Injective protocol (INJ) hit $6.23 on April 11 to stretch its 2023 growth to 400%. With near euphoric social sentiment and a large cluster of holders approaching the break-even point, is INJ due for a price correction?

Injective is an EVM-compatible Layer 1 blockchain network built on the Cosmos ecosystem. INJ’s recent price pump has been partly linked to its acquisition of new network participants. Since the start of the year, the network has attracted several new projects that leverage its decentralized bridges, oracles, and composable smart contract layer to build DeFi applications.

However, on-chain data shows how the rise in Social Volume and historical Market-Value-to-Realized-Value (MVRV) patterns could soon trigger INJ price correction.

Impending Injective Protocol (INJ) Sell-Off Ahead

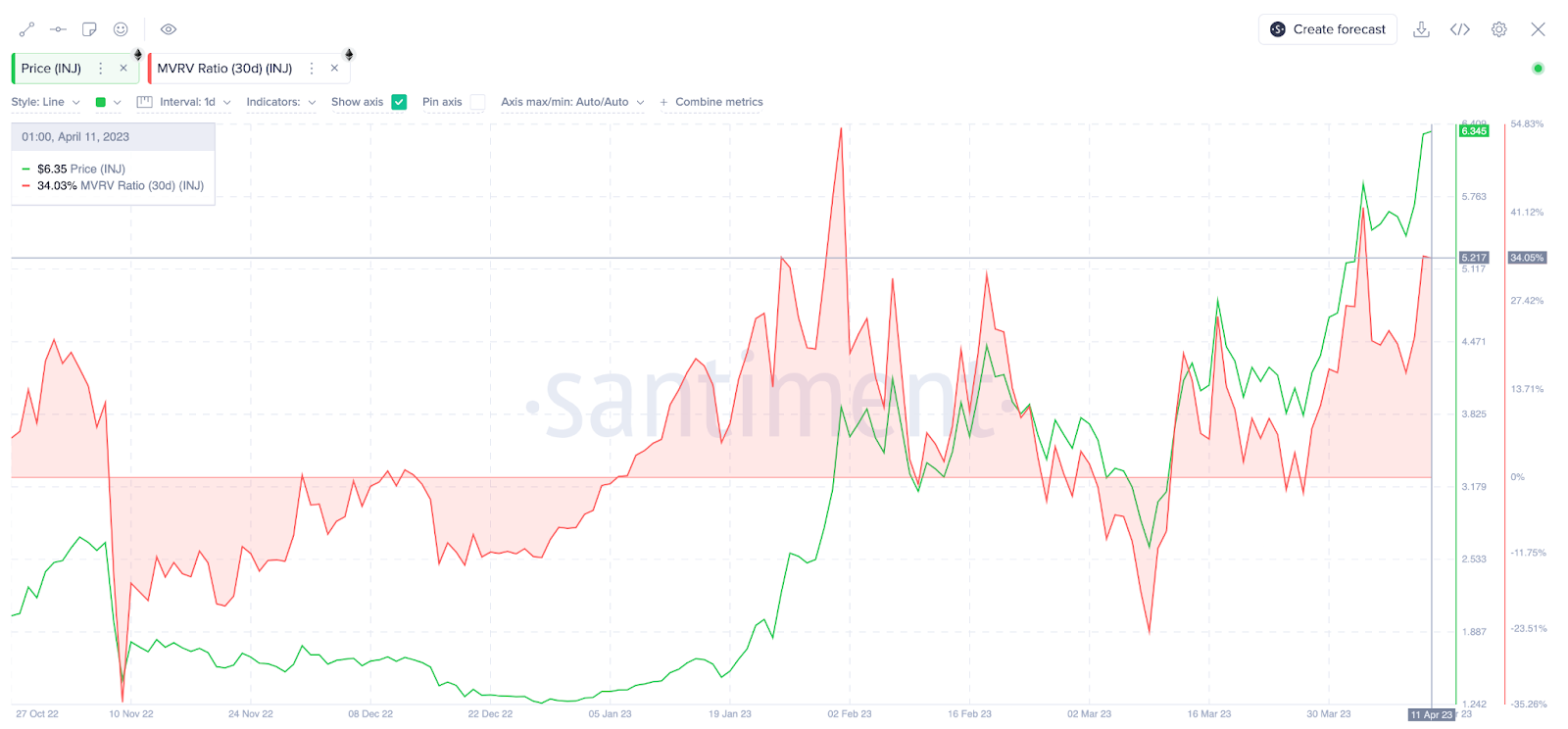

INJ continues its strong 2023 performance, hitting another year-to-date high of $6.30 on April 11. However, the Market Value to Realized Value data compiled by Santiment shows that INJ could experience a price correction. The MVRV determines potential buy/sell zones by comparing the average price at which an asset was acquired by its holders to its current market value.

The chart below shows that the MVRV could soon reach a critical sell zone. Currently, most INJ holders that bought in the last 30 days are sitting on profits of about 34%. The historical MVRV data shows holders will likely book profits around the 42% zone. This means that once prices approach the $6.9 zone, INJ could experience a retracement.

MVRV data provides insights on market sentiment swings to identify potential buying or selling opportunities. And with a significant sell zone approaching, Injective holders could soon begin to grow pessimistic.

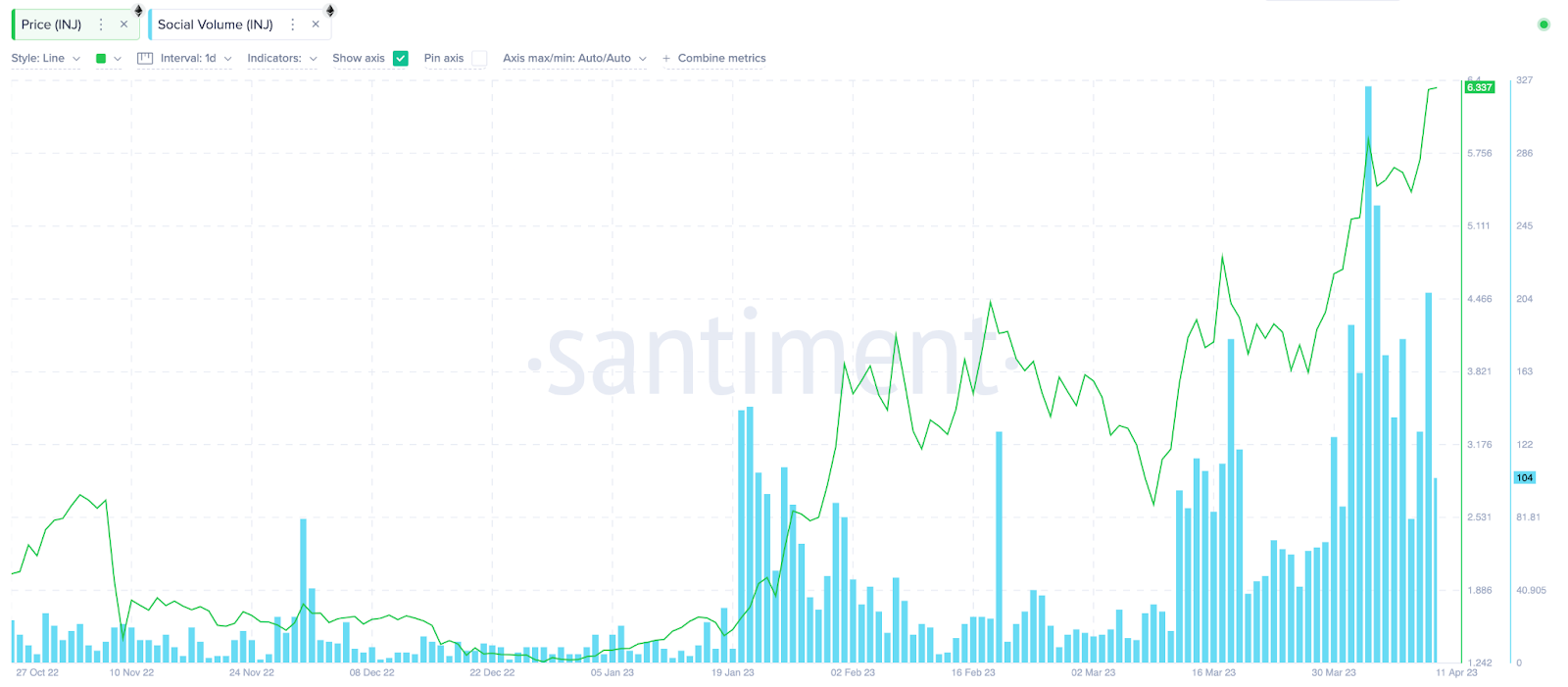

Similarly, the spike Social volume of INJ is another key metric that validates the bearish premise. Injective has attracted considerable media attention due to its remarkable 2023 performance and several Airdrops from its native DeFi projects.

According to the Santiment chart below, the total mentions of the INJ project across crypto social media platforms have spiked more than 1,000% in the past month.

Between March 11 and April 11, Injective protocol Social volume increased from 18 to 208 while making several local highs in the first week of April.

Historically, sudden spikes in Social volume have often been followed by periods of INJ price correction. If the trend repeats, then Injective Protocol holders could expect a price drop in the coming weeks.

INJ Price Prediction: $5.42 Retest Incoming

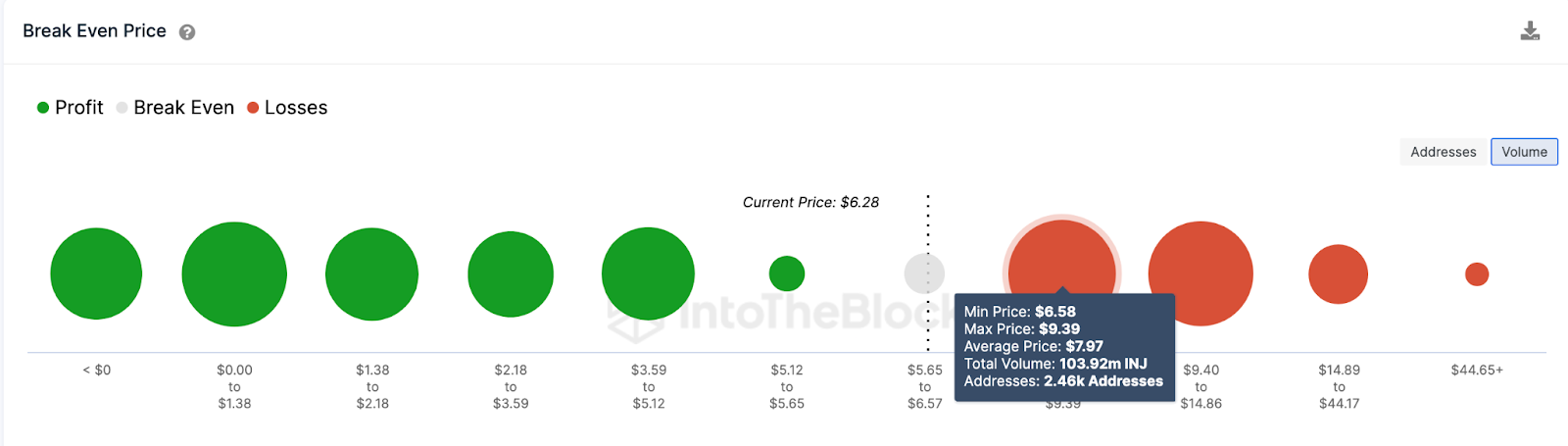

According to IntoTheBlock, the price distribution data on coins held in INJ wallet addresses show that a cluster of over 100 million holders could soon break even.

Typically, when the market value of an asset rises toward the break-even price of a significant number of holders, they may be more inclined to sell and take profits. This selling pressure could create resistance and inadvertently knock back the price.

As shown below, investors controlling the 2,460 break-even addresses holding 104 million coins could start selling once INJ price marginally surpasses the $6.58 minimum price. However, the 1,300 addresses that bought INJ at an average price of $5.42 can offer support buy-pressure to ward off losses.

Still, the bulls could forge ahead with the rally if INJ manages to scale the $6.58 resistance. But it will face an uphill battle against the 104 million INJ that could hit the market when 2,460 addresses break even.

A break beyond that zone could see the Injective protocol native coin reach a 2-year high above $9.40.

beincrypto.com

beincrypto.com