally, Frax Share (FXS), the governance and value accrual token of the Frax Stablecoin Protocol, has already profited off its upcoming launch of a propriety Ethereum Virtual Machine (EVM) compatible Layer 2 blockchain Fraxchain, which combines optimistic rollup architecture with zero-knowledge proofs.

As it happens, FXS has grown its price by 0.47% over the previous day, aside from increasing 6.88% across the past week and moving upward by 14.68% over the previous month, currently changing hands at $6.27.

Conclusion

All things considered, the above crypto assets’ success during the major bearishness in the industry shows their resilience to negative sentiment. However, whether they continue their bullish trend will depend on their further strength and developments related to their ecosystems.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com