In the tumultuous second quarter of 2023, the resilience of cryptocurrency was put to the ultimate test. The market witnessed a series of ups and downs, including positive developments for Bitcoin, concerns surrounding two prominent exchanges, a surge in memecoins, and various other significant events.

These unpredictable circumstances left individuals pondering about the future of the crypto landscape. To shed light on the present state of the cryptocurrency world, CryptoRank has recently unveiled its newest market analysis and comprehensive report. This article will delve into the insights provided by this report.

Absence of Sustained Trends in the Market

The cryptocurrency market in the second quarter of 2023 was a wild ride, resembling a rollercoaster with its ups and downs. After a decline in April, the market saw a rebound in May, followed by a relatively quiet June. Unfortunately, the majority of large-cap projects experienced negative performance during this period, primarily due to ongoing litigation involving the SEC and exchanges. This legal scrutiny had a significant impact on many top-100 coins and tokens.

However, amidst the turbulence, Bitcoin and other digital currencies, such as BCH and LTC, stood out with strong performances. As per the CryptoRank report, the driving force behind their success was the news surrounding ETFs and institutional listings. Bitcoin, in particular, delivered remarkable returns that surpassed traditional financial instruments, outshining the Nasdaq, S&P 500 indices, as well as gold and silver, in the first half of 2023.

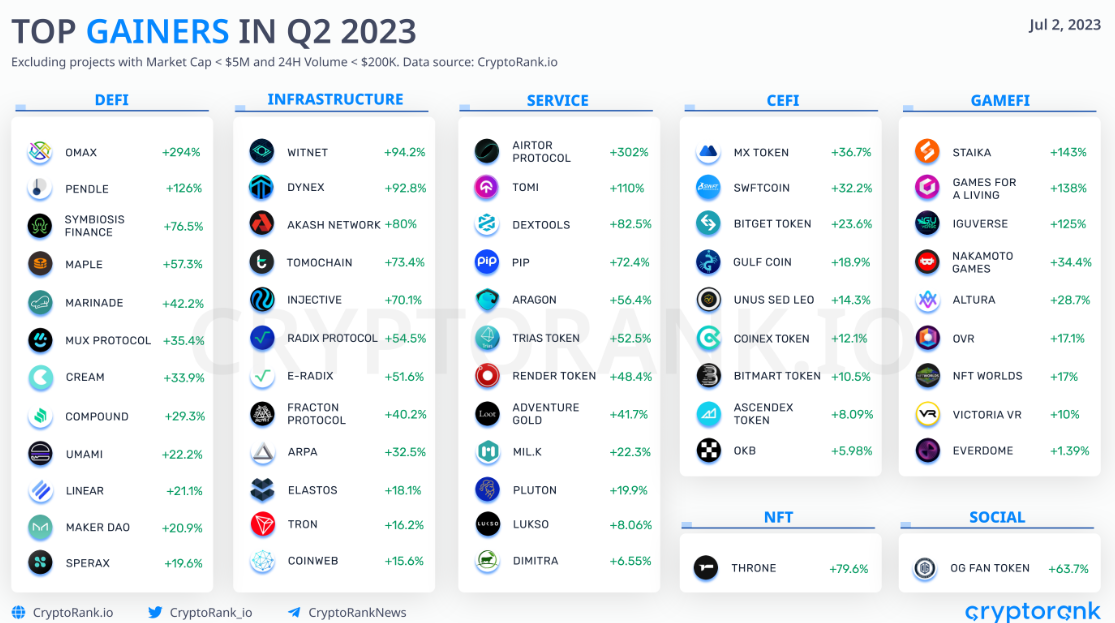

When examining the gainers this quarter, the list appears rather modest. No prominent trends persisted throughout the months, unlike the AI trend observed in the first quarter. Additionally, major blockchains faced legal challenges, with the SEC focusing its attention on Polygon, Solana, and Binance. These factors contributed to the second quarter’s complex and uncertain market landscape.

The Rise of Bitcoin Spot ETF

Undoubtedly, one of the most noteworthy and impactful events in the cryptocurrency market was the submission of a Bitcoin ETF application by Blackrock, the largest asset manager globally. This development had a profound effect, particularly on BTC, which experienced substantial growth and reached a new all-time high in 2023. Blackrock’s move set off a chain of events that is still unfolding, with numerous asset managers either renewing or submitting their applications for a Bitcoin spot ETF.

In the midst of this frenzy, it is important to mention the Grayscale Bitcoin Trust (GBTC), which significantly reduced its undervaluation relative to its assets under management (AUM) and witnessed a strong surge in value. The rumor of a potential acquisition of Grayscale’s assets by a larger corporation, Fidelity Investments, played a crucial role in boosting GBTC’s value.

CryptoRank highlights that GBTC currently holds around 626,000 BTC, accounting for approximately 3% of the total Bitcoin supply. It can be speculated that larger funds like Blackrock or Fidelity, with a Bitcoin spot ETF and larger assets under management, would possess an even more substantial amount of BTC. This, coupled with the growing popularity and increased accessibility of Bitcoin, could drive these funds to make significant purchases of the cryptocurrency.

However, it’s important to note that the Securities and Exchange Commission (SEC) remains opposed to the idea of a Bitcoin ETF and has previously rejected all applications, only approving futures-based ETFs. Recent news indicates that the SEC has returned new applications for revision, some of which have already been resubmitted. Regardless, the resolution of the Blackrock collaboration is not expected until mid-Q3 at the earliest and no later than mid-March 2024, just a month before the halving event.

Regulators’ Growing Attention to Crypto

The realm of cryptocurrency regulation has been a prominent and dynamic subject in recent years, showcasing both positive advancements and setbacks. Notably, US regulators have displayed a negative stance toward cryptocurrencies. In a surprising turn of events, the SEC sent shockwaves through the industry by filing lawsuits against Binance, CZ (Changpeng Zhao), and Coinbase in early June.

CryptoRank says that while legal disputes between exchanges and regulators are not unheard of, the SEC’s targeting of these industry giants was unprecedented. These lawsuits carry significant implications as the SEC has classified numerous cryptocurrencies as securities, which greatly affects the overall market.

Binance encountered additional challenges when several European regulators took action against the exchange, prompting Binance to gradually withdraw from the European market. Nonetheless, as certain doors close, others open. Many Asian countries are increasingly embracing cryptocurrencies, making them the focus of attention for numerous exchanges.

Furthermore, several countries that are actively developing their Central Bank Digital Currencies (CBDCs) are approaching the final stages of testing. It won’t be long before we witness the emergence of the first true cryptocurrencies issued by central banks. This development likely contributes to the heightened regulatory measures observed in some regions as governments seek to eliminate competition from alternative cryptocurrencies.

Bitcoin NFTs and The Rise of the Memecoin Frenzy

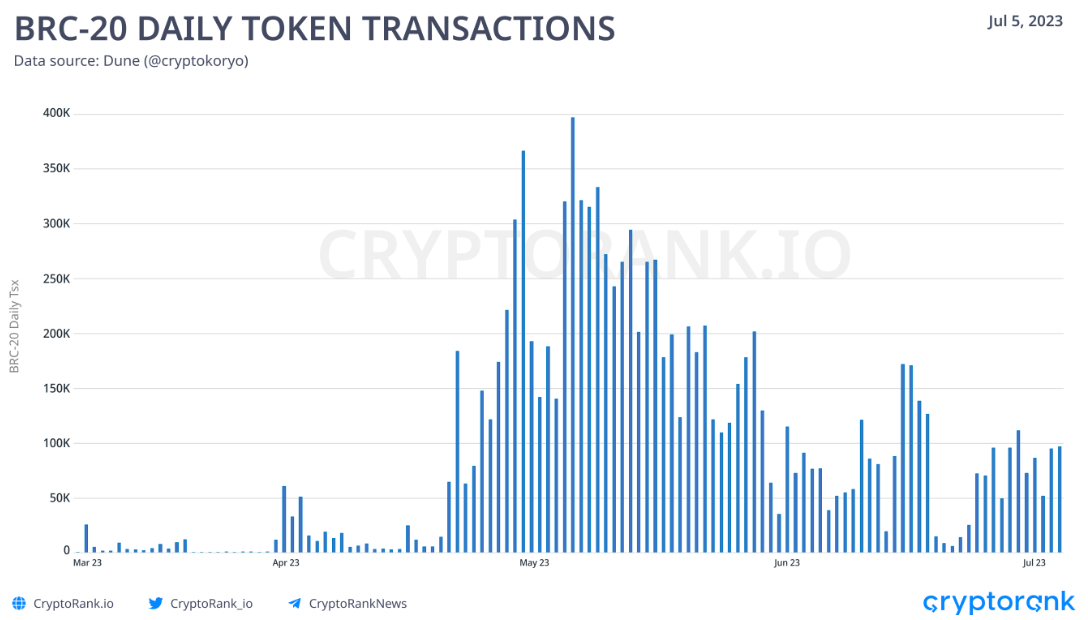

The second quarter witnessed two noteworthy trends that had a swift but significant impact: memecoins and Bitcoin NFTs. The memecoin frenzy took the crypto market by storm, beginning in April and gaining further momentum with the emergence of numerous new memecoins in May. According to the CryptoRank report, these memecoins profoundly affected the Ethereum network, resulting in a peculiar shift in the top 10 gas-spending coins. Instead of ETH, WETH, and USDT, many memecoins dominated the list of highest gas spenders.

However, May was not solely defined by the Ethereum memecoin craze. Bitcoin NFTs, known as Ordinals, gained immense popularity as they offered a decentralized means of storing digital assets on the Bitcoin blockchain. This led to the creation of numerous new memecoins on the Bitcoin network. One such memecoin, Pepe, even reached a market capitalization exceeding one billion dollars, securing a spot in the top 100 coins.

The concept of Ordinals was first introduced earlier in 2023, and by the end of May, the number of Ordinal inscriptions on the Bitcoin blockchain surpassed nine million. As per CryptoRank, the total fees paid for these Ordinal inscriptions experienced an astonishing increase of over 600% in May, surpassing 1,664 Bitcoin.

Ethereum’s Rising Staking Ratio post-Shanghai

During the month of April this year, Ethereum underwent a significant update known as Shanghai (EIP-4895). This update introduced the capability for Ethereum stackers to withdraw their staked coins and rewards, leading to an unforeseen outcome. Contrary to expectations, the staking ratio of Ethereum continued to rise even after the introduction of withdrawals. It appears that individuals are now more willing to stake their ETH, knowing they have the ability to swiftly withdraw their coins.

CryptoRank highlights that Liquid staking protocols have demonstrated strong performance, with both the price and total value locked (TVL) experiencing growth during the initial weeks of the second quarter. Among various categories, the group of Liquid Staking Derivatives (LSD) protocols currently holds the top position in terms of TVL. The on-chain dynamics also provide an interesting perspective.

Following the Merge in September, Ethereum is no longer subject to constant inflation. Its supply now depends on the level of activity on the network. The memecoin frenzy in May 2021 resulted in a surge in network activity, leading to the largest decline in Ethereum supply in history during that month. This recent upswing in network activity tested the deflationary nature of the coin during periods of high engagement, further showcasing the long-term advantages of transitioning to Proof-of-Stake (PoS).

Summer Slump and Shifting Preferences

The summer months typically witness lower trading volumes in the cryptocurrency market. While June did feature some notable events and trading volumes did experience an increase, overall, the second quarter saw a decline in trading activity. According to CryptoRank, crypto exchanges recorded a decrease in trading volume throughout the second quarter, reaching the lowest levels observed in over two years.

On the other hand, decentralized exchanges (DEXs) displayed a relatively modest decline in trading volume. With Binance and Coinbase facing their own challenges, users have gradually shifted towards DEXs. This trend initially emerged following the collapse of FTX, and users are now becoming more proactive in their adoption of DEXs.

This transition is not limited to spot trading alone; it is also evident in the derivatives market. Although DEXs currently represent a small portion of the derivatives market, their growth is already visible. For instance, their market share reached a new high in June. While DEXs’ spot market share also reached an all-time high a month earlier, it has slightly decreased since then.

Weaker ROI and Decline in Public and Private Fundraising

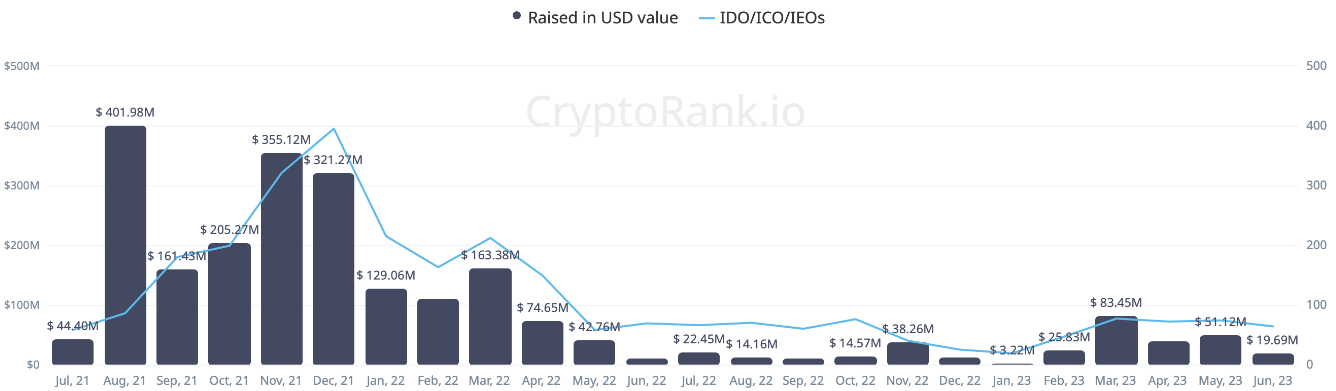

The token sales market has shown signs of recovery in the first half of 2023, highlights CryptoRank. Compared to the second half of the previous year, the market has been on an upward trajectory. However, it has not yet reached the levels witnessed in 2021. It is important to highlight that the majority of successful token sales occurred in the first quarter of this year.

The performance in the second quarter has been slightly weaker, with many projects experiencing a significant decline in return on investment (ROI) compared to their all-time highs (ATH). A standout token sale of the quarter, and potentially even the year, was Sui, which raised nearly $50 million from public rounds. However, it did not include an airdrop, which left some disappointed.

It remains to be seen if other major projects will follow Sui’s approach. Conversely, the landscape for private fundraising presents a contrasting picture. Private raises have been declining consistently for the past month (noting that Stripe funding contributed $6.5 billion in March) and have reached their lowest levels since the fourth quarter of 2020 by the end of the second quarter.

In the face of regulatory challenges, numerous funds are contemplating relocating their operations to jurisdictions that offer more favorable conditions. Notably, the Asian market has witnessed the highest growth in crypto startup raises through private funding rounds over the past three months compared to other countries.

Layer 2 Networks’ Rise with Impressive TVL Growth

In the second quarter, a decline in prices led to a decrease in TVL across most blockchains. According to the CryptoRank report, only a select few have demonstrated significant upside, while BNB Chain faced challenges due to Binance’s legal issues with the SEC and regulatory rejections in Europe, resulting in a notable decline in its TVL.

On the other hand, the new Layer 2 Blockchains have shown impressive performance. Polygon zkEVM experienced a remarkable TVL increase of up to 3,617% during the quarter, making it the strongest gainer. zkSync Era, poised to potentially enter the top 10, exhibited a substantial increase of +467%. StarkNet, although still a distance from the top, has also witnessed notable growth with a +252% increase.

Liquid Staking has emerged as a growing trend this quarter. As ETH accumulation on the beacon chain smart contract continues to rise, LSD protocols are gaining popularity and establishing dominance. Ethereum, Solana, and Klaytn lead the way in terms of LSD share in the total TVL, while protocols from other platforms are also gaining traction.

Liquid staking derivatives offer various advantages to delegators and validators, contributing to increased network stability and performance. Presently, ETH staking demonstrates promising returns relative to risk and market activity. However, in the future, with the onset of a genuine bull run, decentralized exchanges may once again take the lead in the cryptocurrency landscape.

Final Thoughts

The second quarter of 2023 served as a crucial trial for the cryptocurrency market as several significant events unfolded, leaving a lasting impact for the remainder of the year and beyond. The ongoing excitement surrounding Bitcoin ETFs carries substantial weight, with a potential positive decision from the SEC expected to result in an influx of new investors into the crypto space and large-scale BTC purchases by institutional players.

CryptoRank states that the industry may see further regulatory developments, particularly in the United States. Notably, influential figures from traditional finance (TradFi) are increasingly advocating for the integration of cryptocurrencies into the global financial landscape. However, the ultimate decisions lie in the hands of regulators.

Despite relatively lower activity in the second quarter, the market continues to display a positive trajectory, aligning with expectations. With approximately a year remaining until the next Bitcoin halving, there is potential for a significant boost in the upcoming bull run. The extent of this impact will depend on how well the crypto industry prepares itself during the remaining time leading up to the halving event.