1inch Network ($1INCH) price currently sits at $0.47 after gaining 102% over the last 30 trading days. On-chain data analysis reveals solid network fundamentals that could power $1INCH into more gains.

$1INCH is the native governance token of the leading decentralized exchange (DEX) aggregator, 1inch Network. The Ethereum-based protocol is designed to improve crypto trading liquidity and reduce slippage by aggregating liquidity from various decentralized exchanges.

Since the start of 2023, the number of cryptocurrency users deploying transactions on the $1INCH network has increased. Now, halfway through the year, that consistent growth in active userbase has started to impact the native token’s price positively.

1NCH User Activity is on the Rise

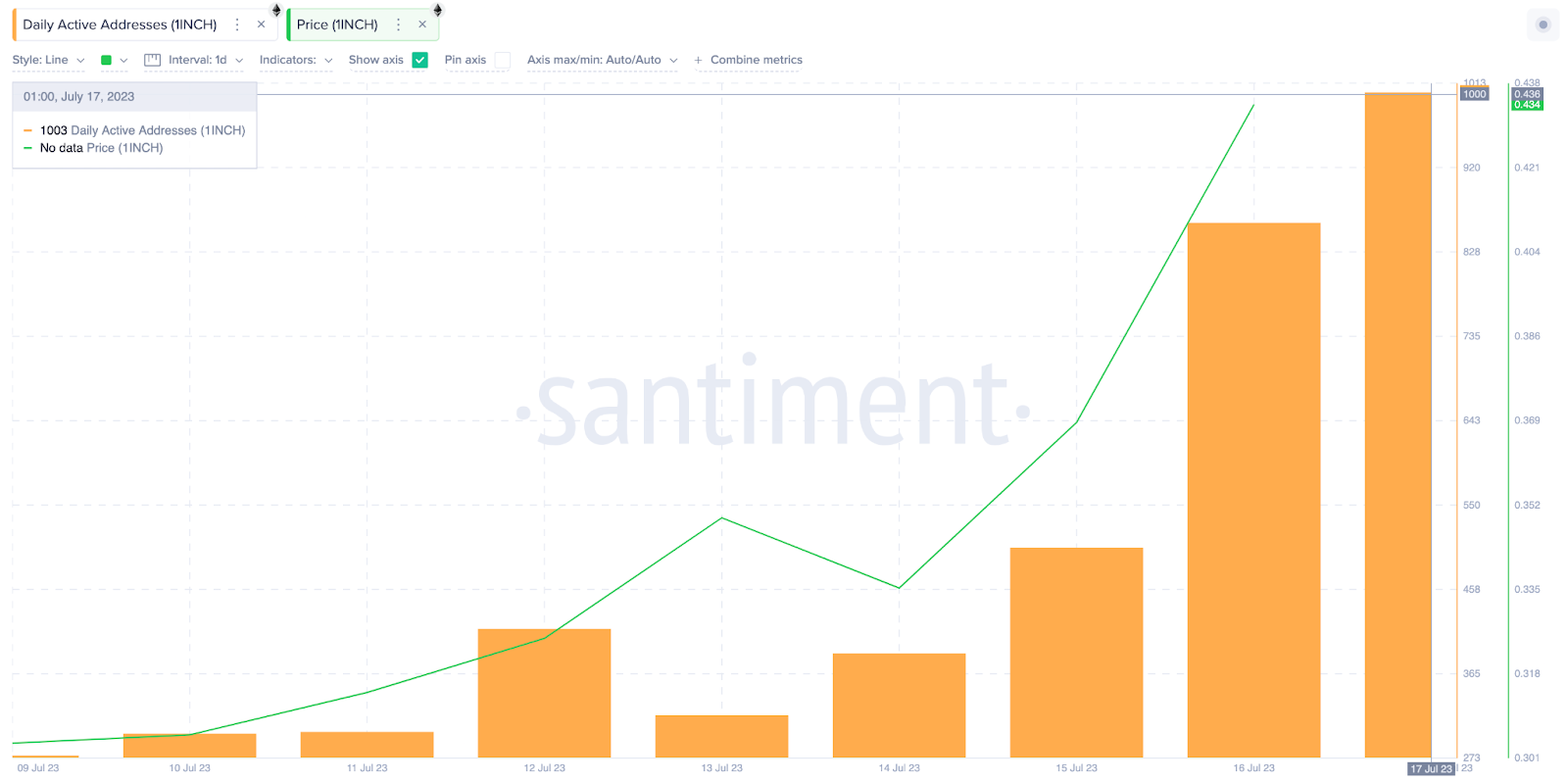

This month, $1INCH Network has consistently gained traction. According to data compiled by the blockchain intel platform, Santiment, Daily Active Addresses (DAA), the network activity has increased since the start of July.

Pointedly, between July 9 and July 17, INCH DAA increased from 276 to 1,003 active users.

Daily Active Users evaluate real-time changes in network activity by summing up the number of individual wallet addresses carrying out transactions. Typically when the number of active addresses rises persistently over an extended period, it puts upward pressure on price.

As seen above, while DAA has spiked 264%, $1INCH price also gained 90% between July 9 and July 17. Provided they continue to carry out economically viable transactions, further growth in $1INCH active users will likely extend the price rally.

Read More: Best Crypto Sign-Up Bonuses in 2023

Whale Demand Has Pushed the Ongoing Price Rally

Furthermore, on-chain data reveals that increased demand from whale investors has been a critical driver behind the ongoing $1INCH price rally.

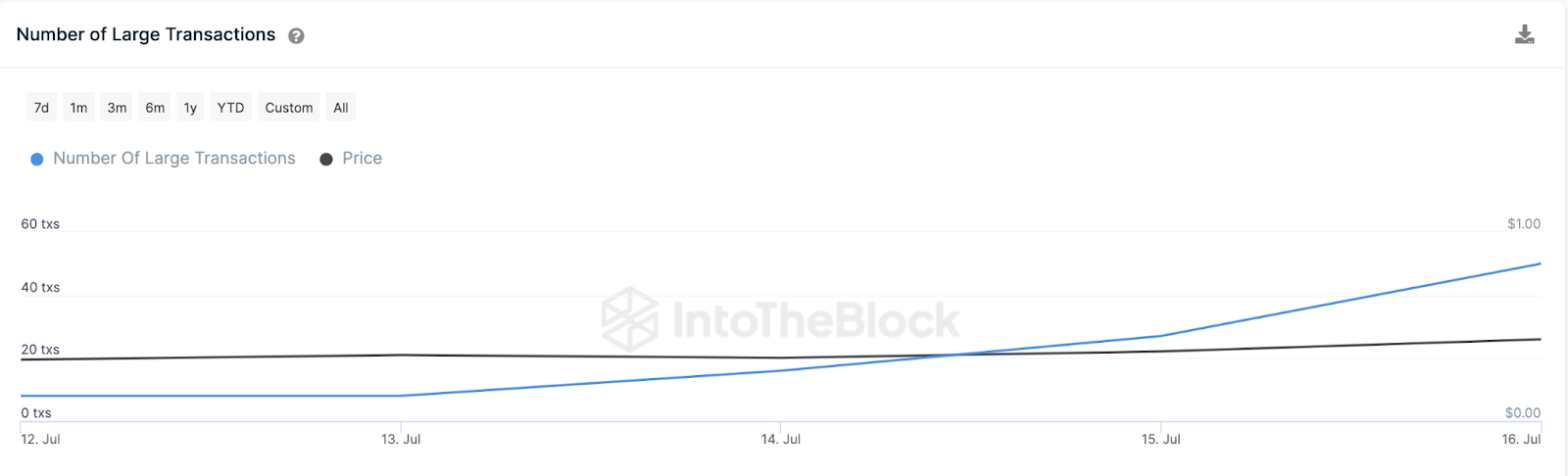

According to IntoTheBlock, the number of whale transactions on the $1INCH network has doubled in the last 3 trading days.

The chart below shows that on July 12, whales only conducted 8 transactions. However, that figure grew progressively to reach 50 whale transactions at the close of July 16.

Whale Transactions track the trading activity of large institutional investors by aggregating the daily number of transactions that exceed $100,000. When whales put up a bullish disposition, as observed above, they often soak up sell pressure and drive up the asset’s price.

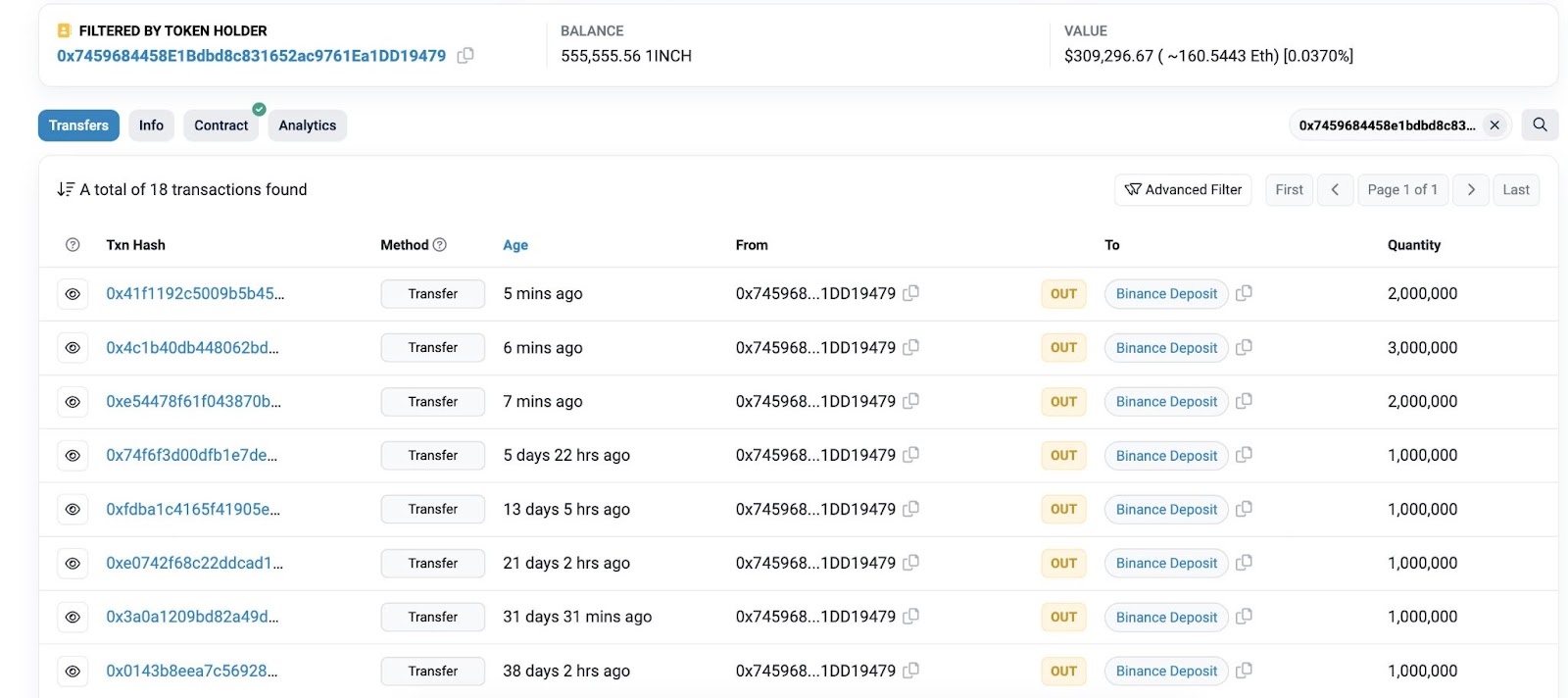

The chart below shows how a $1INCH whale investor moved 7 million tokens into Binance on Monday, July 17.

At the current market price of $0.50, this exchange inflow of 7 million $1INCH tokens made by the 0x7459 whale is worth around $3.5 million. Typically, when whales move millions of dollars worth of tokens into an exchange, strategic investors take this as a major bearish signal, poised to be sold on the exchange.

However, given the level of whale demand that $1INCH has attracted over the past week, the bulls should have enough in the tank to absorb this massive sell order.

Read More: Best Upcoming Airdrops in 2023

$1INCH Price Prediction: The Bulls Will Look to Defend $0.45

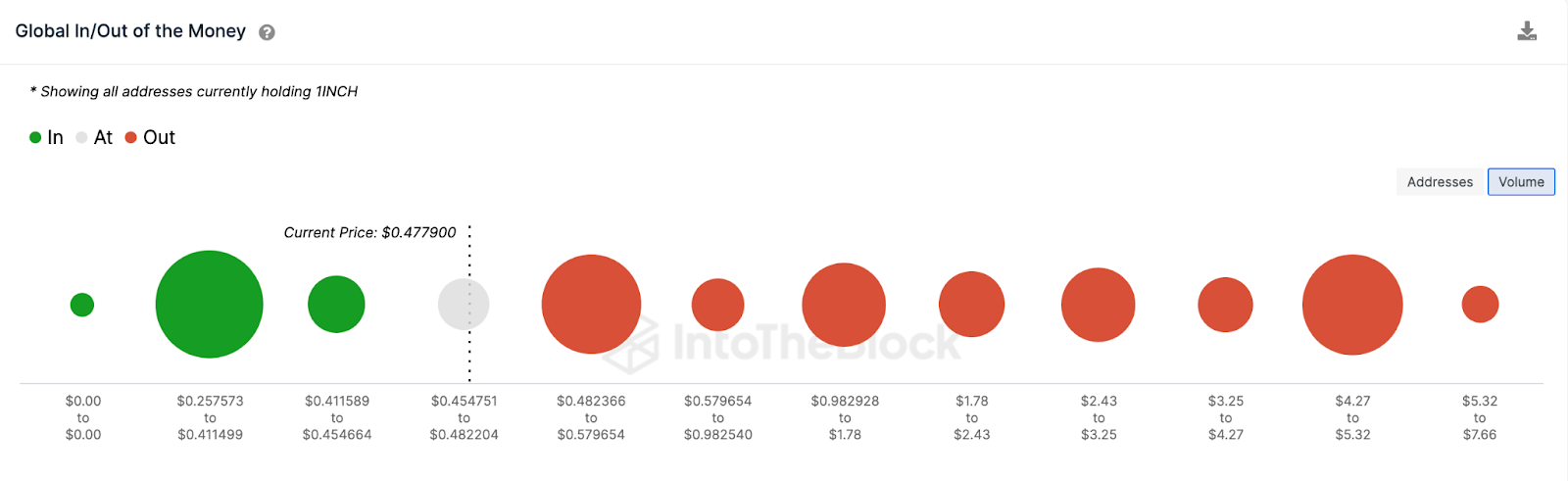

On-chain data shows that the $1INCH will likely reclaim $0.60 in the coming weeks. However, with the growing number of whales looking to cash out, the bullish investors must first defend the $0.45 support level.

At that zone, 2,420 investors holding 56 million $1INCH tokens at an average price of $0.43 will look to trigger a rebound.

If that support level holds, the $1INCH bulls could regroup for another brazen attempt at the $0.60 resistance.

Conversely, if that support level gives way, the bears could seize control and force a further downswing toward the $0.35 range. Although the 7,000 investors that bought 352 million $1INCH tokens at the maximum price of $0.41 could prevent the drop.

But, if the bears can scale that buy wall, the $0.34 range will be the next significant support level.

beincrypto.com

beincrypto.com