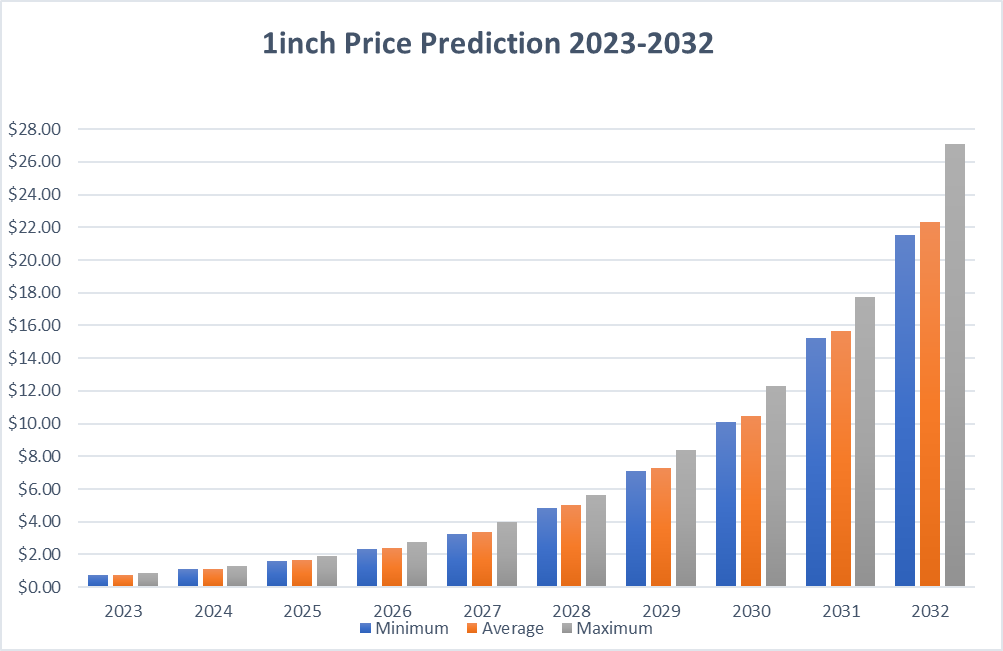

1inch Price Prediction 2023-2032

- 1inch Price Prediction 2023 – up to $0.84

- 1inch Price Prediction 2026 – up to $2.77

- 1inch Price Prediction 2029 – up to $8.40

- 1inch Price Prediction 2032 – up to $27.12

Aiming to provide the best rates by discovering the most efficient swapping routes across all leading DEXes, 1inch collates and aggregates token prices across a range of decentralized exchanges to seek the best deals for clients. This 1inch Price Prediction will help you know more about the native token and the reasons for considering the coin for your portfolio.

Curious about how #1inch is performing across supported blockchains?

Check out their weekly stats! Week-over-week changes are shown in parentheses.

- 1inch #FusionMode: $5.5B in volume (+$467.7M) | 494.1K swaps (+53K) | 117.8K users (+10.6K)

- #Ethereum: $262.2B in volume (+$2.6B) | 10.1M swaps (+106.7K) | 1.8M users (+14.2K)

- #BNBChain: $34.4B in volume (+$139.4M) | 15.7M swaps (+127.8K) | 3M users (+25K)

- #Polygon: $19.1B in volume (+$76.4M) | 13.1M swaps (+127.8K) | 1.5M users (+22K)

At the beginning of 2022, the blockchain launched a documentation portal to help technical analysts gain access to crucial detailed descriptions of protocols on the platform. The 1inch aggregation protocol uses the Pathfinder Algorithm to find the best prices from more than 60 liquidity sources on Ethereum, more than 30 on Binance, and more than 30 liquidity sources on Polygon Optimistic Ethereum and Arbitrum.

As 2022 closes, the 1inch community has reason to celebrate: #1inch has hit 1.2M followers on #Twitter!

How much is 1inch worth?

Today’s 1inch Network price is $0.575335 with a 24-hour trading volume of $22,333,269. We update our $1INCH to USD price in real-time. 1inch Network is up 1.66% in the last 24 hours. The current CoinMarketCap ranking is #93, with a live market cap of $468,896,480 USD. It has a circulating supply of 814,997,247 $1INCH coins and the max. supply is not available.

$1INCH is a good investment for the short term when the market is in a BULL run.

What is 1inch?

1inch is the utility token for the 1inch network. 1inch is a DEX aggregator. 1inch exchange is developed to ease and convenience for DeFi users to obtain better services within the DeFi space.

An aggregator like 1inch derives its liquidity from several other DEXs and pools them into one platform. The pooling allows the DEX aggregator to offer its users the best swapping rates possible, beating all the individual DEX platforms like Uniswap and Sushiswap due to its vast liquidity provider pool.

Additionally, 1inch has undergone tremendous changes in its core over the years, and today, the platform embraces the Decentralized Autonomous Organization model.

The DAO model allows 1inch users to be more involved in shaping up the future direction 1inch, giving investors a significant level of control that isn’t available on other platforms.

1inch was launched in 2020 and has since realized impressive gains. It serves as the utility token for the 1inch platform, and holders use it to vote within the DAO model.

The liquidity pools created by the aggregation model ensure that 1inch stays ahead of other regular DEX platforms indicating that the future is bright, and investors are beginning to consider it as a good investment.

1inch Technical Analysis

As the crypto market experiences a resurgence, 1inch, the popular decentralized exchange (DEX) aggregator, has caught the attention of investors by breaking past its monthly resistance. Bitcoin’s triumphant return above the $30K mark, coupled with encouraging economic indicators such as positive Consumer Price Index (CPI) and Producer Price Index (PPI) data, have stirred bullish sentiments, driving 1inch’s impressive performance. However, the token has faced minor rejection today, dropping below its 23.6% Fib level. Hence, our 1inch technical analysis aims to bring you an in-depth price projection of the 1inch token to guide you through a profitable investment plan.

CoinMarketCap reports that the current 1inch price trades at $0.5628, showing a downtrend of almost 0.15% from yesterday’s rate. 1inch recently broke above its monthly resistance line at $0.54 following Ethereum’s Shanghai upgrade, sparking a significant movement that is worth noting for investors as the token appears to be heading toward a bullish breakout this week.

Our 1inch crypto technical analysis unveils that this digital asset may soon witness a massive jump in trading volume if it continues its upward trajectory. Looking at the daily price chart, the $1INCH token showed an impressive surge as bulls gained control of the price chart, increasing its value by 10%. 1inch token has formed support near $0.5, from which the token is climbing above its bullish triangle pattern. However, $1INCH’s price depends entirely on its upcoming developments, partnerships, and competitive landscape.

Moreover, the 1inch community has recently experienced a spike in accumulation following its milestone achieved on the Polygon network, with prices touching $0.57. 1inch token is currently on a bullish trajectory after recovering from the market’s turmoil. However, the asset faced rejection near $0.57 and made a slight downward retracement to the bottom of the Fib level. In addition, the Balance of Power (BoP) indicator is trading in a bearish region at 0.14, which may initiate a downward correction and put a stop to its bullish rally.

The popular RSI-14 indicator is trading on the verge of a bullish territory at 58, which can send 1inch coin upward to break its resistance near the 38.6% Fib level. Furthermore, the MACD line has formed an ascending channel pattern above the signal line, indicating that the bearish domination in the $1INCH price chart is slowing down. The SMA-14 is making an attempt to surge above the midline as it trades just below the RSI trend line at level 53, suggesting increased investor confidence for the 1inch token.

However, a downward correction is predicted if the 1inch token fails to surge above $0.57. If 1inch’s price breaks above EMA-200 at $0.59, it may attempt to break its crucial resistance at the upper limit of the Bollinger band at $0.65. On the other hand, a sudden decline is expected if the $1INCH token’s price drops below the critical support level of $0.5; below this level, the token may witness a sharp drop and head toward its Bollinger band’s lower limit of $0.44. If 1inch fails to stay above $0.42, it may lead to more bearish market sentiment, and the token may be forced to trade at $0.38.

1inch Price Predictions by Cryptopolitan

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2023 | 0.75 | 0.77 | 0.84 |

| 2024 | 1.08 | 1.11 | 1.31 |

| 2025 | 1.59 | 1.63 | 1.88 |

| 2026 | 2.33 | 2.4 | 2.77 |

| 2027 | 3.26 | 3.38 | 4.01 |

| 2028 | 4.84 | 5.01 | 5.65 |

| 2029 | 7.08 | 7.28 | 8.4 |

| 2030 | 10.12 | 10.48 | 12.32 |

| 2031 | 15.26 | 15.68 | 17.73 |

| 2032 | 21.56 | 22.34 | 27.12 |

1inch Price Prediction 2023

Our 1inch price prediction for 2023 predicts a maximum trading price of $0.84, with an average trading price of nearly $0.77. 1inch token might retrace with a minimum price of $0.75 by the end of 2023.

1inch Price Prediction 2024

1inch network promises the crypto space a solid web3 platform with strong fundamentals. 1inch price prediction for 2024 predicts that the token will extend its bullish momentum and likely achieve a maximum price of $1.31. After that, 1inch crypto might record a low of $1.08, with an average trading price of $1.11.

1inch Price Prediction 2025

Our 1inch price prediction for 2025 predicts a minimum value of $1.59 and a maximum value of $1.88. In addition, our 1inch price forecast for 2025 predicts an average trading price of $1.63.

1inch Price Prediction 2026

1inch may witness a massive pump in 2026 and bring an exponential return to its long-term holders. Our 1inch price prediction for 2026 expects a maximum trading price of $2.77, with an average trading price of $2.40. 1inch token may reach a minimum value of $2.33.

1inch Price Prediction 2027

The crypto market is predicted to witness a bull season in the next few years and achieve a significant milestone in global market cap as it is preparing for a skyrocketing market with a potential uptick in value in the next few years. Our 1inch price prediction for 2027 suggests it may touch a maximum trading price of $4.01. 1inch may trade at an average price of $3.38, with a minimum value of $3.26.

1inch Price Prediction 2028

Our 1inch price prediction for 2028 states that the token may touch a maximum price of $5.65 and an average trading price of $5.01. The minimum value for the 1inch cryptocurrency is predicted to hit $4.84.

1inch Price Prediction 2029

In the upcoming years, 1inch may expand exponentially and gain investors’ attention with robust enhancements that can push its price to the North. Our 1inch price prediction for 2029 expects a maximum price for this token to be $8.40 and a minimum price of $7.08. 1inch crypto may reach an average value of $7.28.

1inch Price Prediction 2030

Depending upon the future market sentiment, global regulation, and feedback from the community, 1inch’s price can see a maximum price of $12.32 with an average trading price of $10.48. However, 1inch is projected to hit the bottom level at $10.12 by the end of 2030.

1inch Price Prediction 2031

According to our 1inch price analysis, the 1inch token is poised to bring a skyrocketing price trend to its long-term holders as the developing team is actively looking for more partnerships. The price of 1inch is projected to reach a maximum of $17.73, with an average trading price of $15.68. The minimum trading price of 1inch is predicted to be $15.26 by the end of 2031.

1inch ($1INCH) Price Prediction 2032

1inch price is forecasted to hit a minimum value of $21.56 in 2032. Per our prediction, the 1inch price could attain a maximum value of $27.12 with an average forecast price of $22.34.

1inch Price Prediction By Wallet Investor

According to Wallet Investor’s 1inch token price forecast, the token may witness a sharp decline in demand in the future. The website expects that the token may attain an average trading price of $0.0489, with a maximum price value of $0.0687 and a minimum value of $0.031 in 2024.

In 2027, 1inch token may hover at an average value of $0.0248 with a minimum value of $0.00644 and a maximum value of $0.048.

1inch Price Prediction By DigitalCoinPrice

DigitalCoinPrice gives a bullish analysis of the 1inch price prediction. The website expects 1inch token to trade above the level of $1.26 in 2024. By the end of the year, 1inch Network is predicted to reach a minimum value of $1.18. In addition, the $1INCH price may attain a maximum level of $1.28.

In 2032, the 1inch network is predicted to surpass the level of $10.54. By the end of the year, 1inch Network is projected to reach a minimum value of $10.47. In addition, the $1INCH price may secure a maximum level of $10.58.

1inch Network Price Prediction By CryptoPredictions.com

Cryptopredictions.com’s 1inch price forecast states that the token may begin trading in May with a price of approximately $0.53 and conclude at a remarkable $0.64. Throughout the month, the $1INCH token is projected to reach a peak price of $0.78, while its lowest value is anticipated to be around $0.53.

In 2027, the 1inch token may attain an average trading price of $1.391, gaining the potential to reach a maximum level of $1.73 and a minimum price of $1.18.

1inch Price Prediction By Market Sentiment

1inch’s future potential lies in its ability to adapt and expand its offerings to cater to the ever-changing DeFi landscape. As more DEXs enter the market, the demand for efficient exchange aggregation will only grow, solidifying 1inch’s position in the space. The token has achieved significant milestones in recent months in the latest development as 1inch has announced a remarkable achievement, reaching 1.4 million users on the Polygon network, pushing the token upward by 20%. According to some market analysts, the 1inch token may surge to $10 this year as it has solid past performance, while some expect a bearish path to $0.01 by the end of 2024.

Conclusion

The 1inch roadmap includes several feature upgrades as it continues to gain popularity. Some somewhat convincing arguments for holding the 1inch token at this time are shown by an initial deep dive into the network’s innovation. According to the 1inch prediction, these coins will reach their all-time high in 2031.

Since its inception, the 1inch ecosystem has attracted investors thanks to a thriving community and the arbitrage opportunities it offers to investors. Since the token has a low price relative to the total quantity in circulation, traders may purchase a big 1inch with a relatively modest investment.

Remember that your decision should be based on your comfort level with losing money, risk tolerance, market knowledge, portfolio spread, and other factors. Never forget that investing in cryptocurrencies may be quite risky, and past success is no guarantee of future results. Defi initiatives like 1inch are also vulnerable to assaults from malicious actors that exploit system flaws. 1inch’s cryptocurrency research and forecast do not constitute investment advice. Never risk more money than you can afford to lose on anything, and do your own research.

The 1inch ecosystem has continued to draw investors since its launch with a growing community and the arbitrage opportunities it provides to investors. Traders can acquire a large 1inch with a relatively small investment, given that the token has a small price from the total circulating supply.

1inch token is likely to continue soaring in the future with collaboration from other DeFi protocols. As the DeFi industry matures, 1inch is expected to play a leading role and could be worth over $27.12 by 2032. The staking program will also attract more investors in the coming years.

Remember that your pick should depend on your risk tolerance, market expertise, portfolio spread, and how comfortable you are with losing money. Always keep in mind that cryptocurrencies are very volatile investments, and previous performance is no guarantee of future outcomes. Never put more money into something than you can afford to lose.

Defi projects like 1inch are also prone to attacks by bad actors who take advantage of vulnerabilities in the system. 1inch crypto analysis and prediction are not investment advice.

cryptopolitan.com

cryptopolitan.com