Axie Infinity’s (AXS) price slid to a three-year low amid the ongoing legal battle against US SEC. In addition to the price decline, on-chain data shows players are increasingly abandoning the GameFi protocol. Can AXS recover from the ongoing bearish trend?

Behind TheSanbox (SAND) and Decentraland (MANA), Axie Infinity (AXS) has now slid to third in the global GameFi rankings by market capitalization. The recent price correction was triggered after the US Securities and Exchange Commission listed AXS among the cryptocurrencies identified as securities.

What are the chances of an AXS price recovery amid the overwhelmingly negative sentiment?

Active Gamers are Abandoning Axie Infinity

Axie Infinity native token AXS derives most of its utility and traction from gamers who use it to pay for in-game assets and exclusive access to critical ecosystem perks and features.

As the SEC-induced market FUD spread across the Axie Infinity ecosystem, active players have also begun to abandon the GameFi protocol.

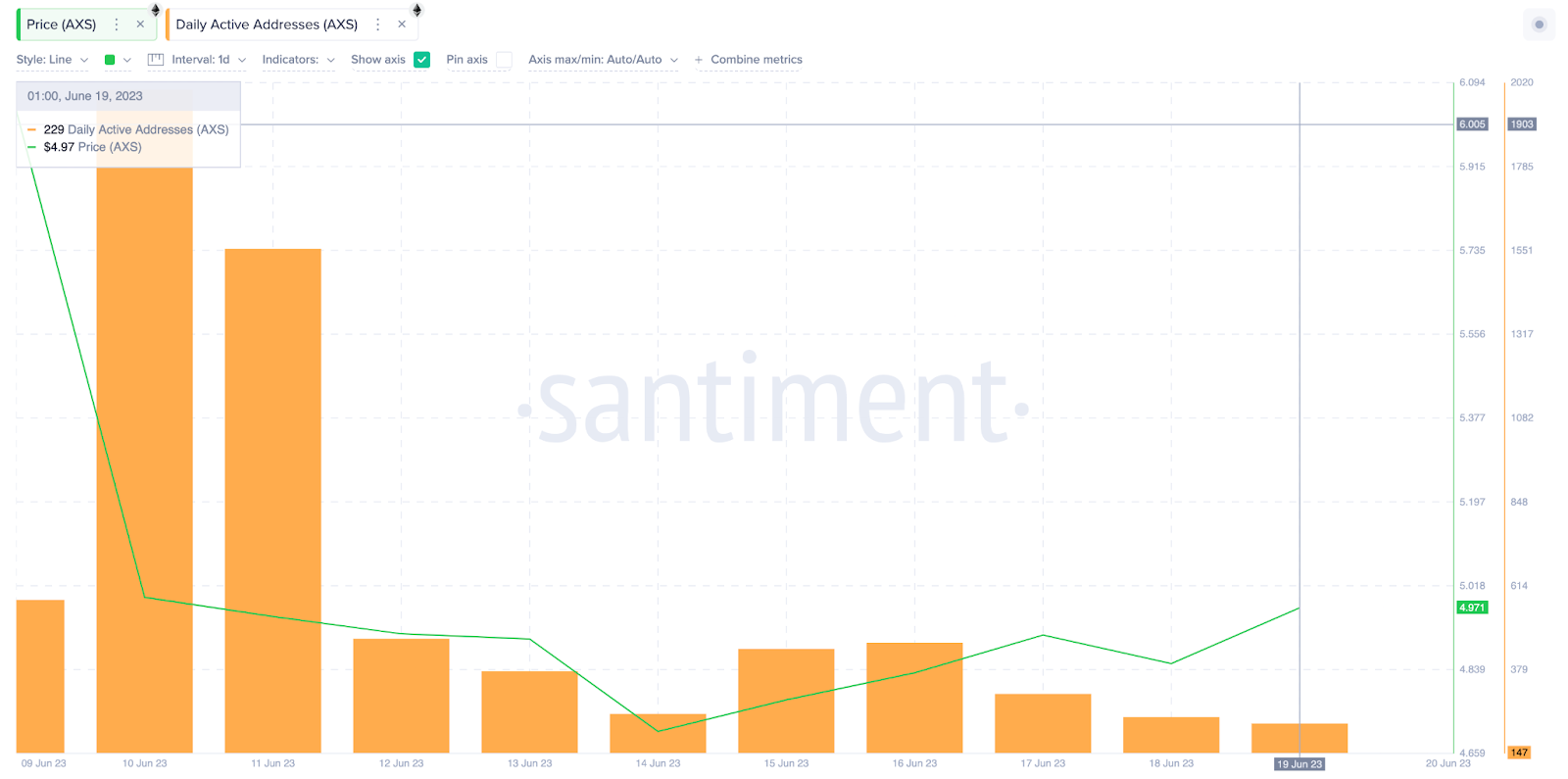

On June 10, AXS attracted 2,000 active addresses. However, at the close of June 19, that figure has dwindled by a whopping 89% to 229 active wallet addresses.

The Daily Active Addresses (DAA) metric measures the underlying demand for a blockchain network’s core service by summing up the number of unique wallet addresses interacting daily.

The chart above shows that Axie Infinity is losing network traction faster than AXS’s price is declining. When this happens, it signals that the underlying token may experience some tough times ahead.

More From BeInCrypto: Crypto signals: What Are They and How to Use Them

Whale Investors Have Lost Confidence in AXS

Furthermore, large institutional investors appear to have lost confidence in the AXS price prospects amid the current market sentiment.

IntoTheBlock’s chart below shows that AXS has recorded only 2 large transactions in the last 6 trading days combined. And, remarkably, zero in the last two trading days.

The Large Transactions metric tracks the number of confirmed transactions that exceed $100,000 in value. The chart above indicates that institutional investors are increasingly avoiding Axie Infinity.

If the whales continue to keep their trading activity at a minimum, AXS will likely drop below $4 in the coming weeks.

Read More: Top 11 Crypto Communities To Join in 2023

AXS Price Prediction: Bearish Reversal Toward $4

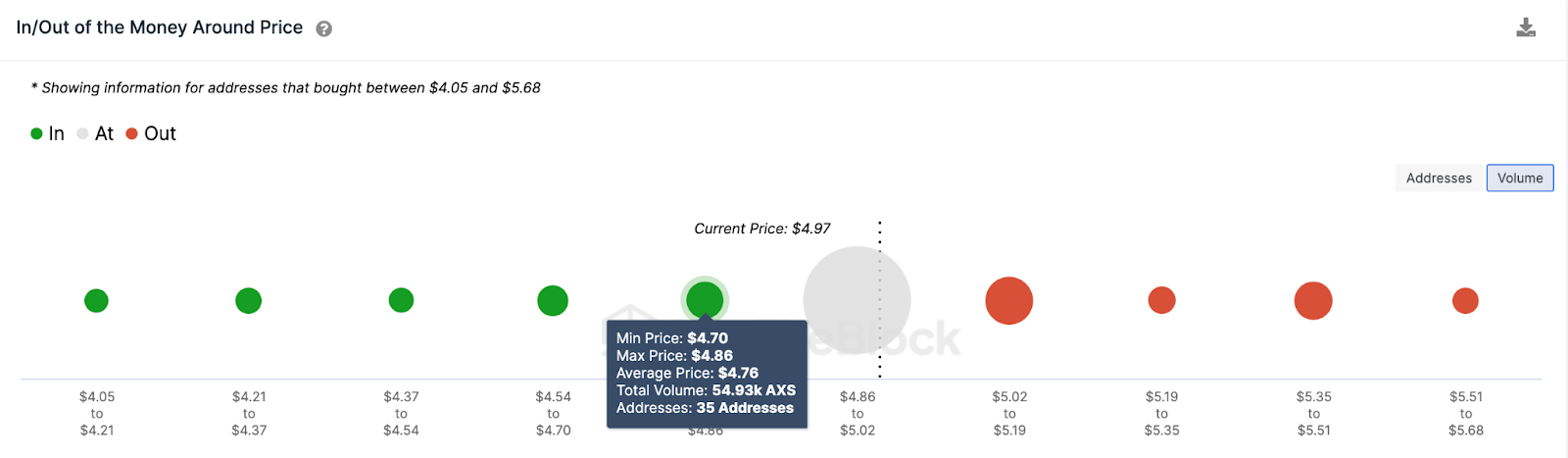

According to IntoTheBlock’s IOMAP distribution data, UNI price will likely enter a bearish downswing toward $3.75. But currently, the 35 investors that bought 55,000 AXS tokens at a minimum price of $4.70 are expected to offer considerable support.

Nevertheless, if that support folds, as expected, then the Axie Infinity price will likely decline toward $4.05.

Still, the AXS bulls can negate this bearish narrative if it rises above $5 against the run of play. But as seen above, the 1,020 addresses holding 2 million AXS tokens at the maximum price of $5.02 could pose significant resistance.

And if that resistance level caves, the price could finally reclaim the $6 milestone.

beincrypto.com

beincrypto.com