A popular crypto strategist warns that altcoins could be on the verge of a big move to the downside as he updates his outlook on Pepe (PEPE) and Avalanche (AVAX).

Pseudonymous analyst Altcoin Sherpa tells his 195,100 Twitter followers that altcoins could drop as much as 50% from their current prices.

However, he says that there are likely going to be bounces on their way down as they cross key support levels.

“It’s possible that altcoins have another 30%-50% downside to go from here in the long term. If that happens, there are going to be bounces in between.

To be honest, prices are currently at support levels, so expecting bounces across the board around here.”

According to the trader, the memecoin Pepe may soon bounce after collapsing about 67% from its all-time high.

Altcoin Sherpa says that a confluence of technical indicators including the Fibonacci retracement levels and the volume profile visible range (VPVR) suggests that the memecoin could witness a short-term rally.

Traders keep a close watch on the VPVR as it shows price areas where market participants actively traded an asset.

Says Altcoin Sherpa,

“PEPE: I think this is a support area; expecting price to bounce. Fib (Fibonacci) level + higher volume area on VPVR, S/R (support/resistance) level. Not sure how high it goes but let’s see. I still have a PEPE position.”

Pepe is worth $0.00000156 at time of writing, up 11.7% during the past 24 hours.

The trader also looks at Ethereum (ETH) rival Avalanche, which he notes has been trading in a wide range between $13 and $21 for most of 2023. According to Altcoin Sherpa, AVAX could bounce once it hits the lower boundary of the range.

“AVAX: Help is on the way soon in the mid $13s.”

Avalanche is worth $15.14 at time of writing, up 1.2% during the past 24 hours.

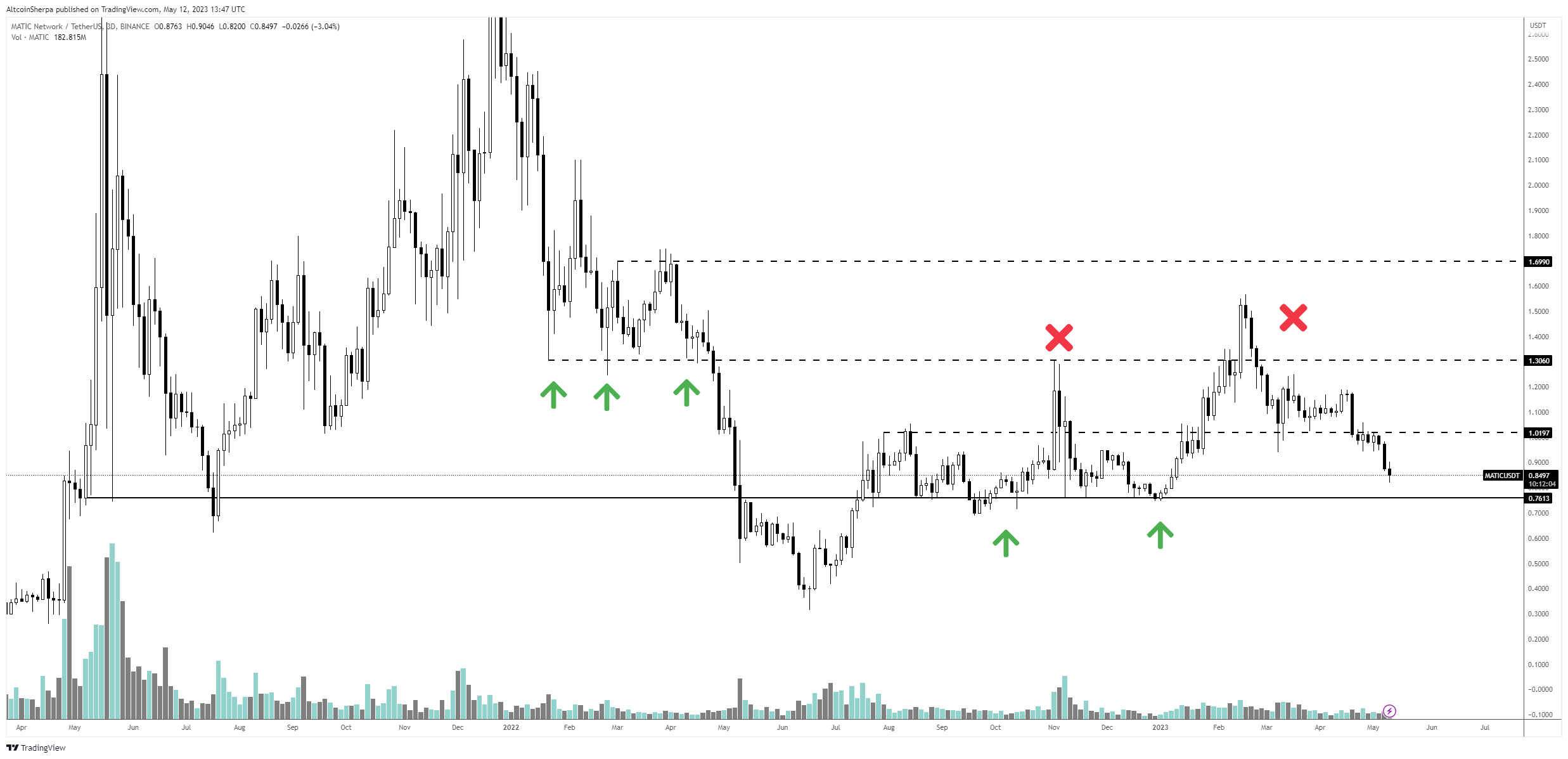

Another crypto on Altcoin Sherpa’s radar is the layer-2 scaling solution Polygon (MATIC), which he says could find support at the $0.75 price level.

“MATIC: I think it bounces soon but still undecided if it’s going to bottom around $0.75.”

MATIC is trading for $0.86 at time of writing, up 3% during the past 24 hours.

Lastly, the trader says Injective Protocol (INJ), a decentralized derivatives exchange, could see a short-lived bounce in the near term. However, he warns that INJ is still in a downtrend and could drop below $4.

“INJ: this one has done great in the past but I think it still goes sub $4 in the long term. I still am expecting some bounce right around here and the .618 fib (fibonacci) though. Probably a good spot to long around here – S/R (support/resistance) level, fib, etc.”

At time of writing, Injective is trading for $6.07, up 4.9% during the past 24 hours.

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com