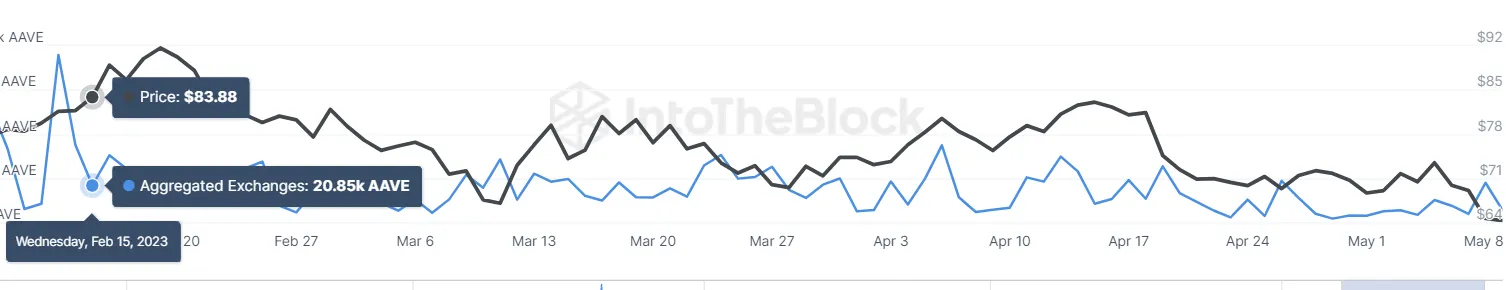

- 1 $AAVE outflow volume has been observing a decline over the past three months.

- 2 Daily loan originations of $USDT on $AAVE have observed a strong surge. $AAVE has seen a drop of 0.89% in the intraday session

$AAVE is a defi platform that runs on the Ethereum blockchain. It allows users to earn interest on their crypto holdings and borrow and lend crypto. The platform uses smart contracts to facilitate borrowing and lending. $AAVE v2 TVL on Ethereum has seen a decline from a high of $11 Billion to $2.95 in the last year. The protocol has a liquidity of $7647330468 which can observe a rise in the future. The Daily loan origination of $USDT on $AAVE has surged to $51.83 Million which is more as compared to other tokens. The highest APY on $AAVE is BAL which is 6.52% and 3.03% on USDC. The outflow volume of $AAVE has reached to 6.87k which has observed a decline from a high of 43.4K.

The daily active address of the $AAVE is also on the decline which can affect the price in the long term. Meanwhile, $AAVE V3 was recently launched on the Ethereum layer 2 metis network. $AAVE has a market cap of $918 Million with a slight decline in volume. The V/M ratio of $AAVE hints towards a downside trend in price.

Will $AAVE Hit $50 Before A Rebound?

The weekly technical chart of the $AAVE suggests a consolidated trend in price. $AAVE correlation with Ethereum is currently near 0.81 but can observe a rise in the future. $AAVE is currently trading near the value of $64 with a slight decline in the intraday session. The upside trend of the asset price can see a halt near the value of $80.Meanwhile, the support of the asset price can observe a bounceback from $50.

$AAVE is trading in a downside trend but can see a bounce back soon. It is trading below the 50 and 100 Daily Moving Averages. There can be a negative crossover in the future which can push the price to a new low.

The RSI of the asset price is near 35 suggesting its presence in the overbought zone. There is a downside slope in it hinting towards a bearish momentum.

Summary

$AAVE has been seeing a decline in active address and outflow volume which can push the price down. $AAVE is trading in a bearish trend but can see a bounce back soon.

Technical Levels

Major Support:$50

Major Resistance:$80

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only, and they do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

thecoinrepublic.com

thecoinrepublic.com