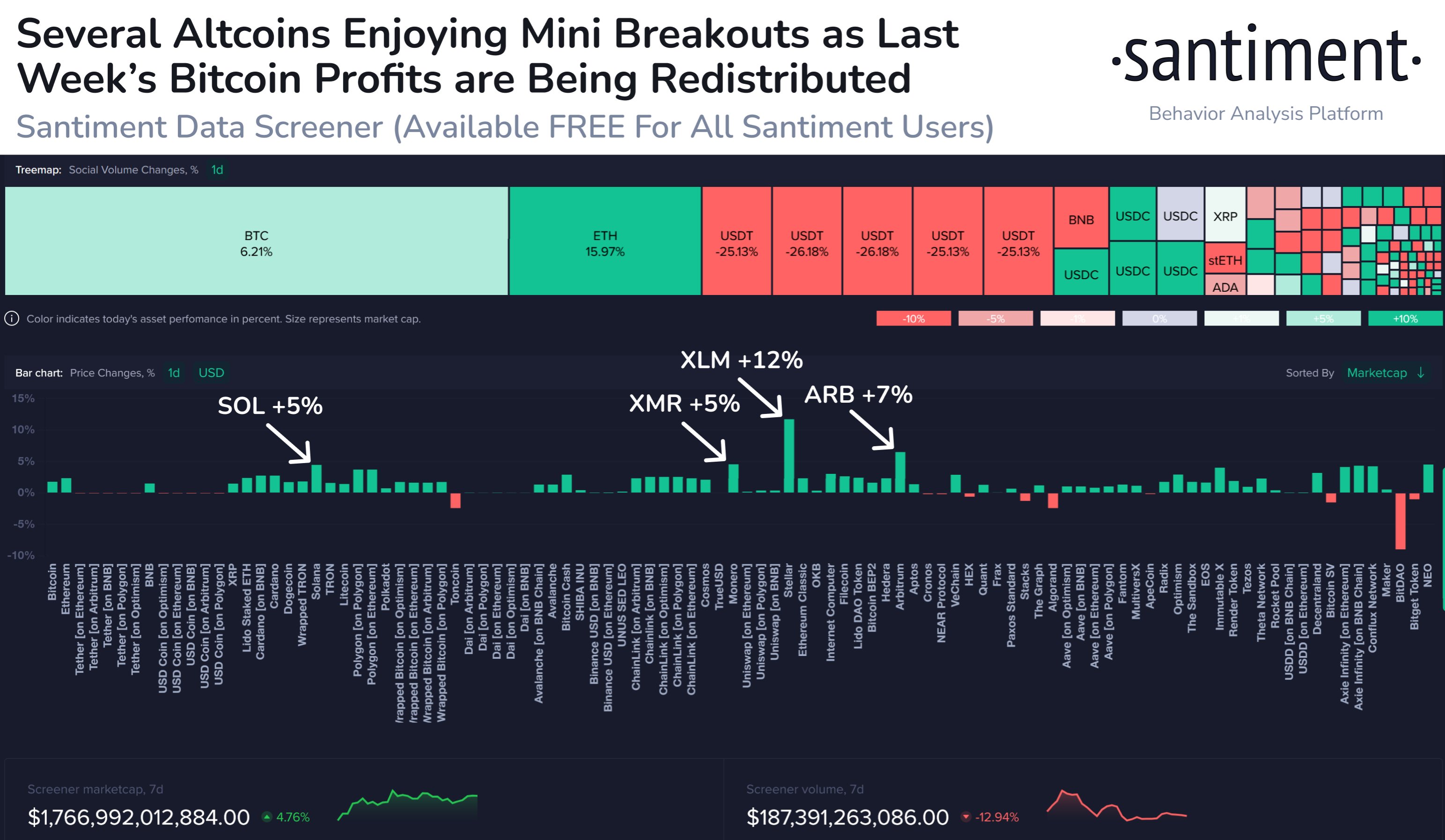

Blockchain analytics platform Santiment says a handful of altcoins are experiencing mini-breakouts as Bitcoin (BTC) trades near $30,000.

According to Santiment, Solana (SOL), Arbitrum (ARB), Monero (XMR) and XRP rival Stellar (XLM) are benefiting from the redistribution of profits from Bitcoin’s latest rally and from the frenzy around the recent spot Bitcoin exchange-traded fund (ETF) applications.

“As Bitcoin continues its week-long ranging between the $29,000 and $31,000 level, altcoins are showing signs of benefiting from the profit redistributions from BTC’s pump. With ETFs creating more trader exposure, trader optimism is beginning to emerge.”

Santiment says XLM was seeing the biggest rally at 12%, followed by ARB at 7% and both SOL and XMR at 5%.

Stellar is trading for $0.10 at time of writing, up 18.3% in the last seven days. Ethereum (ETH) scaling solution Arbitrum is worth $1.14 at time of writing, up 2% in the last seven days.

Solana is trading for $17.76 at time of writing, up 4.8% in the last seven days, while Monero is worth $163.28 at time of writing, up 8% in the last seven days.

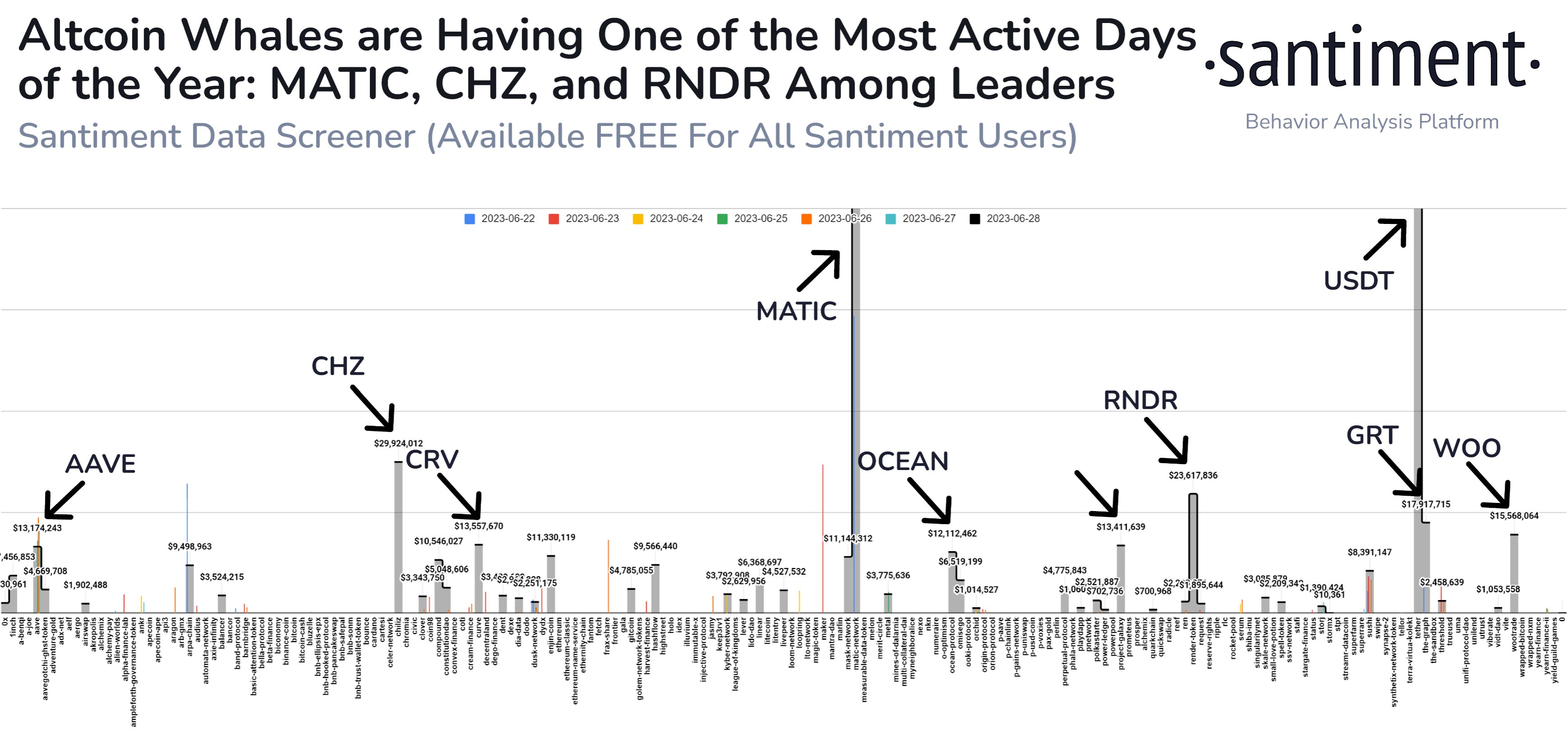

Santiment also notices that deep-pocketed investors moved massive amounts of altcoins on Wednesday, making it one of the top three days for whale transactions so far in 2023.

“With altcoins becoming significantly more volatile this past week, data indicates that several assets have seen major transfers worth $10 million + today, easily making it a top three highest whale movement day of the year. Keep an eye on MATIC, CHZ, CRV, and even USDT.”

According to Santiment, many crypto traders kicked off this week with a bearish bias, a historic indicator that the market will flip bullish.

“After crypto markets topped out last Friday, traders came into the start of the week with expecting that prices would continue to retrace and provide opportunities to buy in the $27,000-$29,000 level. High bearish sentiment increases further rise probability.”

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com