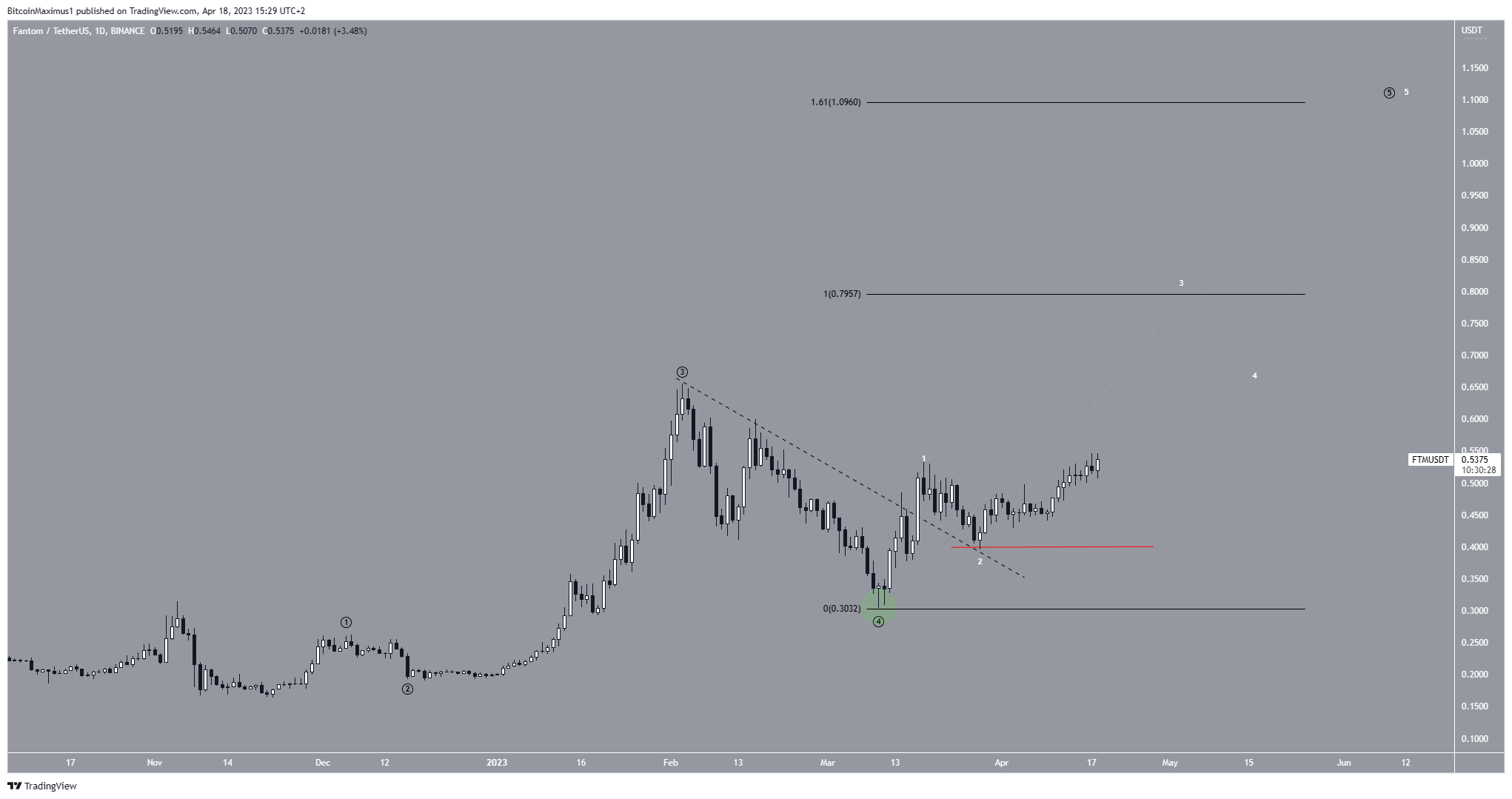

The Fantom (FTM) price has cleared a crucial horizontal resistance area. The next important resistance is 110% away from the current price. So where to next for FTM?

The FTM price is nearing its yearly highs and shows bullish signs in multiple time frames. It is possible that the rate of increase will accelerate soon or could it decrease in price?

Fantom Price Clears Long-Term Resistance

In January 2022, the FTM price hit an all-time high before decreasing below a descending resistance line. This caused a breakdown from the support level of $0.20 and led to a low of $0.16 in November 2022. However, this decline was just a temporary deviation, as the price of Fantom has since risen.

Upward movements usually follow breakdowns and deviations such as these. This is because the sellers could not push the price down. Rather, the $0.20 support area was reclaimed, and an upward movement followed.

The Relative Strength Index (RSI) showed a bullish divergence (green line) before the increase and now sits above 50, indicating a bullish trend. The RSI is a momentum indicator used to determine overbought or oversold conditions. An upward trend and a reading above 50 suggest that bulls still have momentum.

The FTM price currently trades above the $0.38 horizontal support area. The next critical resistance is found at an average price $1.15, an increase of 112% from the current FTM token price.

The technical analysis of both the daily time frame indicates a bullish FTM price prediction because of the price action and Elliot Wave theory wave count. Elliott Wave theory is a tool used by technical analysts. It looks for recurring long-term price patterns and investor psychology in order to determine the trend’s direction.

The price seems to be in the fifth and final wave of an upward movement (black). The short-term sub-wave count is given in white. If correct, the price is in sub-wave three of the final wave. This is usually the portion in which the increase accelerates sharply.

The two most probable areas for the future price top are at $0.80 and $1.10. The former is identified by projecting the length of waves one and three to the bottom of wave four (green circle). The latter is found by doing the same with the 1.61 Fib length (black).

Fibonacci retracement levels work on the theory that after a big price move in one direction, the price will retrace or return part of the way back to a previous price level, before resuming in the original direction. They can also be used to determine the top of future upward movements.

Given that the $1.10 target coincides with the previously mentioned long-term resistance area and fits better with the sub-wave count, it is more likely to act as the top.

Despite this bullish outlook, if the FTM price falls below the sub-wave two low of $0.39 (red line), it will invalidate this bullish prediction and could drop toward $0.20.

beincrypto.com

beincrypto.com