Since the start of June, the crypto industry has witnessed many ups and downs and even some unexpected events that have impacted the markets significantly. The month started with the US SEC taking legal action against Binance and Coinbase, making the decentralized ecosystem tremble.

Over the past two weeks, however, some of the largest asset management companies — BlackRock, Fidelity, WisdomTree, VanEck, and Galaxy — have filed their exchange-traded fund (ETF) applications, not only in the US but also in Hong Kong. This helped the crypto industry gain traction again as investors piled in.

Moreover, the global crypto market capitalization is up by 1.2% over the past 24 hours. It stands at $1.21 trillion when writing, marking a two-month high, according to CoinMarketCap (CMC) data.

You might also like: Fidelity, VanEck and other moguls re-file bitcoin ETF applications

Top gainers of June 2023

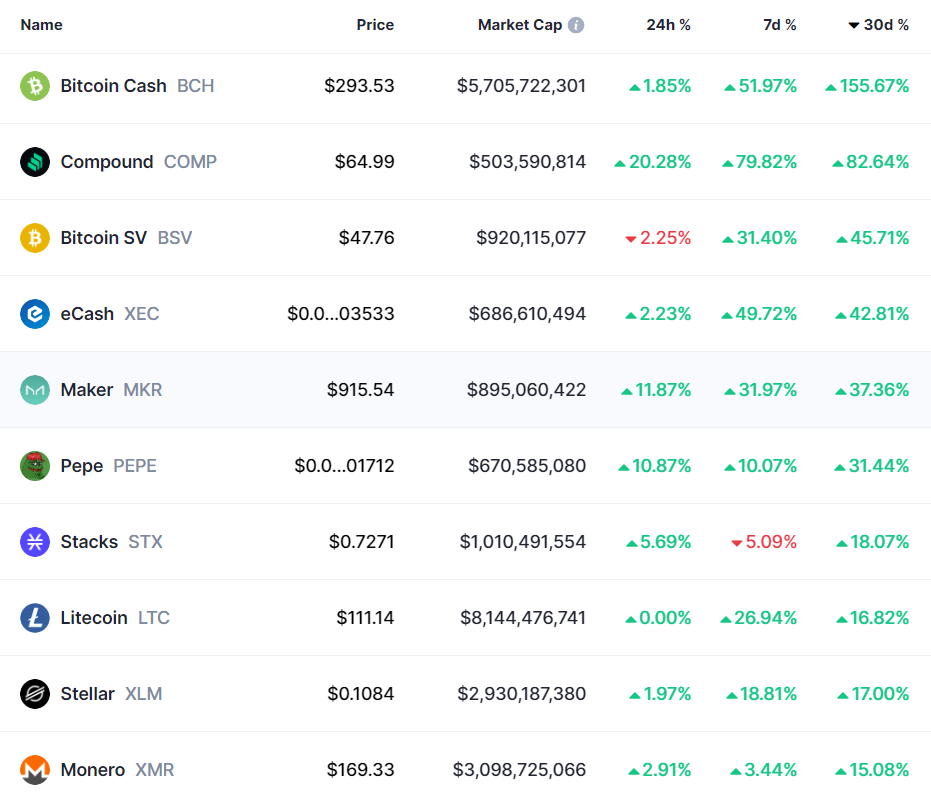

Bitcoin Cash (BCH) has led the charts among the top 100 cryptocurrencies over the past two weeks. The asset has already registered 155.6% gains in June, with its price reaching a 14-month high of around $325 on June 30. The BCH price currently stands at $293 with a market cap of $5.7 billion.

Compound (COMP) could also rise significantly with the help of the recent rally, registering 82.6% gains over the past 30 days. The asset is also up by 20% in the past 24 hours, trading at $64.99 at the time of writing.

Bitcoin SV (BSV), eCash (XEC), and maker (MKR) have also secured the next three spots with 45.7%, 42.8%, and 37.6% gains over the past month, respectively.

Furthermore, the only meme coin on the list is the Pepe token (PEPE), with a 31.4% hike over the past 30 days. The asset has been tumbling since mid-May and plunged even further with the SEC’s actions in early June.

PEPE is up by 10.8% in the past 24 hours and trading at $0.0000017 at the time of writing. The rise comes with the help of the significant amount of its trading volume, which skyrocketed by 83%, reaching $166 million.

Stacks (STX), litecoin (LTC), stellar (XLM), and monero (XMR) could also save the last four spots of the top gainers among the top 100 crypto assets with 18%, 16.8%, 17%, and 15% gains over the past 30 days.

While many of the top 100 cryptocurrencies could surpass crucial price points with high amounts of advancements, it’s still early to decide whether the current bull run would last longer. However, a recent report suggests that bitcoin (BTC) investors have been trying to sell less and accumulate more which could indicate steady growth.

Read more: On-chain data suggests the rise of long-term BTC investors