Stablecoins played a significant part in crypto's explosive decade of growth. First developed and launched in 2014, the asset class was meant to bring much-needed stability to the volatile field of cryptocurrencies and create a safe haven for crypto holders and traders.

Over the past few years, the benefits of stablecoins have become apparent, powering diverse use cases. Stablecoins have become almost a life-saver for digital nomads, who could receive real-time payments in their preferred currency at any time. They have also been widely used to provide humanitarian aid during times of crisis, like during the war in Ukraine.

Currently, stablecoins account for 15% of the crypto market, with USDT (issued by Tether) and USDC (issued by Circle) having the lion’s share. How strong are these leading tokens in the current market — and what are the specifics of the space?

Exploring the numbers: dashboards

To understand the stablecoin market’s current state and identify potential risks, let’s analyze the key metrics behind its trades. The data below comes from anti-money laundering company AMLBot, which has released extensive analytics of Tether and Circle’s stablecoins across CeFi and DeFi platforms.

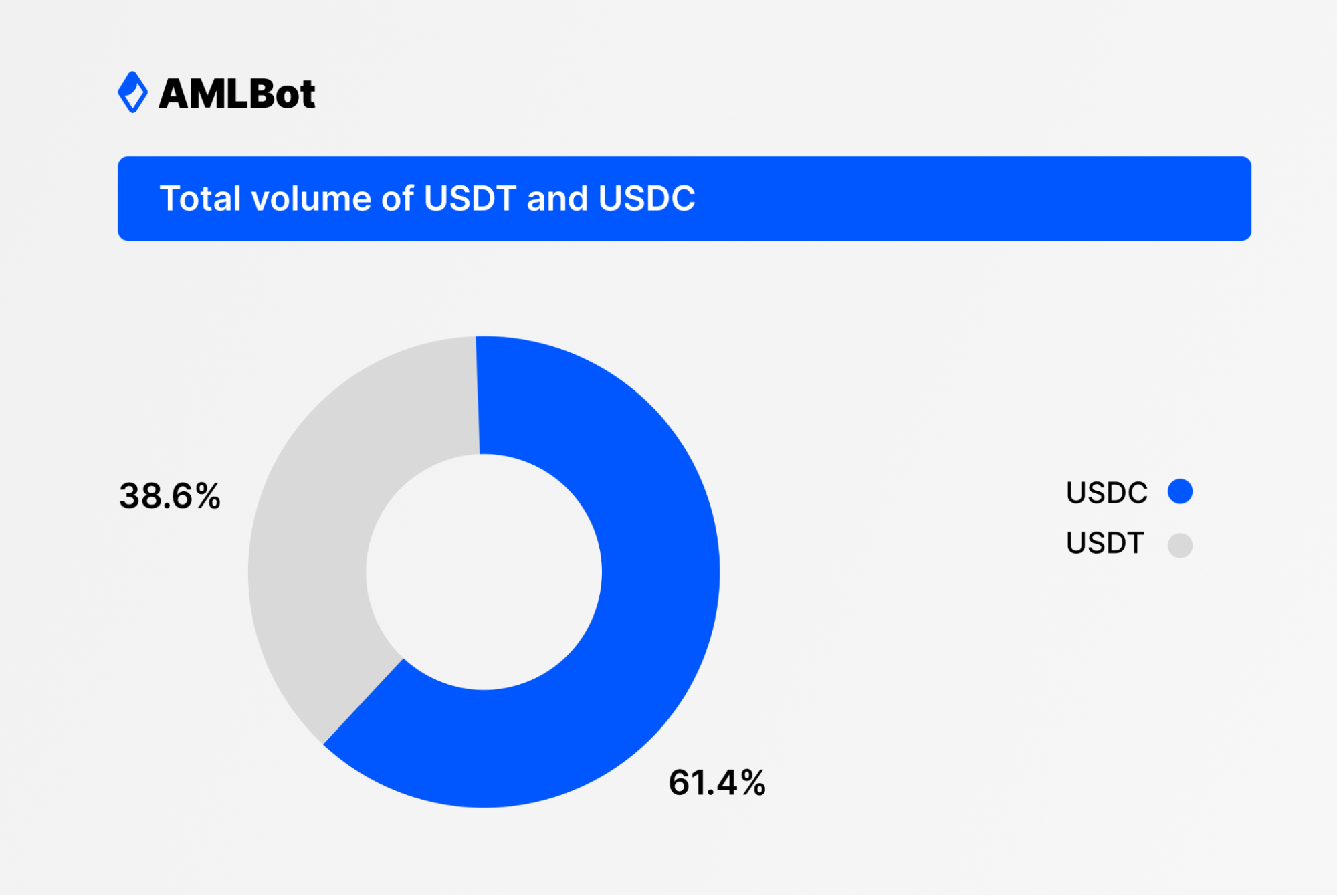

The analytics revealed that in terms of transaction value, USDC leads the way with nearly $6.5 trillion worth of total transactions between 2021-22, while USDT accounted for just over $4 trillion. However, the total number of USDT transfers was almost double that of USDC: 90 million against just over 47 million. At the same time, the statistics reveal that USDC transfers are less frequent than USDT, while Circle’s transactions are much more prominent in volume.

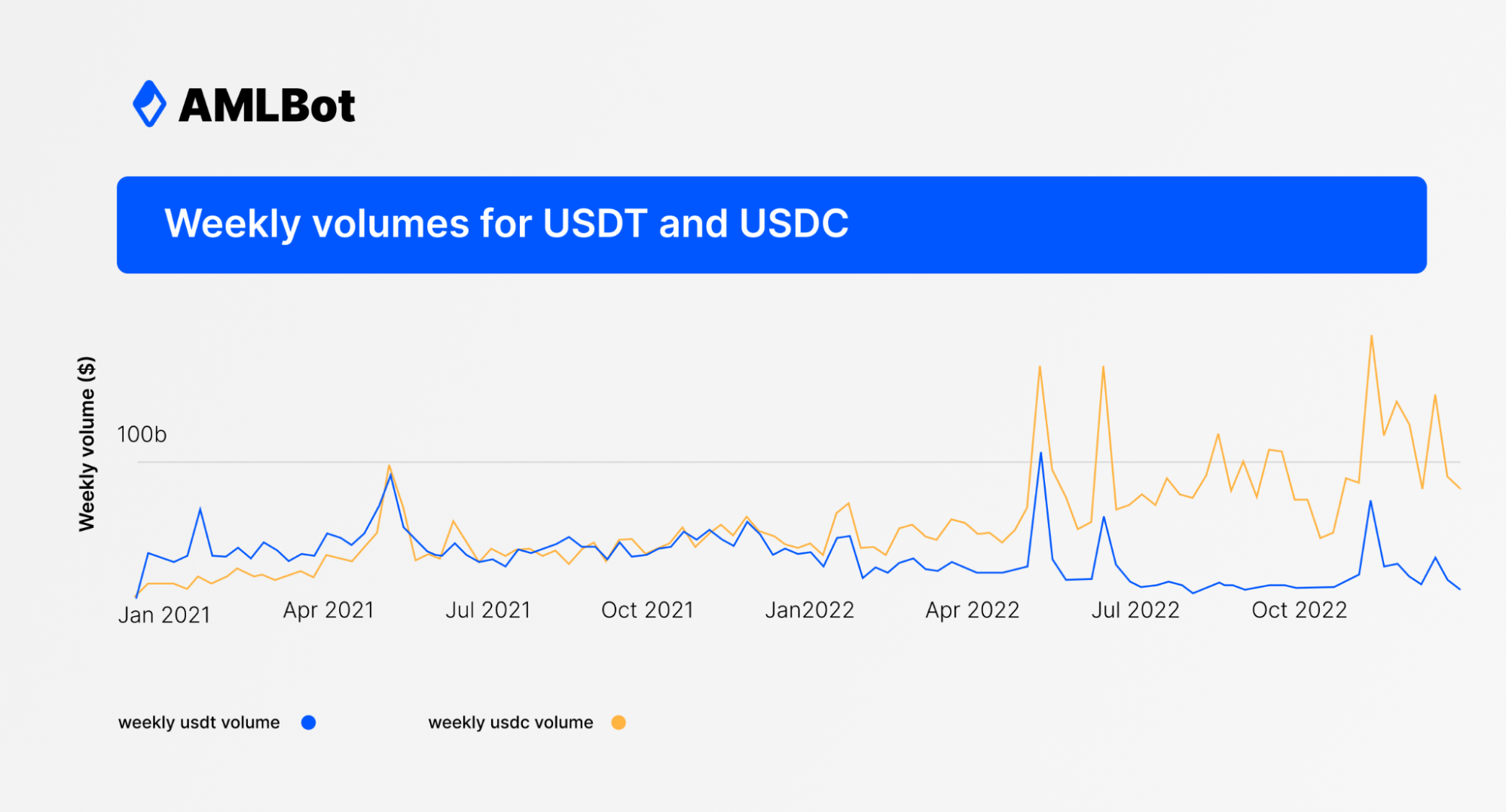

This is further evident from both tokens' weekly transfer volume and transaction numbers. Between December 2020-2022, there were an average of nearly 1 million USDT transfers every week, while USDC weekly transaction numbers were well below 600,000. The highest number of USDC transactions in a week was just over 878,000, while the highest number of USDT transactions in a week was more than 1.5 million. The USDC's weekly transfer volume was significantly higher.

USDT weekly transfer volume crossed the $100 billion mark only once during the observed period, while USDC weekly transactions were frequently worth over $100 billion, reaching the peak of $183 billion on November 2022.

Circle’s stablecoin also has also been ahead when it comes to DeFi protocols, as the total volume of USDC tokens bought and sold on Uniswap was four times higher than USDT. Similar patterns were persistent across other DeFi exchanges like SushiSwap, with only the exception of CurveFi, where USDT transaction volume was slightly higher.

USDC and USDT, on par

The statistics show that USDC is much more popular for large-volume transactions. USDT transactions were much more frequent than its counterpart, however, the total value of those transfers was significantly lower. This trend implies that USDC has garnered a lot of trust within the crypto community.

But why is USDT more frequently used for trading and payments? Most likely, the reason is that Tether’s stablecoin has been around longer than USDC. The token was launched in 2014, four years before USDC. Also, most exchanges offer more trading pairs denominated in USDT, making it more convenient to use Tether’s stablecoin as a base currency.

Major concerns for stablecoins

The dominance of both stablecoins also raises some notable concerns in the broader crypto market. For instance, USDC being more trusted for high-value transactions means that if the token loses its dollar peg, it will create a more significant ripple effect across the spectrum.

In such scenarios, assets backed by the stablecoin will start losing their value, affecting the entire crypto market. A similar incident happened earlier this year when USDC lost its dollar peg after the Silicon Valley Bank collapsed. This caused DAI to lose 7.4% of its value, as nearly half of its assets consisted of Circle's stablecoin.

The fact that both USDT and USDC are solely pegged by the US dollar also raises concerns. This means any economic or financial event that affects the fiat currency will also affect the value of the leading stablecoins. A practical solution would be to have such stablecoins pegged against more local currencies, providing much-needed protection to traders in regions where USD is not the primary currency.

At the same time, Bahamas’ Digital Assets and Registered Exchanges (DARE) Bill and MiCA are going to tighten their requirements for stablecoin issuers, adding to the challenge.

The power of diversity

The main takeaway is that the industry requires a diverse range of transparent stablecoins to mitigate their impact on the cryptocurrency market.

Having a variety of stablecoins available would increase the resilience of the cryptocurrency market to any potential risks, and prevent disastrous consequences should stablecoins encounter depegging do to the local economy issues, such as the recent incident with USDC, or face tightening regulatory requirements.

coincodex.com

coincodex.com