THORChain Price Prediction 2023-2032

- THORChain Price Prediction 2023 – up to $2.43

- THORChain Price Prediction 2026 – up to $4.75

- THORChain Price Prediction 2029 – up to $14.23

- THORChain Price Prediction 2032 – up to $40.12

THORChain is a decentralized exchange allowing cross-chain token swaps. Current chaos involving certain major exchanges is threatening to keep hope in the deep freezer for the crypto market. This THORChain price prediction, however, adds some spark with many foods for thought, for instance, THORChain is a fundamental innovation for #Bitcoin, creating the most trust-minimized way to buy and sell $BTC for other digital assets or stablecoins On-chain, verifiable. The way it was. Wrapped $BTC doesn’t suffice.

Simple to use, 3 years of hard work until 2021 to make it real, and safe. And in the top 5% of Security Scores.

Despite the 2021 hacking incidents, the THORChain project has the strength to become the next biggest DeFi project. The market cap is midsize, but it could eclipse Uniswap since it does the same thing but is significantly better. Imagine Uniswap and Pancakeswap combined into one. But, you can stake your $RUNE in a liquidity pool to earn interest and get a chunk of the fees.

How much is $RUNE worth?

Today’s THORChain price is $1.60 with a 24-hour trading volume of $29,139,114. THORChain is up 2.83% in the last 24 hours. The current CoinMarketCap ranking is #84, with a live market cap of $522,454,662. It has a circulating supply of 327,056,566 $RUNE coins and a max. supply of 500,000,000 $RUNE coins.

Let’s see the nitty-gritty of an overview of the $RUNE coin, price history, and technical analysis before we get into the long-term commentary on THORChain price predictions.

History of THORChain

The THORChain foundation was developed in 2018 to assume that using centralized exchanges to move cryptocurrencies across blockchains was problematic. Long-term solutions included non-custodial exchanges often referred to as decentralized exchanges (DEXs ).

As a result, the THORChain crew sought to create an independent blockchain capable of bridging to other networks and thus facilitating cross-chain transactions akin to a DEX. Finding adequate liquidity is a common issue for DEXs.

Traders choose platforms where they would not lose money owing to slippage. However, these particular traders supply adequate liquidity to avoid disruption. As a result, the THORChain crew intends to use a modified Bancor’s native token to establish Continuous Liquidity Pools ( CLPs ). These collections of accessible assets provide traders with liquidity without any need to locate or engage another trader.

THORChain additionally compensates users that contribute tokens to a liquidity supply with $RUNE token (the network’s native token). At about the same period, token owners may bet their coins and receive the fees collected from other pool members. Because THORChain is a Tendermint – based chain, its consensus method is Tendermint BFT (Byzantine Fault Tolerance). Proof-of-the Stake ( PoS ) can also be used for Sybil resistance.

A network of verifiers may stake $RUNE coins as a portion of the PoS feature to operate network nodes and authentication. Coin owners may submit to these validators in THORChain; this makes verifiers check and enables delegators to get a part of every block bonus. The project intends to deploy its mainnet sometime around 2021. It has also created an AMM called BEPSwap on the Binance Chain.

Today’s live THORChain price is $2.01, with a 24-hour trading volume of $61,801,264 USD. THORChain is up 0.11% in the last 24 hours. The current CoinMarketCap ranking is #67, with a live market cap of $664,742,340. It has a circulating supply of 330,688,061 $RUNE coins and a max. supply of 500,000,000 $RUNE coins.

What is THORChain ($RUNE)?

The Cosmos SDK was employed to create THORChain, which is backed by the Tendermint consensus mechanism. THORChain coins are now accessible on multiple blockchains, like Binance Chain and $ETH.

$RUNE, a native token of the THORChain platform, has responded to continuous investor demand. The digital roadmap built out by the THORChain protocol for its subscribers has given investors more power, increasing the liquidity possibilities.

THORChain is a decentralized liquidity system that allows users to quickly trade digital assets over various networks while maintaining complete custody of the assets. Furthermore, using THORChain, crypto users may easily exchange one coin for the other without depending on balance sheets to generate liquidity. Relatively, market values are preserved by the asset ratio in a supply.

Furthermore, $RUNE is the THORChain platform’s native utility coin. It is, nevertheless, used as the foundation currency within the THORChain ecosystem. As a section of THOChain’s resistance approach, the platform is used for governance and safety. The explanation is that the THORChain node must execute a minimum of 1 million $RUNE and the opportunity to participate in its revolving consensus process.

THORChain is financed via an initial DEX offering ( IDO ), released on the Binance DEX (BDEX) in July 2019. Furthermore, its mainnet was supposed to launch in Jan 2021, although a multi-chain redesign is now planned for 2021.

Features of the THORChain network

- THORChain technology

THORChain employs various fundamental technologies to guarantee that the framework operates as intended: Tendermint Pools of Constant Liquidity ( CLPs ) and The Bifröst Protocol The Protocol of Yggdrasil Tendermint. The THORChain chain is a Tendermint – based chain that uses the same design and consensus mechanism as the Cosmos platform.

In other words, THORChain technology uses the native $RUNE token to secure the network via the Cosmos Tendermint Proof-of-Stake (PoS) consensus mechanism. Moreover, the project provides a suite of decentralized exchanges (DEXs) that facilitate cross-chain token swaps. These include SKIP Exchange, BEPSwap, ASGARDEX, and THORSwap.

Tendermint uses its BFT (Byzantine Fault Tolerance) consensus method based on synchronicity. As a result, THORChain, like Cosmos, limits the number of verifiers (100 at first) required to achieve finality for every proposed block. Tendmint also enables a Proof – of- Stake consensus method since every Validator is assigned a burden on the network based on the stakes they possess.

- Benefits for investors

Since THORChain guarantees that all financial information is anonymous, it is the primary advantage of THORChain. Traders who have backed the THORChain cryptocurrency network rely on its several features, and there is no danger of censorship when it comes to adopting THORChain. This skill set is an excellent reason to stick around as ardent supporters.

THORChain possesses dynamic blocks of deserving scientists and engineers, which also include core developers. It also has a well-regarded protocol that enables owners to manage their money without the assistance of a third party or mediator and with no additional fees or costs.

THORChain eliminates unnecessary expenses while providing the benefit of faster transaction speeds. This coveted digital currency offers users the advantage of stable money created in June 2019. The maximum supply is one feature of THORChain, in which the benefits of $ETH ERC – 20 tokens are wrapped at no escalating cost.

- Supply curve specifications

The total supply of $RUNE coins was one billion in 2019. Nevertheless, in October 2019, the network chose to burn all of the “utilized reserves” of the original maximum supply.

The decrease in supply did not affect the tokens that had already been issued to Presale, and IDO, which, when coupled with the coins burnt via Project Surtr, equaled 50% as follows:

- Service nodes and source liquidity bonus

220, 447, 472 $RUNE (originally 500 million) in continuing emissions via validator awards and liquidity pool monthly over 40 months (3.5 years) from first distribution. Coins fromIDO ) clients. The initial and post-burn quantities, and their distribution schedules, are allocated supply incentives.

- Operation reserves

Sixty-five million (initially 130 million) that vest any of this pool may also be used by THORChain over 2.5 years via the RUNEVault reward scheme and airdrop events.

- Team & Advisors

Fifty million ( at first 100 million ) were frozen until manner initially 60 million ), 4 million of which were for OTC purchases to partnerships. Community reserves ( RUNEVault ): 60 million ( at first 120 million ) released debut and then distributed in 20 % batches every three months.

- Seed investors

Thirty million (dispersed immediately). The remaining coins will be frozen until the mainnet’s launch, after which they will be millions. When the pool was distributed, half of it was released to offer adequate liquidity on the BDEX. The remaining half became available and distributed in 20% increments every three months.

- Models

As a section of its staking incentives scheme, RUNEVault releases two million $RUNE coins depleted, making the RUNEVault initiative function for about 2 . 5 years after with civic engagement to minimize reserve emission. Monthly payments will be made to service nodes and liquidity dropships based on the block bonuses computation shown below . 2 / 3 the remainder of its debut.

It should be noted that THORChain may reconsider this approach in the future when this block bonus is distributed to service nodes ( also known as validators ), with moving to liquidity incentives.

Block rewards will be given out until the bucket’s supply of 220, 447, 472 $RUNE 2019, THORChain launched Project Sutr, which seeks to burn any excess $RUNE from the foreign coin reserves. Every month on the 20th is depleted.

- ( max supply – circulating supply )/ ( 6 * 12 ) = block rewards per month according to the Surtr Project ( The $RUNE burn program )

In August, the team sought community feedback to decide if unallocated $RUNE should be destroyed. Because the overall amount burnt each month is uncertain, the Liquid Supply Curve doesn’t fully reflect tokens withdrawn via the burn program.

THORChain Fundamental Analysis

According to sources, THORChain does not have an inventor, CEO, or board. Gitlab will be in charge of the policy interventions. According to the THORChain Twitter account, self-organized inventors work via Gitlab and figure out what to create.

The THORChain framework was first financed via an initial DEX offering (IDO), which debuted alongside the Binance DEX in 2019. Its mainnet went live in the first quarter of 2021, although a multi-chain upgrade is scheduled for 2021.

The BiFrost Protocol (BFT) allows chain interconnection. Interconnection is the foundation of the ecosystem; without it, the whole ecosystem would collapse. BFT validates the system and safety while preventing double-spending and some other harmful behavior. THORChain uses the Yggdrasil protocol to address blockchain scalability problems. As the governance coin, the Aesir protocol provides an inexpensive on-chain governance framework.

THORChain’s mainnet was announced to be available in 2020. They created the beta for BEPSwap, thus discontinuing the previous RUNEVault software. The mainnet is a crucial objective for 2021. The crew intends to add additional chains to BEPSwap in the future and provide native apps that will enable validators to fill connections to other chains once requested by the community.

Generally, THORChain has a promising future. With the continuing advancements in the $RUNE community and the broader cryptocurrency market, we may see $RUNE continue to flourish and break new ATH. The bullish $RUNE price forecast system for 2021 is predicted to hit a maximum price of $19.4. As previously said, it might hit a new all-time high if investors believe $RUNE, along with popular coins, is a suitable investment in 2021.

Every DEX has liquidity pools, but Thorchain operates a bit differently. Rune is a required partner in LP and Thorchain’s lifeline, causing guaranteed demand if/when/as the platform scales.

Multiple benefits from the Asgardex feature:

- Providers will need to stake Rune with their coin of choice as liquidity grows within the network. The yield is currently incredibly attractive, at over 60% APY.

- Assuming we are entering a bull market phase, a general rise in market values will pull Rune up with them. This is a great side effect of how liquidity pools work.

- Node Operators who secure the network need to bond Rune to the network, further increasing demand in a competitive battlefield in which node operators have quite literally to raise their stake to stay in the game.

The THORChain exchange is reportedly working hard to prevent such attacks in the future. Multiple blockchain security companies checked THORChain to locate bugs in a given network. Changes were being made to the THORChain protocol to make it more impervious to attacks and be able to react quickly to save funds.

ThorChain Technical Analysis

THORChain ($RUNE) has recently experienced a surge in its price, surpassing its monthly resistance level ahead of the much-anticipated Ethereum Shanghai upgrade launch hype. This surge in the cost of $RUNE has created excitement in the cryptocurrency community, with many investors and traders keeping a close eye on the token’s performance. The upcoming Ethereum Shanghai upgrade launch has been a hot topic in the cryptocurrency industry, and it is anticipated to have a significant impact on the market. In anticipation of the Ethereum Shanghai upgrade launch, THORChain ($RUNE) has witnessed an immense surge in demand and investor interest, resulting in a spike in buying pressure in recent days. Hence, it is important for investors to go through a detailed technical analysis to make a profitable investment decision for the $RUNE token.

CoinMarketCap reports that the current price of THORChain is at $1.65, showing a bullish trend of over 5% from yesterday’s price. Our technical analysis of the $RUNE token suggests that this cryptocurrency may soon witness massive surges as it surges above the range-bound area, resulting in it pushing to new highs as it continues to break critical resistance levels in line with the overall bearish trend in the altcoin market. Looking at the daily price chart, THORChain has recently broken above its monthly resistance level of $1.47, achieving new highs this week. After forming a low near $1.3, the $RUNE token formed strong support and continued to make an effort to surge above the 23.6% Fib level. As the EMA-50 trend line’s upward trajectory is bringing confidence to market bears, altcoin traders have switched their attention to the $RUNE Token. The Balance of Power (BoP) indicator is trading in a highly bullish region of 0.86, suggesting that an extended bullish rally is on the horizon if the $RUNE token breaks more of its crucial price hurdles.

To get a more detailed price analysis of the THORChain token, the RSI-14 indicator is necessary to take a look. The indicator has significantly surged above its midline and is trading in a strong bullish territory at the 63-level. It is expected that THORChain will soon make an attempt to break its 38.6% Fib level to accomplish its short-term bullish goals. If $RUNE fails to test its resistance, a downtrend is anticipated. However, the SMA-14 continues to surge, aiming to surpass the RSI line in the next few days, which may accelerate the token’s uptrend in the price chart. If the THORChain coin breaks above its resistance of $1.6, it may pave a smooth road to its EMA-200 resistance of $1.8, and if it manages to break its strong resistance of $2, the token may attempt to surge higher to its Bollinger band’s upper limit. On the other hand, if $RUNE drops below the crucial support level of $1.2, a severe bearish rally is expected, which may bring more price drops for the $RUNE token and force it to trade near its Bollinger band’s lower limit of $1.1. If THORChain’s price fails to hold above $1, it may witness a collapse.

THORChain Price Prediction by Cryptopolitan

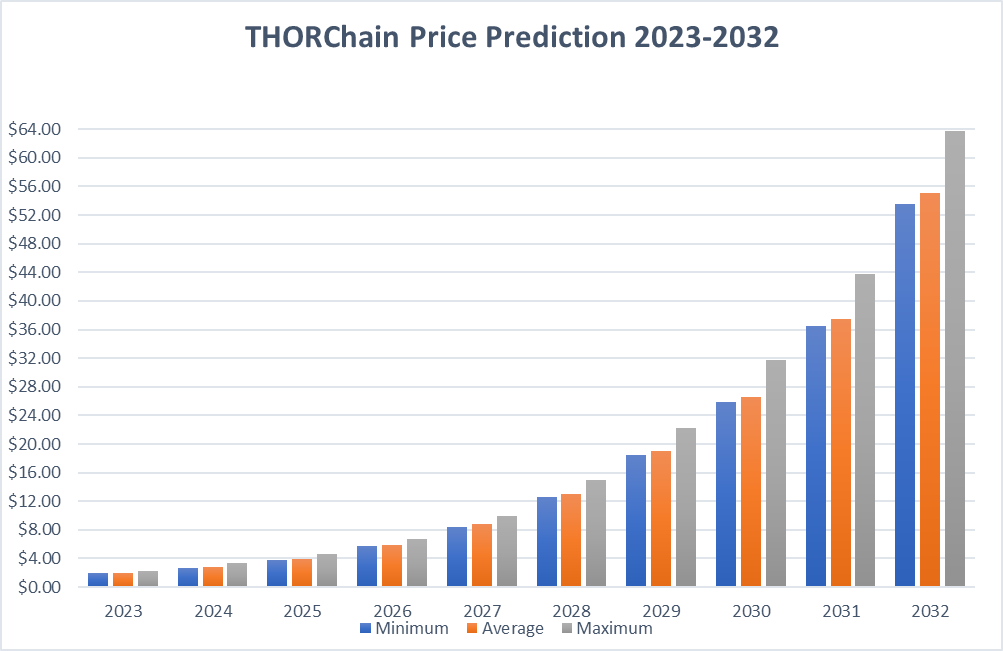

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2023 | 1.92 | 1.98 | 2.22 |

| 2024 | 2.67 | 2.77 | 3.31 |

| 2025 | 3.85 | 3.99 | 4.66 |

| 2026 | 5.69 | 5.85 | 6.66 |

| 2027 | 8.45 | 8.75 | 10 |

| 2028 | 12.65 | 13.08 | 14.95 |

| 2029 | 18.49 | 19.01 | 22.28 |

| 2030 | 25.81 | 26.57 | 31.72 |

| 2031 | 36.44 | 37.5 | 43.78 |

| 2032 | 53.52 | 55.02 | 63.72 |

THORChain Price Prediction 2023

In 2023, it is expected that the price of THORChain cryptocurrency will reach the highest price level of $2.22, with an average trading price of $1.98. THORChain’s price may go as low as $1.92.

THORChain Price Prediction 2024

An astronomical THORChain price increase is anticipated as $RUNE may skyrocket in the near future as it is projected to touch a maximum price of $3.31. According to our technical analysis, THORChain price might consolidate and record a low of $2.67, with an average trading price of $2.77.

THORChain Price Prediction 2025

In 2025, it is expected that the maximum trading price of 1 $RUNE token will be equivalent to $4.66. The average $RUNE token price is expected to be around $3.99 in 2025. THORChain price can touch the bottom at $3.85.

THORChain Price Prediction 2026

The THORChain protocol and its fundamentals are excellent, which can bring a high of $6.66, with an average price of $5.85. It is anticipated that the THORChain price will trade at a minimum level of $5.69.

THORChain Price Prediction 2027

THORChain may experience a bull market and stretch its bullish momentum, as it is projected to touch a maximum price of $10.00, with an average trading price of $8.75. THORChain may record as low as $8.45 by the end of 2027.

THORChain Price Prediction 2028

In 2028, $RUNE token holders may generate a lucrative ROI as the price of THORChain is expected to reach a maximum price level of $14.95, with an average trading price of $13.08. Our technical analysis reveals that THORChain may reach a minimum price of $12.65.

THORChain Price Prediction 2029

Our $RUNE price prediction states that THORChain’s price is anticipated to hit a maximum price of $22.28. The average price of THORChain is predicted to be $19.01, with a minimum price of $18.49.

THORChain ($RUNE) Price Prediction 2030

In 2030, it is expected that the $RUNE token price may witness a massive price rise as its maximum value may be around $31.72, with an average trading price of $26.57. THORChain may touch a minimum value of $25.81 if it retraces downward.

THORChain Price Prediction 2031

The price trend of THORChain may bring a wave to portfolios as the $RUNE token has bright promises ahead. The price of THORChain is projected to reach a maximum value of $43.78, with an average forecast price of $37.50. The minimum trading price of THORChain is predicted to be $36.44 by the end of 2031.

THORChain Price Prediction 2032

In 2032, the $RUNE token may witness a huge demand from investors as the developing team is poised to bring more enhancements to the network. Our price projections for the $RUNE token expect it to trade at an average value of $55.02, with the potential of reaching a maximum of $63.72 and a minimum of $53.52.

THORChain Price Prediction By DigitalCoinPrice

As $RUNE’s price is showing impressive gains, it has attracted industry experts’ attention to predict its future price trends. DigitalCoinPrice gives a bullish analysis for THORChain as the token may add significant value in the future. According to the website, the price of $RUNE will surpass the $3.88 threshold in 2024, while THORChain is projected to achieve a minimum fee of $3.46 by the end of the year. Furthermore, the $RUNE price has the potential to reach a maximum of $3.93.

In 2032, it is predicted that the price of $RUNE will exceed $31.06, while THORChain is projected to attain a minimum value of $30.80 by year-end. Moreover, the $RUNE price has the potential to reach a maximum level of $31.79.

THORChain Price Prediction By CryptoPredictions.com

CryptoPredictions.com’s upcoming $RUNE price predictions are optimistic as the website expects the THORChain to surge significantly in the next few years. The website forecasts that THORChain will commence in May 2023 at a price of $1.455 and end the month at $1.773. The anticipated highest $RUNE price during May is $2.097, while the projected minimum price is $1.426.

In 2027, the price of the $RUNE token may reach an average trading level of $2.13. However, the token may record the lowest possible price of $1.81, with a maximum price of $2.66.

THORChain Price Prediction By Wallet Investor

Despite bullish fundamentals and price trends in the $RUNE price chart, Wallet Investor weighs in a bearish future trend for the THORChain forecast. They predict the $RUNE token to reach an average price value of $0.222, with the potential of reaching a minimum level of $0.111 and a maximum level of $0.333.

By the end of 2027, $RUNE’s price may attain an average trading level of $0.112, with a minimum price of $0.0558 and a maximum price of $0.167.

THORChain Price Prediction by Industry Influencers

THORChain ($RUNE) has shown impressive growth potential in the past few days. The decentralized liquidity network has the potential to revolutionize the way cryptocurrencies are exchanged and traded, enabling users to easily and securely swap tokens across different blockchains. In addition to its technology, THORChain has also gained attention due to its strong community support and active development team.

According to the latest price predictions, $RUNE is expected to see significant growth in the coming months and years. Many crypto experts predict that the token’s price will reach new highs due to its growing adoption and innovative technology. In the long term, $RUNE is expected to see significant growth, with some experts predicting that the token’s price could reach as high as $50 by the end of 2025.

Conclusion

The cryptocurrency sector is all set to follow the trails of the THORChain network to bring a revolutionary wave to the space, as $RUNE’s fundamentals are based on reliability and provide complete transparency on liquidity and infrastructure. Being a DeFi project, THORChain provides lightning-speed cross-chain liquidity to ease the transaction process of the crypto network.

THORChain is a multi-chain project that is being further advanced to an extent network level as the developing team is ambitious toward fulfilling the project’s goal. It is anticipated that THORChain may rebound to new highs following the current market sentiments and end its prolonged bearish trend. However, Crytopolitan advises investors to do their own research and conduct strategic investment plans from experts’ opinions before investing in the volatile market.

cryptopolitan.com

cryptopolitan.com