Stablecoins play a pivotal role within the cryptocurrency industry, being used as the basis for most trading activity.

A study by Juniper Research shows that the use of these financial products will grow by leaps and bounds in the coming years even outside of the crypto industry, particularly in what concerns the cross-border payments market.

How much are stablecoins being used in 2023 and what is the future forecast?

Let’s delve deeper into this topic in this article.

The use of stablecoins could grow dramatically in the coming years

Stablecoins, i.e cryptocurrencies pegged to the value of a fiat currency, are one of the key building blocks of the cryptocurrency industry, allowing users to trade with an asset free from volatility.

However, trading is not the only area where these assets are most widely used, just think of their use in DeFi, such as in lending protocols, AMMs and interoperability platforms.

In any case, stablecoins can also play a key role outside the mere world of cryptocurrencies, especially in what concerns the cross-border payments market.

Research by Juniper Research, a British fintech analytics firm, found that by 2028 the value of payment transactions powered by stablecoins will reach $187 billion.

This is a 250% increase from the projected $53 billion for all of 2023.

The study found that stablecoins are making particular headway in the cross-border payments market because they are more efficient than FIAT coins and their associated infrastructure, which are significantly slower and more expensive.

In addition, these kinds of cryptocurrencies are much easier to track due to the existence of public distributed digital ledgers and hence could be exploited to ensure the control of monetary flows worldwide.

According to Juniper Research, by 2028 the value of cross-border payments will reach a 73% share of total payments made in stablecoins, becoming the predominant use case.

Nick Maynard, author of the cited research, explained the phenomenon with these words:

“Stablecoins have vast potential to unlock the flow of money across borders, but payment platforms need to roll out acceptance strategies for this to progress. MTOs (Money Transfer Operators) can leverage stablecoins in a wholesale manner, but this will need networks to be built across wide geographic footprints.”

To date, the main obstacle to large-scale deployment of stablecoins for the cross-border transaction market is dictated by the need to build new networks capable of supporting heavy traffic.

CBDCs, (Central Bank Digital Currencies) could also prove to be an enemy of stablecoins, being issued by central banks, the main enemies within the cryptocurrency ideology.

However, we will most likely see a phase of growth and cohesion for both sides in the coming years, without one taking over the other.

The stablecoin market in 2023

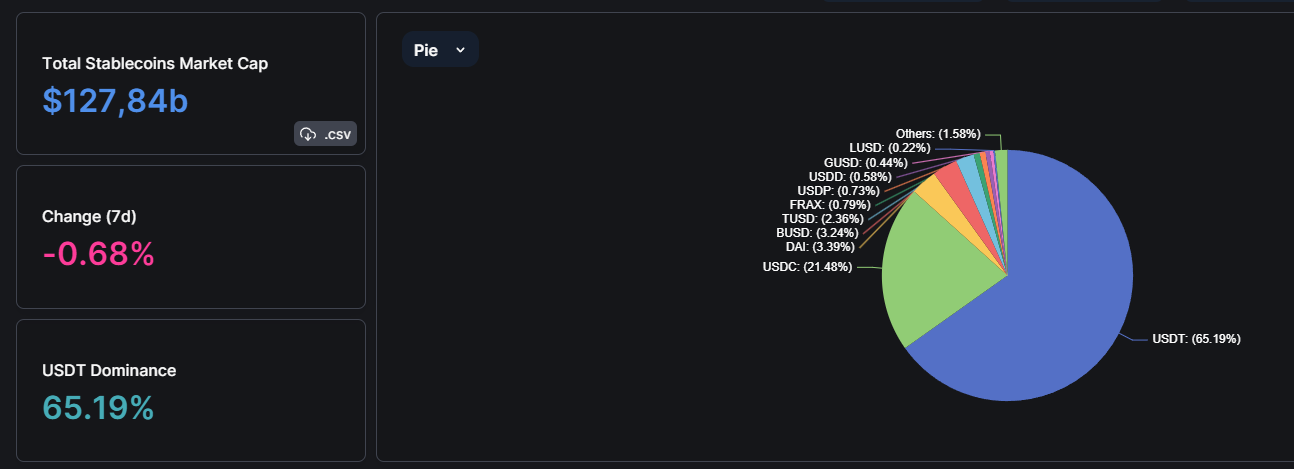

In the current year, the stablecoin market records a total value of $127.8 billion.

The most widely used cryptocurrencies pegged to the value of the US dollar are USDT, USDC, DAI, BUSD, TUSD, FRAX, USDP, and USDD.

Although there are a wide range of stablecoins, we can see that the ones that garner the most capital are actually USDT and USDC, which collectively cover 86% of the market share in the sector.

With 89 different ones with a capitalization of more than $1 million, only the first two are worth $110 billion.

The centralization of this market is likely to increase, given also the implications with Binance’s stablecoin, BUSD, on which new supply can no longer be issued after the SEC’s warning against the exchange and Paxos.

In recent weeks USDT, the main financial product of Tether Limited Holdings, which manages the issuance of the currency itself, has reached a new all-time high, further increasing its hegemony over the sector.

By itself USDT has a dominance of 65.19%.

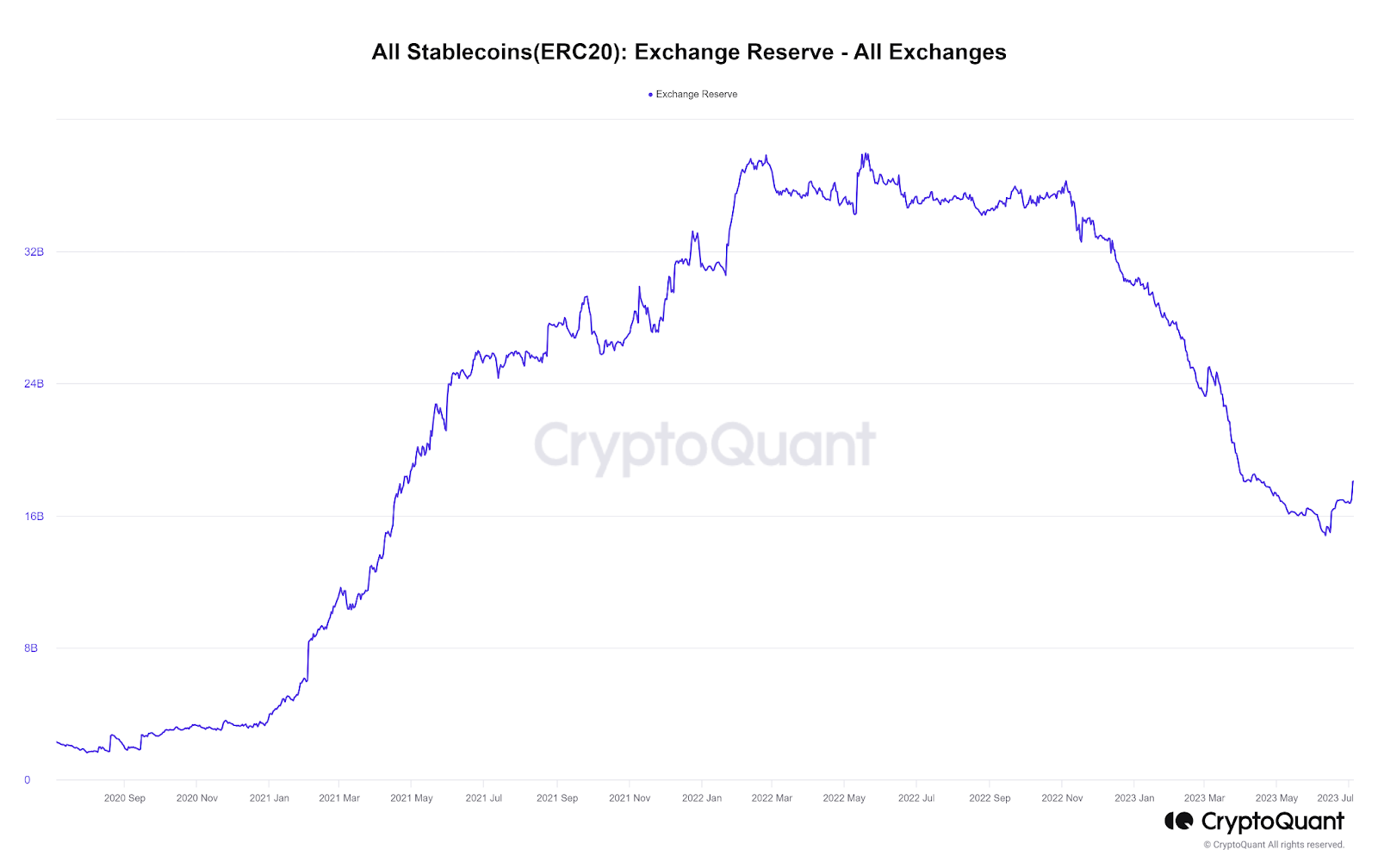

Leaving aside issues concerning the dominance of one currency over the other, it is interesting to note that in 2023 we are witnessing a significant decrease in ERC-20 stablecoin reserves on centralized exchanges.

According to CryptoQuant data, from $30 billion in countervalue on the major trading platforms we are down to the current $18 billion.

This is a 40% decrease in just 6 months.

It is worth noting how the supply shock of stablecoins in the market has been the main driver of the 2021 bull run: many traders use this metric to identify the best time to position themselves on the most speculative assets, stablecoins being the primary source of these trades.

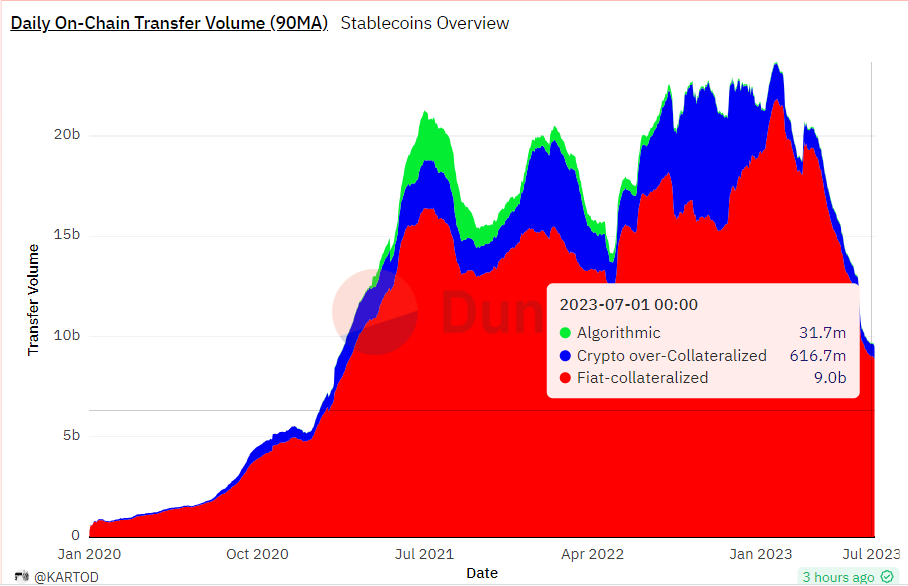

On the other hand, regarding the volumes generated by on-chain transactions in stablecoins, we see how, according to data from Dune Analytics, $2.731 billion has been moved since January to date.

In the last 7 days alone, the movements of cryptocurrencies with a base value of $1 involved a volume of $76, 36 billion.

These values may seem high, and yet the volumes since the beginning of the year are actually significantly lower than those recorded in 2021 and 2022.

Also curious to note is the nature of the coins moved on-chain: at the moment the ones most used in this context are stablecoins backed by fiat currency collateral.

Algorithmic and over-collateralized stablecoins have lost investor confidence and attractiveness.

In particular, after the collapse of the Terra-Luna and UST stablecoin, the market for algorithmic currencies has crashed heavily, from 2.4 billion recorded in July 2021 to the current 31.7 million

The struggle between USDC and USDT

As anticipated, USDT and USDC compete for the leadership of the most widely used stablecoin in the market.

While noting the dominance of USDT, which amasses about three times as much capital as USDC, we cannot but recognize a diversity of the two products, both in the uses to which they are put and the entities that manage them.

USDT is mainly used for off-shore exchanges and less for transactions in public markets. It is backed by US dollars and US Treasury securities and is issued by Tether, a company based in the British Virgin Islands.

USDC, on the other hand, is more widely used in the DeFi context and is “backed” entirely by US dollars, held at various financial institutions such as BlackRock and BNY Mellon.

The company that manages the issuance of new currency is Circle, headquartered in Boston, Massachusetts.

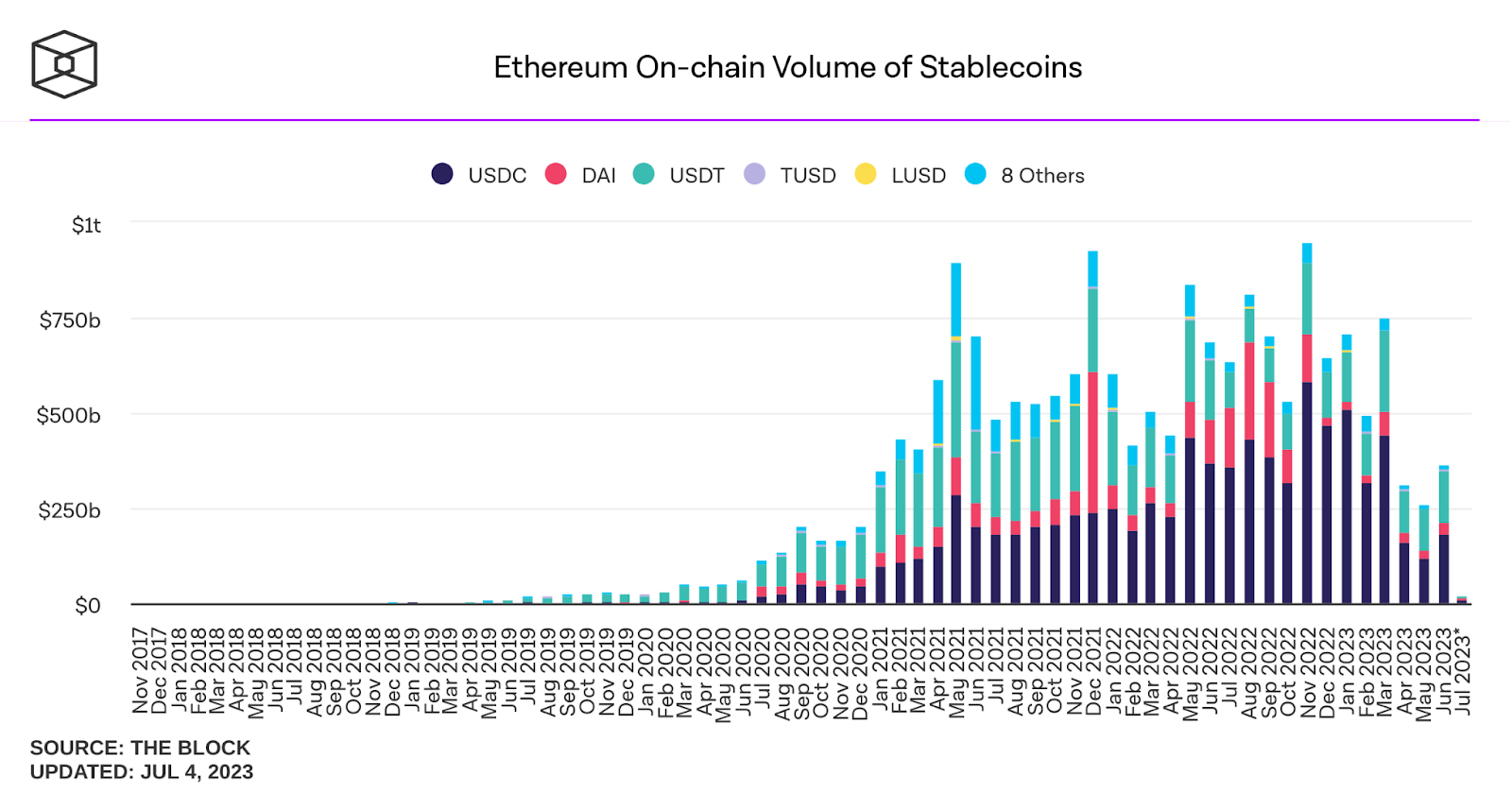

USDT has a larger presence on the Ethereum and Tron blockchains, while USDC competes only on the Ethereum network, with small fractions scattered on other networks.

On Vitalik Buterin’s network, USDT’s supremacy is less visible, as the latter is used extensively for off-shore exchanges, as mentioned.

Looking at the supply metrics of ERC-20 stablecoins and the volumes generated in the network, we can see how USDC has carved out a primary role within this ecosystem.

Before July 2020, USDC was completely nonexistent, while USDT has been acting as a gateway between the crypto and mainstream worlds since as early as 2019.

en.cryptonomist.ch

en.cryptonomist.ch