The Near Protocol ($NEAR) price has fallen since clearing a long-term resistance level at the beginning of April. The decrease casts doubt on the validity of the breakout.

However, the short-term price action suggests that the price is mired in a correction, after which the preceding upward movement will resume.

Near Protocol Price Fails to Sustain Breakout

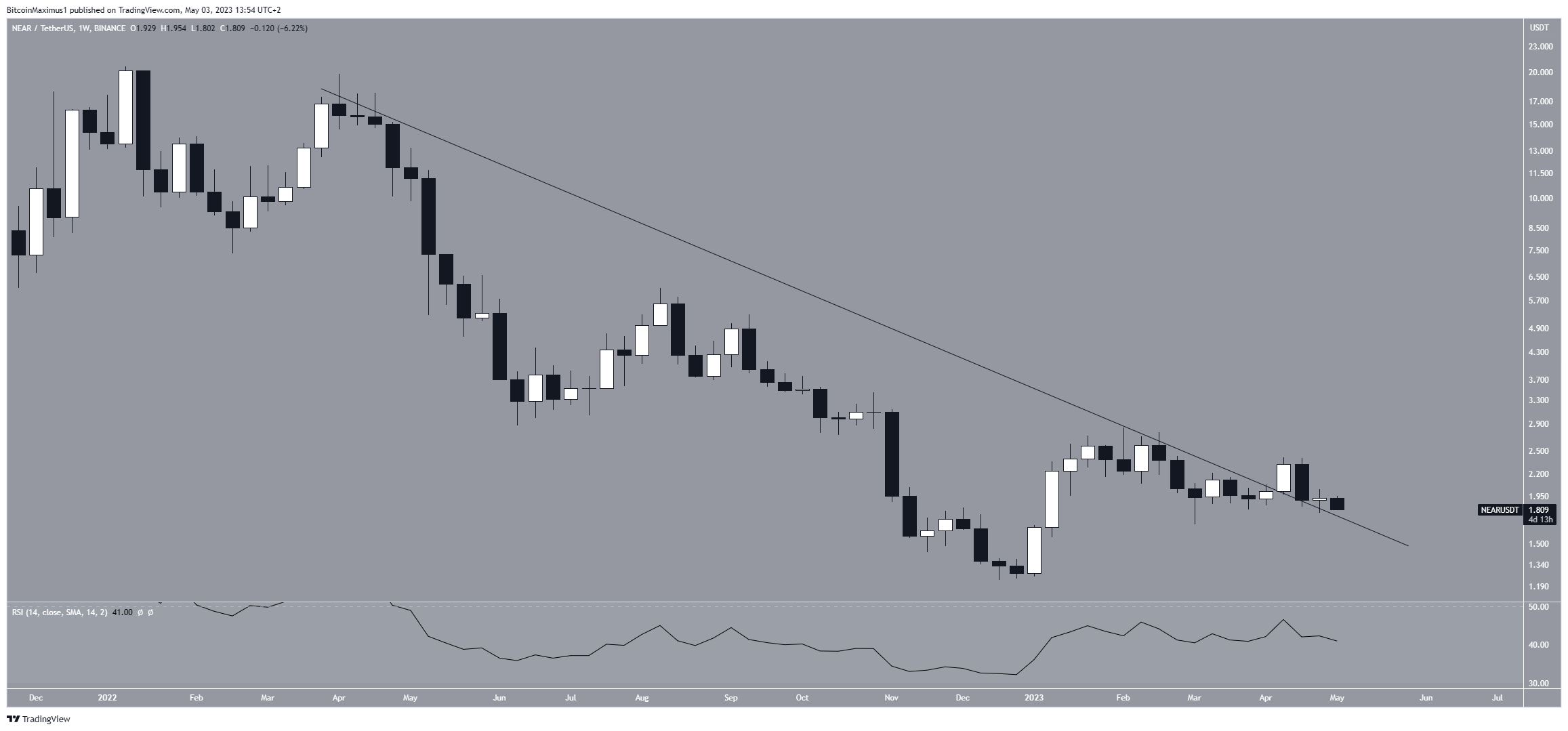

The $NEAR price has fallen under a long-term descending resistance line since May 2022. The price broke out above this line during the week of April 10 to 17.

However, it failed to sustain the upward movement and has fallen below the breakout level since. However, the price still trades above the descending resistance line, allowing for the possibility that the current decrease is just a retest.

The RSI gives a neutral reading. By using the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls have an advantage, but if the reading is below 50, the opposite is true.

The weekly RSI is below 50 but increasing, hence providing an undetermined trend.

$NEAR Price Prediction: Wave Count Supports More Downside

The technical analysis from the daily time frame supports the continuing decrease. This is because of both the wave count and RSI readings.

Technical analysts employ the Elliott Wave theory as a means to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

The wave count suggests that the price is in the Y wave of a W-X-Y complex correction. If so, it will likely reach a bottom near the $1.55 horizontal support area.

Depending on when the price reaches it, this could either be slightly below or right at the long-term descending resistance line.

The RSI also supports the decrease. The current reading below 50 (red icon) alongside a downward trend supports the fact that the trend is bearish. Therefore, it reinforces the bearish wave count.

Despite this bearish $NEAR price forecast, a movement above the X wave high (red line) at $2.41 will mean the trend is bullish.

In that case, an increase to the resistance at an average price of $2.75 and possibly higher will be the most likely scenario.

beincrypto.com

beincrypto.com