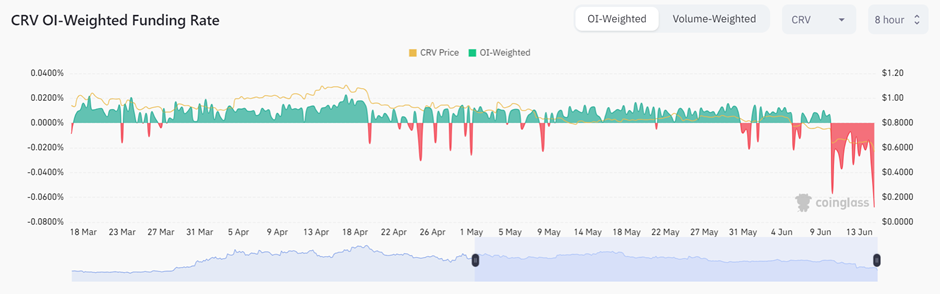

According to a recent analysis, the Curve DAO token $CRV’s funding rate has fallen to a new yearly low, with a rate of -0.0733% over the past 8 hours. Over the past 24 hours, the token has fallen by more than 10%.

Following the imbalance in the Curve ecosystem, there has been a large exchange of $USDT for DAI and $USDC, resulting in the 0.25% discount in $USDT’s price. At press time, $USDT is trading at a price of $0.998, down 0.26%, while $CRV is at $0.5683, down 12.17%.

A prominent Chinese reporter Collin Wu, shared a series of threads on Twitter via his official page Wu Blockchain, throwing insights into the possible reasons for $CRV’s yearly low.

The main reason for this may be due to a bet on the liquidation of the position held by Curve founder michwill (0x7a…5428) by short sellers. This address holds 430 million $CRV tokens (about 50% of the circulating supply) as collateral for lending protocols.…

— Wu Blockchain (@WuBlockchain) June 15, 2023

Reportedly, a few days before, the Curve Finance founder Michael Egorov deposited $24 million worth of $CRV tokens, accounting for 34% of the total supply. The massive deposit to the decentralized protocol Aave was an attempt to mitigate a liquidation risk of a $65 million stablecoin loan. According to the crypto sleuth, Lookonchain, Egorov deposited 291 million $CRV and borrowed $65 million $USDT and $USDC.

Today, Wu asserted that $CRV’s decline in the funding rate could be attributed to the Curve founder michwill’s bet:

The main reason for this may be due to a bet on the liquidation of the position held by Curve founder michwill (0x7a…5428) by short sellers. This address holds 430 million $CRV tokens (about 50% of the circulating supply) as collateral for lending protocols.

The reporter has incorporated the michwill’s wallet address, highlighting that the address holds more than 400 million $CRV tokens, equivalent to a total amount of $2,342,134.

coinedition.com

coinedition.com