Although BTC remained relatively flat immediately after yesterday’s FOMC meeting, the asset spiked in the following hours and reclaimed $29,000.

The altcoins have also turned green with minor daily increases. FTM has jumped the most from the mid-cap alts.

BTC Bounces Back Above $29K

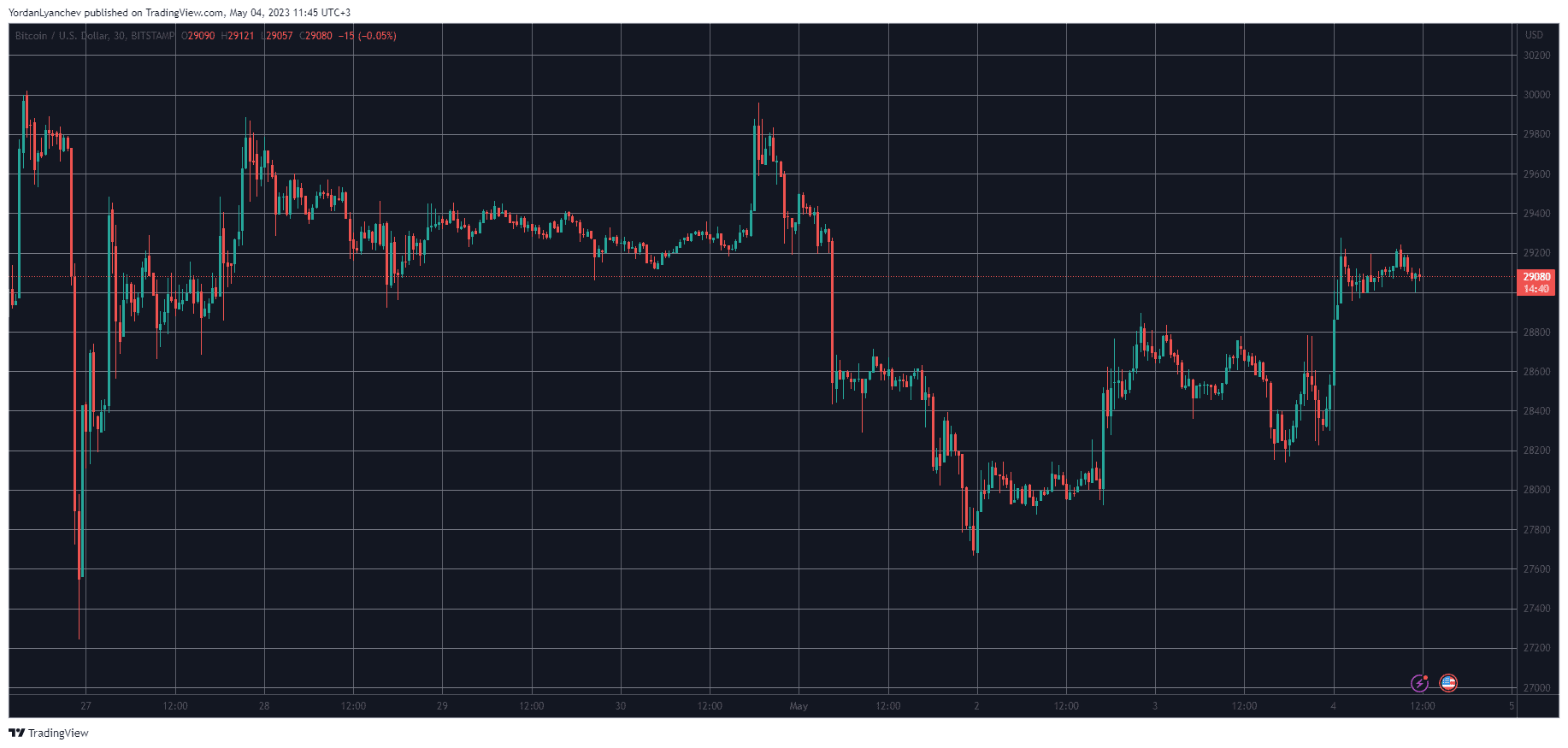

As April was coming to its end, bitcoin initiated a leg up that drove it to $30,000. However, the bears intercepted the move and pushed the asset south hard. As such, BTC found itself slipped to $27,600 just a few days later.

Despite recovering some ground on Wednesday, the cryptocurrency was still unable to reclaim $28,000 decisively. More volatility was expected later on when the US Federal Reserve was set to meet and announce perhaps another interest rate hike.

Such an increase indeed transpired, and the central bank’s new rates are now at 5%. Interestingly, though, bitcoin didn’t react in its usual manner and remained stuck at just over $28,000. However, the trend started to change hours later, and BTC pumped by roughly a grand.

As of now, the asset trades inches above $29,000, and its market capitalization is just north of $560 billion. Its dominance over the alts has also risen a bit to 47.1% on CMC.

SUI’s Rollercoaster

The alternative coins, despite being more volatile by nature, have also remained relatively calm after the Fed’s latest interest rate hike. Ethereum is among the most substantial gainers from the top 10, having jumped by 2%. As a result, ETH now stands at $1,900.

Binance Coin, Cardano, Dogecoin, Polygon, Solana, Polkadot, Shiba Inu, and Avalanche are also slightly in the green on a daily scale.

FTM has risen by over 6% in the past 24 hours, making it the best performer from the top 50. The highly-anticipated SUI token also started trading yesterday as the mainnet went live, and it pumped to $3.5 before it dumped to under $1.5 hours later.

Overall, the total crypto market cap has neared the $1.2 trillion mark after gaining around $15 billion daily.

cryptopotato.com

cryptopotato.com