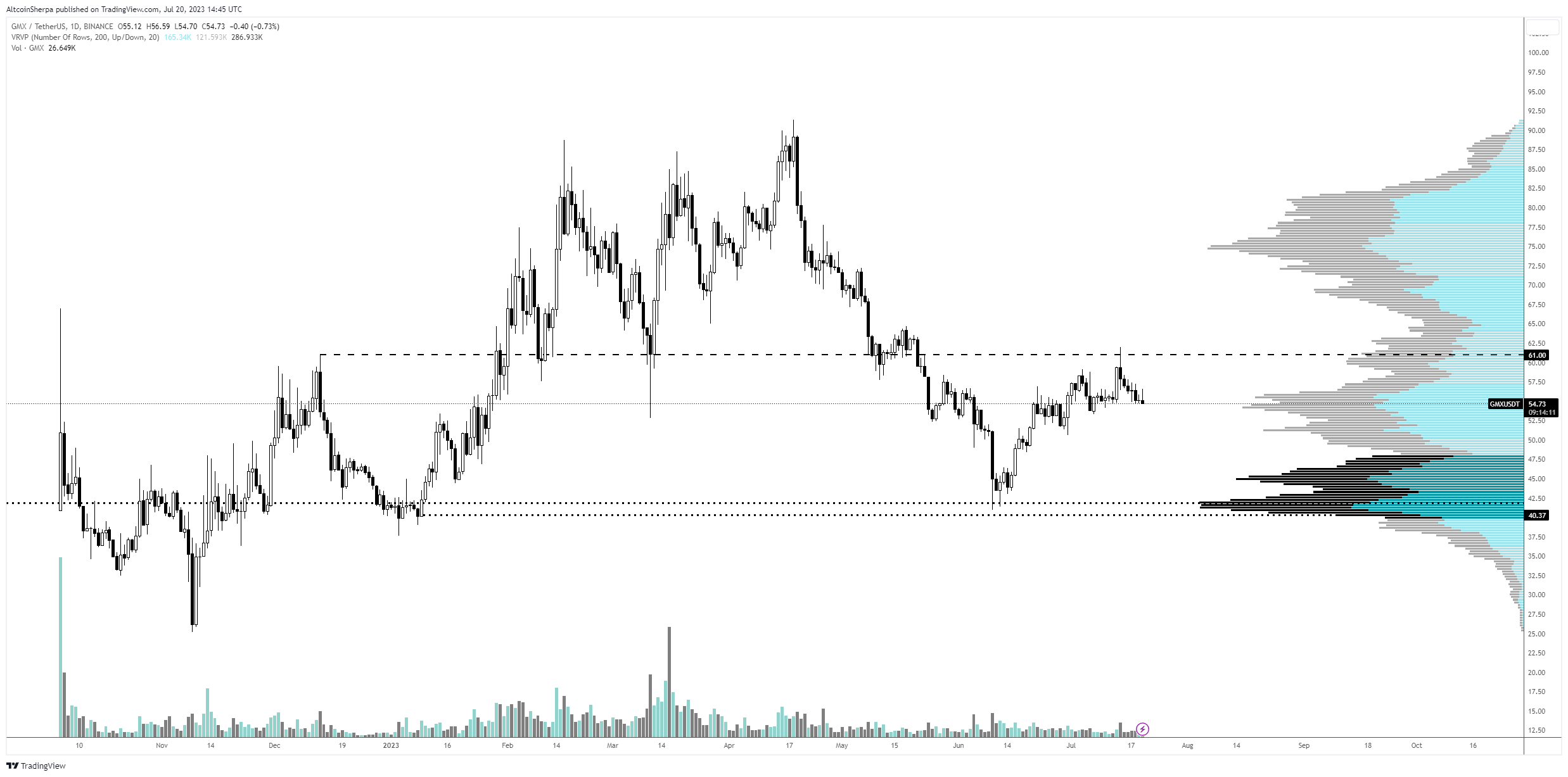

A widely followed crypto trader believes that one decentralized exchange altcoin (DEX) is primed for a move to the downside after its strong performance earlier this year.

Pseudonymous trader Altcoin Sherpa tells his 196,200 Twitter followers that the decentralized perpetual trading platform GMX (GMX) will likely witness about a 20% move to the downside.

GMX had a strong start this year, rallying over 143% from a low of $37.50 to a high of $91.40.

Says Altcoin Sherpa,

“GMX: I think this one looks like it’s going to go back to the $40s. It was the darling of crypto a few months ago but expecting it to cool and go into accumulation mode after a bottom. Expecting this to underperform the rest of the market for the mid-term.”

At time of writing, GMX is trading for $50.68.

Looking at Bitcoin (BTC), the crypto trader says that traders appear to be bearish on the crypto king even though it is still trading above support at around $29,500.

“BTC: the whole timeline is bearish… but this is still the range low and support is still support (until it’s not).”

Bitcoin is trading for $29,929 at time of writing, up 0.4% during the last 24 hours.

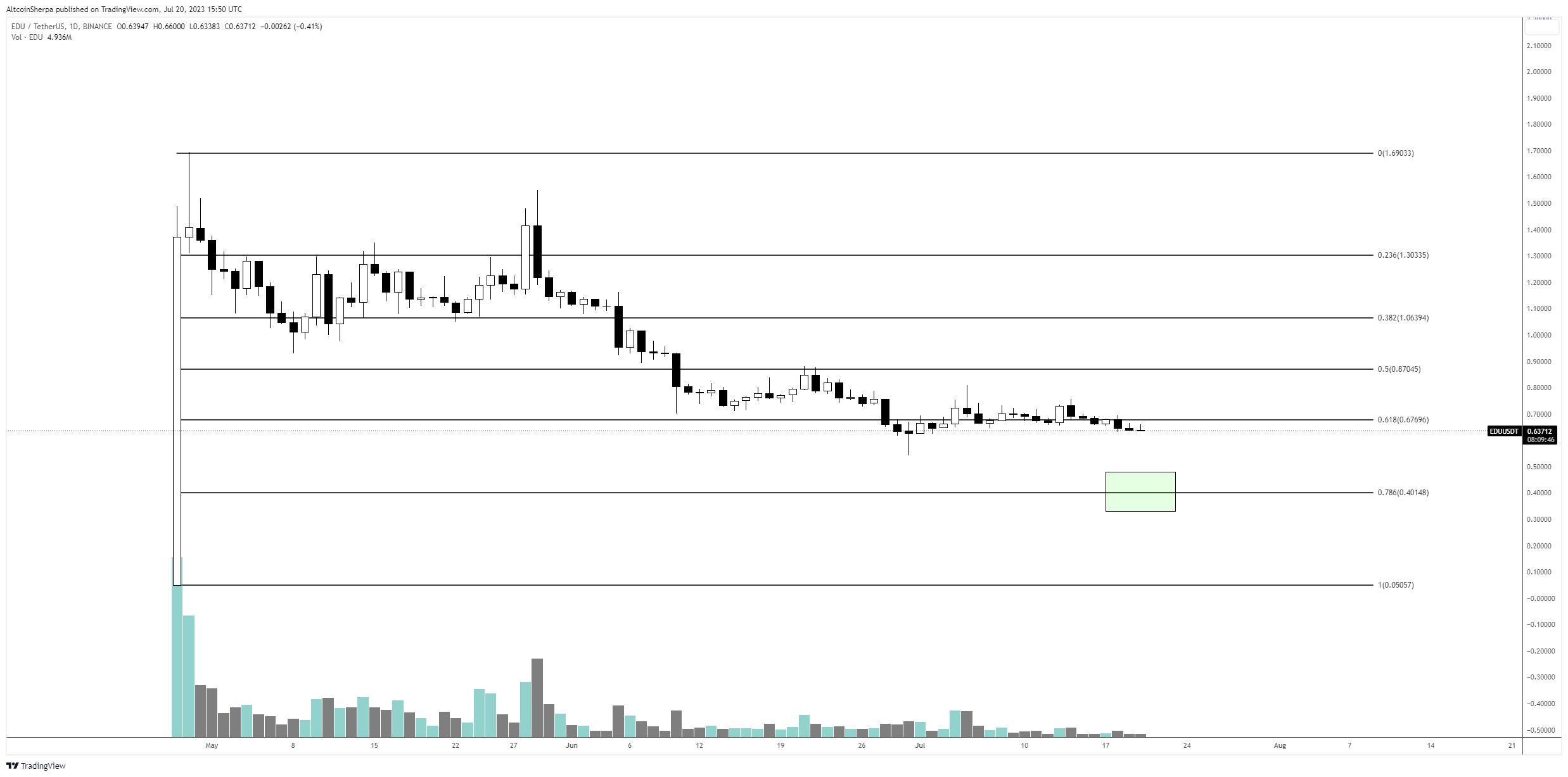

Sherpa also says he is keeping his eye on other altcoins for a retracement to their respective Fibonacci 0.786 price levels, including Sui (SUI), Hooked Protocol (HOOK), Open Campus (EDU) and Arkham (ARKM).

According to the trader, the altcoins are likely to bounce back up once they hit the 0.786 Fibonacci level.

“Looking at some of these Binance launchpad projects and the 0.786 Fib (Fibonacci) and the reactions…hmm…

For those who don’t understand what I’m talking about… the 0.786 Fib has shown to have decent reactions for both HOOK and SUI. I’m sure there are others out there like these coins – look for slow grinding price action to the downside followed by a nice reaction.”

He also notes that “BTC will be the biggest factor” for the overall performance of altcoins.

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com