Bitcoin failed to continue upwards after tapping $28,500 yesterday and has slipped below $28,000 ahead of arguably the most anticipated FOMC meeting in a while.

The altcoins have suffered even more, with DOT, MATIC, SOL, and others dumping by up to 7-8% in a day.

BTC Retraces Before FOMC Meeting

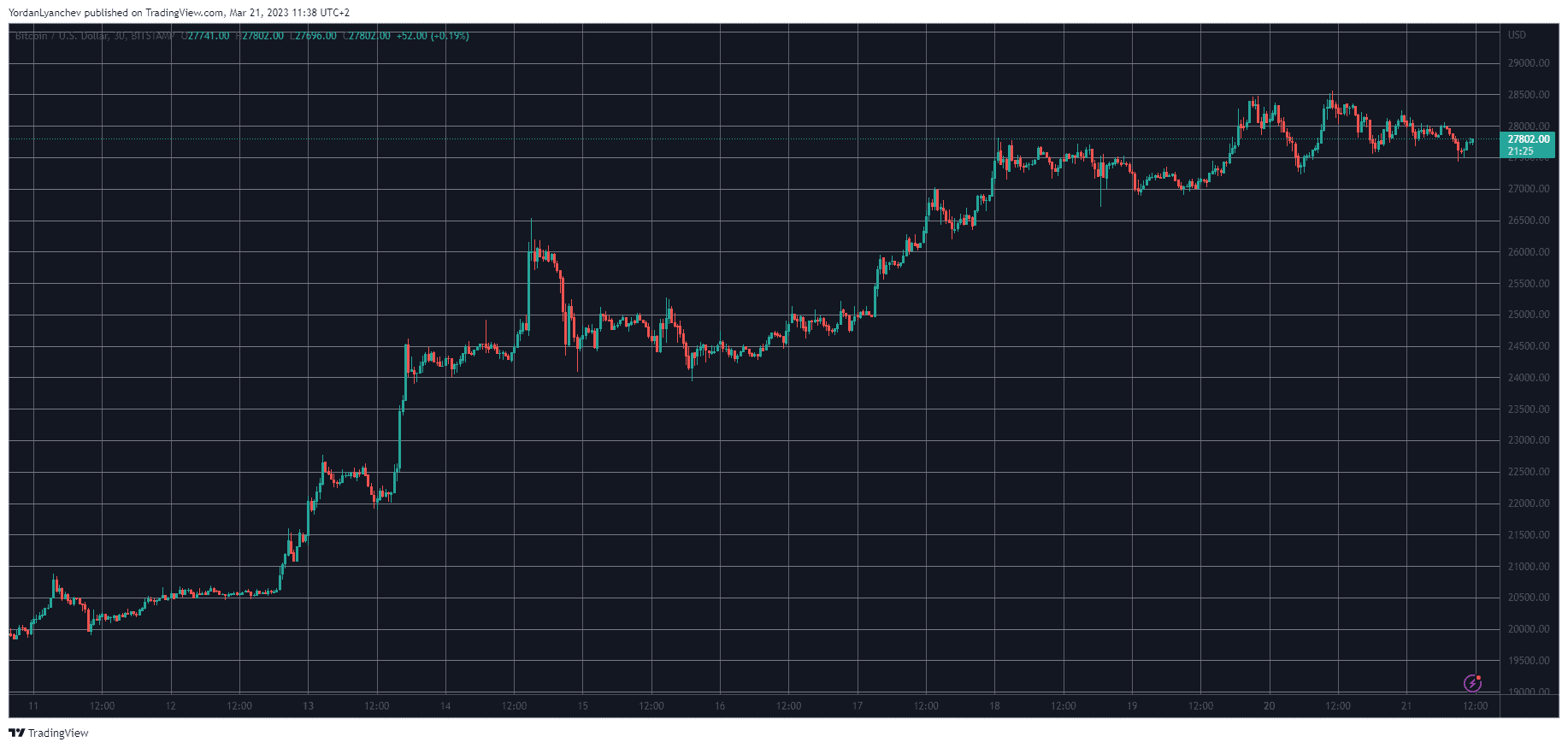

Ever since the banking issues worsened in the US and even expanded to Europe, bitcoin’s price performance has been nothing short of spectacular. The cryptocurrency soared from $20,000 to $28,500 within just over a week and tapped a 9-month high. The BTC Fear and Greed Index also skyrocketed to new peaks.

The $28,500 high came yesterday, just after news that UBS had agreed to buy the struggling banking giant Credit Suisse. However, the asset started to retrace in the following hours and dipped to $27,500 earlier today. Despite recovering a few hundred dollars since then, it still trades under $28,000.

All eyes in the financial world tomorrow will be on Jerome Powell – the Chairman of the US Federal Reserve. The next FOMC meeting is scheduled to take place on March 22, and the banking crisis could deter the central bank from further hiking the interest rates.

In fact, prominent billionaires, such as Elon Musk and Bill Ackman, believe the Fed should revert from its current monetary strategy and even decrease the rates by up to half a point.

Altcoins Retrace Hard

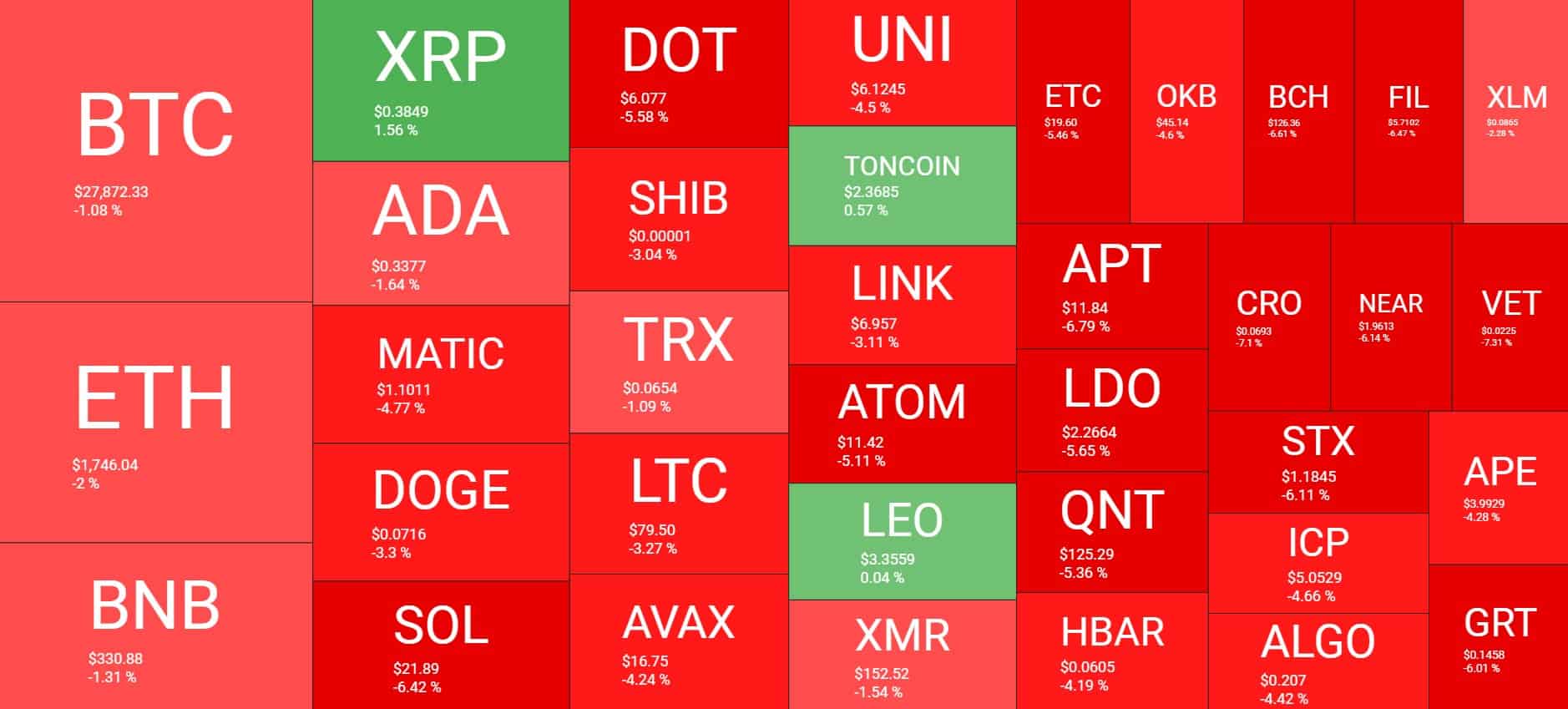

Most altcoins registered notable gains in the past week or so, but there’re some big retracements charted on a daily scale now. Ethereum has further distanced itself from $1,800 after another 2.3% drop. Binance Coin is back at $330 following a 1.5% decline.

More losses come from the likes of MATIC, DOGE, SOL, DOT, SHIB, LTC, and AVAX. The landscape with the mid-cap alts is no different, with CRO, ICP, GRT, APE, VET, FIL, APT, and others dumping by up to 8% in a day.

As such, it’s no surprise that the overall crypto market cap has declined by just over $30 billion in a day and is down to $1.150 trillion.

cryptopotato.com

cryptopotato.com