To the surprise of many, Compound ($COMP) price has spiked by nearly 50% in the last 3 trading days. On-chain data flash multiple green signals, potentially indicating more gains ahead. Can the bulls push for the $50 target?

Compound is a decentralized finance (DeFi) protocol that allows crypto investors to lend or borrow selected cryptocurrencies. It algorithmically sets interest rates based on the real-time supply and demand of assets.

Since the US Fed announced a rate pause two weeks ago, crypto investors have increasingly allocated funds towards yield-bearing DeFi protocols to maximize capital efficiency. This week, it appears that $COMP has benefitted immensely from this trend.

Here’s an on-chain analysis of the main driving factors behind the ongoing $COMP price rally.

Investors are Racing Toward the Compound Ecosystem

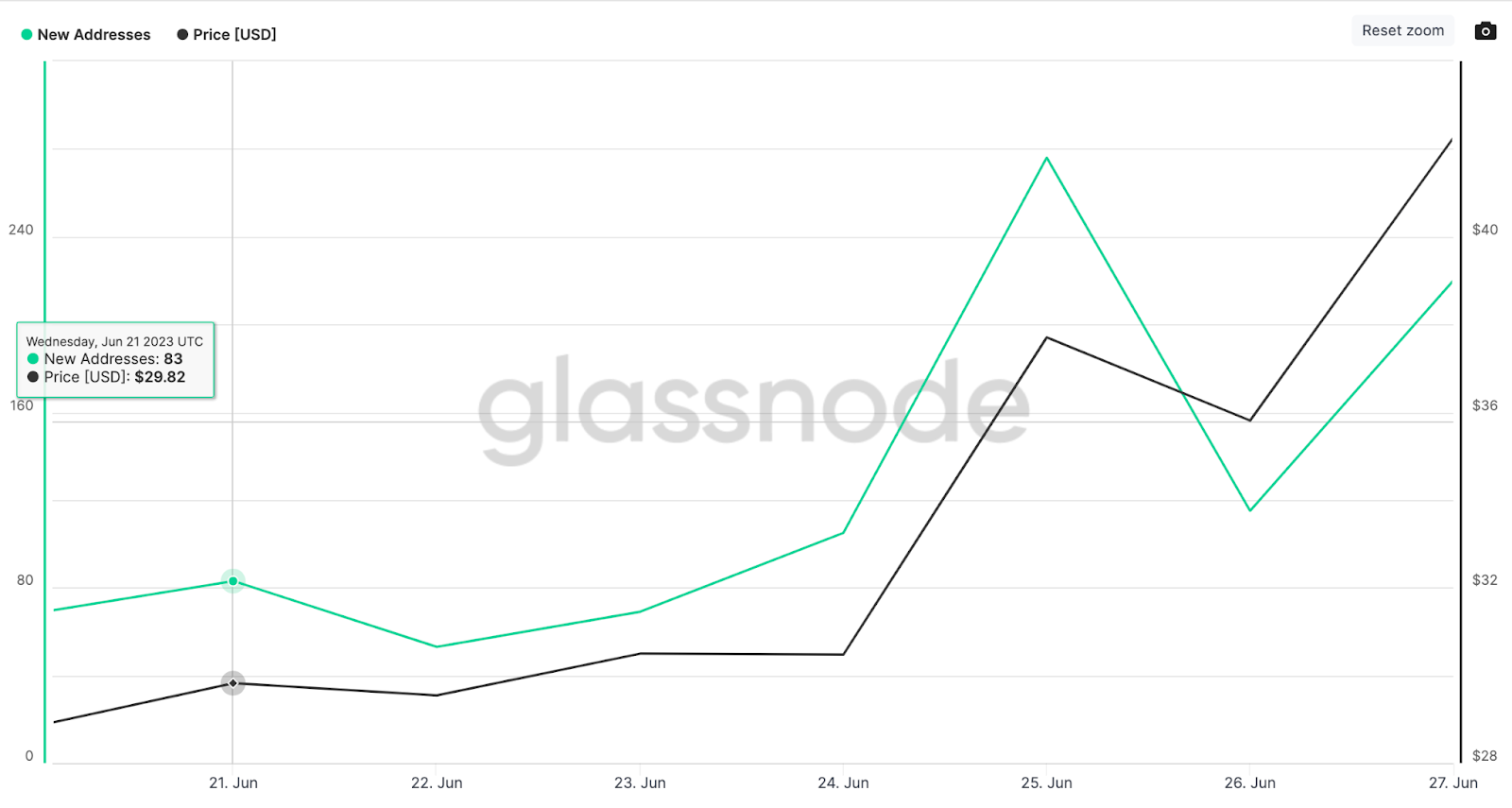

The positive upturn in the global crypto markets has seen investors begin to turn toward yield-bearing protocols like Compound. Within the past week, $COMP Network Growth has increased significantly.

On June 21, only 83 new wallet addresses were created on the Compound network. By the close of June 27, that figure has skyrocketed to 220. This represents a 165% increase in the new-user acquisition rate.

New Addresses measures the new-user acquisition rate by summing up the daily number of wallet addresses created on a blockchain network.

When it rises astronomically, it signals that the underlying token is attracting new demand. This often ultimately powers the price to new heights.

Notably, The Compound ecosystem registered 276 new users on June 25, its highest since January 2023. And as seen above, this has already contributed immensely to the $COMP 48% price surge.

If $COMP maintains a steady network growth of 200 daily new users, it will likely deliver more price gains in the coming weeks.

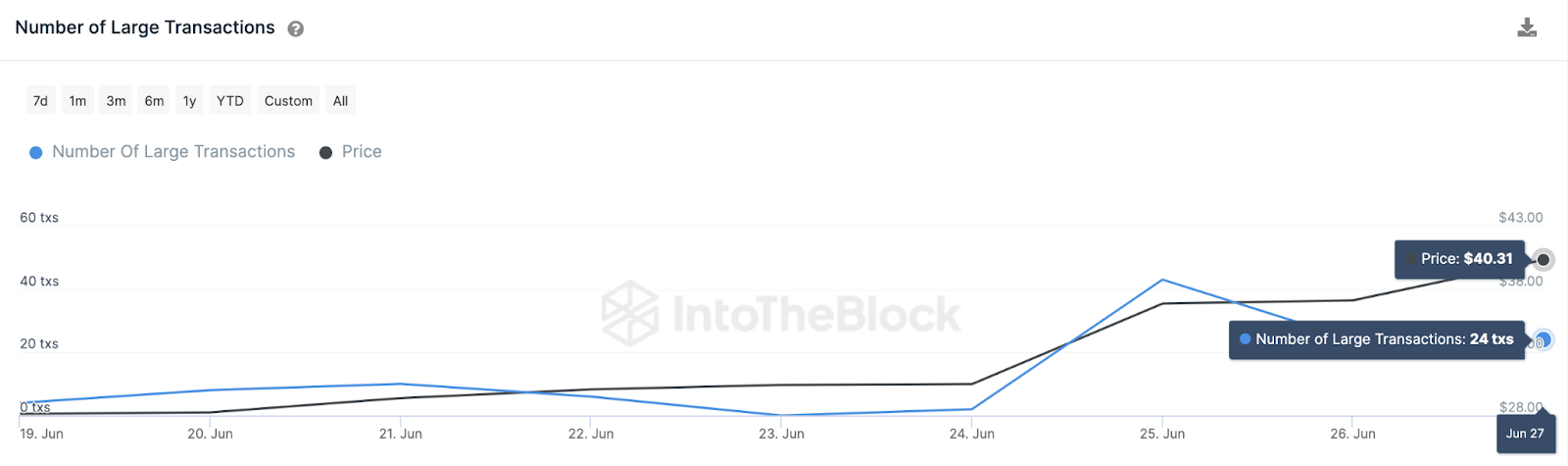

Whale Investors Are Turning Attention to Compound

The trading activity of large institutional investors appears to be another major driving factor that helped $COMP break above the $40 price resistance zone. Between June 20 and June 28, whale transactions involving $COMP skyrocketed by 300%.

The IntoTheBlock chart below shows how $COMP Large Transactions increased from 8 transactions to a 5-month high of 24 transactions between June 20 and the close of June 27.

Large Transactions tracks the trading activity of whale investors by aggregating the daily number of confirmed transactions that exceed $100,000. Due to their purchasing power, the price often trends upward when whales begin to increase their bets on a token.

Furthermore, the bullish stance among the whales could inspire retail investors to take long positions as well.

In summary, the rising Network Growth and bullish sentiment among institutional holders could see Compound deliver more price gains.

Read More: Best Crypto Sign-Up Bonuses in 2023

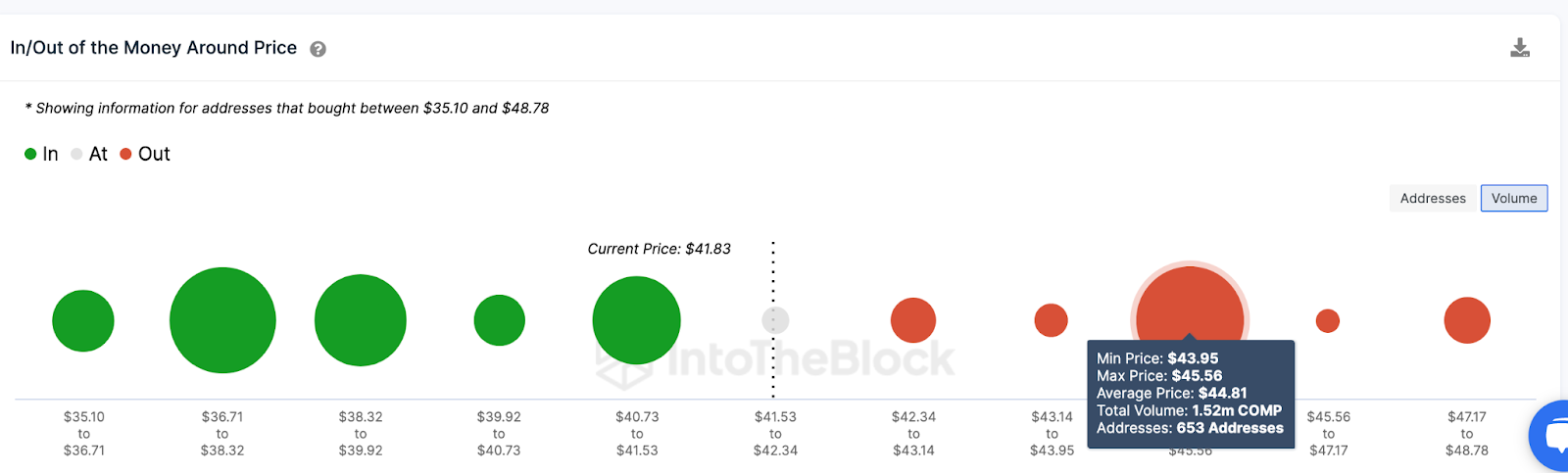

$COMP Price Prediction: $50 Could Be the Next Target

Given the ease at which they pushed aside the $40 resistance, the bulls can build momentum to rally toward $50. But first, they would have to smash the next significant resistance at $45.

At that zone, 653 investors that bought 1.52 million tokens at the rate of an average price of $44.81 could exit their positions.

If the bullish momentum is strong enough, this could form a major accumulation zone and consequently power $COMP above $50.

Still, the bears could stage a overturn of the bullish $COMP price prediction if the price slips below $38. But, as seen above, 2,940 investors that bought 1.44 million Compound tokens at an average price of $38.58 could offer significant support.

If that support level caves, then $COMP could retrace further toward $35.

beincrypto.com

beincrypto.com