The cryptocurrency sector faced several challenges at the beginning of 2023 as it attempted to recover from the bear phase of the previous year while also dealing with prevailing macroeconomic factors.

Despite being overshadowed by the impressive bull run of 2021, several cryptocurrencies have managed to achieve remarkable performance, while the pioneering cryptocurrency Bitcoin (BTC) continues its search for new highs.

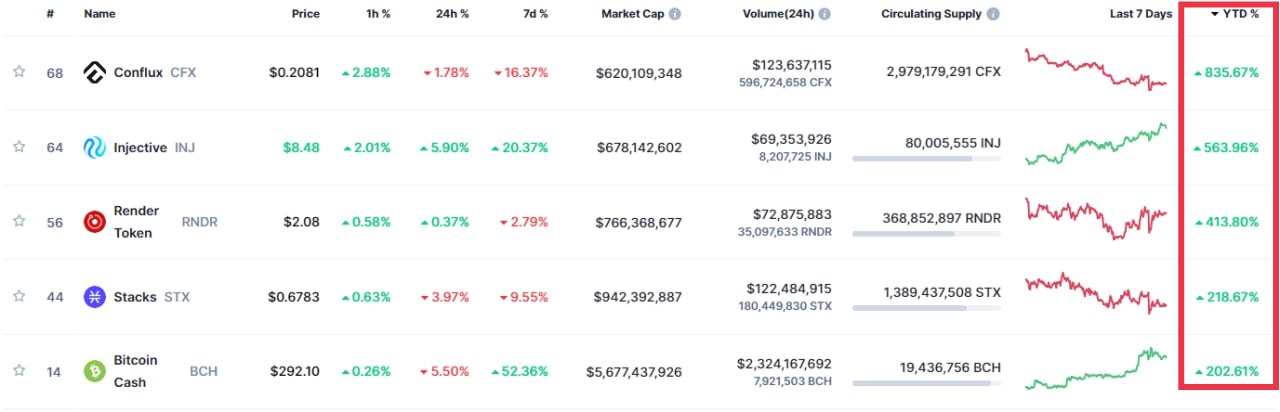

Having reached the midpoint of 2023, it is an opportune time to reflect on the cryptocurrencies that have stood out. In this line, five digital assets, ranked by gains on a year-to-date (YTD) basis as of July 1, dominated the market and have collectively recorded a remarkable average gain of 446%. Here is a breakdown of the cryptocurrencies;

Conflux ($CFX)

With its focus on harnessing the potential of blockchain technology, Conflux ($CFX) strives to be a driving force behind the emergence of a borderless economy. Since its establishment, Conflux has garnered attention primarily for being the sole public blockchain in China, a factor that has contributed to its impressive run in 2023.

Notably, a significant share of the token’s gains emerged due to strategic alliances, particularly its noteworthy partnership with China Telecom, the second-largest telecommunications company in China. Together, they have embarked on a venture to develop blockchain-enabled SIM cards, signaling Conflux’s commitment to exploring new avenues for blockchain integration and adoption.

Although $CFX has corrected in the short term, the asset has recorded significant gains of about 835% YTD. The token is trading at $0.2 by press time.

Injective ($INJ)

Injective ($INJ) has experienced a significant surge in valuation due to the increasing interest in the protocol’s development activity. While the platform has achieved numerous positive advancements, the most noteworthy update revolves around its intention to overhaul the proof-of-stake (PoS) delegation mechanism through the Avalon upgrade.

This upgrade will introduce a sophisticated system integrating sub-second block times and layer-1 scalability optimizations. By leveraging the Avalon upgrade, Injective aims to improve transaction speed and efficiency, ultimately ensuring a smoother user experience on their decentralized finance (DeFi) platform.

Currently, $INJ is valued at $8.3, with YTD gains of about 563%.

Render Token (RNDR)

Render Token (RNDR), an ERC20 token aimed at transforming the 3D rendering industry, has achieved substantial profits within the cryptocurrency sector, even amidst sideways price movement in early 2023. The surge in the token’s value coincided with a period when prominent tech giants expressed their interest in the metaverse realm.

While RNDR’s gains can be attributed to factors like network development and heightened accumulation by whales, the asset experienced significant annual gains following reports of Apple’s (NASDAQ: AAPL)intention to release a long-awaited VR headset.

In the first half of 2023, the RNDR token has rallied by about 413%, currently trading at $2.07.

Stacks ($STX)

Despite various phases in the cryptocurrency market, Stacks ($STX) has encountered a rollercoaster ride in 2023. As an extension of the Bitcoin blockchain, Stacks enables developers to create and deploy smart contracts, and it has predominantly displayed a bullish trend.

A significant driving force behind the price of Stacks is the adoption of Bitcoin-based non-fungible tokens (NFTs) known as Ordinals. The increased adoption of NFTs has led to heightened network activity, resulting in a significant rise in the price of $STX.

Additionally, Stacks achieved a noteworthy milestone by becoming the first token approved by the Securities Exchange Commission (SEC) amidst growing regulatory scrutiny impacting various cryptocurrencies.

This regulatory approval sets $STX apart from other tokens and provides reassurance to investors regarding its legitimacy and compliance with regulatory requirements. Currently trading at $0.6, $STX has surged 218% YTD.

Bitcoin Cash ($BCH)

Bitcoin Cash ($BCH) has emerged as a surprise package in the cryptocurrency space, experiencing significant gains primarily during the latter part of June. According to Finbold’s report, $BCH has attracted considerable capital in recent weeks, largely driven by institutional interest in the crypto market. This development has instilled a sense of optimism among investors.

Of particular note, BlackRock (NYSE: BLK), the world’s largest asset manager, made headlines by filing with the US Securities and Exchange Commission (SEC) to introduce a spot Bitcoin exchange-traded fund (ETF). This move would provide investors with convenient access to cryptocurrencies through one of Wall Street’s major players. Subsequently, other notable financial institutions, including Invesco, Valkyrie, and WisdomTree, followed suit by submitting similar applications.

Simultaneously, the impressive rally of $BCH can also be attributed to the launch of EDX Markets—a cryptocurrency exchange supported by prominent institutional investors such as Citadel Securities, Fidelity Investments, and Charles Schwab. This influential backing likely played a role in boosting $BCH’s performance in the market.

By press time, $BCH was trading at $288 with YTD gains of 202%.

Having stood out in the market for the first half of 2023, the focus turns on how the highlighted cryptocurrencies can sustain the rally moving into the second part of the year.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com