In order to better prepare for Bitcoin’s next halving (the halving of miners’ rewards per validated block of $BTC), which is expected to take place around the beginning of 2024, this new article looks at recent movements in the crypto market to try and understand which sectors and tokens are delivering the best performance in this early part of the year.

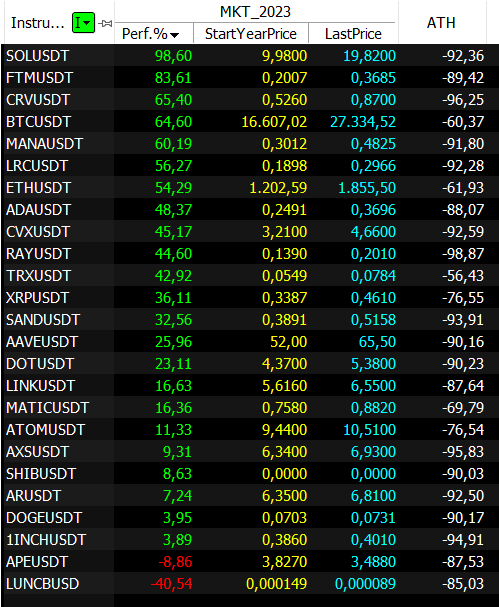

Figure 1 shows 25 of the top tokens in the crypto landscape. These are the most capitalised (excluding stablecoins) and belong to different sectors such as DeFi (AAVE), Gaming ($AXS), Exchanges (BNB), Layer 2 (MATIC) and of course the two main cryptocurrencies $BTC and $ETH.

Figure 1. Most capitalised crypto yields in early 2023

The last date taken into account for these calculations is 23/05/2023, while the first date is obviously 01/01/2023. In these first months, most of the stocks under consideration have shown a positive performance.

In fact, only $APE and $LUNC show negative returns of -8.73% and -40.54% respectively. We all know by now the sad epilogue of the LUNA project, which saw everything it had built destroyed in a matter of days, leaving many investors on the brink and triggering a chain reaction throughout the sector. $APE, on the other hand, a project at the heart of the NFT sector, probably paid for the sharp rise seen in 2022 following its listing on Binance.

Currently, the best performing cryptocurrency in 2023 is Solana (SOL) with a performance of 98.6%, followed by Fantom (FTM) with a return of 83.6%. Also performing well are Curve (CRV) and Decentraland (MANA) with performances of 65.4% and 60.19% respectively.

Bitcoin ($BTC) also performed very well, rising from $16607 to $27334 in 2023, a positive result of 64.6%. Ethereum ($ETH) is a little further down the list, up a good 54.29%.

Scrolling down the list, a number of altcoins from different sectors stand out, such as Cardano (ADA) with 48.37%, SandBox (SAND) with 32.56% and so on.

Among the worst performers are Dogecoin (DOGE), which is hovering around parity (3.9% to be precise), Axie Infinity ($AXS) with a slight increase (considering the volatility of the crypto sector) of 9.31% in 2023, and of course the aforementioned $APE and $LUNC.

These results might suggest that a new rally in cryptos is on the horizon, but in reality the road back to the highs of recent months is still a distant mirage for most of them. Indeed, in Figure 1, in the column labelled ATH (all-time high), it can be seen that the distance between the current price and the all-time high is still very large.

Suffice it to say that despite bitcoin’s recent rise of 64.6%, the distance from the all-time high is still very pronounced (-60.37%). For altcoins, the figure is even worse, with tokens well over 90% away from all-time highs.

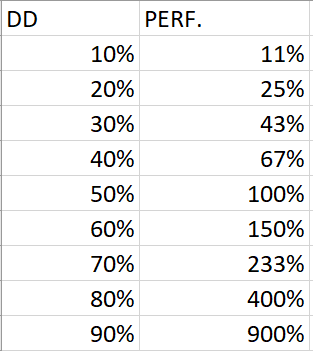

All of this means that, as can be seen in Figure 2, to recover these drawdowns and return to historical highs, there needs to be a much bigger rally than we have seen so far. In fact, to recover a 50% drawdown would require a 100% positive performance. Similarly, to recover a 60% drawdown, a 150% performance is required, and so on down to 90%, where a 900% rally is required to return to historical highs.

This period in history could certainly be a good time for those who believe in these projects to accumulate some cryptocurrencies, given the strong drawdowns and the imminent halving of bitcoin, but beware, it is by no means a given that cryptocurrencies that have experienced drawdowns of over 90% can definitively recover the lost ground.

Cryptocurrencies are a highly volatile market, as evidenced by the figures we have seen so far, and this implies that one should treat them with extreme caution, without committing too much of one’s capital, or at least the percentage of one’s account that one is willing to lose up to 90-95% of one’s investment.

All in all, 2023 continues to recover from the strong drawdowns of 2022, but there is still a long way to go. So watch out for movements between now and early 2024, when we will see the halving of bitcoin, which historically has been the start of all rallies seen in bitcoin (and other cryptos as well) since its inception.

Until next time!

Andrea Unger

en.cryptonomist.ch

en.cryptonomist.ch