A popular crypto analyst is warning traders to be realistic about the possible future price of the newly launched token for the Ethereum (ETH) scaling solution Arbitrum (ARB).

In a new YouTube video, the anonymous host of InvestAnswers pushes back against the “false hopium” internet chatter about the possibility of ARB skyrocketing to $100.

“If that were to happen, Arbitrum would have a full diluted market cap of $1.3 trillion. It’s never going to be worth that, okay? Just put things in perspective. Be careful what you read and do your numbers on the back of a napkin, don’t just say, ‘Oh, I can buy something for a dollar and sell it for $100.’ No, it’s not going to happen.”

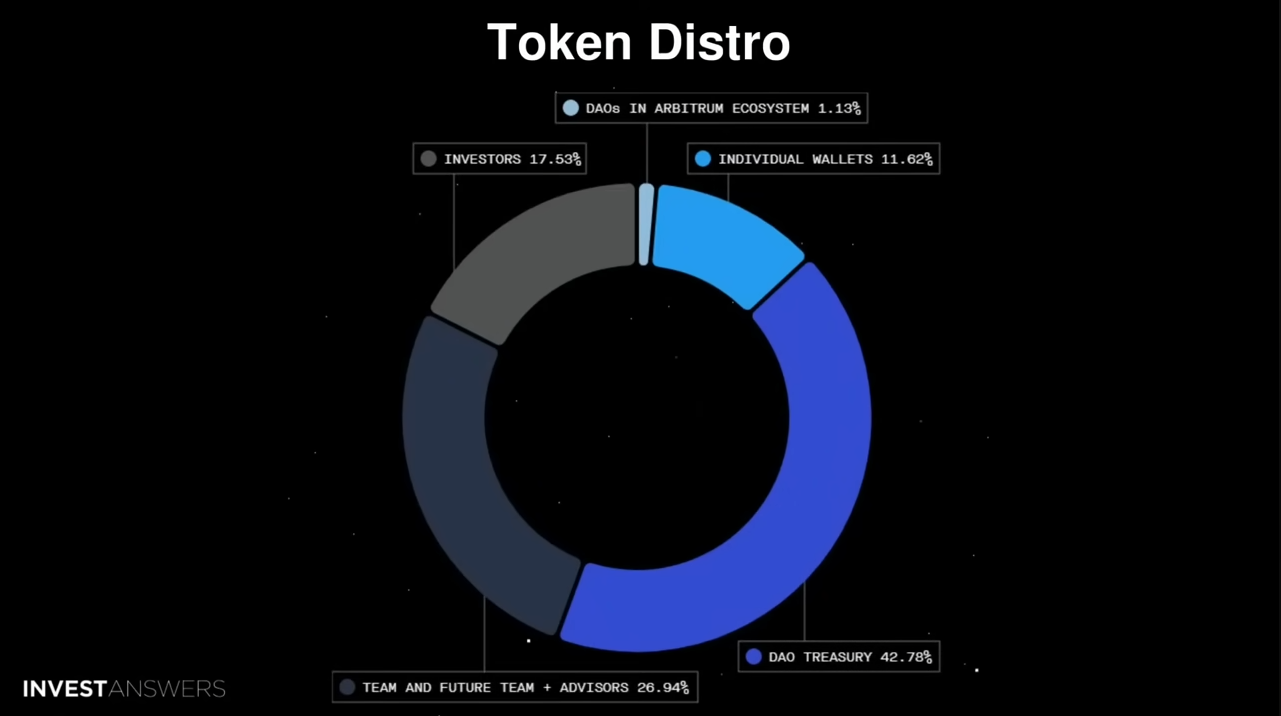

The InvestAnswers tells his 443,000 subscribers that he’s concerned that Arbitrum is heavily centralized, heavily concentrated in the hands of whales, and still has 87.2% of its token circulation left to be unlocked.

According to the InvestAnswers host, Arbitrum has a fully diluted market cap of over $13 billion, which he notes is already greater than the fully diluted market cap of other established large-cap altcoins such as Polygon (MATIC) and Solana (SOL).

Arbitrum just kicked off its first airdrop last week, distributing 12.75% of its token supply. The asset rapidly plunged from trading around $5.04 at launch to around $1.19 only a few hours later.

At time of writing, ARB is trading for $1.16.

dailyhodl.com

dailyhodl.com