Good morning.

Here’s what’s happening:

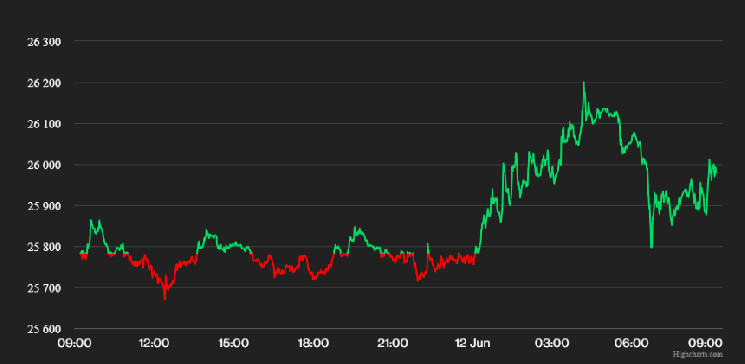

Prices: Amid regulatory challenges and liquidity issues, the crypto market, especially Bitcoin and Ether, remains resilient.

Insights: Why can't crypto exchanges have more simple corporate structures?

Prices: Buying Pressure is Keeping Bitcoin From Dipping More

What a week it was.

U.S. regulators are on a warpath, going after major crypto exchanges and declaring a handful of major altcoins securities – a scarlet letter in crypto terms.

But crypto is proving resilient.

Bitcoin is opening the Asia trading week up 0.4% to $25,912, while ether is slightly down to $1,748.

“The liquidity situation has worsened considerably. This is exacerbated by the departure of institutional investors from the market, particularly US-based market makers, who anticipate potential scrutiny from the SEC,” said Johnny Teng, Senior Researcher at LBank Labs, in a note to CoinDesk. “While the S&P 500 continues to achieve new monthly highs, the crypto market remains troublesome.”

Teng says that bitcoin's performance remains robust amidst minimal selling interest in bitcoin and ether, with notable factors such as interest rates, stablecoin outflow trends, policy-related news in the US, China, and Europe, and cryptocurrency sector developments under close observation by his team to see what finally moves the needle.

In a note to CoinDesk, BitBull Capital’s Joe DiPasquale pointed to bitcoin’s support at $25K as still holding up “reasonably well”, but the upcoming release of new Federal Open Market Committee (FOMC) minutes could change that.

“Moving forward, market participants will do well to keep an eye on indications from regulators and decisions taken by Binance, Coinbase, and other exchanges,” he said.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Polygon | MATIC | +3.4% | Smart Contract Platform | Cosmos | ATOM | +2.4% | Smart Contract Platform | XRP | XRP | +2.2% | Currency |

InsightsA Plea for a More Simplistic Corporate Structure

In the early days of FTX’s bankruptcy proceedings, its restructuring team published a chart of its corporate structure.

Sam Bankman-Fried’s former empire had 300 employees but controlled 130 companies when it filed for bankruptcy in November 2022.

All companies have subsidiaries, but companies that have this many subsidiaries are infinitely more complex operations. General Motors, a multinational with dozens of international partnerships and multiple product lines, has 455 subsidiaries for its $156.73 billion in revenue and 167,000 employees.

To be sure, some of FTX’s subsidiaries had a bonafide purpose. It needed to separate its licensed derivative business out from the corporate mothership; some of the major markets it operated in, like Japan, had separate entities because of the nuances of the market.

Others have pointed to Bankman-Fried’s father, Joseph Bankman, as the architect of the FTX leviathan, given that he’s a professor specializing in taxation at Stanford Law.

These days FTX is relatively out of the spotlight as Bankman-Fried’s trial is months away. Now, it’s Binance that’s under the gun as its faces dual cases from the CFTC and SEC.

SEC Chair Gary Gensler told Bloomberg in an interview that there are parallels between FTX and Binance. Both are being accused of comingling, for start.

But deeper than that are the similarities between Binance and FTX’s corporate structures.

As part of recent legal actions against Binance, the SEC listed out the dozens of corporate entities controlled by Changpeng ‘CZ’ Zhao in a recent court filing. Inca Digital, a crypto forensics company, recently published a more comprehensive list which shows the web of firms connected to CZ and top Binance associates.

Certainly, there are legitimate uses for such a long list of companies. But the parallels between FTX and Binance that SEC Chair Gensler alluded to continue with their corporate structures.

CZ, for instance, often uses his personal name and personal accounts in Binance company operations, noted Inca Digital. The SEC also noted this in its complaint against Zhao (though Binance has denied any wrongdoing) as part of its accusations of comingling.

Consider this a plea for a more simplistic corporate structure for crypto companies.

FTX’s restructuring team is charging tens of millions of dollars a month as they spend countless manhours picking apart its corporate web. Binance’s claims that CZ did nothing wrong would be more easily believed should its transactions look more straightforward to a trained eye: if Binance didn’t rely so much on companies controlled by CZ, then it wouldn’t look like comingling to the SEC’s accountants.

For the record, Coinbase has 15 subsidiaries, according to a Feb. 2023 filing with the SEC. So it is possible to be a large crypto exchange and have a corporate structure that would fit on an A4 piece of paper.

Important events.

2 p.m. HKT/SGT(6 a.m. UTC): Japan machine tool orders (May/YoY)

3 p.m. HKT/SGT(7 a.m. UTC): China M2 money supply/loans (May)

coindesk.com

coindesk.com