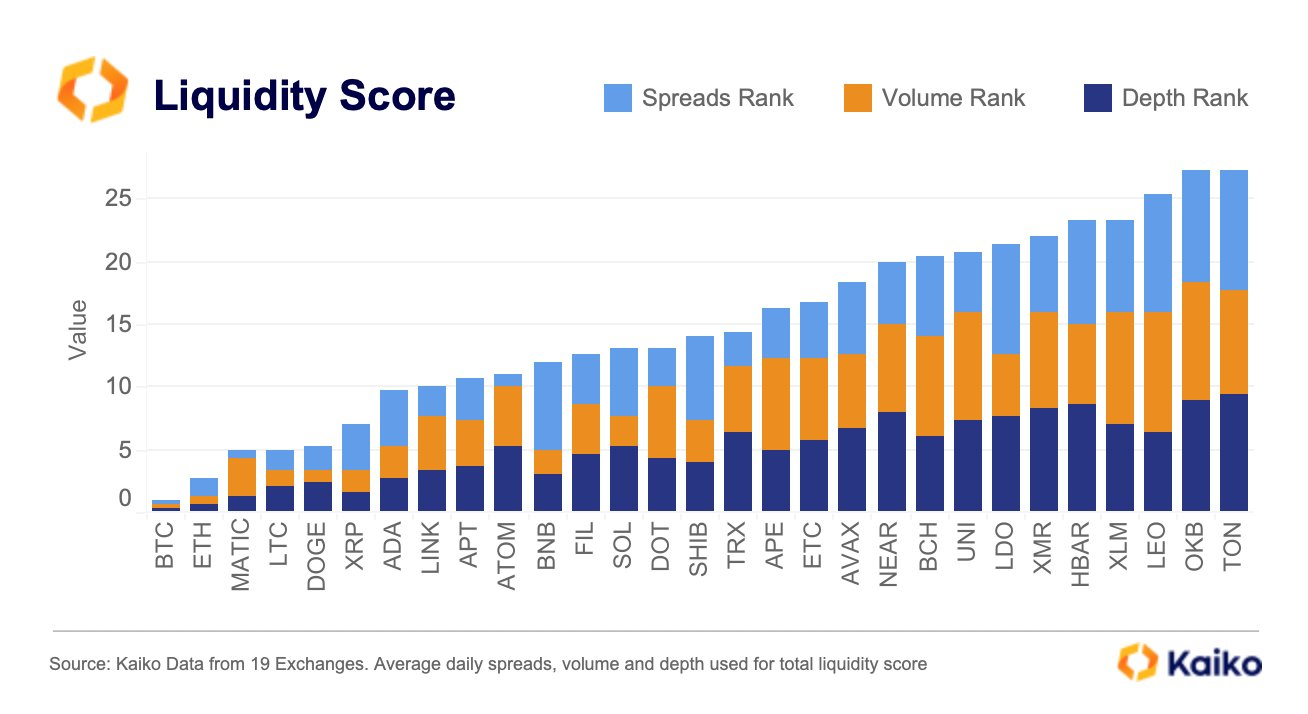

Kaiko Data’s Research Analyst Conor Ryder has released a report on the liquidity of the top 30 tokens in the cryptocurrency market. Using market depth, volumes, and spreads, Ryder ranked each token to arrive at an overall asset liquidity score.

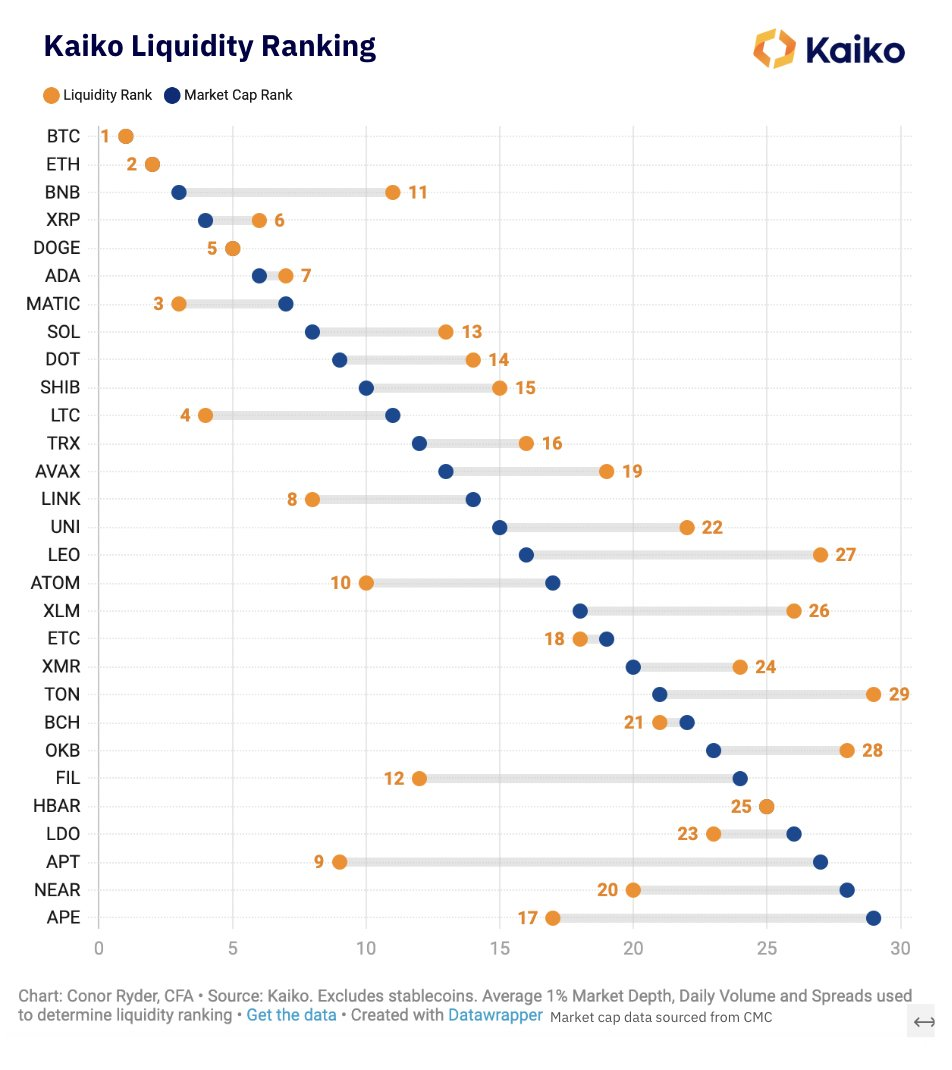

The results of the study, which Ryder shared in a thread on Twitter, showed which tokens have the most misleading market cap when compared to their liquidity score. Relying solely on market cap to evaluate cryptocurrency can be harmful as it fails to take into account factors like token lockup periods and insider-held supplies, which can result in inaccurate assessments and investment decisions. This information can empower investors to make informed decisions about their cryptocurrency investments.

I ranked the top 30 tokens in crypto by liquidity using:

— Conor Ryder (@ConorRyder) April 11, 2023

1. Market Depth

2. Volumes

3. Spreads

Using those ranks I arrived at an overall asset liquidity score, which can then be compared to its market cap to find most misleading tokens ✍️

Results in a short 🧵 below pic.twitter.com/PNVVK7LmGN

According to Ryder’s study, Dogecoin (DOGE) and Litecoin (LTC) were among the standouts in the volumes category, while Polkadot (DOT) did not perform as well. Meanwhile, Solana (SOL) and Binance Coin (BNB) were among the standouts for market depth, with Binance Coin falling short in this category.

Moreover, Polygon (MATIC) and Cosmos (ATOM) were among the standouts in the bid spreads category, indicating a high level of liquidity. However, Solana (SOL) did not perform as well in this category.

According to the report, Cosmos (ATOM) saw a significant improvement in liquidity, moving up five spots in the rankings. Additionally, both Filecoin (FIL) and Litecoin (LTC) experienced improvements in liquidity, although Ryder suspects wash trading may have played a role in these changes.

On the other hand, Binance Coin (BNB) saw a significant decline in liquidity, moving down six spots in the rankings. Tron (TRX) also saw a decline, moving down three spots in the rankings.

Additionally, the report highlights several examples, including Binance Coin (BNB), which is less liquid than its market cap rank suggests, and Polygon (MATIC), which is more liquid than its market cap rank suggests. In addition, Solana (SOL), Polkadot (DOT), and Shiba Inu (SHIB) are less liquid than their market cap ranks suggest, while Alpha Token (APT) is more liquid.

On the other hand, Kaiko also recently reported that over the past four weeks, XRP has surged by almost 40%, outperforming other leading digital assets like Bitcoin, primarily due to the contribution of retail investors.

coinedition.com

coinedition.com