Injective (INJ) price has gained 13% in the last 24 hours. After booking some profits at the start of May, long-term investors are again taking bullish positions on INJ price. What is the most likely INJ price prediction for the coming weeks?

On Friday, May 26, Injective completed its most recent token burn exercise. The weekly-scheduled deflationary event saw another 5,689,124.96 INJ tokens destroyed.

Furthermore, the token burn coincided with the crypto market bounce prompted by positive sentiment surrounding the US debt ceiling crisis. By Monday morning, the INJ price had already gained 13% to emerge as the top performer in the crypto top 100 rankings.

Here’s a>Long-Term Investors Are Back in the Driver’s Seat

The 13% price gain over the weekend in can be attributed to the renewed bullish trading activity among the long-term investors on the Injective network.

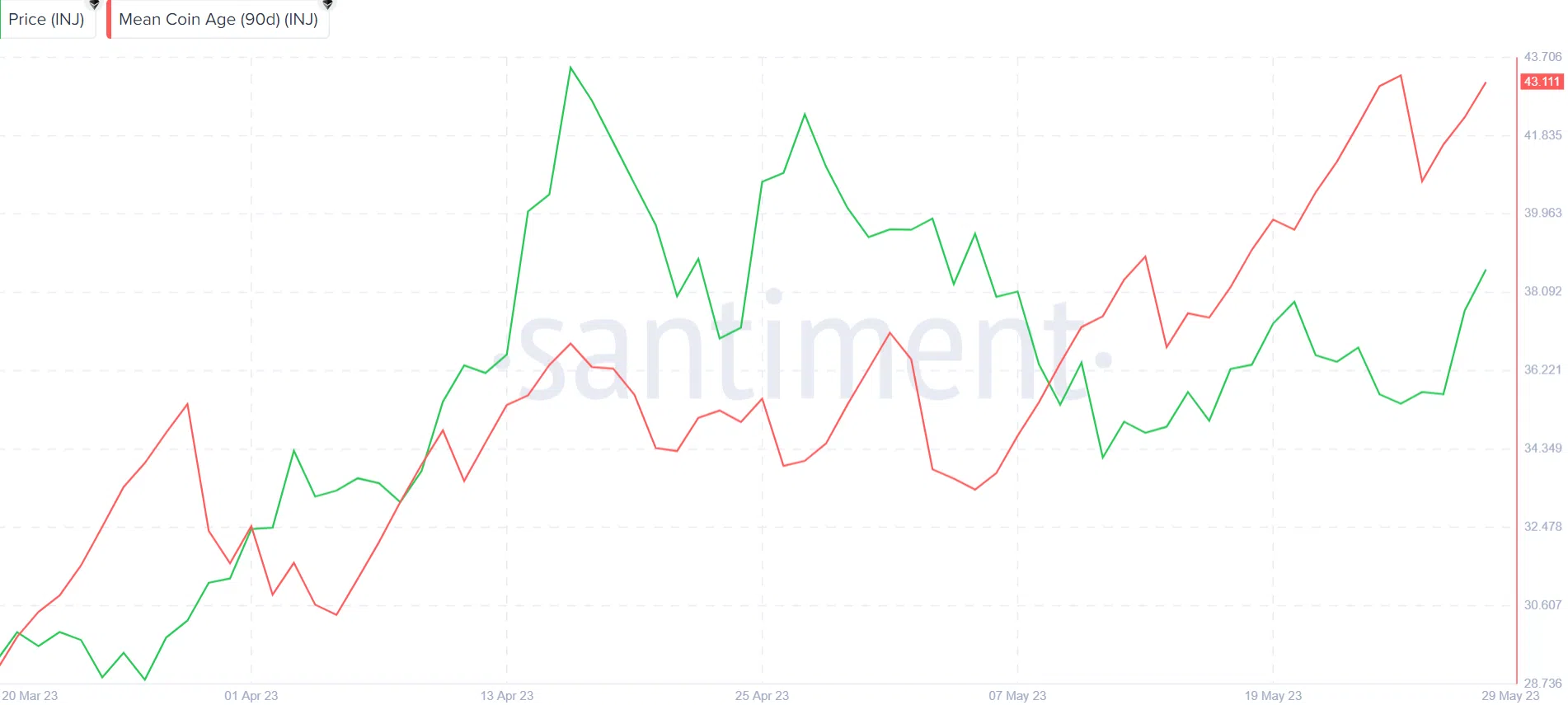

INJ Mean Coin Age declined 10% in the first week of May from 37.13 to 33.38 between May 1 and May 5. But notably, it has rebounded 30% to 43.17 as of May 29.

In simple terms, Mean Coin Age evaluates how long coins in circulation have stayed in their previous wallet addresses.

When Mean Coin Age rises considerably, it indicates a network-wide accumulation. As seen above, INJ long-term holders investors appear to be showing renewed confidence in the long-term price prospects and viability of the Injective ecosystem.

If the trend continues, it could spread bullish momentum across the Injective network.

Injective Price Could Go One Leg Up Before Correction

The general sentiment within the INJ community is trending upward, but on-chain data shows that it is still in the negative zone. This indicates that its placement on the list of top crypto gainers is not yet priced in.

Indicatively, after dropping deeper into the negative zone on May 26, INJ Weighted Sentiment has recently rebounded toward the neutral area, sitting at -0.04 as of May 29.

Santiment’s Weighted Sentiment metric compares the ratio of positive mentions of an asset to the negatives. When it trends below zero during a price surge, it indicates that the asset is still flying under the radar of a significant number of investors.

By the time its top gainer status kicks in, other stakeholders will also take notice and turn bullish. This could potentially send INJ’s price on leg higher in the coming days.

INJ Price Prediction: Bulls are Making Headway to $8.55

Considering the bullish activity among long-term Injective investors, INJ might rise above $8 in the coming days.

However, IntoTheBlock’s In/Out of The Money Around Price (IOMAP) data suggests that INJ will face its initial major resistance of around $7.90.

As seen below, 343 investors that bought 5.06 million INJ at an average price of $7.86 could mount a sell-wall. However, if the bullish momentum prevails, as expected, the price could increase further toward $8.50.

Additionally, the bears could invalidate the bullish Injective price prediction if INJ unexpectedly drops below the critical $7.0 support zone.

But, the 285 investors that purchased 4.7 million INJ at an average price of $6.95 will likely prevent that. Although unlikely, INJ could retrace further toward $6.4 if that support level is breached.

beincrypto.com

beincrypto.com