With 150% gains in June, Bitcoin (BCH) emerged as one of the biggest winners after the SEC listed several mega-cap altcoins as ‘securities’. However, Ripple’s (XRP) recent victory against the SEC now threatens to put the Bitcoin Cash price rally at risk.

Bitcoin Cash (BCH) price surged 150% in June 2023 as institutional investors turned to Proof of Work (POW) altcoins in fears of SEC prosecuting prominent Proof of Stake (PoS) protocols.

The BCH price rally cooled off in July since it hit the 2023 peak of $320 on June 30. XRP’s victory against the SEC could see investors re-allocate capital toward the embattled PoS altcoins.

Bitcoin Cash Investors Are Increasing Selling Pressure

Bitcoin Cash is down 15% from July 1. The underlying price data shows that BCH investors are anticipating tough days ahead.

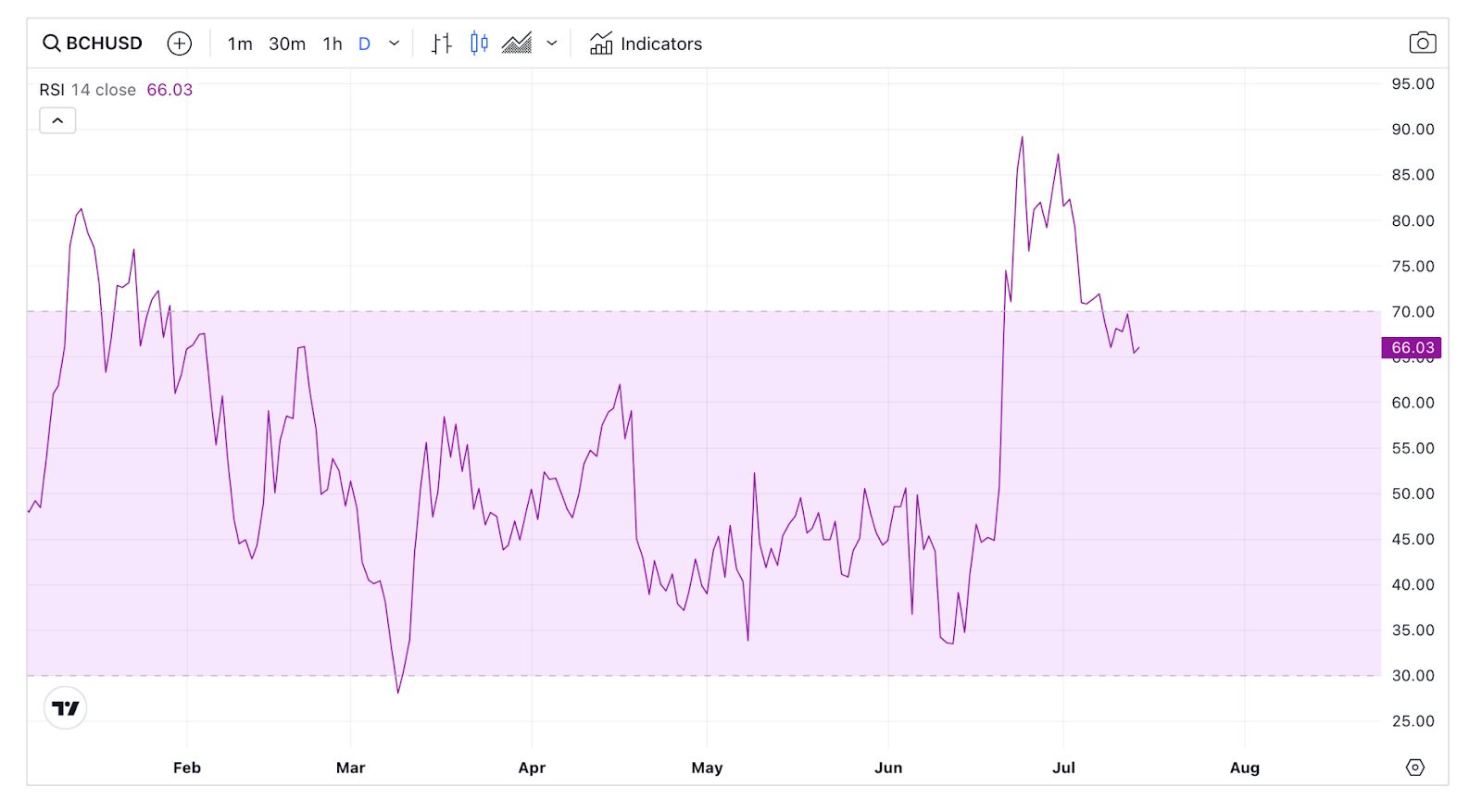

According to the Relative Strength Index data, BCH is poised to make a series of new lows in the coming days. As seen above, after racing to euphoric highs at the end of June, BCH RSI has dropped below the critical 70 mark, hitting 66.03 at the close of July 13.

The Relative Strength Index assesses the strength and momentum of a price trend. When the RSI crosses below the 70 level from above, it suggests that selling pressure is increasing,

Strategic traders may interpret this as a signal to take bearish positions on BCH in the coming days.

Price-Savvy Whales Are Making Massive Withdrawals

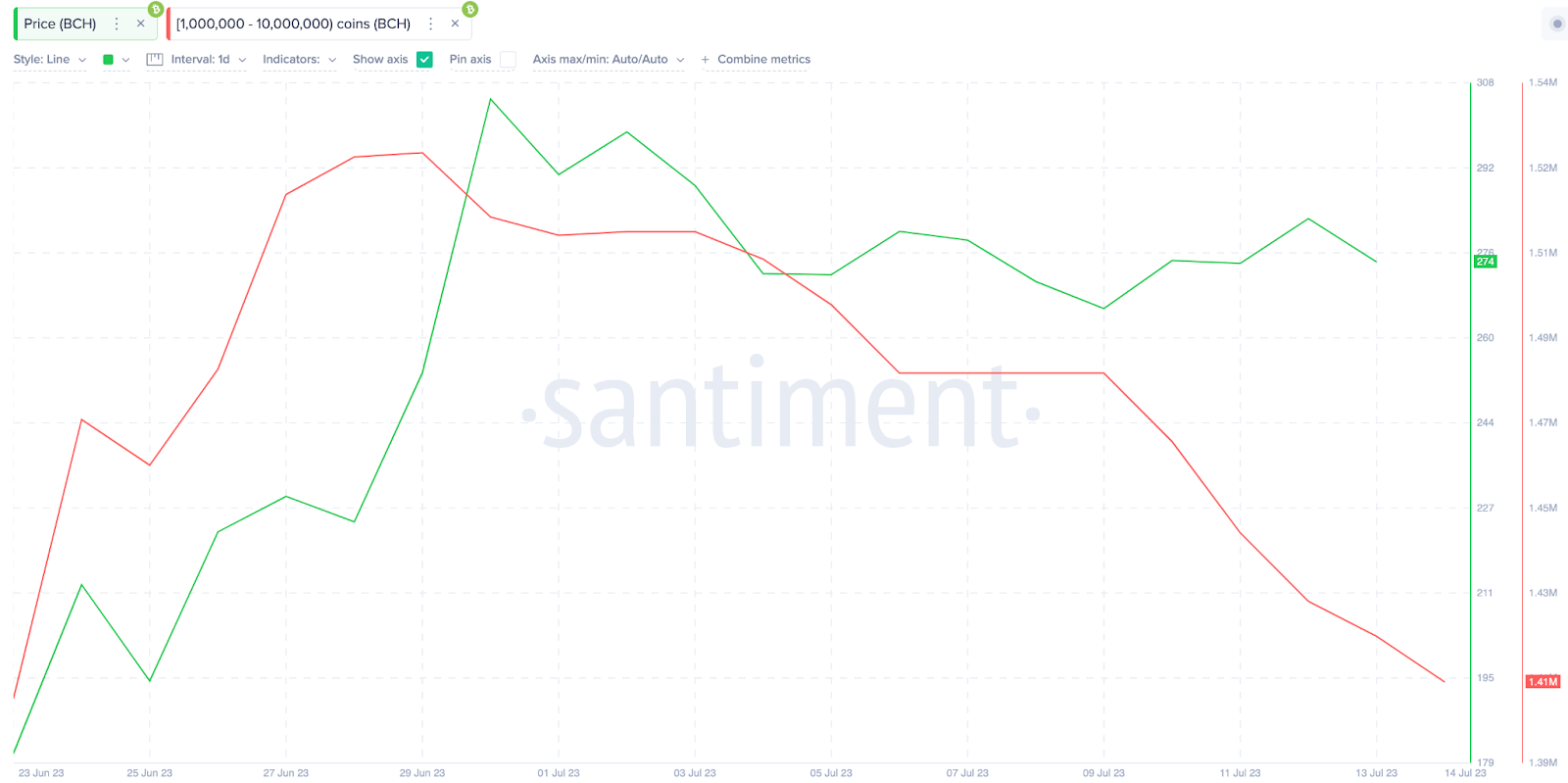

Furthermore, the price-savvy cohort of crypto whales has started to offload their Bitcoin Cash holdings. Since the start of July, whales holding 1 million to 10 million BCH have reduced their balance by 100,000 coins.

At the current market price of $275, the whales have withdrawn over $27.5 million from Bitcoin Cash halfway into the month.

The chart above shows that the BCH price initially began to climb when this group of whales started buying around June 18. Hence, their current selling frenzy could also weigh heavily, risking the Bitcoin Cash price rally.

XRP’s victory has apparently triggered improved market sentiment around the embattled mega-cap altcoins. This could encourage investors to pull out more funds from BCH and reallocate that capital towards the underbought and resurgent tokens.

Read More: Best Upcoming Airdrops in 2023

BCH Price Prediction: Impending Reversal to $200?

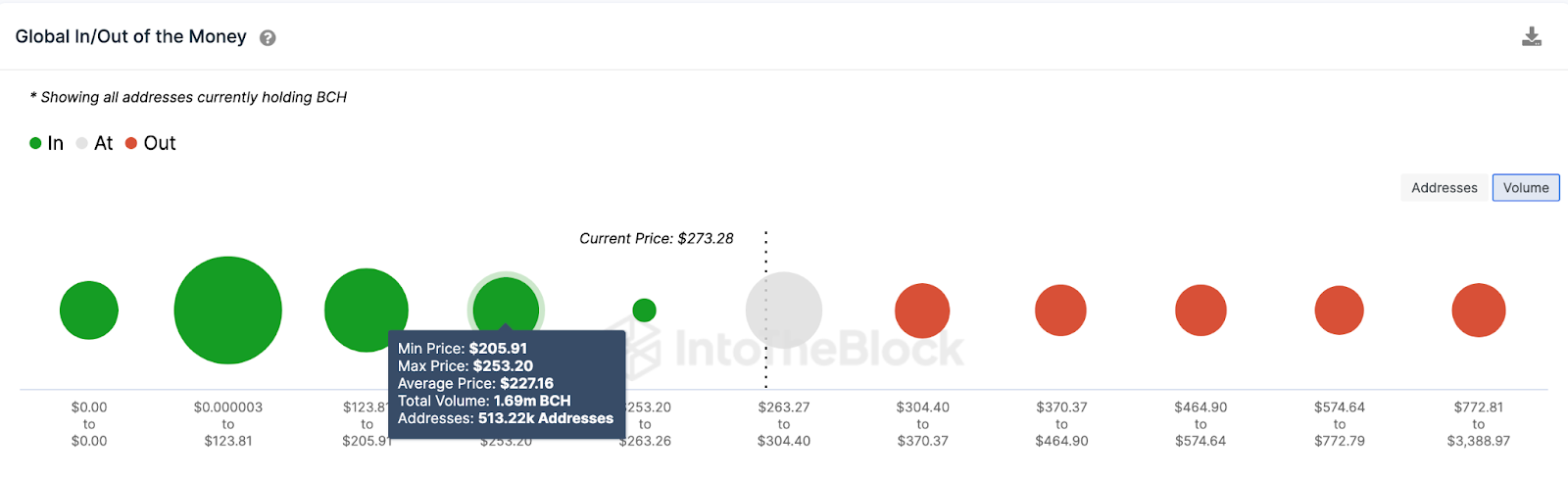

Considering the critical bearish indicators highlighted above, BCH looks set for a price reversal toward the $200 range. But the bears must first surmount the buy wall around $250.

IntoTheBlock’s GIOM data shows that 513,220 investors had bought 1.69 million BCH coins at a maximum price of $253. They could desperately start buying more once the Bitcoin Cash price approaches $250 to cover their long positions.

But if they do not have enough in the tank, BCH could slide toward $200 as predicted.

Still, the bulls can regain control if BCH can break above $300 again. But as seen above, the $286 resistance could prove too hard to beat. Around that zone, 1.39 million addresses hold 2.58 million BCH bought at an average price of $286.

Considering the growing bearish momentum, those holders could close their positions once they break even. However, if that resistance level does not hold, the BCH price could rally toward $300 again.

beincrypto.com

beincrypto.com