Bitcoin Cash (BCH) price is down 28% from the start of July 2023, with on-chain data signaling growing bearish sentiment. Where will BCH find support?

After ending June 2023 with triple-digit gains, BCH has been unable to build on that stellar performance in July so far. Bitcoin Cash Miners and Whale investors now appear to be taking bearish positions. The bulls will have their work cut out to prevent a prolonged BCH bearish sentiment.

Bearish Bitcoin Cash Miners Have Offloaded 1.12 Million Coins

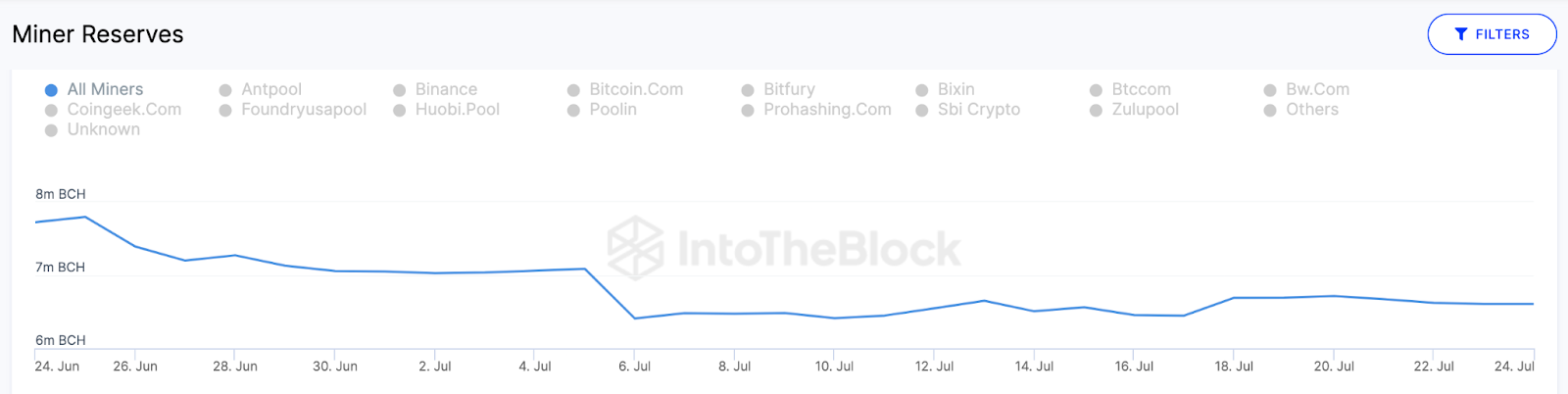

Bitcoin Cash Miners have taken advantage of the recent price rally to offload 1.12 million coins within the past month. According to data from IntoTheBlock, the Miners held a cumulative reserve balance of 7.73 million BCH at the close of June 24. But as of July 25, that figure has dropped to 6.61 million.

Miners Reserves tracks the real-time changes in the cumulative wallet balance of recognized miners and mining pools. When miners reduce their balances, they are cashing in on their block rewards rather than holding out for future gains.

Over the past month, the BCH miners have reduced their exposure by 1.12 million coins, totaling $263 million at the current price of $235 each. In the process, they have diluted their share of the holdings from 40% to 34% of total Bitcoin Cash in circulation.

This generally shows that the Bitcoin Cash Miners are not confident they can get higher prices soon. It’s only a matter of time before other strategic investors begin to take a similar BCH bearish sentiment.

Whale Investors are Taking on an Increasingly Pessimistic Disposition

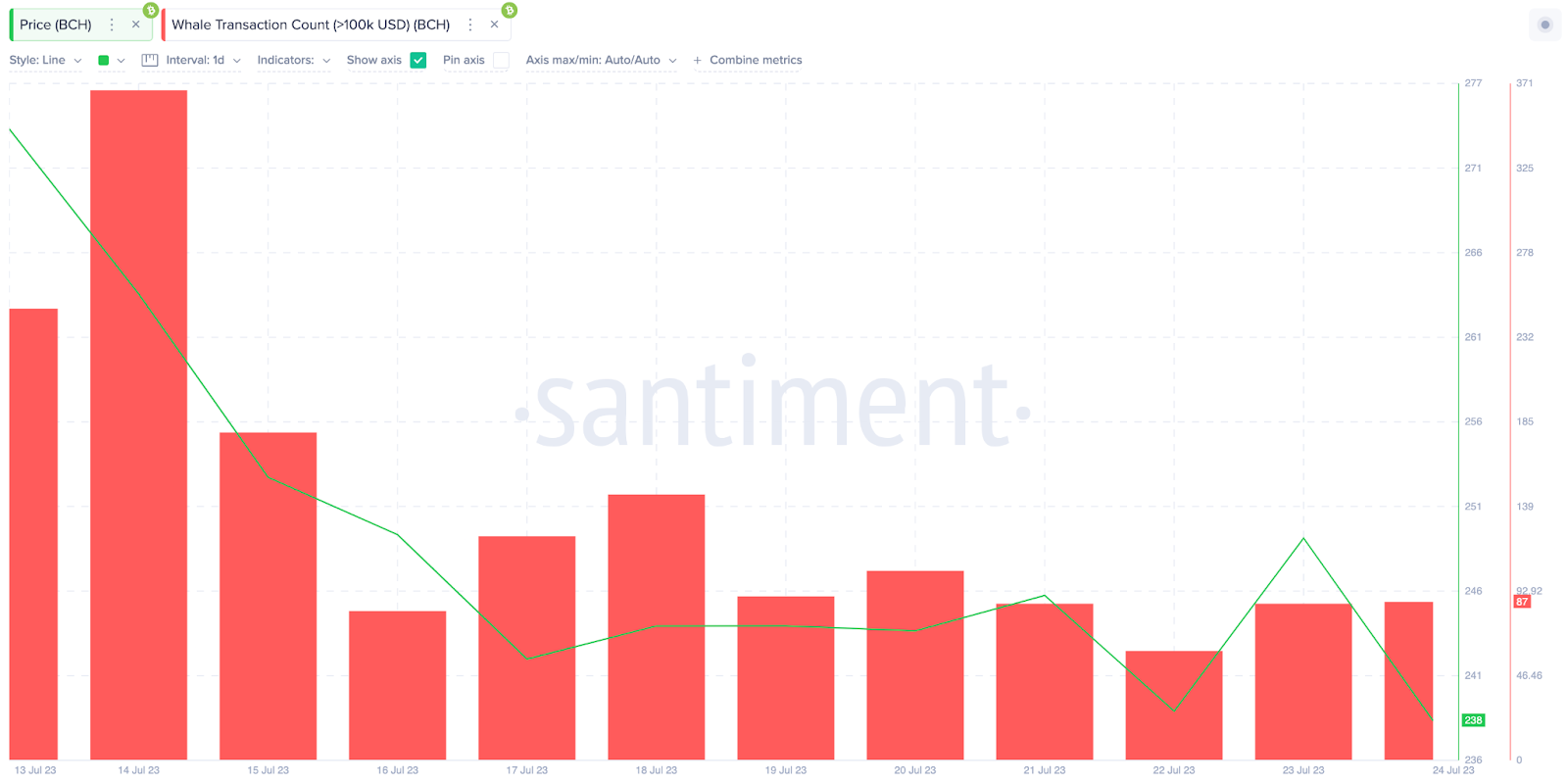

In confirmation of the miners’ pessimistic disposition, Bitcoin Cash whale investors have also begun trimming down their trading activity. Between July 14 and July 25, BCH Whale Transaction Count (>100k) dropped 76% from 368 to a mere 87 transactions.

The Whale Transaction Count data depicts the level of trading activity among large institutional investors on a blockchain network. Essentially, it is derived by summing up every transaction that exceeds $100,000 within a given period.

This drop in Whale Transaction Count invariably means that large investors are growing less confident regarding BCH price prospects. If they continue on this trajectory, the liquidity drop could push BCH to new lows in the coming weeks.

Read More: 9 Best Crypto Demo Accounts For Trading

BCH Price Prediction: The Bears Have Their Eyes on $200

Given the pessimistic disposition among the Miners and Whale investors, BCH looks set for a prolonged retracement toward $200.

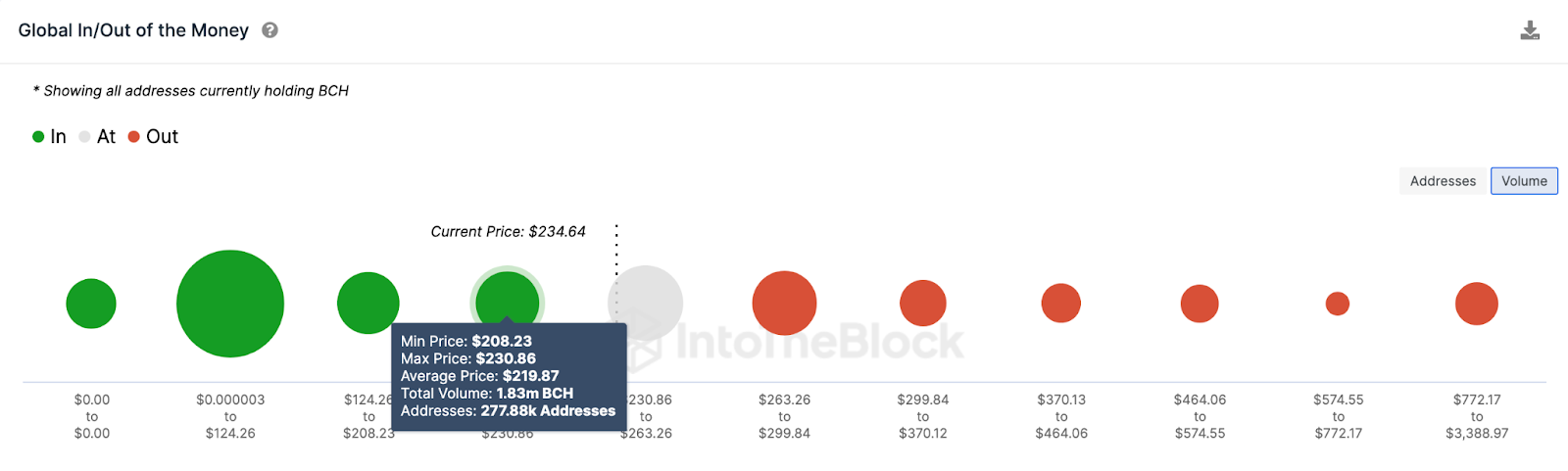

However, the $220 support level could offer a lifeline. As seen below, 278,000 investors had bought 1.83 million BCH coins at an average price of $219.87. Once the price approaches that zone, they could trigger a rebound by accumulating more coins to avoid slipping into a net-loss position.

But if the BCH bearish sentiment from the miners and whales does not abate, the price will likely drop below $200.

Still, the bulls can negate the BCH bearish sentiment if the price breaks above $260. However, the 427,000 investors that bought 2.65 million Bitcoin Cash at a maximum price of $263 could slow the rally.

But if that resistance level cannot hold, BCH may retest $280 again.

beincrypto.com

beincrypto.com