Cryptocurrencies have witnessed remarkable gains, fueled by increasing institutional adoption and optimistic investor sentiment in the last month, with Bitcoin leading the charge.

However, certain crypto assets continue to trade significantly below their all-time highs, presenting an enticing opportunity for investors to look for an opening for the next alt season.

In this context, on July 10, Finbold thoroughly examined the crypto market to uncover the most promising digital assets that traders and investors can acquire for as little as $1.

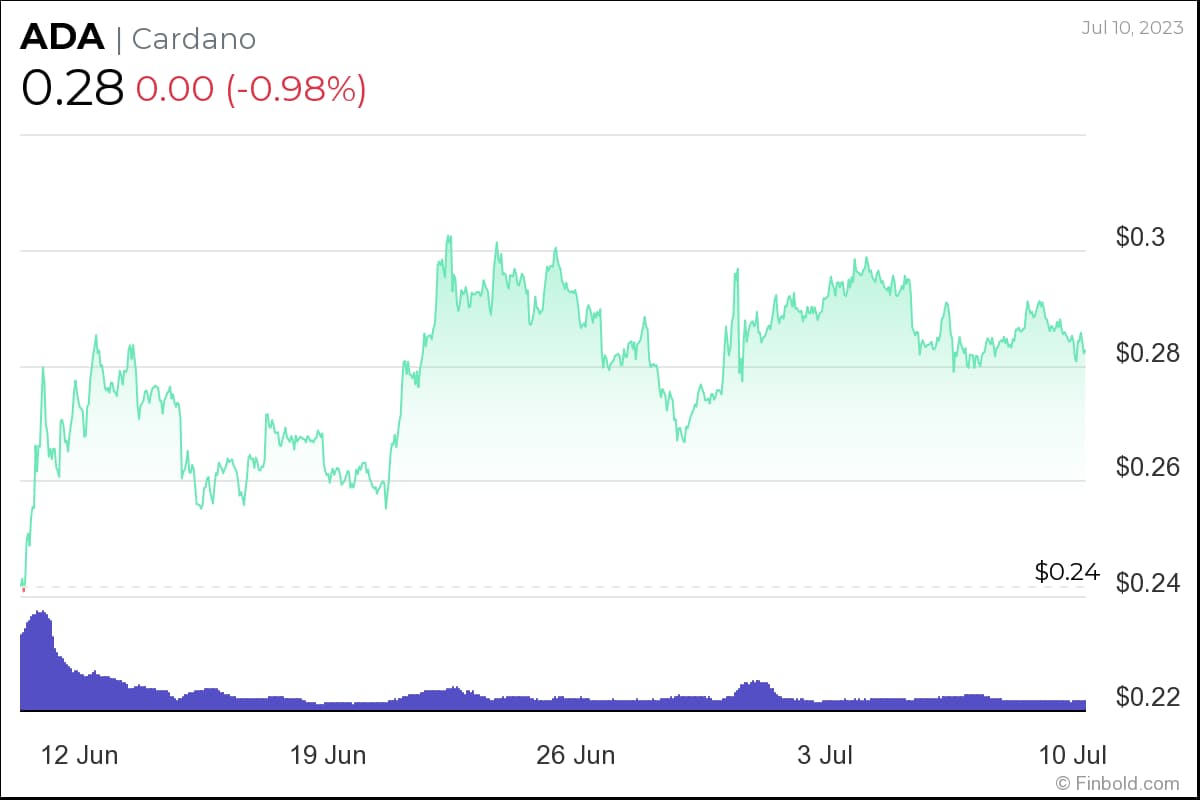

Cardano (ADA)

After getting caught in the crosshairs of the US Securities and Exchange Commission (SEC) last month, Cardano’s native token ADA came under significant pressure. However, the blockchain’s network has been experiencing notable growth in the decentralized finance (DeFi) space in recent weeks, with ADA hitting an all-time high on July 8 in terms of the total tokens locked on its associated Decentralized Applications (DApps).

At press time, the cryptocurrency was trading at $0.28, down less than 1% on the day. The crypto token is down more than 4% on the weekly chart, though it remains up over 17% on a monthly basis.

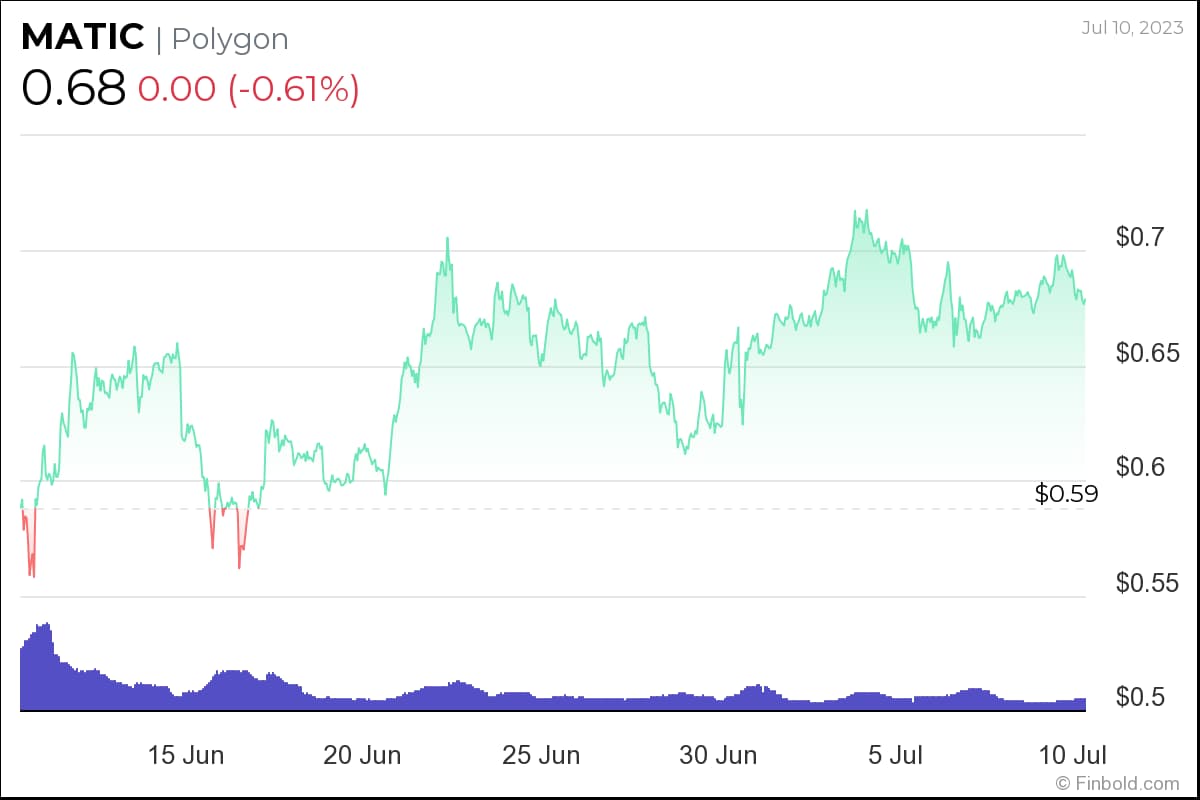

Polygon (MATIC)

Polygon (MATIC) is a blockchain network known for facilitating fast and cost-effective transactions. Notably, Polygon is set to undergo a major network upgrade this week aimed at enhancing the chain’s performance and stability.

Given that the update is bringing an array of improvements, the move could have a positive impact on MATIC’s price imminently. A month ago, Polygon Labs also introduced Polygon 2.0 – a significant upgrade aimed at establishing the network as the “value layer of the internet.”

According to the announcement, 2.0 “can support a practically unlimited number of chains and cross-chain interactions can happen safely and instantly, without additional security or trust assumptions.” In turn, this could also turn out to be a major price catalyst for MATIC.

At press time, MATIC was down 0.6% at $0.68. Over the past week, the altcoin lost around 1.5% while rising more than 15% on a monthly chart.

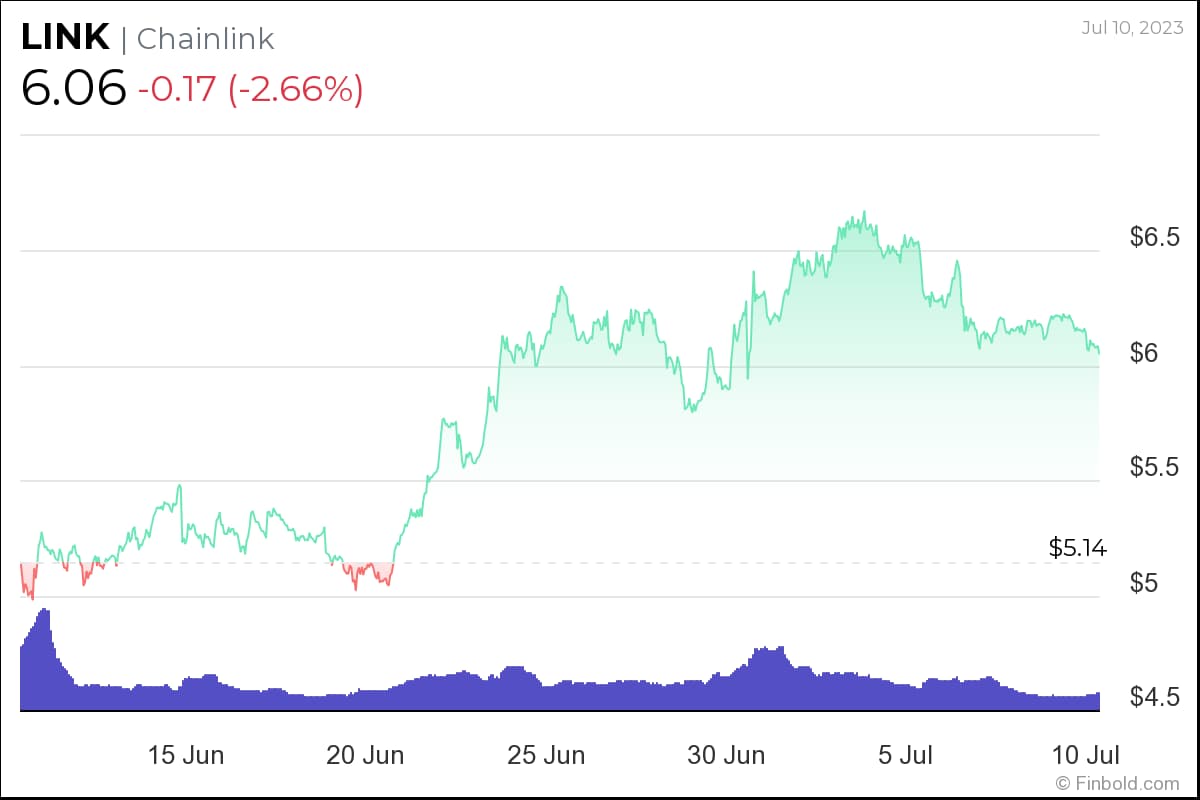

Chainlink (LINK)

In June, Chainlink (LINK) and the interbank messaging system SWIFT announced a plan to collaborate with numerous financial institutions to see how they can connect with multiple other blockchain networks.

Earlier this month, crypto market expert Michaël van de Poppe said that LINK has successfully reclaimed its key support level at $6, after hitting a 2023 low of around $5.

At the time of publication, LINK was changing hands at $6.08, down around 2% in the past 24 hours. The cryptocurrency declined more than 8%, but it rose almost 20% monthly.

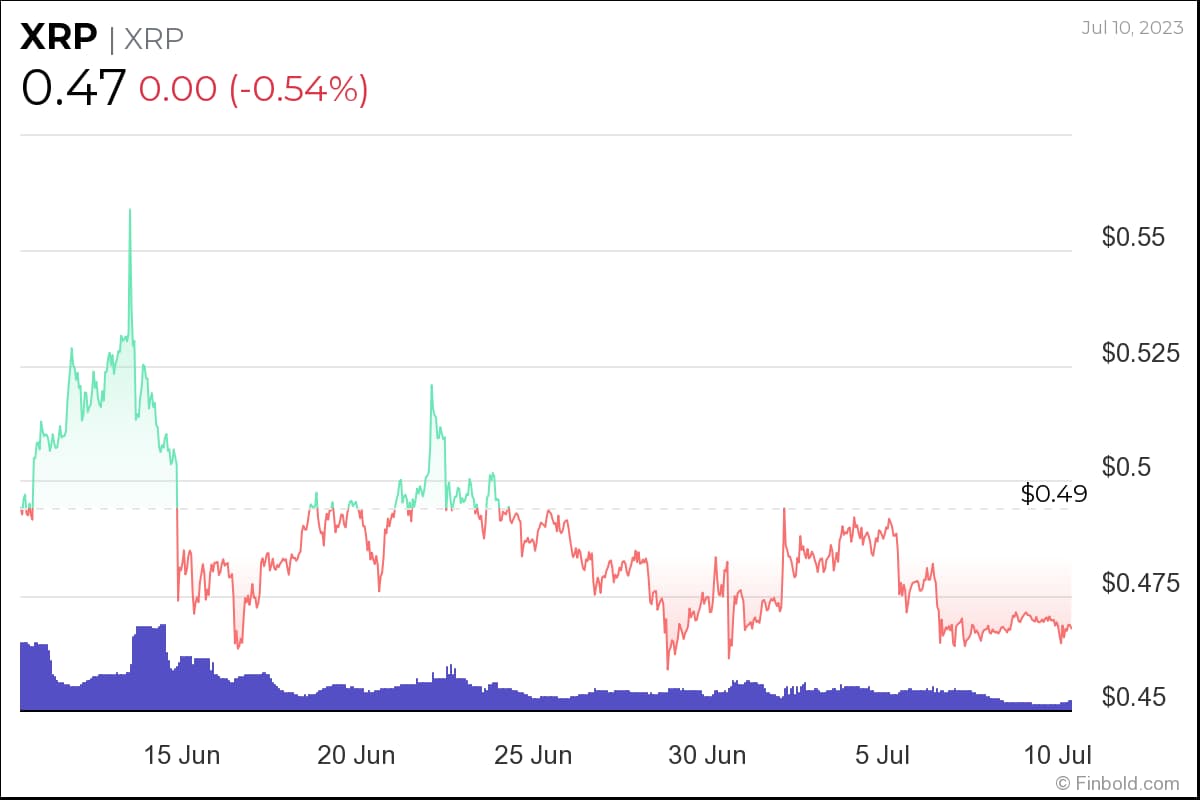

XRP (XRP)

XRP was the third most-traded cryptocurrency in Q2 2023, “as investors start to position themselves for the ruling in the SEC v Ripple case that is expected imminently,” digital assets data provider Kaiko noted in its recent blog post.

XRP was down 0.3% at $0.47 at the time of publication. The cryptocurrency is down 3% and 4.5% over the past week and month, respectively, after failing to break through the barrier at around $0.50 barrier. Clearing this level would let XRP have another attempt at breaking through the key technical level at $0.55.

Crypto whales have bought more than 1.1 billion since late February, for a total of around $570 million, market analyst Ali Martinez noted on July 8. This suggests that the biggest crypto investors are bullish on XRP, despite uncertainty around Ripple’s legal dispute against the SEC.

Widely-followed crypto market analyst CoinsKid carried out a technical analysis of XRP’s chart last week, saying he believes the crypto token could see a major breakout to $0.69 ‘at a minimal,’ assuming it can clear a descending trend line that connects its earlier highs in late March and June.

Stellar (XLM)

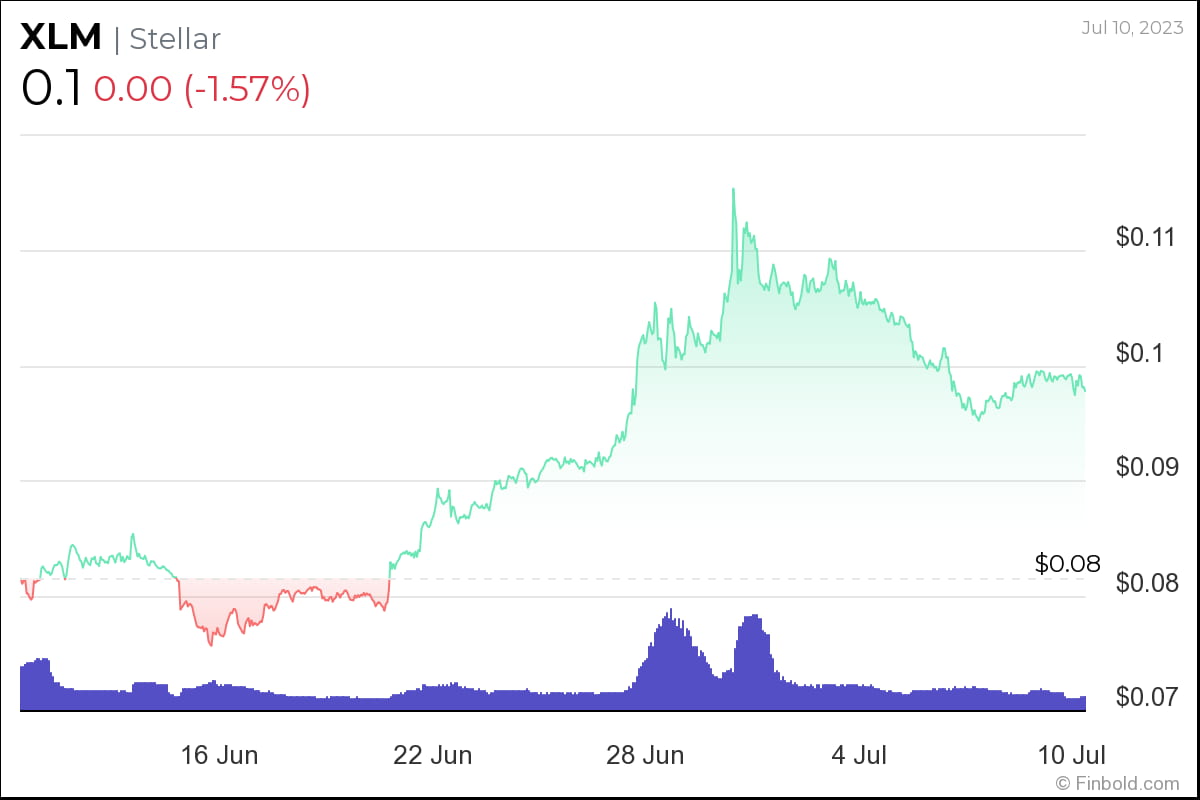

XLM, the native crypto asset of the Stellar blockchain, has been among the top 10 cryptocurrencies in terms of monthly returns in 2023, up more than 37% year-to-date.

Its price rally this year has been partly boosted by Stellar’s major collaboration deals with Coinbase and MoneyGram. The crypto exchange now fully supports deposits and withdrawals of the USDC stablecoin via the Stellar chain, while MoneyGram allows its users to directly deposit or withdraw cash from their crypto wallets via USDC on the Stellar network.

At press time, XLM’s price was standing at $0.10 after slipping around 1.5% on the daily chart. The crypto asset plunged around 9.2% over the past week; however, its monthly gains remain strong at over 19%.

Conclusion

It is important to remember that investors should not give less consideration to cryptocurrencies that trade at lower prices, as trading prices, do not reduce the potential of these assets.

For that reason, it is just as important for crypto traders to stay current on the latest altcoin market trends, and gain insights into which assets could go big next.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com