The crypto market has seen a shift in the winds, as the total market capitalization of stablecoins experienced a decrease of 0.57% to $128 billion in June, the lowest it’s been since September 2021, according to the latest Stablecoins & CBDCs report by CCData.

The figures mark the fifteenth consecutive month of decline in the stablecoin market. Amidst the downward trend, however, the market dominance of stablecoins rose to 11.8%, in a decrease from its all-time high of 16.6% in December 2022, but an increase from 11.0% in May, showing the fluctuating nature of the market.

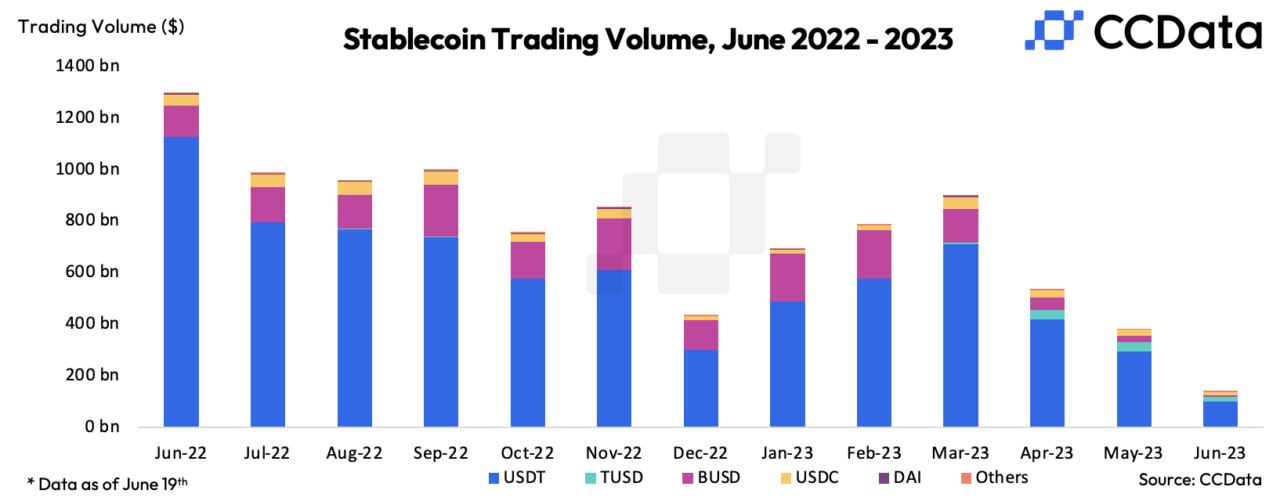

Last month, according to the report, the trading volume of stablecoins fell 10% to $414 billion, the lowest level in nearly six months, when major cryptocurrencies remained range-bound and volatility in the space was relatively low.

The leading stablecoin, Tether (USDT), saw its trading volume fall by a significant 29.9% to $293 billion in May. This is the lowest trading volume for the stablecoin since January 2020, and marks the second consecutive month of decline in USDT trading volume.

The market cap of USDT had a slight increase of 0.03% to $83.2 billion in June, after momentarily reaching an all-time high of $83.3 billion. The market share of USDT in the stablecoin sector also increased slightly to 64.6% in June from 64.3% in May.

Stablecoins experienced a brief moment of instability on June 15 when USDT momentarily deviated from its peg, falling as low as $0.9878, after an imbalance occurred in the Curve 3pool. The disruption was caused by a substantial selling of the asset, which resulted in Tether’s weightage in the pool rising above 70%, outweighing other stablecoins like USDC and DAI.

Meanwhile, the market share of fiat trading pairs fell to 18.8% in June after the trading volume of fiat pairs plunged 33.9% to $99.7 billion. Fiat trading pairs have been witnessing a downward trend due to issues faced by exchanges with their banking partners.

cryptoglobe.com

cryptoglobe.com