Injective (INJ) price has been on a 48% tear since Blackrock filed a Bitcoin ETF application with the SEC on June 15. On-chain data shows that long-term investors are doubling down on their bullish positions. Is Blackrock ETF driving INJ to $10?

Injective is a unique DeFi protocol allowing users to trade on diverse derivative markets using off-chain and on-chain price feeds.

Blackrock’s Bitcoin ETF filing has sparked renewed interest in the crypto derivatives market. Large institutional firms like Wisdom Tree and Invesco have also thrown their hats in the ring.

The close correlation with the recent INJ price uptrend suggests that the Blackrock ETF application may be a major driver behind the ongoing Injective rally.

Can the bulls ride this bullish momentum to crack the $10 milestone for the first time since December 2021?

Injective Long-Term Holders Have Regained Confidence

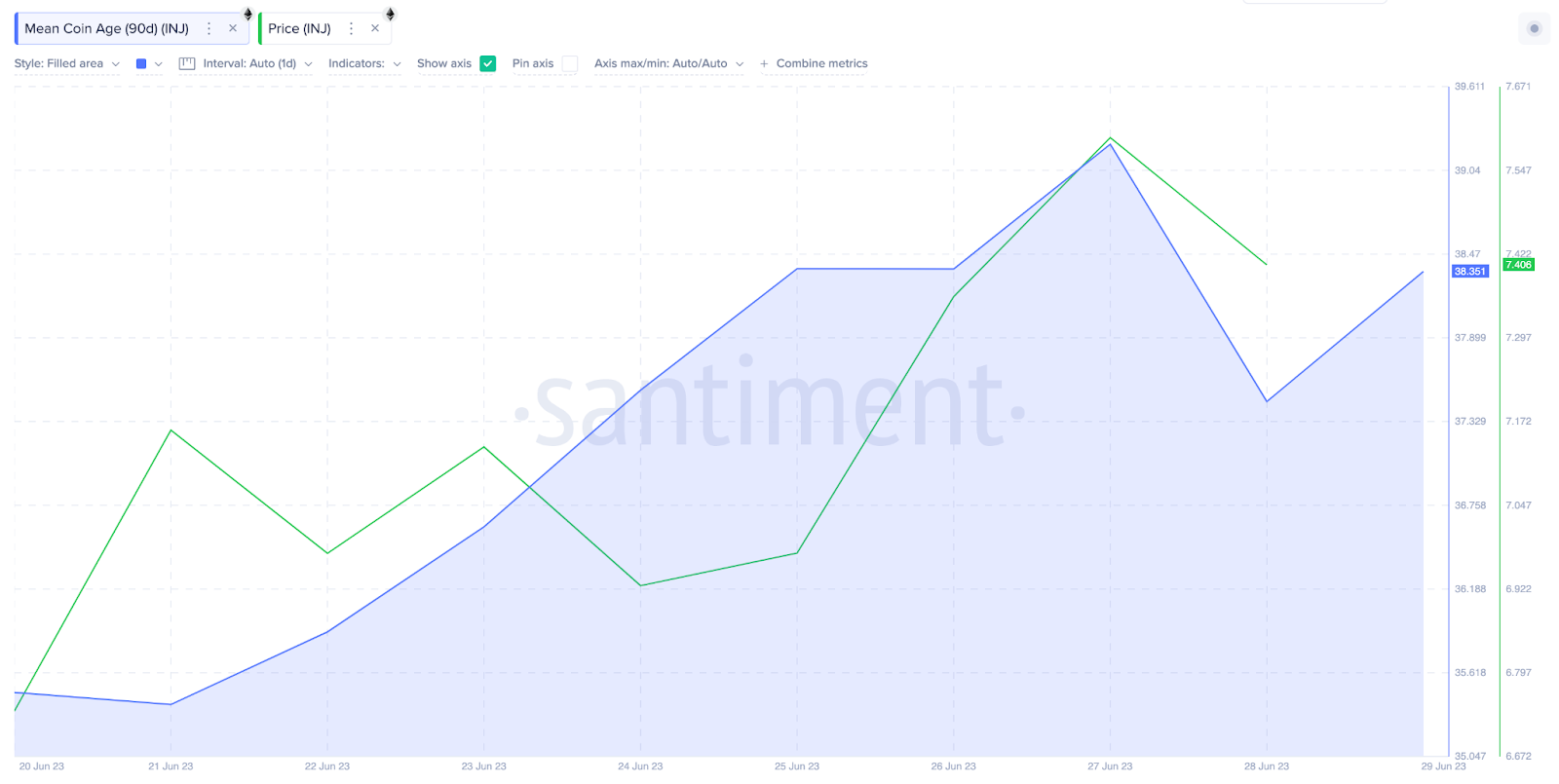

On-chain data compiled by Santiment indicates renewed confidence among long-term investors holding Injective. As seen below, the INJ Mean Coin Age began to trend upward around June 20, a few days after news of the Blackrock ETF filing broke.

Mean Coin Age evaluates the trading sentiment among long-term investors by computing the average number of days that coins in circulation have spent in their current wallet addresses.

When it rises significantly, as seen above, it indicates a network-wide accumulation trend within the Injective ecosystem.

If the long-term investors sustain the confident outlook, INJ’s price will likely rise further in the coming weeks.

Media Buzz is Building up Around Injective

Furthermore, the media buzz surrounding crypto derivatives recently seems to have spread across the INJ ecosystem as well. Over the past two weeks, Injective Social Volume has been on the rise.

The chart below illustrates how it has increased progressively between June 19 and June 29.

The Social Volume metric evaluates the number of times a project is mentioned across relevant crypto media channels.

When it rises during a price surge, it is a bullish signal that indicates a media buzzing building up around the project.

Considering the timing, the flurry of ETF filings appears to have triggered renewed interest in INJ as one of the leading crypto protocols facilitating derivates trading.

In conclusion, the growing confidence among long-term investors and institutional interest in crypto derivates could drive INJ’s price toward $10.

Read More: Best Crypto Sign-Up Bonuses in 2023

INJ Price Prediction: Is $10 a Viable Target?

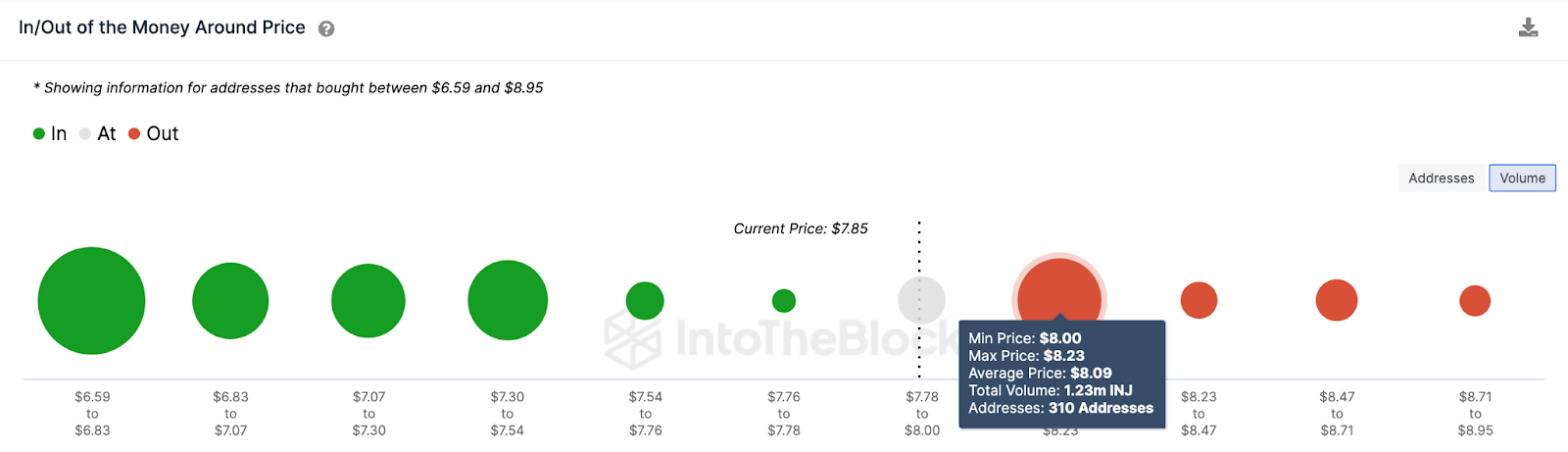

Given the aforementioned driving factors, the bulls have a fair chance of riding the bullish wave toward $10. But first, INJ will have to smash the sell wall around $8. At that zone, 310 investors that bought 1.23 million INJ tokens could sell and trigger a retracement.

But if the bullish momentum is strong enough, INJ could head toward a new 2-year peak of $10.

Still, INJ could fall below $7 again if the bears seize control. But for that to happen, they must first contend with the support line at $7.50. At that zone, 412 investors that purchased 1.09 million INJ coins at an average price of $7.41 could prevent the drop.

Nevertheless, if the buy wall is weakened, INJ could drop to $6.5.

beincrypto.com

beincrypto.com