CoinShares Report Highlights

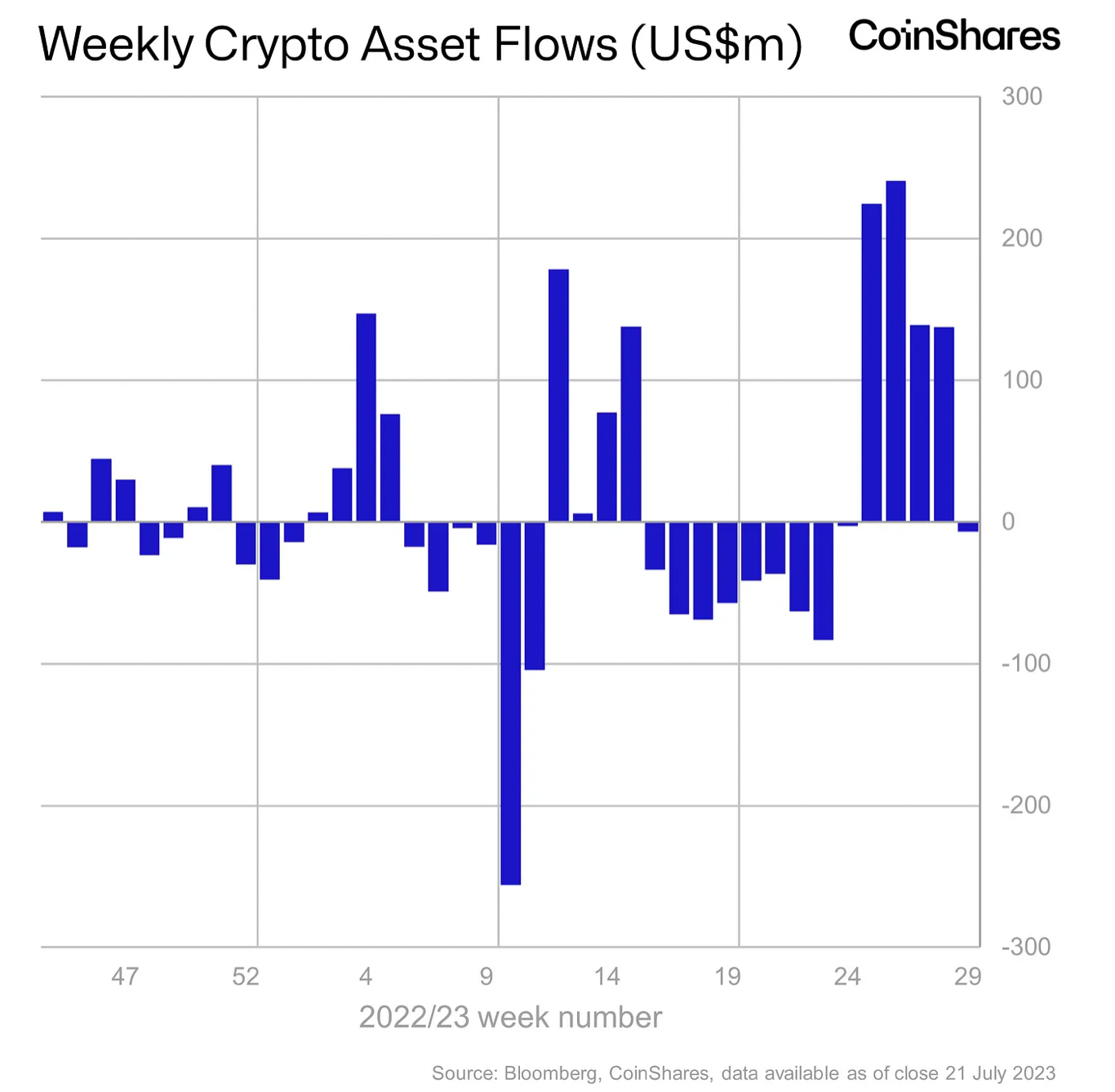

CoinShares, the digital asset manager, has published its weekly report sharing data on fund inflows and outflows in digital asset investment products. According to the CoinShares report, after a total of $742 million in inflows over four consecutive weeks, there was a $6.5 million outflow in digital asset investment products last week.

Furthermore, despite the $13 million outflow in Bitcoin (BTC) focused investment products, there was a $6.6 million fund inflow in Ethereum (ETH) focused investment products. CoinShares also noted in its report that XRP is gaining more trust among investors, with a total of $6.8 million fund inflow recorded in XRP-focused investment products in the last 11 weeks.

In addition, there were fund inflows of $1.1 million in Solana (SOL) focused investment products, $0.7 million in Uniswap (UNI) focused investment products, and $0.7 million in Polygon (MATIC) focused investment products last week.

Bitcoin (BTC) Falls Below $29,000

Bitcoin (BTC) experienced an average loss of 3% in the last 24 hours, dropping to the $29,000 price levels. Most cryptocurrencies with high market capitalization started the new week with a decline, influenced by the depreciation of BTC. The total market value of the cryptocurrency ecosystem decreased to $1.17 trillion. Additionally, due to the high volatility in the cryptocurrency market, more than $150 million worth of short and long positions were liquidated in the past 24 hours, according to Coinglass data.

Ethereum (ETH) also suffered a loss of over 2% in the last 24 hours due to the downward trend in the cryptocurrency market, trading at $1845. However, despite this downward trend, Dogecoin (DOGE) gained momentum and reached $0.075 with its recent value increases.