According to a recent analysis by Blofin, the volume of in-house spot trading in May has reached a new low compared to December 2020. This decline in trading activity can be attributed to the increasing influence of artificial intelligence (AI) in the financial markets.

In June, the crypto market experienced a severe lack of liquidity due to ongoing liquidity pressure, shifting market narratives, and decreasing uncertainty levels. Investors’ preference for alternative strategies, such as selling volatility, further contributed to low market volatility.

The article suggests that although the uncertainty surrounding the June rate hike may introduce some liquidity, the crypto market will continue to face a shortage until the interest rate hike cycle concludes.

The stagnant trading volume has resulted in persistently low realized volatility for mainstream crypto assets. Despite some deviations from the usual patterns, the current market performance aligns with the close relationship between the crypto market and the macroeconomy.

Furthermore, the rise of AI has led speculative liquidity to favor US stocks over the crypto market. While BTC’s macro fundamentals remain stagnant, investing in stocks like NVDA can provide immediate gains upon financial report releases.

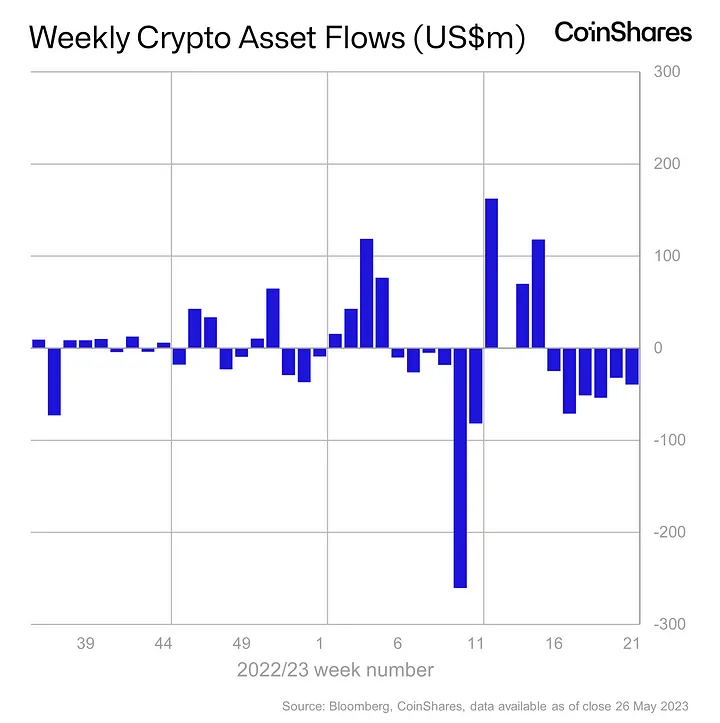

Meanwhile, Bitcoin’s volatility has decreased, resulting in a 5% drop in May. Rational liquidity providers, including institutions and high-net-worth investors, are reducing their positions in the crypto market due to difficulties in achieving excess returns. This has led to consecutive weeks of outflows and a decline in crypto fund managers’ assets under management.

The analysis highlights that as the crypto market currently experiences a liquidity shortage, investors seek opportunities in other markets. Selling volatility has become a significant income source for crypto investors, leading to a cycle of volatility suppression.

Additionally, the increase in option sellers have driven down bid prices and implied volatility. Option market makers have transitioned to relative volatility buyers, impacting market volatility. The duration of the liquidity shortage is uncertain, and macro events provide limited relief. Investors’ trading enthusiasm has decreased, and liquidity challenges are expected to persist until the end of the interest rate hike cycle.

coinedition.com

coinedition.com