The past month has been extremely hard on ApeCoin ($APE) as the crypto’s price decreased by more than 17% during this period alone. In addition to this, $APE’s struggles have also been reflected in the performance of the Bored Ape Yacht Club (BAYC) $NFT collection.

The crypto market tracking website, CoinMarketCap, indicated that $APE was trading hands at $1.92 at press time following a 0.26% price drop over the past 24 hours of trading. This meant that the crypto was trading much closer to its all-time low of $1.00. Since $APE was able to reach its all-time high of $39.40 in 2022, the price of the crypto slipped by 95+%.

$APE’s recent struggles were also evident in the fact that the meme coin saw its price drop by more than 11% over the past week. Furthermore, it seems like the prices of Bored Ape Yacht Club NFTs are declining along with the value of $APE.

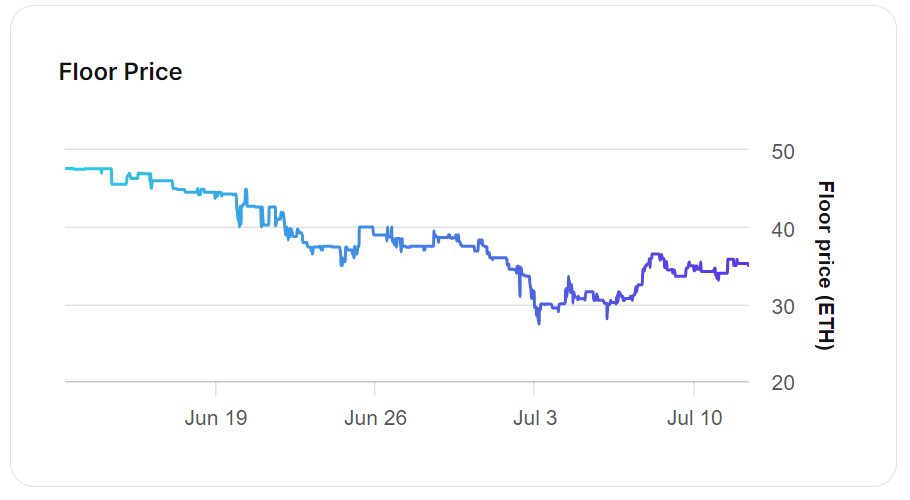

The floor price for these highly sought-after digital assets has plummeted by 26% over the past week, which left it standing at about 35 ETH at press time. This downward trend closely aligns with the decline of $APE, indicating a potential correlation between the two.

From a technical perspective, $APE was resting on the critical support level at $1.767, and had been hovering above this significant price point for the past week. If bulls don’t step in to protect the $1.767 support, then the altcoin may be at risk of continuing its descent to its all-time low of $1.

On the other hand, if $APE is able to break above the 9-day and 20-day EMA lines at around $2.142 in the next 48 hours, then it may look to challenge the resistance level at $2.547. A break above this resistance will clear a path for $APE to rise to $3.078 in the following week.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com