Altcoins like Ripple (XRP) and Stellar (XLM) have witnessed significant gains as Bitcoin’s (BTC) bullish momentum took a momentary pause. According to CoinMarketCap, XRP has gained 69.74% in the last 24 hours.

Developments Leave BTC Behind

This price increase came off the back of a partial win in Ripple’s long-standing case with the SEC. XLM has been doing spectacularly well. Based on data from the price tracking platform, XLM’s 30-day performance has ended in a 109.57% hike.

One major reason the altcoin has surged is the rising adoption of its Anchor Network. For context, Stellar Lumens’ Anchor Network is the on-and-off ramp connecting the Stellar network to traditional finance institutions.

Bitcoin, which has had an impressive Year-To-Date (YTD) performance, has cooled down its increase. At the time of writing, BTC traded at $30.120. Additionally, TradingView revealed that Bitcoin’s dominance, which was over 52% some weeks back, had decreased to 49.90%.

This decrease in BTC dominance has led to speculation among market participants about the possibility of an altcoin season on the horizon. Also, the hypothesis could be valid because historically, a decrease in BTC dominance leads to a spike in altcoin prices.

XPR Targets $0.90

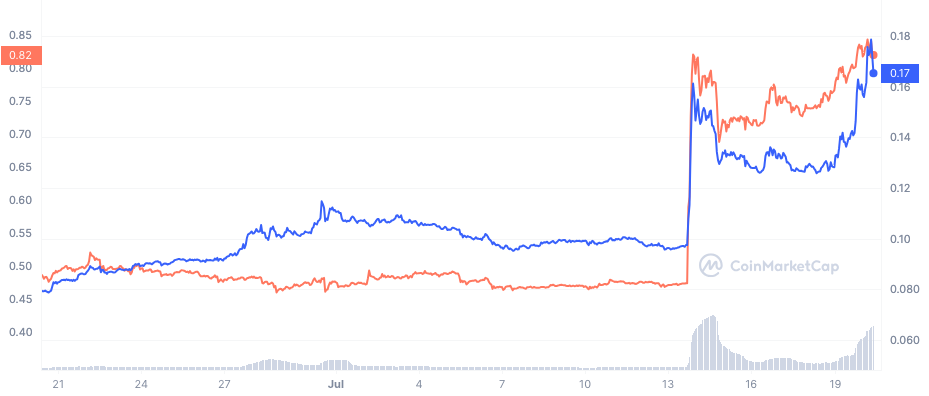

The XRP/USD 4-hour chart showed that XRP, since exiting consolidation on July 13, has had enormous demand. Although selling pressure appeared a day after, XRP has been able to sustain an upturn since buying pressure resumed at $0.68.

Additionally, the Money Flow Index (MFI) showed that a lot of liquidity has entered the XRP market. At press time, XPR’s MFI was 70.98. Since the value had not reached 80, then XRP isn’t overbought. Therefore, there might be no trend change soon, and XRP tended to cross above the $0.90 threshold.

XLM Eyes the Top But Pulls Back

Interestingly, XLM/USD 4-chart had a similar pattern to XRP. But unlike, XRP, XLM had hit an overbought level.

This inference was reinforced by the Bollinger Bands (BB). With increasing volatility, the upper band of the BB touched XLM at $0.168. When this happens, it means that an asset is overbought.

In addition, the Relative Strength Index (RSI) was 73.27. The BB, and the RSI indicated that XLM was overbought. Thus, the XLM price could retrace to around $0.151. Nonetheless, the Chaikin Money Flow (CMF) had a positive reading of 0.06.

The CMF reading showed that XLM’s buying strength was intact. So, if the price pulls back, it might take a short while before it rallies provided the CMF remains above zero.

In conclusion, the current XRP and XLM display showed signs that altcoins had gained strength over Bitcoin.

Besides, CoinMarketCap revealed that other altcoins, including Polygon (MATIC), and Chainlink (LINK) have also outperformed Bitcoin. So, there is a chance that the altcoin season could be close.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com