To keep up with the most important updates in crypto, we have compiled a list of 5 altcoins, that you should keep tabs on in the following days.

So, without further ado, let’s get into it.

Ethereum

Recently, the price of $ETH had briefly surged to $1,900, a level not seen since August 2022. Recent on-chain data indicates that large investors have been buying up Ethereum in preparation for the Shappela network upgrade.

As the global Ethereum community eagerly anticipates the upcoming Shappela upgrade scheduled for April 12, major investors are taking advantage of negative social sentiment to accumulate more $ETH and potentially profit from an expected price increase.

Despite reaching an 8-month high, Ethereum’s overall social sentiment has remained pessimistic, with some predicting a crash in the price of $ETH when 13 million $ETH are unstaked after the ETH2.0 transition on April 12 is complete.

According to IntoTheBlock’s Global In/Out of Money chart, there is potential for Ethereum’s price to surpass $2,000 soon.

Currently, $ETH is valued at $1,860 after a 4% increase within the past 7 days and has a volume of almost $6.2 billion. The altcoin’s market cap is around $224 billion.

The summary on the 1-day TA from TradingView points to “buy” at 11, while the moving averages suggest “strong buy” at 111. Oscillators show “sell” at 9.

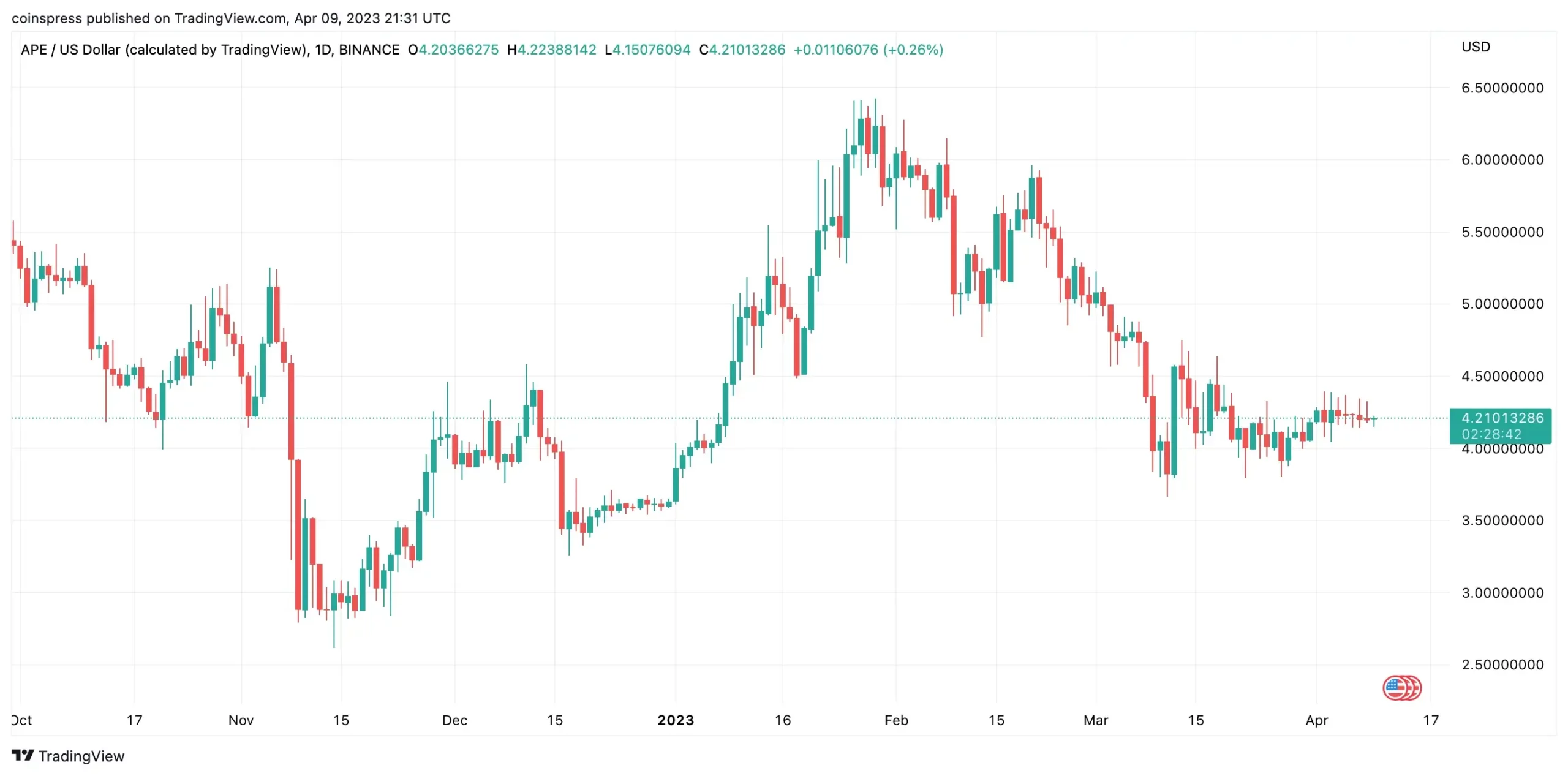

ApeCoin

The $APE ecosystem is supported by ApeCoin ($APE), a governance and utility token designed to empower its community. The ecosystem is built on the foundation of the Bored Ape Yacht Club (BAYC), a widely popular NFT collection consisting of 10,000 distinct cartoon ape images.

ApeCoin ($APE), an altcoin based on Ethereum, has been identified by analytics firm Santiment as a potential candidate for a significant value increase. Santiment’s report highlights $APE’s on-chain signal, which resembles that of Stargate Finance (STG), which saw a 50% rally in the previous month.Santiment believes that $APE’s network activity could be a sign of an impending value surge. According to the report, token holders have increased their balances, indicating that retail investors are becoming more involved.

Despite this positive development, Santiment cautions that the signal does not necessarily guarantee a price rally. The report suggests that if the market trend reverses, $APE’s price could rise, given the growing network activity and retail investor participation.

$APE is trading at $4.21 with no significant price movements in the past 24 hours and has a volume of around $48 million. $APE stands at a $1.55 billion market cap.

The summary and the oscillators from the 1-day TA stand at “neutral” at 9 and 8, respectively, while the moving averages are showing “sell” with 9 signals.

EOS

EOS.IO (EOS) is a blockchain-based smart contract project that was originally believed to be a competitor to Ethereum. The project raised an impressive $4.1 billion during its initial coin offering (ICO) in 2017 and has since emerged as one of the top cryptocurrencies in the market.

This blockchain technology supports core functionalities that enable both individuals and businesses to create blockchain-based applications in a manner similar to that of web-based applications. EOS offers secure access and authentication, permissions, data hosting, usage management, and communication between dApps and the internet.

The project is supported by a web toolkit store aimed at streamlining app development without complications.

After launching its new EVM testnet on March 14, EOS is finally ready to take the next step, as the beta launch of the EVM mainnet is scheduled for April 14.

📆 Mark Your Calendar 📆#EOS EVM is set to launch on April 14th! 🚀

This project has been a massive undertaking for developers & contributors across the $EOS ecosystem and it's exciting to be in the final stretch.

The EVM launch roadmap lays out the final milestones ✅

🧵👇 https://t.co/X7QJnegeD8 pic.twitter.com/J3BKJYygXs

— EOS Network Foundation (@EOSnFoundation) February 28, 2023

EOS’ current price is $1.19, with a trading volume of almost $100 million. EOS’ market cap at the time of writing is $1.3 billion.

As for the TA, the santiment is really bullish, with the summary pointing to “buy” at 12 and the moving averages score 11 for “strong buy.” Oscillators are “neutral “at 9.

Avalanche

Avalanche is a blockchain platform that aims to solve the scalability, security, and decentralization issues associated with blockchain technology using its unique Proof of Stake (PoS) mechanism.

Avalanche is the first smart contract platform capable of finalizing transactions in less than one second, addressing the slow transaction speeds of traditional blockchain networks.

The platform creates an interoperable ecosystem where users can engage with different networks and applications built on the platform. This blockchain platform empowers users and enterprises to build their own financial assets and DeFi applications for various use cases and create both public and private blockchain networks. Users can customize blockchain networks and establish their own set of rules to govern the network.

$AVAX, the native token of the Avalanche platform, is used to facilitate transactions within the ecosystem. $AVAX is utilized for distributing system rewards, participating in governance, and paying network fees for transactions.

Ava Labs, the company behind the project, is going to hold a discussion on April 12, to talk about the ecosystem’s growth, partnerships, new updates, and many more.

Join Ava Labs' @MorganKrupetsky and @luigidemeo for the Q2 State of the Ecosystem discussion, hosted by @TheTIEIO 👇

RSVP for your spot April 12th @ 12pm ET! https://t.co/Nug8f4C7dF

— Avalanche 🔺 (@avalancheavax) April 4, 2023

With a 24-hour volume of around $92 million, $AVAX is currently priced at $17.5. The project’s current market cap is $5.65 billion.

All indicators on the 1-day TA from TradingView point at “neutral “with 10 signals from the summary, 9 from the oscillators and 1 from the moving averages.

Verge

Verge ($XVG) is a decentralized cryptocurrency that promotes completely anonymous transactions by concealing those involved’s location and internet protocol (IP) address. The cryptocurrency can be traded on major exchanges with the symbol $XVG.

Originally called DogeCoinDark, Verge was introduced in 2014 as an alternative to Dogecoin, intended to offer anonymity to its users. Verge is categorized as one of the “privacy coins” alongside other cryptocurrencies like Monero, Pivx, and Zcash.

The project’s main focus is on anonymity, which it achieves by obscuring IP addresses. An IP address is a unique number associated with a particular computer or network that can be used to identify the user and their online activities. By concealing IP addresses, Verge transactions are rendered untraceable.

To guarantee anonymity, Verge employs multiple networks that are focused on anonymity, such as The Onion Router (TOR) and Invisible Internet Project (I2P). TOR protects users’ identities by routing their communications through a decentralized network of tunnels and relays that are run by volunteers worldwide. I2P encrypts user data and sends it via a globally distributed, anonymous peer-to-peer network that is also volunteer-run.

The network will undergo a halving at block height 6700000, which could be really beneficial for the small-cap project.

At the time of writing, $XVG is trading at $0.00261 after a 5.5% increase in the past 24 hours and has a $4.5 million volume. The altcoin is ranked #446 with a market cap of around $43 million.

Looking at the technical analysis, currently, $XVG is showing bearish santiment with the summary pointing to “sell” with a score of 12 and the moving averages at “strong sell” with a score of 11. Oscillators are “neutral” at 9.