$AAVE holders endured a 12% loss in February. Yet, several on-chain metrics signal an extended price slump.

Will sell pressure heighten as bearish crypto investors keep moving tokens into exchanges?

DeFi Investors are Unstaking

Holders of $AAVE, the native token of the open-source lending protocol, have endured a 12% slump in price over the last 30 days. Still, on-chain indicators indicate that the market may remain bearish for the foreseeable future.

According to prominent on-chain data and intelligence provider, Glassnode, the volume of $AAVE deposited in smart contracts has been on a downtrend for two consecutive months.

The percentage of $AAVE tokens locked up in DeFi smart contracts has made a series of consecutive new lows since the start of February.

Since Feb 28, the volume of $AAVE tokens locked up across various DeFi protocols has decreased considerably by nearly 60,000 $AAVE (0.42% of the total circulating supply) as of March 15.

When DeFi investors unlock tokens from smart contracts, it increases the units of tokens available to be traded on exchanges. And the influx of newly-unlocked tokens can trigger a price slump in the short term.

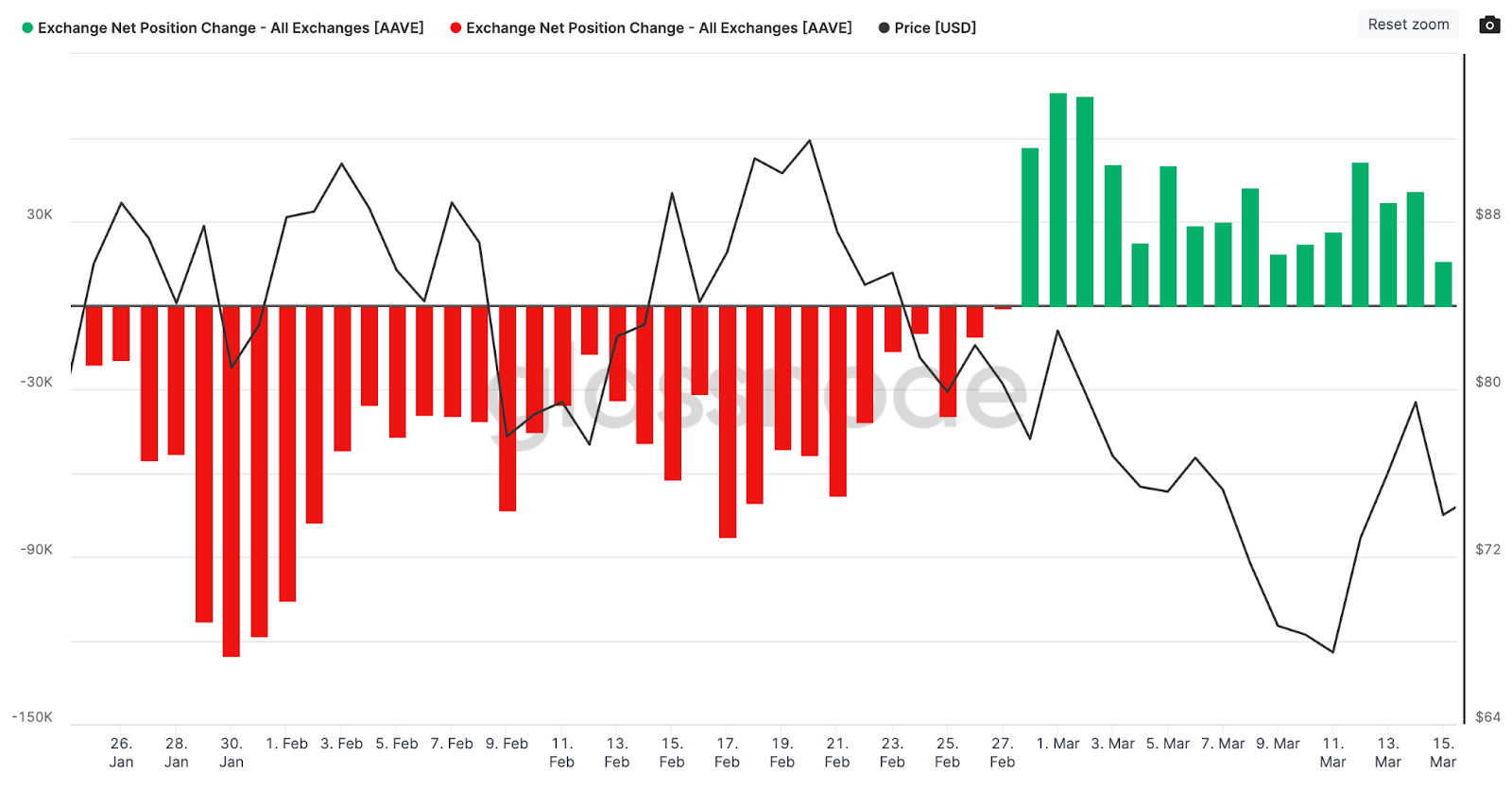

In a similar bearish outlook, the inflow of $AAVE tokens on exchanges has consistently outpaced outflows in the first half of March. The Exchange Netflow metric tracks the surplus flow of tokens into exchanges when daily outflows are deducted.

The netflow of $AAVE tokens on recognized exchange wallets has been positive for more than 14 consecutive days since the close of February.

According to Glassnode, exchange inflows have outweighed outflows by at least 16,000 $AAVE tokens each day of the opening half of March 2023. An extended period of positive exchange netflow typically denotes an oversupplied market. This could mean holders are increasingly positioning themselves for short-term trading opportunities.

Ultimately, if $AAVE holders continue to unstake tokens from smart contracts at the current rate and exchange netflow remains positive, crypto investors can expect an extended price slump in the coming weeks.

$AAVE Price Prediction: The Odds Favor the Bears

IntoTheBlock’s Global In/Out of the Money data provides an insight into the potential $AAVE bullish price performance. The GIOM metric tracks the price distribution of token holders based on the volume of tokens held in each address.

Only 33% of $AAVE holders are “in the money” or “in profit” around the current prices. Still, $AAVE currently flashes signals of impending sell pressure.

Going by the current on-chain indicators, $AAVE is likely to decline toward $68. This is where 16,000 addresses holding 3 million tokens can offer some support. If this support fails to hold, $AAVE will likely drop to $55. The average purchase price of another cluster of 20,000 holders with 2 million tokens.

However, if $AAVE makes an unlikely rebound, it could be tested initially at $85. The maximum price that 13,000 addresses have bought 6.4 million tokens. If it breaks above $85, $AAVE could rally toward the next significant cluster of resistance at around $110. Here is where 28,000 addresses may be looking to take some profit on their 2.3 million $AAVE holdings.

beincrypto.com

beincrypto.com