Axie Infinity (AXS) price scored double-digit gains last week, and so did other prominent metaverse projects like TheSandbox (SAND) and Decentraland (MANA). What is behind the price rally?

Top metaverse tokens, like AXS, SAND, and MANA, struggled in Q1 as global interest in the metaverse dwindled. However, Apple’s recent launch of the mixed-reality Vision Pro headset has again redirected the media spotlight toward the GameFi and Metaverse sectors.

Likewise, Meta (Facebook) CEO Mark Zuckerberg stating the company’s intention to double down on the sector appears to have inspired investor confidence in the future of the metaverse.

How could this recent improvement in market sentiment impact AXS price action going forward?

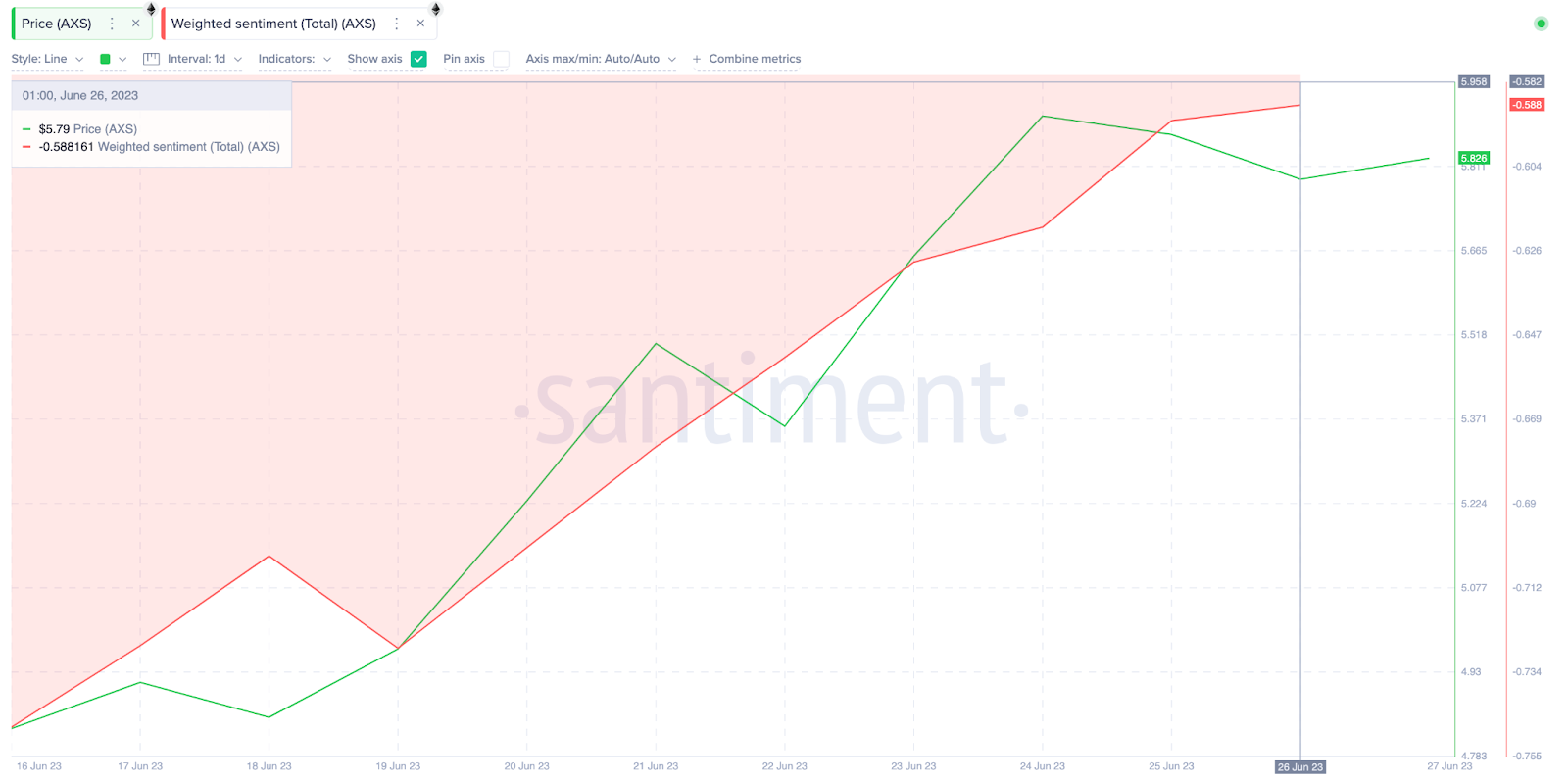

Axie Infinity’s Social Sentiment Has Experienced an Uptrend

Over the past week, the social sentiment surrounding AXS has improved considerably. According to Santiment‘s Weighted Sentiment data, AXS closed June 26 -0.5 points away from the neutral zone.

This is a 40% improvement from the figures recorded on June 9, a few days after the SEC listed AXS among tokens labeled as a security.

Weighted Sentiment analyses the general market sentiment surrounding a project by comparing the volume of its positive and negative mentions. There has been a growing trend of positive opinions surrounding AXS across relevant crypto-media platforms.

Despite the recent 18% price pump, Axie Infinity’s Weighted Sentiment is still in the negative zone. This implies that AXS has more room for growth, as the rally is still relatively unnoticed by a significant number of investors.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits

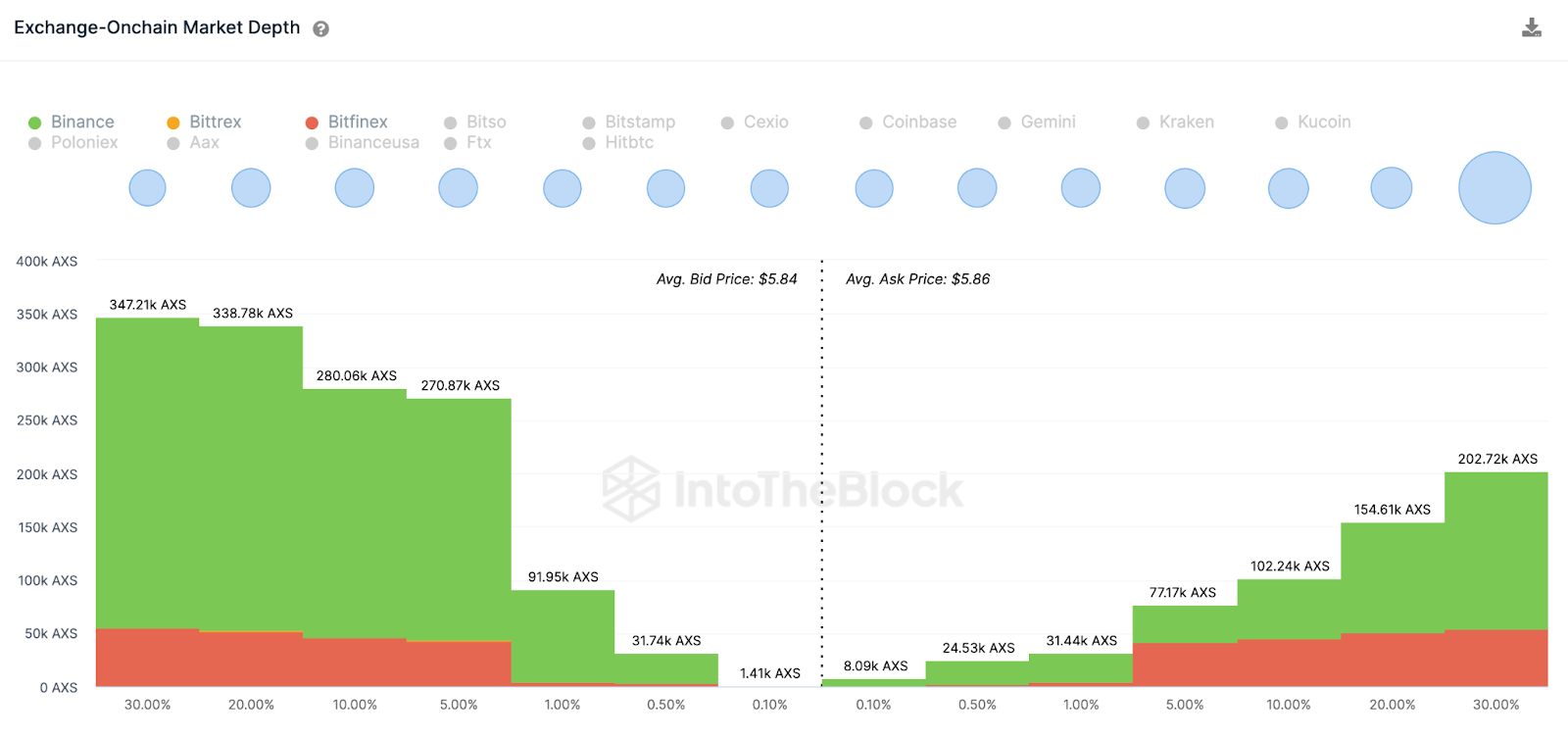

Investors are Queuing Up Orders to Buy AXS

Furthermore, the growing demand for AXS across exchanges is another crucial indicator that confirms this bullish stance. IntoTheBlock’s Exchange On-Chain Market Depth chart summarizes the total buy/sell orders for a token across top crypto exchanges.

Potential investors have placed active orders to purchase 1.4 million AXS tokens. But holders have only put up 600,000 AXS for sale.

This shows that the demand for AXS is more than double the supply available on exchanges at present. With a supply shortage of 761,000 AXS tokens, it’s only a matter of time before buyers start to bump the price to have their orders filled.

AXS Price Prediction: Is $7 a Viable Target?

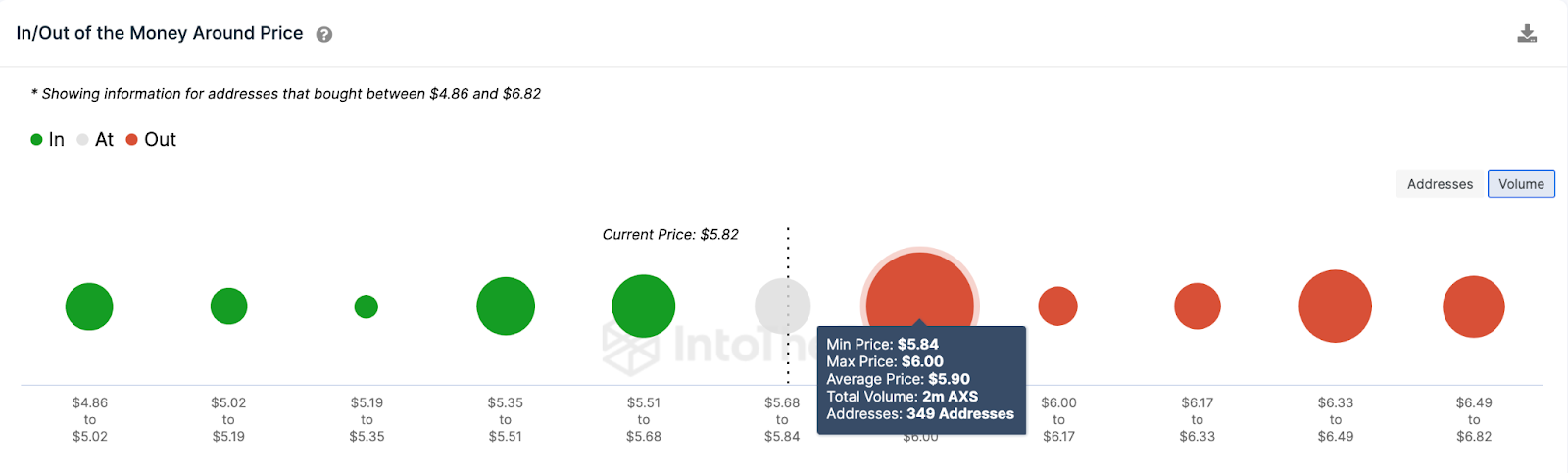

Considering the uptrend in market sentiment and the towering buy wall, the AXS price rally will likely garner enough momentum to rally toward $6.50.

However, AXS must first clear the major resistance at $6 for the bulls to gain control. At that zone, 349 investors that purchased 2 million AXS tokens at an average price of $5.90 could slow the rally.

If the bullish momentum is strong enough, AXS can make an attempt to reclaim the $7 milestone.

Yet, the bears could invalidate the bullish price prediction if AXS falls below the $5.50 support level. Although, 121 investors that bought 433,780 tokens at the minimum price of $5.51 could prevent the drop.

But if that support level caves, AXS could unexpectedly fall to a 2023 low of $4.

beincrypto.com

beincrypto.com