Bitcoin’s price dip below $28,000 seems to be short-lived as the asset has spiked back above that level and even tapped $28,500 hours ago.

The altcoins are also slightly in the green. LDO has recovered some of yesterday’s losses, while STX has soared the most.

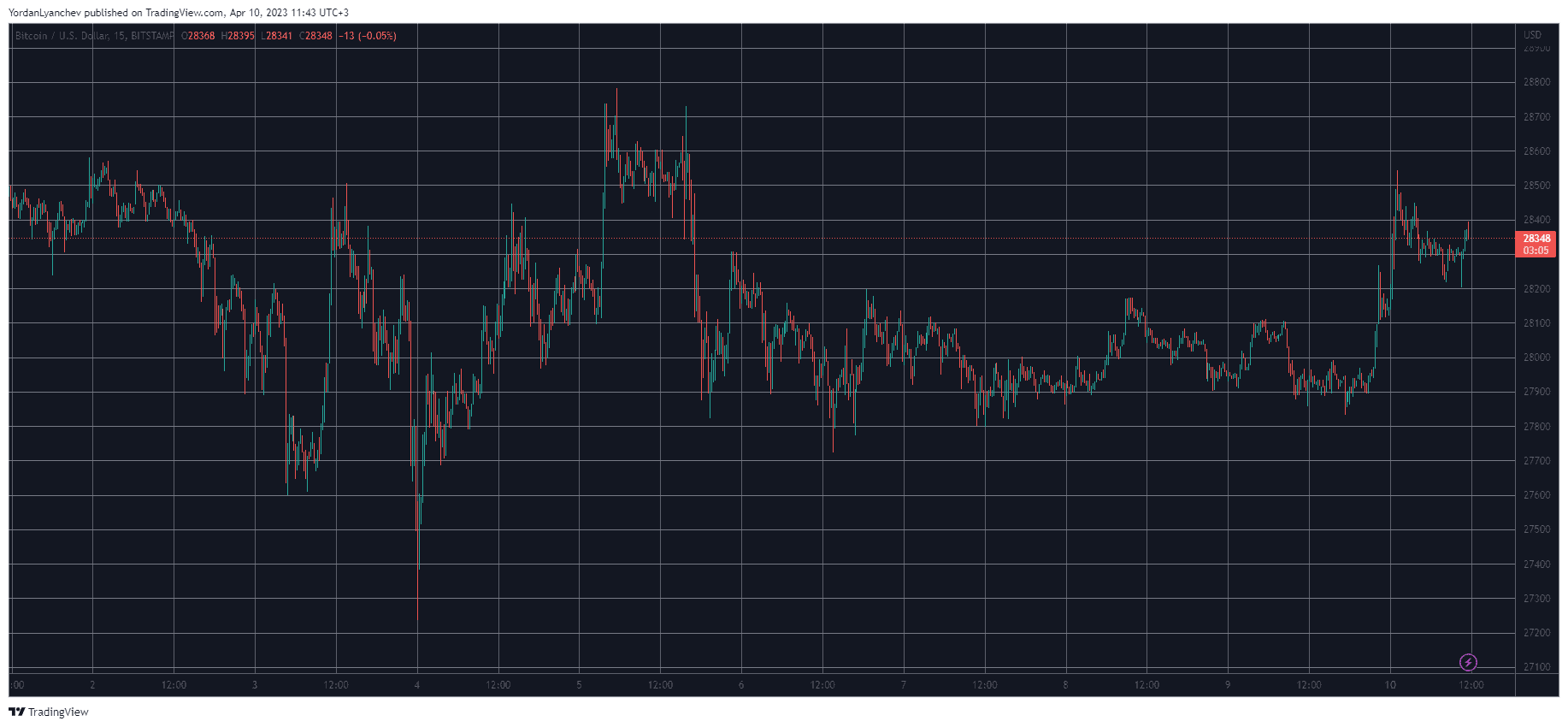

BTC Returns Above $28K

After the massive volatility last Monday, which brought BTC south by over a grand on fake news surrounding Binance’s CEO, the cryptocurrency performed slightly better and calmer in the following days.

The weekly peak came on Wednesday when bitcoin spiked to just under $29,000. However, the bears intercepted the move and pushed the asset south. As such, BTC returned to around $28,000 and spent most of the next several days around that line.

The weekend was calmer, with bitcoin sitting in a tight range between $27,800 and $28,200. The latest dip to the former came yesterday. Nevertheless, BTC initiated a notable leg-up in the following hours, resulting in a brief jump to over $28,500.

Despite losing a few hundred dollars since then, the cryptocurrency still trades above $28,000. Its market cap has neared $550 billion once more, and its dominance over the alts is again at just over 46%.

STX Jumps 7%

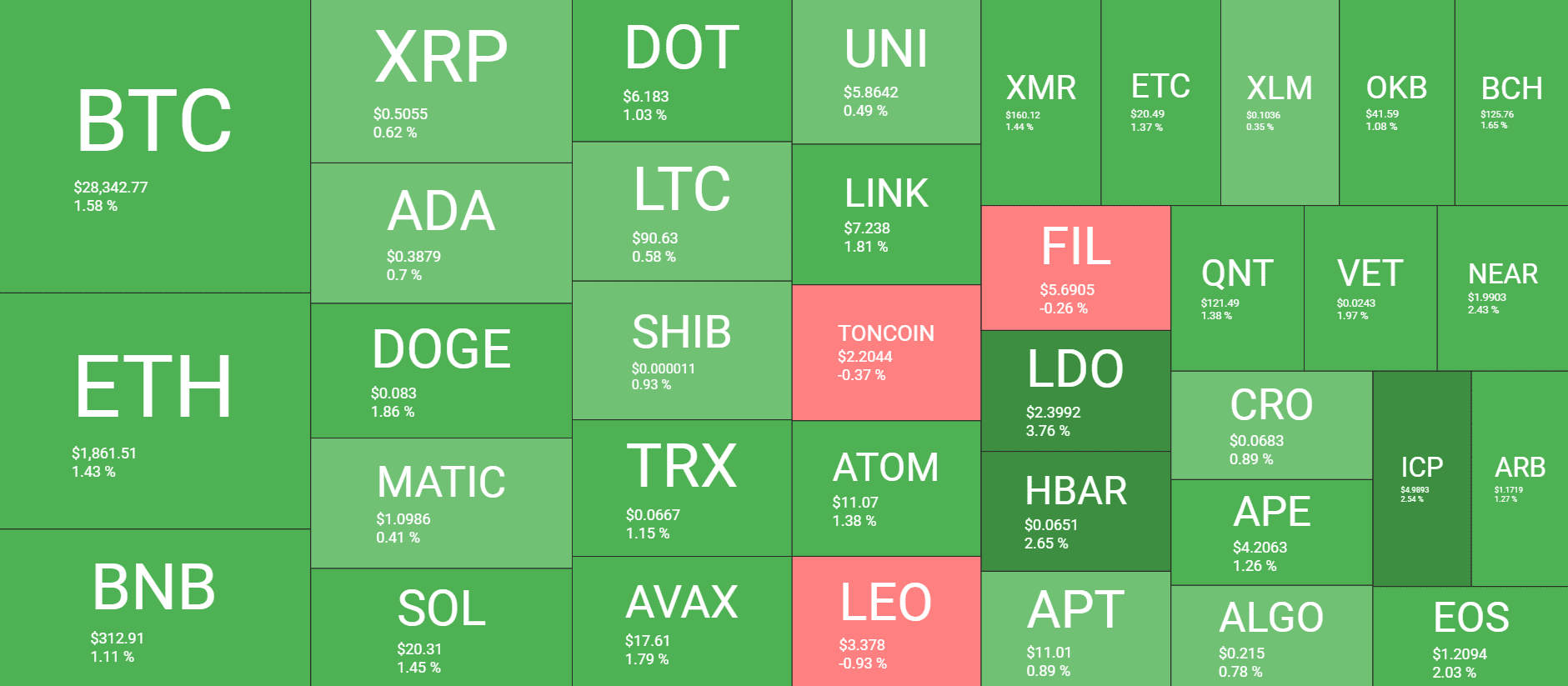

Most altcoins were slightly in the red yesterday, but the landscape is exactly the opposite today, with minor gains. Ethereum is 1.5% up on the day and trades at $1,860. The second-largest cryptocurrency registered its highest price tag in eight months last week at over $1,950.

Binance Coin (1.1%) sits above $310. Ripple, Cardano, Dogecoin, MATIC, Solana, Polkadot, Litecoin, Shiba Inu, Tron, and Avalanche have all posted similar gains now.

LDO, one of the poorest performers yesterday, has recovered some ground and sits at $2.4 after a 3.5% increase today.

Stacks’ native token has gained the most today, with a substantial 7% increase. As a result, STX now trades at $0.85. It’s worth noting, though, that STX went well beyond $1 during the hype around the Ordinals NFTs.

The total crypto market cap has erased yesterday’s losses and stands at $1.185 trillion once again.

cryptopotato.com

cryptopotato.com