The U.S. Federal Reserve has taken action to address the nation's elevated inflation rates by raising rates once again, as expected.

At the same time, the institution is grappling with the fallout from a series of bank collapses that have garnered significant attention.

How might this dynamic macroeconomic backdrop influence the best cryptos to buy now?

The Federal Open Market Committee (FOMC) of the Federal Reserve has maintained its trajectory of interest rate hikes, a trend spanning over a year.

The committee raised the federal funds rate by 25 basis points once again, setting a target range of 5% to 5.25%.

Following the announcement, bitcoin (BTC) experienced a slight uptick, registering a gain of 1.32% for the day as it once again attempts to mount the significant 29k level, trading at $29,071.

Though the Fed's decision was anticipated, market participants were keen to hear Chair Jerome Powell's remarks during the post-meeting press conference.

The central question was whether the Fed would consider pausing its rate hikes, which have propelled the federal funds rate from 0% in early 2022 to its present level.

The policy statement excluded language implying a definite continuation of rate hikes and acknowledged the impact of "tighter credit conditions" on the economy.

The FOMC emphasized its consideration of the overall effects of monetary tightening and other economic factors.

Although inflation has shown signs of easing to approximately 5%, it continues to significantly exceed the Federal Reserve's objective of 2%, indicating that additional measures to constrict monetary policy could be necessary.

The Fed also faces challenges from bank vulnerabilities, with the recent example of First Republic (FRC) requiring intervention by the FDIC and JPMorgan (JPM) to prevent collapse.

Powell refrained from announcing a rate hike pause during the press conference, emphasizing the Fed's readiness to curb inflation.

As the Fed addresses inflation and banking sector stability, observers will closely watch the central bank's next steps, with one possibility being that the banking crisis may continue to draw people to bitcoin and other cryptocurrencies.

Investors may be wise to diversify their investments either way, and based on a combination of fundamental and technical analysis some of the best cryptos to buy now for investment portfolios may be AI, STX, LPX, OP, ECOTERRA, BCH, and SWDTKN.

One of the Best Crypto to Buy Now: AiDoge Rides High on Meme Generator

The hype surrounding the launch of ChatGPT has opened the floodgates for AI-themed cryptocurrencies.

Amid the deluge of new offerings, AiDoge has distinguished itself with its unique attributes and meme coin appeal, prompting many investors to consider it one of the best crypto to buy.

AiDoge's presale phase started on April 26th, with a structure consisting of 20 stages.

Early investors enjoyed lower entry prices, and the project has attracted more than $1.2 million in funding since its inception.

The developers aim for centralized exchange listings in Q3 2023, a move that could potentially propel the project further.

AiDoge sets itself apart from other meme coins by offering real-world value through its AI-powered meme generator.

The generator allows users without photo-editing skills to create trending memes in mere seconds, increasing the likelihood of their content going viral.

The $Ai token, AiDoge's native ERC-20 token, is essential to the project's ecosystem.

Users must utilize the token to purchase credits for meme creation, while token holders can also stake their $Ai to receive daily rewards, early access to new meme templates, platform enhancements, and voting rights.

In addition to staking, AiDoge plans to introduce a "public wall" feature, where users can vote on their favorite memes created with AiDoge's technology.

Top memes will gain more visibility, and their creators will receive extra $Ai tokens as rewards.

AiDoge's tokenomics have captured investors' interest, with a total supply of one trillion tokens, 50% of which are allocated for presale investors.

To prevent potential "rug pulls," 25% of the token supply will be vested over ten years for the development team.

The project's smart contracts have undergone a thorough audit by CertiK, a leading blockchain security company, bolstering AiDoge's credibility.

As crypto trading volume continues to soar, AiDoge is well-positioned to capitalize on the current positive sentiment surrounding digital assets.

Stacks (STX)

Stacks (STX) recorded a notable 10.7% upswing yesterday, striving to breach the barrier of the 20-day EMA.

This positive trajectory persisted into today as Stacks approached the resistance level of 0.382 at $0.8251, reaching an intraday peak of $0.8236.

At present, Stacks is trading above both the 20-day and 50-day EMA at a price of $0.8012, experiencing an increase of 6.12% so far today.

The STX price underwent a correction of approximately 40% from its peak at $1.3115 and is currently consolidating above the Fib 0.236 level at $0.7097 prior to yesterday's 10.7% move.

The price remains above the 200-day EMA, signaling that the long-term trend is still upward.

However, trading volume for Stacks has been in a declining phase for several months, and price momentum appears to be lacking.

On March 10, Stacks found support around $0.5200, forming a bullish hammer candlestick pattern. Subsequently, prices reversed course, rising and creating higher peaks.

The STX price experienced a rally of roughly 120%, reaching a high of $1.3115.

After consolidating for several days near a supply zone, buyers encountered difficulty maintaining upward momentum.

Prices then saw profit-taking, gradually shifting in a downward direction.

So, is Stacks returning to a bullish trajectory? The cryptocurrency has performed commendably in recent months, yielding returns for long-term holders.

At present, the price is undergoing a downward retracement as part of a short-term correction.

As long as STX remains above the $0.52 level, the likelihood of a rebound persists.

However, a drop below this level could raise concerns for long-term holders.

Technical analysis suggests that Stacks is under bullish control, with signs of a potential bullish trend continuation.

Positive momentum may resume if buyers manage to surpass the $1.000 barrier.

Until then, the price may fluctuate within a range, exhibiting a bullish inclination.

Web3 Dashboard for Savvy Investors: Introducing Launchpad.xyz

Launchpad.xyz is a comprehensive Web3 dashboard designed to give users real-time updates on upcoming investment opportunities, including exclusive presales available only to a select few.

To participate in these presales, users must stake a minimum of 10,000 $LPX tokens for 90 days.

Staking $LPX tokens is one of the core features of Launchpad.xyz, and it offers numerous benefits, such as discounted fees, access to beta play-to-earn games, and community prestige badges.

$LPX stakers also gain access to NFT mint whitelists, making it easier to find the best crypto to buy.

Aside from staking, Launchpad.xyz is developing a decentralized exchange that will allow users to trade various asset pairs and perpetual contracts.

This exchange offers yet another real-world utility for $LPX tokens, as stakers will enjoy reduced trading fees.

The team behind Launchpad.xyz is a diverse group of industry leaders with experience spanning multiple fields.

Terence Ribaudo, the CEO, has over ten years of experience in Web3, working with major clients such as Nike, Rolls Royce, and the NBA.

COO Alexis Garcia has worked with Apple and Accenture, among others, while CTO Stephen Baker has developed products for some of the world's biggest brands.

Currently, Launchpad.xyz is holding a presale for its $LPX token.

The total supply of tokens is 1.025 billion, with 250 million allocated for the presale. $LPX can be purchased with ETH, BNB, USDT, or credit cards.

The token is in the first stage of its presale, priced at $0.035, with the listing price set at $0.07.

With its wide array of features and tools, Launchpad.xyz is a strong contender for anyone looking to decipher the best crypto to buy.

Optimism (OP)

The Optimism network, recognized for its role as a prominent scaling solution for Ethereum, once boasted a market capitalization exceeding $900 million.

However, the tides turned on April 14 when a security breach in the Hundred Finance DeFi lending protocols, built atop the Optimism network, resulted in a loss of $7 million.

The incident has left a lasting impact on the network and its native digital asset, OP.

In the wake of the security breach, large-scale participants in the Optimism network have demonstrated a shift in sentiment.

These investors, who previously held optimistic positions on the asset, have begun to seek refuge in other DeFi protocols that offer yield-bearing opportunities.

The sense of unease among participants in the Optimism network is further evidenced by a marked decrease in substantial transactions.

Data from Santiment reveals that since the incident on April 14, the frequency of transactions exceeding $100,000 has plummeted by 73%, dropping from 48 to a mere 19 daily transactions between April 15 and May 2.

This trend suggests that larger investors are concerned about the possibility of further negative events affecting the network.

The exodus of whale investors has not gone unnoticed, as on-chain data points to a gradual reduction in OP holdings by these participants.

A closer look at the data reveals that whales holding between 1 million and 100 million OP began to liquidate their positions as soon as news of the security breach became public.

From April 15 to May 3, these investors sold off a total of 12 million coins, equivalent to $25 million at the current market value of $2.10 per coin.

To put this into perspective, the amount sold represents nearly 4% of Optimism's current market capitalization.

The rapid offloading of substantial quantities of OP by whale investors poses a risk to OP's value, potentially leading to a downward price trajectory.

The future of Optimism hinges on the network's ability to restore confidence and reignite interest among these influential investors.

Optimism is currently trading above the Fib 0.236 level at $2.128 with a slight gain of 0.69% so far today.

If the price continues to fall even further, support may potentially be found at the $2 psychological level, followed by the current swing low of $1.768.

Ecoterra Combining Profit and Purpose, One of the Best Cryptos to Buy now

With a focus on promoting recycling and combating climate change, ecoterra, a Recycle-2-earn crypto startup, is developing a unique infrastructure that rewards users for disposing of unwanted items such as cardboard, paper, plastic, clothing, cans, and glass.

At the core of this infrastructure lies reverse vending machines (RVMs).

The process begins with users installing the ecoterra app and setting up an account.

Based on their location, the app directs users to the closest RVMs and informs them of the recyclable items accepted by each. Users then visit the RVM of their choice, scanning items they want to recycle.

In the ecoterra presale, which has already drawn $2.9 million, users receive the platform's native tokens, $ECOTERRA, as a reward for recycling through RVMs.

Green investors will appreciate ecoterra's dual approach: addressing environmental concerns while offering potential investment returns.

Additionally, the company is working on a portal to help businesses source recycled raw materials.

Ecoterra's global network connects suppliers, offering competitive pricing and essential specifications for recycled raw materials.

These materials can be ordered via the Ecoterra portal and paid for using $ECOTERRA tokens or other cryptocurrencies.

Another interesting feature of ecoterra is its carbon offsetting program, which allows users to buy tokenized carbon credits that are subsequently taken out of circulation.

Users can fulfill their carbon offset requirements with $ECOTERRA tokens.

An 'Impact Profile' is also being developed by ecoterra, catering to both consumers and companies, and giving them a platform to showcase their green contributions.

Investors keen on supporting these features can participate in the ecoterra presale.

The ecoterra presale has now entered its fourth stage, with the token priced at $0.007. The project will launch at $0.01 once $ECOTERRA is listed on an exchange.

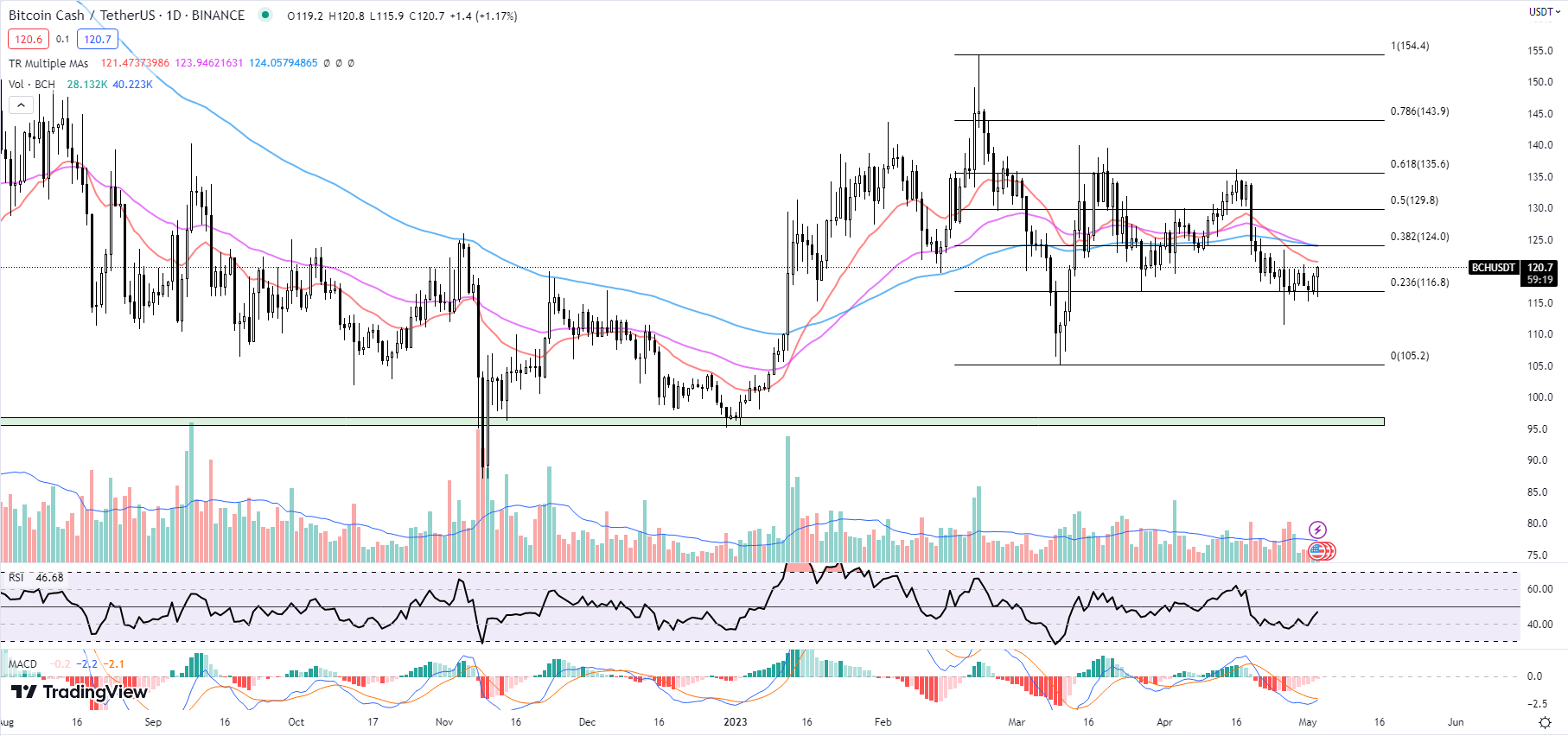

Bitcoin Cash (BCH)

Bitcoin Cash (BCH) has been experiencing a period of consolidation after facing a strong rejection at the Fibonacci 0.618 level at $135.6 on April 16.

Since then, the cryptocurrency has been on a downward trajectory, currently trading sideways above the Fibonacci 0.236 level at $116.8.

As of April 25, BCH has been hovering in this range, and traders are closely monitoring key technical indicators to gauge its next potential move.

Examining the exponential moving averages, BCH is currently trading below the 20-day EMA at $121.4, which is acting as immediate resistance.

Additionally, the 50-day EMA at $123.9 and the 100-day EMA at $124.1 are clustered together, forming a strong resistance zone in confluence with the Fibonacci 0.382 level at $124.

This confluence of resistance levels suggests that BCH may face significant selling pressure if it attempts to break higher.

The RSI is currently at 46.09, up from yesterday's 43.81. While the RSI is still below the neutral 50 level, the slight uptick indicates that buying momentum may be gradually returning to the market.

However, traders should remain cautious as the RSI has not yet entered bullish territory.

The MACD histogram is showing a value of -0.2, an improvement from yesterday's -0.4.

This positive shift in the MACD histogram suggests that bearish momentum is waning, and BCH may be poised for a potential reversal.

However, the MACD line is still below the signal line, indicating that the bearish trend is not yet invalidated.

In terms of trading volume, data from CoinMarketCap shows that BCH's 24-hour trading volume stands at $102,525,846, marking a 1.15% increase from the previous day.

As of writing, BCH is trading at $120.7, with immediate resistance at the 20-day EMA.

A break above this level could see BCH testing the aforementioned resistance zone at $124.

On the downside, immediate support is found at the Fibonacci 0.236 level at $116.8.

Buyers should exercise caution, as a break below this level could lead to a further decline toward the previous swing low of $105, which is nearly 10% below the current support level.

Embark on a Web 3.0 Adventure: $SWDTKN, One of the Best Cryptos to Buy now in Crypto Gaming

The highly anticipated Swords of Blood presale has attracted a diverse array of RPG enthusiasts – from crypto gamers to traditional PC and mobile players, spanning across various age groups.

The hack-and-slash game aims to rival Diablo with its engaging storyline, immersive gameplay, and state-of-the-art Web 3.0 features.

Initially launched by Artifex Mundi in 2019, the award-winning title received a 4.8 out of 5 average user rating, garnering over 4 million downloads on the App Store and Play Store.

Hit Box Games LLC now holds the rights to publish a revamped version of the successful game, integrating cutting-edge Web 3.0 features and functionalities.

Swords of Blood promises advanced user experiences, crypto incentives for players, captivating combat, impressive graphics, and a variety of game modes.

Utilizing Polygon's high speed and low fees, Swords of Blood is set in the fallen World of Ezura, plagued by violence, betrayal, and a nefarious evil.

Players must strategically battle the evil entity and choose from a range of character roles, including a daring dungeon crawler, a battle-mage, or a formidable warrior.

Players will have access to powerful gear and nature's magic on their thrilling quest for vengeance.

The Web 3.0 MVP release of Swords of Blood is slated for May 2023, featuring a host of asynchronous game modes, such as Main campaign dungeons, Monster Hunt dungeons, Boss Fortress, PvP, Daily dungeons, Event dungeons, Challenge dungeons, and Shattered Mazed.

The project's long-term ambition is to evolve into a community-centric MMORPG by incorporating synchronous game modes and multiplayer features.

Swords of Blood offers an array of enhancements, including multi-chain and fiat currency payments via SphereOne and Simplex, a play-to-own game model, fresh F2P mechanics, PVP modes, a new soundtrack, weaponry designed by Ben Abbott from Forged in Fire, e-sport micro tournaments, community-based gaming, G.U.T. NFTs, a 150-hour game expansion pack, and community-based communication areas.

The project will allocate 40% of all tokens and payments to market-making efforts.

Swords of Blood breaks the norm by adopting a play-to-own model, addressing the high barriers to entry typically associated with crypto games.

Unlike the less popular play-to-earn model, the play-to-own approach allows players to enjoy the game for free, with the option to access premium content using $SWDTKN, the platform's native cryptocurrency.

cryptonews.com

cryptonews.com